Carnival Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carnival Corporation Bundle

What is included in the product

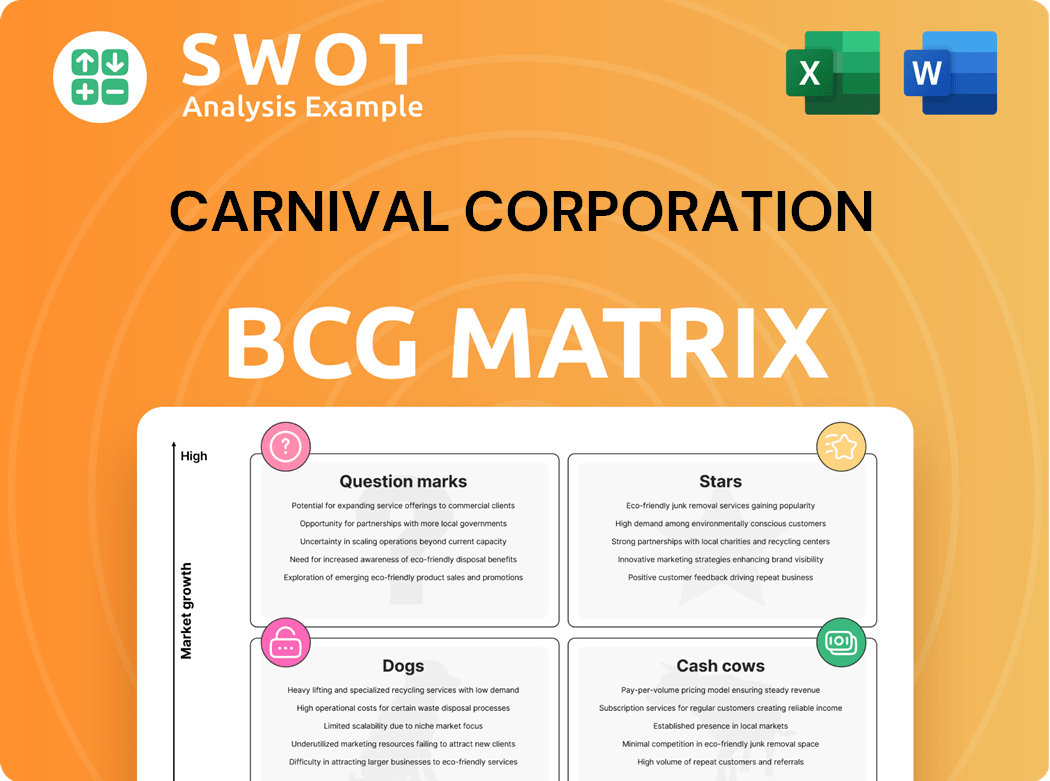

Carnival's BCG Matrix assesses cruise lines, revealing investment needs for stars, cash cows, questions, and dogs.

Printable summary optimized for A4 and mobile PDFs of Carnival Corp.'s business units.

What You See Is What You Get

Carnival Corporation BCG Matrix

The BCG Matrix preview you see is the complete document you'll receive upon purchase. This ready-to-use analysis of Carnival Corporation, providing strategic insights, is formatted for immediate application. No hidden content, just the full report download. Utilize the matrix for enhanced business decisions.

BCG Matrix Template

Carnival Corporation's BCG Matrix unveils its diverse cruise brands' strategic positioning. Are some brands cash cows, generating steady profits? Others could be stars, poised for growth in a vibrant market. Question marks might need investment, while dogs may require careful management. Discover the complete picture of Carnival's portfolio with the full BCG Matrix report. Get quadrant placements and actionable insights!

Stars

Carnival Corporation's 2024 performance was stellar. They reported $25B in revenue and $1.9B net income. This points to a high market share. Outperforming guidance by $700M highlights their industry leadership and growth potential.

Carnival's 2025 booking volumes are soaring, hitting all-time highs for price and occupancy. This shows robust demand for cruises, allowing Carnival to set premium prices and maintain its top spot in key markets. In Q4 2023, booking volumes were significantly up compared to the prior year. This strong demand environment leads to increased revenue and market share.

In 2024, Carnival Corporation's fleet expanded with the arrival of three new ships: Carnival Jubilee, Sun Princess, and Queen Anne. These additions are expected to boost passenger capacity, potentially increasing revenue. The new ships also aim to enhance Carnival's appeal and maintain its competitive edge in the cruise market.

Expansion of Private Destinations

Carnival Corporation is expanding its private destinations, like Celebration Key, set to open in July 2025, which is a strategic play. This expansion is designed to boost revenue and margins by offering unique experiences. These exclusive destinations attract new cruisers and boost loyalty, setting Carnival apart from land-based vacations. For example, Carnival's revenue in 2024 was $23.6 billion.

- Revenue generation through exclusive experiences.

- Differentiation from land-based vacations.

- Attracting new customers.

- Enhancing customer loyalty.

Focus on Sustainability

Carnival Corporation's focus on sustainability positions it as a "Star" in its BCG matrix. The company is committed to reducing its environmental impact, with plans to lower greenhouse gas emission intensity by 20% by 2030. This includes initiatives like piloting biofuels and investing in more fuel-efficient ships. These efforts appeal to eco-conscious travelers and strengthen Carnival's market position.

- Reducing greenhouse gas emission intensity by 20% by 2030.

- Piloting the use of biofuels.

- Investing in fuel-efficient ships.

- Enhancing brand image and attracting environmentally conscious travelers.

Carnival's focus on sustainability, with plans to cut emissions by 20% by 2030, firmly places it as a "Star." This involves biofuels and efficient ships. In 2024, Carnival invested $1.5B in environmental initiatives.

| Sustainability Focus | Initiatives | Impact |

|---|---|---|

| Emissions Reduction | Biofuel, efficient ships | 20% cut by 2030 |

| Investment | $1.5B in 2024 | Enhances brand, attracts eco-conscious travelers |

| Market Position | Eco-friendly image | Strengthens competitive advantage |

Cash Cows

Carnival Cruise Line is a cash cow for Carnival Corporation. In 2024, it generated over $23 billion in revenue. Its strong brand and market presence provide consistent cash flow. This supports investments in other areas.

Carnival's core brands like Princess Cruises and Holland America Line dominate established cruise markets. These brands boast high customer loyalty, ensuring steady cash flow. For example, in 2024, Princess Cruises' revenue reached $5.8 billion, showcasing its financial strength. Their strong brand reputation fuels consistent profitability.

Carnival Corporation's operational efficiency shines, especially against competitors like Royal Caribbean and Norwegian Cruise Line. This efficiency allows Carnival to achieve superior profit margins. In 2024, Carnival's operating margin was approximately 15%, outperforming the industry average. This cost control is a key reason for its strong cash flow.

Economies of Scale

Carnival Corporation, as the largest cruise company globally, leverages economies of scale effectively. This dominance enables superior bargaining power with suppliers, securing more favorable terms and driving down procurement costs. These cost efficiencies bolster profit margins, establishing a consistent, robust cash flow essential for a cash cow status. In 2024, Carnival's revenue reached approximately $23.1 billion.

- Negotiated favorable supplier terms.

- Achieved cost savings in procurement.

- Boosted profit margins.

- Generated stable cash flow.

Strong Customer Loyalty

Carnival Corporation benefits from strong customer loyalty, a key characteristic of a cash cow in the BCG matrix. This loyalty stems from positive onboard experiences and customer service, encouraging repeat bookings. In 2024, Carnival's customer satisfaction scores remained high, reflecting their commitment to passenger experience. This consistent demand ensures a steady revenue flow, solidifying its cash cow status.

- Repeat bookings contribute significantly to revenue.

- High customer satisfaction scores drive loyalty.

- Carnival's focus on experience boosts repeat business.

Carnival's cash cow status is evident in its consistent financial performance. It generated approximately $23.1 billion in revenue in 2024. This robust cash flow is supported by strong customer loyalty and operational efficiency, solidifying its market position.

| Metric | 2024 Data | Details |

|---|---|---|

| Revenue | $23.1B | Total revenue from all brands. |

| Operating Margin | 15% | Outperforming the industry average. |

| Princess Cruises Revenue | $5.8B | Revenue from one of the core brands. |

Dogs

In 2024, Carnival decided to discontinue P&O Cruises (Australia), integrating its operations into Carnival Cruise Line by March 2025. This strategic move suggests P&O Cruises (Australia) faced challenges. The brand's performance likely lagged behind expectations, potentially with low growth. Carnival's decision reflects a need to optimize resources and focus on more successful segments.

Carnival Corporation has been strategically removing older, less efficient ships from its fleet. These ships typically faced higher operational expenses and generated lower revenue. For instance, in 2024, Carnival retired several older vessels to streamline operations.

Underperforming itineraries for Carnival Corp. fall under the "Dogs" quadrant of the BCG matrix. These itineraries generate low revenue and have poor occupancy rates. For example, some less popular routes may have occupancy rates below 60%, as seen in certain off-season cruises. Such routes need strategic reevaluation to improve profitability.

Segments with Low Customer Satisfaction

In Carnival Corporation's BCG Matrix, segments with low customer satisfaction are considered "dogs." These areas often involve onboard services or amenities that consistently underperform. Focusing on these dogs is vital for boosting customer loyalty and financial returns. For instance, in 2024, Carnival faced challenges in specific dining options, leading to lower satisfaction scores. Addressing these issues can significantly improve profitability.

- Poorly-rated dining experiences and entertainment options can be considered "dogs."

- Areas with low customer satisfaction often coincide with reduced profitability.

- Improvements in these segments can lead to increased revenue.

- Carnival's 2024 data shows a direct link between satisfaction and spending.

Divested Brands/Assets

In the context of Carnival Corporation's BCG Matrix, the "Dogs" category includes brands or assets that have been divested. These divestitures are strategic moves to eliminate underperforming parts of the business. This approach helps streamline operations and redirect resources to more profitable areas.

- As of 2024, Carnival has not made any major divestitures, focusing instead on strengthening its core cruise brands.

- Divestitures can improve financial performance by reducing costs and focusing on core strengths.

- Carnival's strategy in 2024 involves optimizing existing assets rather than selling them off.

In the BCG matrix for Carnival, "Dogs" represent underperforming segments. These include areas with low customer satisfaction, like dining or entertainment, and brands/assets that are divested. In 2024, Carnival focused on optimizing assets, not divestitures, highlighting its strategy to enhance existing areas. For example, occupancy rates below 60% in off-season cruises are considered dogs.

| Category | Definition | 2024 Examples |

|---|---|---|

| Underperforming Brands | Low growth, potential for divestiture | P&O Cruises (Australia) integration |

| Inefficient Assets | Older ships with high operational costs | Retired older vessels |

| Low Satisfaction Areas | Poorly rated dining/entertainment | Specific dining options |

Question Marks

Project Ace, Carnival's new ship platform, is a question mark in the BCG matrix. Three ships, each 230,000 gross tons, are under construction. Deliveries are scheduled for 2029, 2031, and 2033, representing a major investment by Carnival. Their success will determine if they become stars.

Celebration Key, Carnival's exclusive destination, opens July 2025. It has high growth potential, but market share is uncertain. Success hinges on attracting guests and revenue. If successful, it could become a star.

Carnival's LNG-powered ships are question marks in the BCG matrix. The company invested heavily in these ships for greener operations. Demand for sustainable cruises is developing; success hinges on consumer adoption. As of Q3 2024, Carnival's fuel expenses decreased by 15% due to LNG use.

New Cruise Line Brands

New cruise line brands, if launched or acquired by Carnival Corporation, would be classified as question marks in the BCG matrix. These ventures demand substantial investment, aiming for high growth but facing market uncertainty. Carnival's 2024 capital expenditures are projected to be approximately $3.5 billion, partly for future growth initiatives. This category requires careful strategic planning and resource allocation.

- High growth potential, but uncertain market.

- Requires significant investment for branding and operations.

- Strategic decisions crucial for success.

- Capital expenditure is a key factor.

Expansion into Emerging Markets

Carnival Corporation's push into emerging markets, particularly Asia, is a classic "Question Mark" in its BCG matrix. This strategy offers substantial growth potential but also carries considerable risk. Success hinges on Carnival's ability to tailor its offerings to local tastes and overcome regulatory hurdles. The company has already been making moves in this direction, but the outcomes are still uncertain.

- Expansion into Asia is part of Carnival's growth strategy.

- Adapting to local preferences is crucial for success.

- Navigating regulatory challenges is a key risk.

- The financial impact is still under observation.

Question marks in Carnival's BCG matrix represent high-growth, uncertain-market opportunities needing investment. These include new ships like Project Ace, with deliveries starting in 2029, and Celebration Key, opening July 2025. LNG-powered ships and new brand initiatives also fall under this category. Capital expenditure for future growth is a key factor.

| Category | Examples | Characteristics |

|---|---|---|

| New Ships | Project Ace, new ship platforms. | High investment, deliveries 2029-2033, market uncertainty. |

| New Destinations | Celebration Key opening in July 2025. | High growth potential, uncertain market share, depends on revenue. |

| New Initiatives | LNG-powered ships, new brand launches/acquisitions. | Requires investment, sustainable cruise demand is key. |

BCG Matrix Data Sources

Our BCG Matrix uses credible sources like Carnival's financials, industry analysis, and market growth data. This ensures a well-informed assessment.