Carrefour Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrefour Bundle

What is included in the product

Tailored analysis for Carrefour's diverse product portfolio. Strategic recommendations for each business unit.

Streamlined template helps Carrefour leaders identify strategic priorities.

Full Transparency, Always

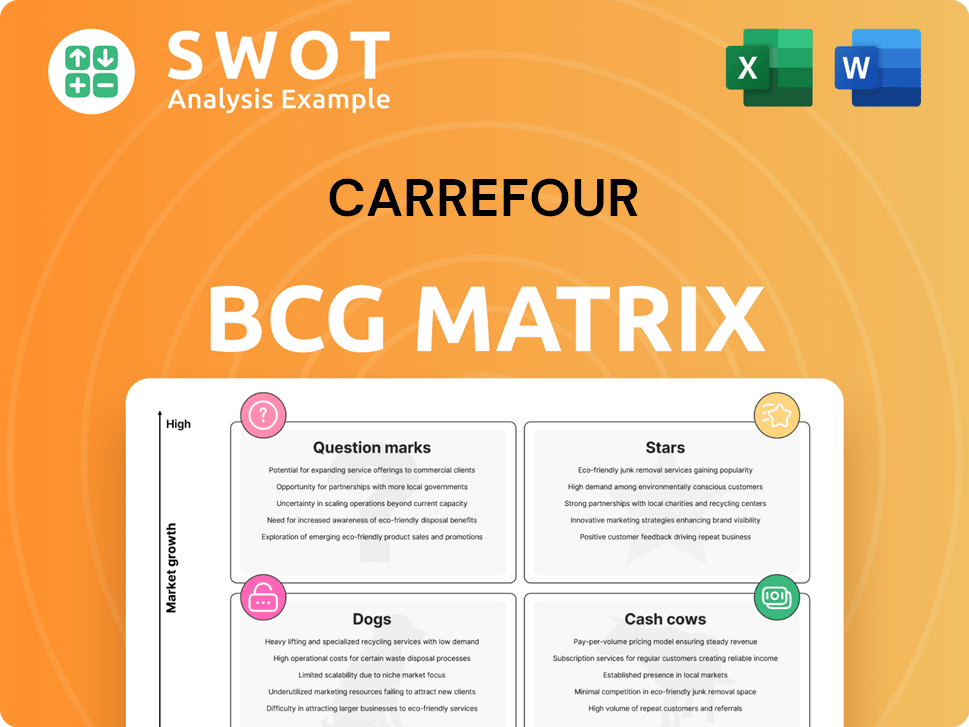

Carrefour BCG Matrix

The Carrefour BCG Matrix preview mirrors the downloadable version. Purchase unlocks the complete, ready-to-use strategic tool. It's identical: no hidden content, fully formatted for immediate application.

BCG Matrix Template

Carrefour's BCG Matrix reveals its product portfolio strengths and weaknesses. Question Marks and Dogs require careful attention and strategic decisions. Identify Cash Cows to fuel growth and Stars to dominate. This is just a glimpse; get the full version to see detailed product placements and actionable insights.

Stars

Carrefour's e-commerce platform is a Star, showing impressive growth. In Q1 2024, it saw a 19% GMV increase, with Brazil leading the way. This growth highlights its potential for market leadership in digital retail. Investment in user-friendly platforms and digital transformation is crucial. Delivery and engagement innovations will sustain this trajectory.

Atacadão, Carrefour's cash-and-carry stores in Brazil, is a star in the BCG Matrix. In 2024, Atacadão reported strong sales growth, making it a key driver for Carrefour. As Carrefour eyes taking its Brazilian unit private, Atacadão's performance is crucial. The focus on this segment highlights its importance.

Carrefour's private label brands are performing well. They represented 37% of food sales in Q1 2024. By Q1 2025, this grew to 38%. This growth shows customer acceptance. It also suggests higher profit margins for Carrefour.

Convenience Store Expansion

Carrefour is aggressively expanding its convenience store network. In Q1 2024, 72 new stores were organically opened, with further expansion planned. This strategy targets busy consumers seeking quick shopping solutions. The Express format saw the highest growth in 2024. Carrefour plans to accelerate development with over 40 new stores in 2025.

- Q1 2024 saw 72 new store openings.

- Focus on the Express format for growth.

- Expansion includes partnerships.

- Over 40 new stores planned for 2025.

Strategic Partnerships

Carrefour's strategic partnerships are key to its growth strategy. In 2024, Carrefour partnered with Apparel Group to enter India. The company has also teamed up with Puig & Fils and Magne to grow its convenience store network in France. These moves help Carrefour expand its reach and product offerings. For example, Carrefour's collaboration with Altarea and RATP introduced a new convenience store concept in Parisian metro stations.

- Partnerships drive market entry.

- Agreements include Apparel Group and others.

- Convenience store network expansion is a focus.

- Collaboration with Altarea and RATP is noteworthy.

Carrefour's e-commerce, Atacadão, private labels, and convenience stores are Stars, showcasing strong performance. Digital platforms saw a 19% GMV increase in Q1 2024. Atacadão fuels Carrefour’s growth. Private labels contributed to food sales.

| Category | Performance | Data |

|---|---|---|

| E-commerce | GMV Growth (Q1 2024) | 19% |

| Private Label Food Sales | Q1 2025 | 38% |

| New Convenience Stores (Q1 2024) | Opened | 72 |

Cash Cows

Carrefour's hypermarkets in Europe, especially in France, are key revenue generators. Despite competition, they have strong brand recognition. Integration of Cora and Match stores aims for €130 million in synergies by 2027. These hypermarkets have a large customer base, providing steady income.

Carrefour's supermarkets in Europe are cash cows. They have a stable customer base, generating consistent cash flow. In 2024, the company operated 4,301 stores under the Carrefour Market name. Efficient supply chains and private labels boost profits. These stores offer diverse products, attracting many customers.

Carrefour's franchise model boosts profits and cuts spending. It teams up with local entrepreneurs, gaining market insights. The company's actively franchising stores. This model lets Carrefour focus on branding and supply chains. In 2024, Carrefour's franchise sales grew significantly.

Cost Savings Initiatives

Carrefour's "Cash Cows" status is supported by significant cost-saving measures. The company is aiming for €1.2 billion in savings by 2025, boosting profitability. These efforts include streamlining operations and enhancing supply chain efficiency. Successful cost management allows for strategic investments and maintaining a competitive edge.

- Targeted €1.2 billion in cost savings by 2025.

- Focus on operational streamlining and supply chain optimization.

- Improved energy efficiency initiatives.

- Supports strategic investments and competitiveness.

Financial Services

Carrefour's financial services, like Carrefour Banque, are cash cows, generating revenue through offerings such as credit cards and loans. Despite some market challenges, these services significantly contribute to the company's cash flow. They boost customer loyalty and create additional revenue streams. This division's performance remains crucial to Carrefour's financial health. In 2024, financial services revenue grew by 7%, demonstrating its stability.

- Revenue from financial services grew by 7% in 2024.

- Carrefour Banque offers credit cards, loans, and insurance.

- These services enhance customer loyalty.

- The division contributes significantly to overall cash flow.

Carrefour's "Cash Cows" consistently generate strong cash flow, vital for investment and growth. Hypermarkets, particularly in France, remain key contributors. The company’s financial services, like Carrefour Banque, are robust cash generators.

| Category | Key Features | 2024 Performance |

|---|---|---|

| Hypermarkets | High brand recognition, large customer base | Significant revenue generation |

| Financial Services | Credit cards, loans | 7% revenue growth |

| Cost Savings | Operational streamlining | €1.2B target by 2025 |

Dogs

Some Carrefour hypermarkets struggle, hurt by shifting consumer habits, discounters, and sluggish e-commerce adoption. Turnaround strategies can be costly and may not always succeed, potentially leading to divestitures. In France, hypermarket sales fell 3.6% in Q1 2024, highlighting urgent strategic needs.

Carrefour's non-food sales in France reflect a challenging environment. The decline in this segment suggests a weak market position. Non-food sales decreased by 6.2% LFL in Q1 2025. This indicates a need for strategic adjustments to improve performance and offerings.

Carrefour's operations in competitive markets, like Poland, struggle against strong rivals and increasing labor costs. These areas demand substantial investment to keep market share, with profitability at risk. In 2024, Carrefour's financial results reflect these pressures, with sluggish markets and cost inflation hurting profits. For example, Poland's retail market is highly competitive.

Struggling Supply Chain Efficiency

Carrefour faces supply chain efficiency challenges, which can hike costs and dent profitability. The company must streamline logistics for timely deliveries and reduce waste. These inefficiencies are a significant hurdle. In 2024, Carrefour's operating income decreased by 1.5%, partly due to supply chain issues.

- Increased logistics expenses.

- Potential for product spoilage.

- Delayed product availability.

- Reduced customer satisfaction.

Inconsistent Store Formats

Inconsistent store formats and branding pose challenges for Carrefour, potentially confusing customers and weakening brand identity. A lack of uniformity across various store types can impede growth and competitive positioning. Carrefour's diverse formats, including hypermarkets and convenience stores, contribute to inconsistencies. This variation impacts customer experience, branding, and product offerings. In 2024, Carrefour reported varied performances across its formats, highlighting the impact of these inconsistencies.

- Store format variations lead to inconsistent customer experiences.

- Branding dilution occurs due to a lack of cohesive identity.

- Growth can be hindered by unclear positioning.

- Product offerings vary, impacting brand perception.

In the Carrefour BCG Matrix, Dogs represent business units with low market share in a slow-growing market, requiring careful management to avoid losses. Carrefour's hypermarkets face this dilemma. These businesses are often divested or restructured to reduce their impact on overall financial performance. For example, in Q1 2024, hypermarket sales fell by 3.6% in France.

| Aspect | Details | Impact |

|---|---|---|

| Market Share | Low | Potential for losses |

| Market Growth | Slow | Limited opportunities |

| Strategic Actions | Divest or restructure | Reduce financial burden |

Question Marks

Carrefour's emerging market strategy, particularly in India, is a "question mark" in its BCG matrix. This expansion into countries like India offers high growth potential. However, it also comes with substantial risks and requires significant investment. The company plans to open 50 stores in north India within five years, signaling its commitment. Carrefour's revenue in India was around $150 million in 2024.

Carrefour's investments in tech, like AI for personalization and supply chain enhancements, are crucial for future growth, demanding considerable initial spending. These advancements might not instantly boost revenue or profits. The company has significantly advanced its digital transformation, expanding e-commerce and digital services, with online sales growing. In 2023, Carrefour's digital sales reached €4.5 billion, reflecting a 15% increase.

Diversifying product lines, like health and wellness, is a growth bet for Carrefour. This move needs investments in R&D and marketing. Dedicated health sections with staff could boost Carrefour's market presence. In 2024, Carrefour's revenue was about €94.1 billion.

Digital Financial Services

Digital financial services represent a question mark in Carrefour's BCG matrix, signifying high growth potential but uncertain returns. Expanding into mobile payments and online lending could draw in new customers and boost revenue. This strategy, however, demands substantial investments in technology and regulatory adherence. Carrefour actively digitizes its financial services to enhance customer experience and cut operational costs.

- Carrefour's digital sales grew by 13.5% in Q3 2023, showing the importance of digital channels.

- Investments in digital transformation reached €2.4 billion by the end of 2023, demonstrating commitment.

- The mobile payment market in Europe is projected to reach $500 billion by 2025, pointing to significant growth potential.

- Compliance costs can be substantial; for example, GDPR fines have reached billions across European companies.

Sustainability Initiatives

Carrefour's focus on sustainability, like cutting plastic use and boosting organic options, is a nod to eco-minded shoppers. These moves, however, need serious cash and might not instantly boost profits. They're tackling risks with plans such as reducing plastic by half by 2025 and offering more local, organic goods.

- Carrefour aims to cut plastic use by 50% by 2025.

- They're investing in more organic and local product lines.

- Sustainability efforts can attract environmentally aware customers.

- These initiatives require substantial financial investment.

Question marks within Carrefour's BCG matrix highlight high-growth, uncertain-return areas. These include digital financial services, like mobile payments, and emerging market expansions. Such ventures require substantial investment and face regulatory hurdles. Digital sales rose by 13.5% in Q3 2023, underscoring their importance.

| Area | Investment | Risk |

|---|---|---|

| Digital Finance | Tech, Compliance | Regulatory |

| Emerging Markets | Store Openings | Market Volatility |

| Sustainability | Organic Products | ROI Uncertainty |

BCG Matrix Data Sources

This Carrefour BCG Matrix utilizes comprehensive sources: financial statements, market analyses, and competitor data for accurate strategic assessment.