Carrols SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrols Bundle

What is included in the product

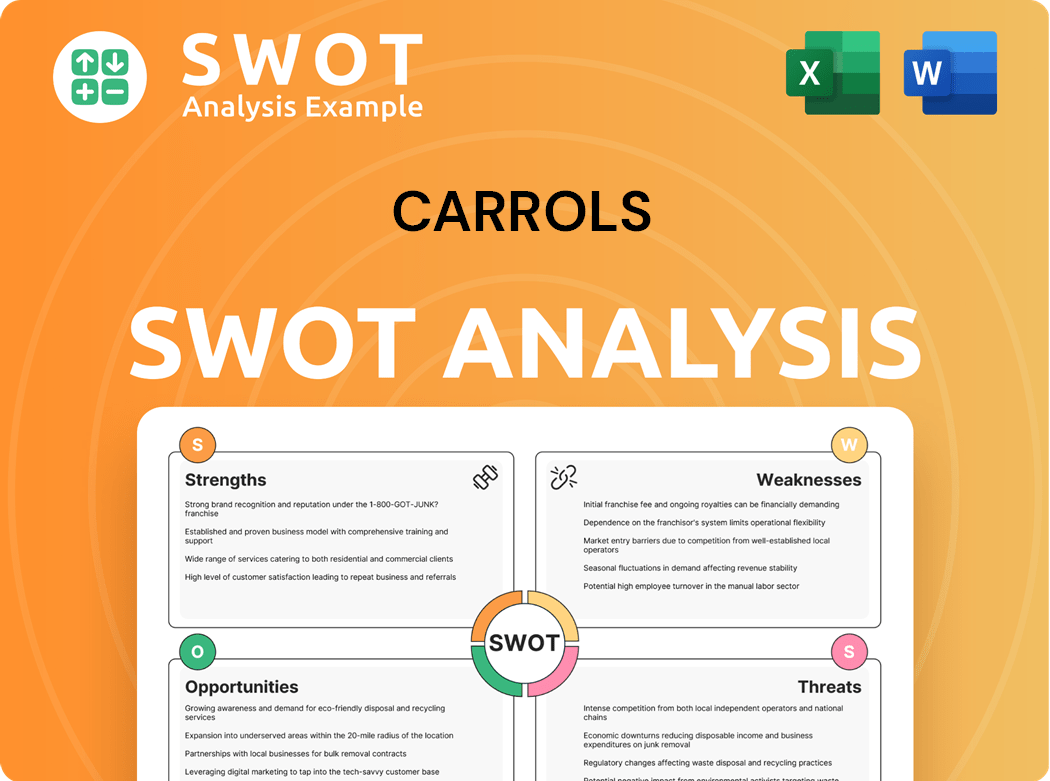

Analyzes Carrols’s competitive position through key internal and external factors.

Gives a high-level overview for quick stakeholder presentations.

Preview Before You Purchase

Carrols SWOT Analysis

See the actual Carrols SWOT analysis here! This is a live preview of the full document. After purchase, you’ll download this comprehensive, in-depth report. No surprises, just professional insights and analysis. Get immediate access now!

SWOT Analysis Template

Our quick Carrols SWOT glimpse spotlights strengths like market reach. You’ve seen how vulnerabilities could hinder expansion, and potential external opportunities, like menu innovation. However, crucial data, such as competitive threats are missing. Don’t miss the big picture!

Discover the complete picture behind Carrols with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways. Ideal for entrepreneurs, analysts, and investors.

Strengths

Carrols Restaurant Group, before its acquisition, was the largest Burger King franchisee in the U.S. This large scale boosted brand recognition. The vast presence let Carrols use economies of scale. In 2024, Carrols operated approximately 1,000 Burger King restaurants. This operational efficiency helped improve profits.

Carrols operated Burger King and Popeyes restaurants, leveraging strong brand recognition. Burger King's global brand value in 2024 was estimated at $7.2 billion. This dual-brand strategy reduced dependence on one brand, offering diversification. Customer loyalty and established marketing strategies support this strength.

Carrols' decades in the restaurant industry demonstrate strong operational expertise. This experience helped maintain consistent service quality and optimize costs effectively. In 2024, their operational efficiency led to improved restaurant-level performance. Carrols' ability to adapt to changing consumer preferences is a key strength. This has allowed them to outperform the Burger King system averages.

Strategic Acquisition and Integration

Carrols Restaurant Group's former status as the largest Burger King franchisee in the U.S. was a major strength. This scale boosted brand recognition and market presence significantly. The company benefited from economies of scale in purchasing, marketing, and operations. This led to improved efficiency and profitability.

- Carrols operated approximately 1,000 Burger King restaurants before the acquisition.

- The large footprint ensured strong negotiation power with suppliers.

- Significant marketing budgets supported brand visibility.

Financial Performance

Carrols' financial performance is bolstered by its operation of Burger King and Popeyes restaurants. These brands have strong brand recognition and customer loyalty, aiding in consistent revenue streams. The dual-brand strategy offers diversification, mitigating risks associated with relying on one brand. This approach is reflected in their 2024 financials.

- Burger King's 2024 same-store sales growth was around 3%.

- Popeyes saw a 5% increase in same-store sales in 2024.

- Carrols' total revenue in 2024 reached $1.6 billion.

Carrols Restaurant Group's significant operational scale improved profitability. The company used its size to negotiate better deals and boost brand recognition. A strong marketing strategy increased customer engagement.

| Strength | Details | 2024 Data |

|---|---|---|

| Franchise Size | Largest Burger King franchisee before acquisition. | Approximately 1,000 Burger King restaurants. |

| Brand Portfolio | Operated Burger King and Popeyes. | Burger King's global brand value: $7.2B. |

| Operational Expertise | Decades in restaurant operations. | Burger King same-store sales: 3% growth. |

Weaknesses

Carrols' significant reliance on Burger King for revenue created a notable weakness. In 2024, over 95% of Carrols' revenue came from Burger King restaurants. This dependence heightened vulnerability to Burger King's performance fluctuations. Any downturn in Burger King's initiatives could directly impact Carrols' profitability. This lack of diversification presented a considerable risk.

Carrols, as a franchisee of Restaurant Brands International (RBI), faced limitations due to RBI's control over operations. This included restrictions on menu changes and marketing. Carrols had to adhere to RBI's standards, potentially hindering its ability to adapt quickly. In 2024, RBI's revenue was approximately $7.1 billion. This dependence could restrict Carrols' strategic flexibility.

Carrols, like other restaurant chains, grapples with rising labor and commodity expenses, squeezing profit margins. In 2024, the National Restaurant Association reported a 5.2% increase in menu prices. Carrols has specifically mentioned labor shortages and escalating costs as financial hurdles. Maintaining profitability hinges on effectively managing these cost pressures, as seen in the industry's 2024 average operating profit margin of about 6%.

Debt Burden

Carrols faced challenges due to its debt burden, particularly given its reliance on Burger King. The company's revenue stream was heavily dependent on the Burger King brand, making it vulnerable to any downturns. In 2024, over 90% of Carrols' revenue came from Burger King restaurants, underscoring this dependence. This concentration risk was further amplified by the fact that the company's profitability was tied to Burger King's success.

- High Debt Levels.

- Brand Concentration.

- Profitability Dependence.

- Vulnerability to Market Shifts.

Past Profitability Issues

Carrols' past profitability was significantly influenced by its role as a franchisee, primarily operating under Restaurant Brands International (RBI). This structure limited Carrols' autonomy in key areas like menu development and marketing, tying it to RBI's strategies. In 2024, this constraint could have impacted Carrols' ability to quickly adapt to changing consumer preferences. Following RBI's initiatives, including sustainability efforts, might not always perfectly align with Carrols' specific market goals.

- Franchise Dependence: Carrols' operational decisions were subject to RBI's directives.

- Strategic Alignment: Sustainability and other initiatives had to align with RBI's policies.

- Market Responsiveness: Limited control over menu and marketing hindered rapid adaptation.

- Financial Impact: Profitability could be affected by RBI's overall strategy.

Carrols showed significant reliance on Burger King, with over 95% of its revenue stemming from it in 2024. This lack of diversity exposed Carrols to operational and financial risks tied to the success of a single brand. The company also dealt with limited strategic flexibility tied to RBI's operational controls.

| Weakness | Description | 2024 Data |

|---|---|---|

| Brand Concentration | Heavy reliance on Burger King for revenue | 95% of revenue from Burger King |

| Franchise Dependence | Limited autonomy due to RBI's control | Menu/marketing tied to RBI strategies |

| Cost Pressures | Rising labor/commodity expenses, affecting margins | Restaurant industry prices increased 5.2% |

Opportunities

Carrols can capitalize on Burger King's 'Reclaim the Flame' plan, which includes restaurant remodeling. This aligns with Burger King's goal to invest $500 million to remodel around 600 restaurants. Modernizing restaurants enhances the customer experience and boosts sales. Remodeling could significantly improve Carrols' brand image and competitive edge in 2024.

Digitalization presents a significant opportunity for Carrols. Investing in online ordering, mobile apps, and self-order kiosks enhances convenience. Data insights from these platforms can personalize offers, boosting loyalty. In 2024, Carrols aimed to deploy self-order kiosks in roughly 250 locations.

Carrols can boost appeal by introducing new menu items, like healthier or plant-based options. This diversification helps attract diverse customers. Customization, catering to dietary needs, is key for differentiation. In 2024, plant-based food sales grew, showing market demand. Offering balanced choices aligns with evolving consumer preferences.

Expansion of Delivery Services

The 'Reclaim the Flame' and Royal Reset initiatives provide Carrols with chances to upgrade its Burger King locations. These remodels can boost customer satisfaction, potentially increasing sales. Burger King's investment of roughly $500 million in remodeling 600 restaurants is a key element. This strategic move by Burger King offers Carrols a significant growth path through brand enhancement and operational improvements.

- Restaurant remodels can boost customer experience.

- Burger King's investment is approximately $500 million.

- This improves the brand image.

- Carrols can modernize their locations.

Refranchising

Refranchising presents opportunities for Carrols. Investing in digital platforms, such as online ordering and self-order kiosks, can enhance customer convenience. Embracing technology provides data insights to personalize offers. Carrols planned to roll out self-order kiosks at roughly 250 restaurants in 2024. This strategic move aligns with the industry's tech-driven evolution.

- Digital platforms boost convenience.

- Technology provides data insights.

- Kiosks were planned for 250 restaurants in 2024.

Carrols benefits from Burger King's remodel plan and tech upgrades. Investment in tech, including self-order kiosks (250 planned in 2024), boosts customer experience. Refranchising offers strategic growth opportunities, aligned with industry trends.

| Opportunity | Details | 2024 Impact |

|---|---|---|

| Restaurant Remodels | Align with Burger King's "Reclaim the Flame" plan; approximately $500 million invested. | Improve brand image and customer experience. |

| Digitalization | Online ordering, apps, kiosks; kiosk rollout planned in 250 locations. | Enhance convenience; personalize offers with data. |

| Menu Innovation | New menu items like plant-based options, catering to diverse tastes. | Attract diverse customers; increase sales with customization. |

Threats

The fast-food sector is fiercely competitive, with major players like McDonald's and Wendy's constantly battling for dominance. Carrols, as a franchisee, directly competes with these giants. To stay ahead, Carrols needs continuous innovation, operational excellence, and smart marketing. In 2024, McDonald's global revenue reached nearly $25 billion, highlighting the intense competition Carrols faces.

Consumer preferences are shifting towards healthier choices and sustainable practices, posing a threat to traditional fast-food models. Carrols must adapt to avoid losing market share; in 2024, the demand for plant-based options grew by 15%. The rise of delivery services like DoorDash and Uber Eats, which now account for 20% of QSR sales, demands operational agility. Failure to meet these evolving needs could lead to decreased customer engagement and financial setbacks.

Economic downturns pose a significant threat to Carrols, potentially curbing consumer spending and reducing restaurant sales and profitability. Carrols' high debt levels and dependence on low-income consumers could amplify its vulnerability to economic fluctuations. For example, in 2023, Carrols reported a net loss of $13.8 million. The company's recovery hinges on economic recovery, despite recent unit-level profitability improvements.

Regulatory and Legal Challenges

Carrols faces significant regulatory and legal threats. The fast-food industry is intensely competitive. Compliance with food safety regulations and labor laws adds operational costs. Legal challenges, like those concerning labor practices or product liability, can impact profitability.

- In 2024, fast-food chains faced increased scrutiny over wages and working conditions.

- Food safety incidents can lead to costly recalls and reputational damage.

- Changes in health and nutrition regulations could affect menu offerings.

Supply Chain Disruptions

Supply chain disruptions pose a significant threat to Carrols. These disruptions can lead to increased costs and reduced availability of essential ingredients, impacting profitability. The company's reliance on specific suppliers makes it vulnerable to external shocks. In 2024, the restaurant industry faced challenges with fluctuating food prices, with beef prices increasing by 5% and poultry by 3%. These disruptions can affect Carrols' ability to meet customer demand effectively.

- Increased ingredient costs.

- Potential for shortages.

- Impact on profitability.

- Reliance on suppliers.

Carrols faces intense competition from fast-food giants, demanding constant innovation. Consumer preferences for healthier options and delivery services add pressure to adapt. Economic downturns, regulatory changes, and supply chain issues significantly impact Carrols.

| Threat | Impact | 2024 Data |

|---|---|---|

| Competition | Market share erosion | McDonald's revenue nearly $25B. |

| Changing consumer habits | Decreased customer engagement | Plant-based demand up 15%. |

| Economic downturn | Reduced restaurant sales | Carrols loss of $13.8M. |

SWOT Analysis Data Sources

The analysis relies on financial statements, market research, and expert insights for accurate and reliable assessment.