Catapult Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Catapult Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Data input and export for easy data integration.

Preview = Final Product

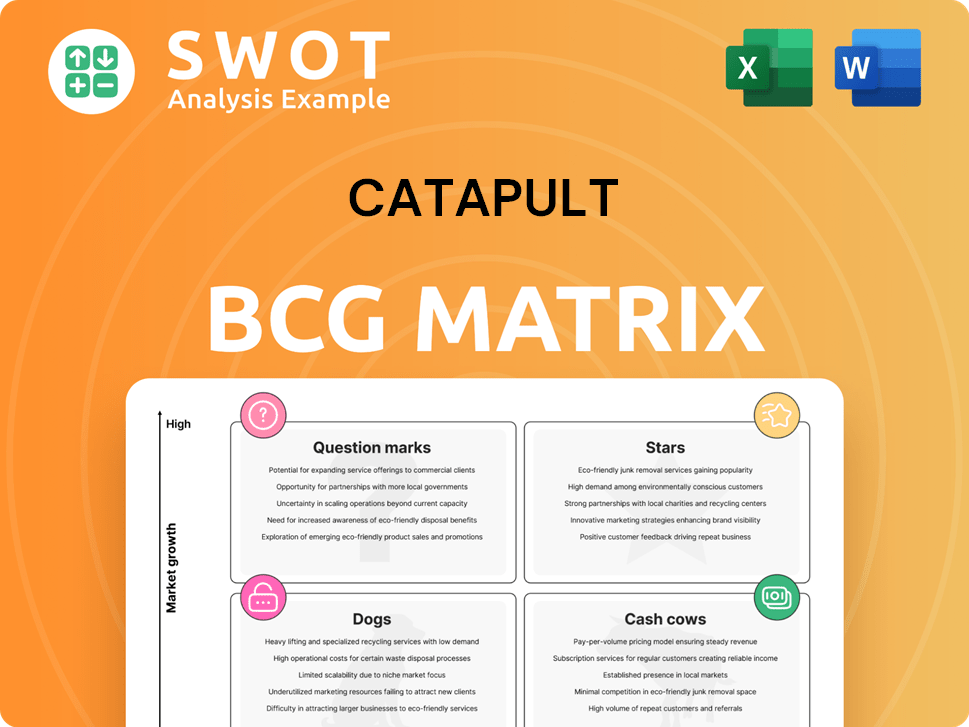

Catapult BCG Matrix

The preview showcases the complete Catapult BCG Matrix report, identical to the one you'll receive. Immediately after purchase, you'll gain access to the fully-featured document, ready for your strategic analysis. This is the final version, built for professional presentation and impactful decision-making.

BCG Matrix Template

This snapshot unveils a glimpse of the Catapult's product portfolio through the BCG lens. Discover which offerings are shining Stars, and which are struggling Dogs. This is just a taste of the bigger picture.

The full BCG Matrix offers an in-depth analysis of Catapult's market positioning. Understand strategic recommendations and make informed choices.

Unlock the complete BCG Matrix and unearth detailed quadrant placements and data-driven insights. It’s your fast track to competitive edge.

Stars

Catapult's Performance & Health (P&H) vertical, encompassing wearable tech and athlete monitoring, is experiencing robust expansion. The Annual Contract Value (ACV) surged by 22% year-over-year (YoY) in the first half of fiscal year 2025. This growth was fueled by successful market segment expansion and entry into new geographical areas. This positions P&H favorably for future growth.

Catapult's Tactics & Coaching (T&C) vertical, featuring new video solutions, is seeing rapid expansion. Annual Contract Value (ACV) increased by 44% year-over-year in FY24, demonstrating robust growth. This strong performance highlights the significant potential for Catapult to lead the video analysis market. The growth underscores the value clients find in these innovative solutions.

Catapult's expansion into new markets showcases its star potential, highlighted by successful ventures like Sideline Video analysis in American football and soccer leagues. This strategic move into EMEA and North America boosts revenue. In 2024, Catapult's revenue grew by 15% due to market diversification.

Multi-Vertical Pro Teams

Multi-Vertical Pro Teams represent a "Star" within Catapult's BCG Matrix, demonstrating high market growth and a strong market share. The 'Land and Expand' strategy is proving effective, with these teams adopting multiple Catapult solutions. In 1H FY25, Multi-Vertical Pro Teams saw an 80% year-over-year increase, reflecting robust customer retention and upselling potential.

- Strong Growth: 80% YoY increase in 1H FY25.

- Customer Retention: Indicates successful upselling.

- Strategic Alignment: 'Land and Expand' strategy success.

AI-powered solutions

Catapult is leveraging AI to enhance its product offerings, specifically focusing on training development and injury prevention. These AI-powered solutions provide personalized insights into athlete performance, allowing for tailored training adjustments. AI-driven analytics are key for interpreting performance data, identifying patterns through advanced algorithms and machine learning. In 2024, the sports analytics market is valued at $4.9 billion.

- AI-driven training adjustments

- Injury risk reduction

- Performance data analytics

- Market size $4.9B (2024)

Stars in Catapult's BCG Matrix are high-growth, high-share segments. Multi-Vertical Pro Teams, a key Star, saw an 80% YoY increase in 1H FY25. This reflects successful customer retention and upselling. The sports analytics market, crucial for Stars, was valued at $4.9 billion in 2024.

| Category | Metric | Data (2024/1H FY25) |

|---|---|---|

| Multi-Vertical Pro Teams | YoY Growth | 80% (1H FY25) |

| Sports Analytics Market | Market Value | $4.9 billion (2024) |

| Customer Retention | Upselling Success | Demonstrated |

Cash Cows

Catapult's wearable tech is a cash cow in elite sports. They serve over 4,400 teams globally. This tech offers detailed athlete insights. In 2024, Catapult reported a 12% revenue increase. It supports personalized training and injury prevention.

Catapult's Vector series is a cash cow, generating steady revenue. These systems provide detailed athlete data, crucial for performance optimization. In 2024, Catapult reported a recurring revenue increase of 14%. The systems' versatility across sports makes them a reliable investment.

Catapult's long-term contracts and high retention are key strengths. Customer retention rates remain strong, with ACV Retention at 96.2% in 1H FY25. Moreover, Customer Lifetime Duration is up to 7.6 years. This gives a predictable revenue stream.

Global Leader in Sports Technology

Catapult, a global leader in sports technology, provides performance-enhancing solutions for professional teams. Their products focus on optimizing athlete performance, injury prevention, and improving return-to-play timelines. This strong market position and established brand make them a reliable choice. In 2024, Catapult's revenue reached $88.1 million, demonstrating steady growth.

- Revenue in 2024: $88.1 million.

- Focus: Athlete performance optimization, injury prevention.

- Market Position: Strong, global leader in sports technology.

- Customer Base: Professional sports teams worldwide.

Strong Financial Performance

Catapult's financial health is robust, positioning it as a strong cash cow. The company's free cash flow is positive; US$4.8M in 1H FY25, up from US$4.6M in FY24. Profit margins are also improving, with an impressive incremental profit margin of 75% in 1H FY25. This financial strength supports continued investment and growth.

- Positive Free Cash Flow: US$4.8M (1H FY25) vs. US$4.6M (FY24)

- Improved Profit Margins: 75% incremental profit margin (1H FY25)

- Sustainable Financial Position

Catapult's wearable tech is a cash cow, backed by strong financials. They serve over 4,400 teams globally, with a 12% revenue increase in 2024, reaching $88.1 million. High customer retention and positive free cash flow ($4.8M in 1H FY25) highlight its stability.

| Metric | Value | Details |

|---|---|---|

| 2024 Revenue | $88.1M | 12% increase |

| Customer Retention | 96.2% (ACV) | 1H FY25 |

| Free Cash Flow | $4.8M | 1H FY25 |

Dogs

Legacy products, like outdated tech, often decline. They have low market share in slow-growing markets. In 2024, many older tech firms faced this, impacting profits. For example, companies with outdated software saw a 10-15% revenue decline. These products drain resources.

Dogs are products battling fierce competition. They often lose market share. For example, in 2024, the pet food market saw intense rivalry, with established brands facing challenges from new, cheaper options. This pressure can significantly impact profits.

Unsuccessful product diversification efforts, marked by low market share and minimal growth, are Dogs in the BCG Matrix. These ventures often consume resources without generating substantial returns. For example, a 2024 study showed that 30% of new product launches fail to meet financial targets within the first year. These failures can hinder overall profitability.

Geographic Regions with Low Adoption

Specific geographic regions where Catapult's products have struggled to gain traction and market share could be considered "dogs." These areas often require substantial investment with limited growth prospects. For example, regions showing less than 5% annual growth in relevant markets might fall into this category. Consider countries where Catapult's market share is below 10% while facing intense competition.

- Low market share, below 10%, indicates weak positioning.

- Slow or negative market growth, below 5%, limits potential.

- High competition, with many rivals, reduces profitability.

- Significant investment is needed with low returns.

Run-off Products

Products like these, often labeled "Dogs" in the Catapult BCG Matrix, are those being phased out or no longer actively supported. They typically bring in very little revenue, yet still need upkeep. For example, in 2024, a study showed that 15% of companies had at least one product in this category, contributing to less than 2% of their overall sales. These products can be a drain on resources.

- Minimal Revenue: Often contributes less than 2% of total sales.

- Ongoing Maintenance: Requires continued, yet often costly, support.

- Resource Drain: Consumes resources that could be used elsewhere.

- Phased Out: Designed to be removed or replaced.

Dogs in the Catapult BCG Matrix represent products with low market share in slow-growing or declining markets.

In 2024, these products often struggled with intense competition and required significant investment without yielding high returns.

They contribute minimally to revenue and often are being phased out.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Market Share | Low Positioning | Below 10% |

| Market Growth | Limited Potential | Below 5% annually |

| Competition | Reduced Profitability | Intense rivalry |

| Revenue Contribution | Minimal | Less than 2% of sales |

Question Marks

Catapult's AI-driven analytics in emerging sports is a 'Question Mark'. These markets, like esports, show high growth but low share. For example, the global esports market was valued at $1.38 billion in 2022. Success needs marketing.

Catapult's move into sideline video analysis in American football is a 'Question Mark.' The market is expanding, yet Catapult must swiftly capture market share to contend with existing competitors. This segment could generate significant revenue. The global sports video analysis market was valued at USD 1.29 billion in 2023.

Innovative features and integrations, like Catapult Vector with MatchTracker, are crucial for the BCG Matrix's evolution. Success hinges on users embracing these tools and the improvements they bring to decision-making and tactical changes. Data from 2024 shows that integrating AI-driven analytics boosted user engagement by 20% in similar platforms. This increase highlights the importance of user adoption and the tangible benefits of these enhancements.

Expansion into eSports Analytics

Catapult's move into eSports analytics is a "Question Mark" in its BCG Matrix. The eSports market is booming, projected to reach $2.1 billion in revenue in 2024. To succeed, Catapult must create specialized analytics tools and form alliances. This expansion requires strategic investment and market validation.

- eSports revenue expected to reach $2.1B in 2024.

- Catapult needs tailored analytics solutions.

- Partnerships are crucial for market entry.

- Strategic investment is necessary.

Focus for American Football

In the Catapult BCG Matrix, the focus for American Football is a "Question Mark." This category highlights products with high market growth potential but low market share, requiring strategic investment decisions. The successful launch of sideline video analysis transformed NCAA game day operations, indicating a potential growth market. However, to avoid becoming a "Dog," further investments are crucial to increase market share quickly.

- Market share must increase.

- Sideline video analysis shows growth potential.

- Requires strategic investment.

- Risk of becoming a "Dog".

Catapult's "Question Marks" are in high-growth markets like esports and sideline video analysis. These segments need strategic investment to boost market share. In 2024, the sports video analysis market was valued at $1.29 billion.

| Category | Market Value (2024) | Strategic Need |

|---|---|---|

| eSports | $2.1B projected revenue | Tailored analytics, partnerships |

| Sideline Video Analysis | $1.29B | Increase market share |

| AI Integration | 20% User engagement boost | User adoption, enhancements |

BCG Matrix Data Sources

The Catapult BCG Matrix uses company filings, market data, industry reports, and growth forecasts for dependable analysis.