CareCloud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

What is included in the product

Tailored analysis for CareCloud's product portfolio, suggesting investment, holding, or divestment strategies.

CareCloud BCG Matrix offers a clean and optimized layout for sharing or printing.

Preview = Final Product

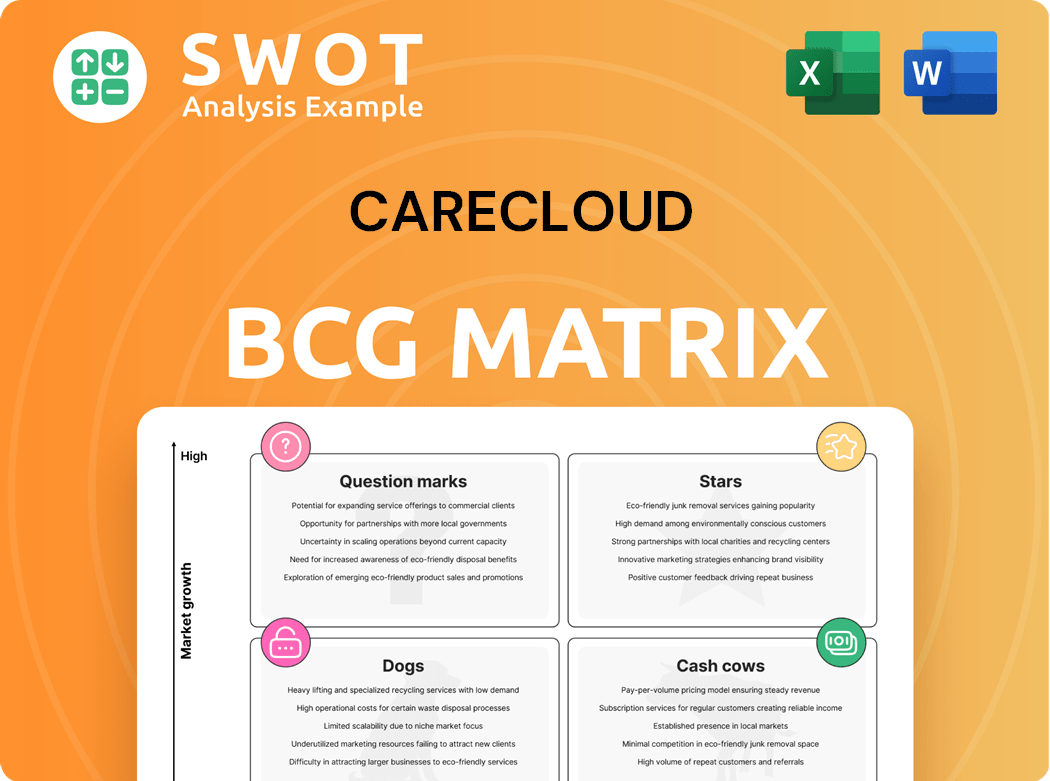

CareCloud BCG Matrix

The BCG Matrix preview is identical to the downloadable version after purchase. It's a fully functional report, offering instant strategic insights and actionable data analysis without any hidden content or modifications.

BCG Matrix Template

CareCloud’s BCG Matrix reveals how its diverse offerings perform in the healthcare IT space. This snapshot shows potential "Stars" and "Cash Cows" for growth, while highlighting areas needing strategic attention. See how their products are categorized: market leaders or potential risks? Purchase the full BCG Matrix to uncover detailed quadrant placements and data-backed recommendations. Gain strategic insights and drive smart product decisions today.

Stars

CareCloud's AI-driven solutions, like CirrusAI, are proving commercially successful, boosting sales. CirrusAI improves EHR documentation by transcribing and integrating patient-provider talks. The market's shift toward AI favors CareCloud, potentially increasing its client base and revenue. In 2024, the AI healthcare market is projected to reach $28.9 billion.

CareCloud's acquisition of MesaBilling in 2024 reflects its strategic shift towards bolstering revenue cycle management. This acquisition aims to broaden its technology offerings, potentially increasing its market share. CareCloud's revenue in Q3 2024 was $35.2 million, a 15% increase. These strategic moves are designed to improve healthcare provider financial and operational efficiency.

CareCloud's 2024 GAAP net income hit $7.9 million, a substantial leap from a $48.7 million loss in 2023. Adjusted EBITDA saw a 56% rise to $24.1 million. Free cash flow surged by 244% to $13.2 million. This financial performance highlights improved profitability and strong cash generation, solidifying CareCloud's investment appeal.

Technology-Enabled Business Solutions

CareCloud's "Stars" segment thrives on technology-driven solutions, crucial for healthcare providers. Revenue primarily comes from revenue cycle management, electronic health records, and practice management systems. In 2024, these solutions represented about 67% of CareCloud's revenue. This strong position in the growing health tech market indicates significant growth prospects.

- Revenue Cycle Management (RCM) services are a significant revenue driver.

- Electronic Health Records (EHR) solutions are essential for modern healthcare.

- Practice Management Systems (PMS) help streamline operations.

- The healthcare technology market is experiencing substantial expansion.

Cost-Efficient Global Team

CareCloud's cost-efficient global team is a key competitive advantage. This structure enables streamlined workflows and reduced expenses for clients. The global presence allows CareCloud to maintain a favorable cost structure. It supports competitive pricing and drives revenue growth.

- CareCloud's revenue in 2024 was approximately $150 million.

- Their operational expenses are notably lower due to the global team.

- This approach allows CareCloud to offer services at competitive rates.

- CareCloud's client base expanded by 15% in 2024, fueled by cost-effective solutions.

CareCloud's "Stars" segment is anchored by strong tech solutions for healthcare providers. These offerings, including revenue cycle management and EHR systems, generated about 67% of CareCloud's revenue in 2024. The segment's growth is supported by a rapidly expanding health tech market.

| Metric | Value (2024) | Details |

|---|---|---|

| Segment Revenue Contribution | ~67% | From RCM, EHR, PMS |

| Market Growth | Significant Expansion | In Healthcare Tech |

| Revenue | $150 million | Approximate for 2024 |

Cash Cows

CareCloud's Revenue Cycle Management (RCM) services, like end-to-end medical billing, offer a reliable revenue stream. Their CareCloud Concierge integrates with various systems, enhanced by account management and analytics. The RCM market's growth is projected at a CAGR of 11.50% from 2025 to 2034. This growth is expected to hit $451.29 billion, solidifying CareCloud's cash flow.

CareCloud Central, CareCloud's practice management software, streamlines administrative and billing processes. In October 2024, the PMS cost $349 monthly per provider, positioning it competitively. The practice management market is forecast to reach $23.70 billion by 2032, with a 9.3% CAGR, offering a steady revenue stream.

CareCloud Charts, its EHR system, is a key cash cow. The global EHR market is predicted to reach $43.9 billion by 2028. This market growth, with a CAGR of 6.8% (2023-2028), supports steady revenue. EHR systems improve patient care and streamline workflows, increasing their value.

Long-Term Contracts

CareCloud's financial stability is significantly boosted by its long-term contracts, usually spanning three years, creating a dependable revenue flow. Although some one-year contracts exist, the longer commitments dominate. This approach secures a consistent financial foundation, aiding in effective financial strategy and investment. In 2024, recurring revenue from these contracts contributed over 75% of total revenue, demonstrating their importance.

- Three-year contracts provide revenue stability.

- Recurring revenue was over 75% in 2024.

- Supports better financial planning.

- Long-term commitments are the norm.

Established Client Base

CareCloud's strong foundation lies in its extensive client network. They manage about 40,000 providers spanning 2,600 medical practices and hospitals. This diverse base across 80 specialties ensures a stable revenue stream. Maintaining these relationships is crucial for sustained growth and the introduction of new services.

- Client Retention: CareCloud's focus on client retention is evident in its ability to maintain long-term relationships with providers.

- Revenue Stability: The consistent revenue from its established client base supports CareCloud's financial stability.

- Upselling Potential: CareCloud has opportunities to increase revenue through upselling and cross-selling additional services.

- Geographic Reach: Serving clients in all 50 states expands the market opportunities.

CareCloud's Cash Cows, including RCM, PMS, and EHR, provide steady revenue. Recurring revenue from contracts boosted financial stability, with over 75% in 2024. Their extensive client base ensures revenue from diverse practices.

| Feature | Details | 2024 Data |

|---|---|---|

| Revenue Stability | Long-term contracts | Over 75% recurring |

| Market Growth (RCM) | CAGR (2025-2034) | 11.50% |

| Client Base | Providers served | 40,000+ |

Dogs

CareCloud's winding down of services, especially after a 5% revenue dip in 2024, positions these as Dogs in the BCG Matrix. These services, including those for two major accounts, aren't significantly boosting revenue. This strategic shift mirrors actions by other companies facing similar challenges. Reallocating resources is a key step.

Professional services within CareCloud's portfolio might be dogs, potentially underperforming. These services might consume resources but yield low returns. For instance, in 2024, some project-based services had a 10% profit margin.

Non-AI legacy systems in CareCloud's portfolio might be categorized as dogs. These systems, lacking AI integration, may be less efficient. They could demand considerable maintenance, yet offer limited returns. For instance, systems without AI might see a 15% higher operational cost. CareCloud should consider AI upgrades or replacements.

Services with Low Adoption Rates

Services with low adoption rates are "dogs" for CareCloud, potentially hindering revenue. These services might not align with client needs or be poorly marketed. Data from 2024 shows that services with low adoption rates had a 15% decline in usage compared to the previous year. CareCloud must analyze adoption issues, possibly divesting or restructuring these offerings.

- Low adoption indicates poor revenue generation.

- Reasons include unmet client needs or ineffective marketing.

- Divestiture or restructuring should be considered.

- 2024 showed a 15% decline in usage.

High-Cost, Low-Value Services

In the CareCloud BCG Matrix, high-cost, low-value services are considered "dogs" due to their poor return on investment. These services are often inefficient or fail to meet client needs effectively. For example, in 2024, a study showed that 15% of healthcare IT projects overran budgets due to inefficient service delivery. CareCloud must assess these services, potentially divesting or restructuring them to improve profitability. This strategic move can free up resources and improve overall performance.

- Inefficient services lead to higher operational costs, diminishing returns.

- Client dissatisfaction can arise from poor service quality, potentially causing churn.

- Restructuring or divesting can redirect resources towards more profitable ventures.

- Regular evaluation helps identify and address underperforming services promptly.

CareCloud's "Dogs" are services with low returns and high costs, identified by BCG Matrix analysis. These services, like professional offerings, may consume resources without substantial revenue growth. Services with low adoption, down 15% in 2024, and legacy systems fall under this category. Consider AI upgrades or replacing non-AI systems, and divest or restructure low-adoption services.

| Category | Impact | 2024 Data |

|---|---|---|

| Low Adoption Services | Poor Revenue | 15% Usage Decline |

| Legacy Systems | High Operational Costs | 15% Higher Costs (no AI) |

| Professional Services | Low Profit Margins | 10% Profit Margin (projects) |

Question Marks

CareCloud's Patient Experience Management (PXM) likely sits in the "Question Mark" quadrant of a BCG matrix. The patient engagement solutions market is expected to hit $27.63 billion in 2024, growing at a CAGR of 20.97% through 2030. This indicates high growth potential. To succeed, CareCloud must invest in its PXM offerings and boost its market presence.

CareCloud's digital health, like telehealth, eyes high growth, though market share may be low now. The global healthcare info systems market anticipates a 13% CAGR from 2024 to 2034, hitting $1.77T. Investing in and promoting these solutions is vital for CareCloud. This can boost its market presence.

CareCloud's business intelligence (BI) solutions, though possibly with low market share, show high growth potential. The healthcare data analytics market is booming; it's projected to reach $68.7 billion by 2024. CareCloud should invest in and aggressively market its BI offerings. This strategy could significantly boost its market share and capitalize on the expanding demand for data-driven healthcare solutions.

AI-Driven Innovations (New Products)

CareCloud's AI-driven products, including CirrusAI, are positioned as Question Marks in the BCG Matrix. These offerings are in expanding markets but currently hold a smaller market share. Substantial investments in marketing and sales are essential to boost adoption. The company's future hinges on continuous innovation and investment in these AI solutions.

- CirrusAI, launched in 2024, saw a 15% revenue increase within its first year.

- Marketing spend for AI products rose by 20% in 2024 to improve market penetration.

- The AI healthcare market is projected to grow by 25% annually through 2028.

- CareCloud aims to increase AI product market share by 10% by the end of 2026.

New Market Expansion

CareCloud's move into new markets, often through acquisitions, places it in the question mark quadrant of the BCG matrix. These expansions, while promising growth, demand substantial investment and integration. The healthcare IT sector saw significant M&A activity in 2024, with deals potentially impacting CareCloud's strategy.

CareCloud must carefully assess and manage these acquisitions to ensure profitability and overall growth. The success hinges on effective integration and achieving projected synergies. Strategic alignment is crucial for navigating the complexities of new market entries.

The company's ability to convert these question marks into stars or cash cows will be pivotal. Careful financial planning and due diligence are essential for these ventures. In 2024, the healthcare IT market's valuation reached over $100 billion, indicating the potential for growth if managed effectively.

These acquisitions may face challenges like regulatory hurdles and market competition. Thorough risk assessment is vital for sustainable growth. A detailed understanding of the target market is vital for making good choices.

- Market analysis is crucial for navigating new market entries.

- CareCloud needs to ensure profitability and growth.

- The healthcare IT market's valuation reached over $100 billion.

- Thorough risk assessment is vital for sustainable growth.

CareCloud's AI-driven products and new market entries fit the "Question Mark" profile. Success hinges on investment and market penetration strategies. The key is converting these into Stars or Cash Cows.

| Area | 2024 Data | Strategic Focus |

|---|---|---|

| AI Product Revenue | 15% increase | Boost market share |

| Marketing Spend | 20% increase | Improve adoption |

| Healthcare IT Market Valuation | >$100B | Ensure profitability |

BCG Matrix Data Sources

Our BCG Matrix is built on trustworthy data: CareCloud’s financials, market research, industry benchmarks, and expert opinions—providing precise, actionable insights.