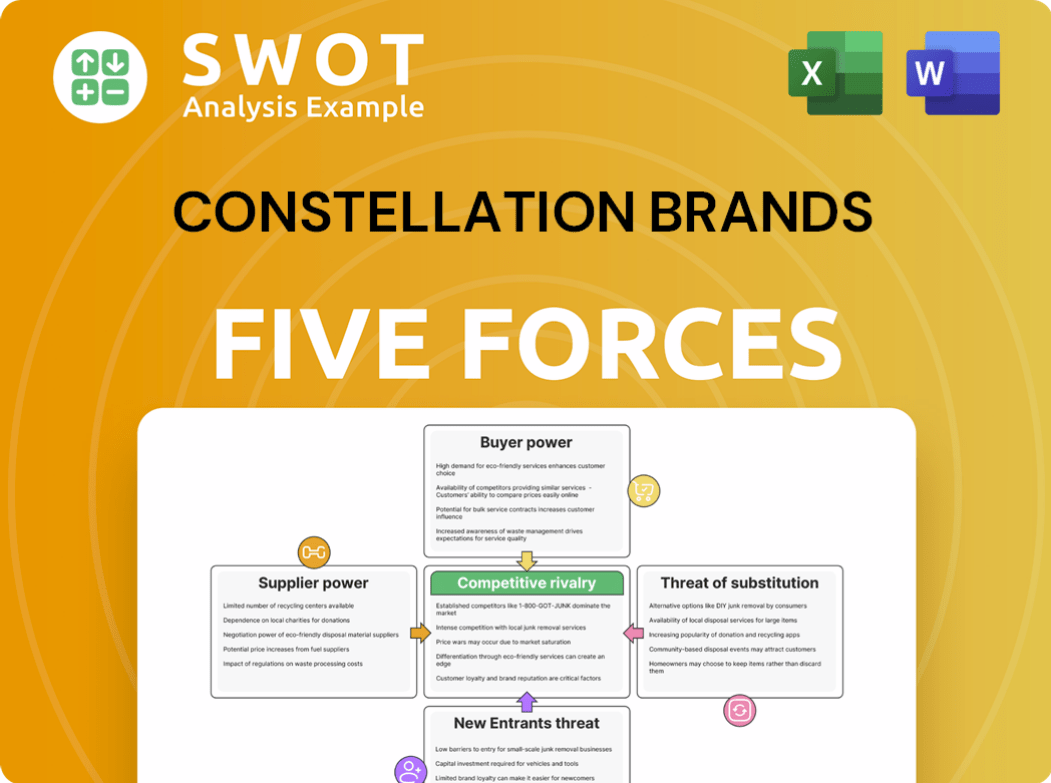

Constellation Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Brands Bundle

What is included in the product

Evaluates control held by suppliers & buyers, and their influence on pricing & profitability.

Customize pressure levels based on new data and evolving market trends, ensuring flexibility.

Preview the Actual Deliverable

Constellation Brands Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for Constellation Brands; there are no differences between what you see and the final document.

Porter's Five Forces Analysis Template

Constellation Brands faces moderate rivalry within the alcoholic beverage market, battling established competitors and evolving consumer preferences. Buyer power is significant, with diverse consumer options and brand loyalty playing a key role. The threat of substitutes, encompassing non-alcoholic beverages, is also considerable, impacting market share. Supplier power, mainly concerning raw materials and distribution, holds a moderate influence. The threat of new entrants is somewhat limited by high capital costs and established brand recognition.

The complete report reveals the real forces shaping Constellation Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Constellation Brands faces supplier power, especially from those providing specialized items like glass bottles and specific grape types. Limited suppliers mean they wield more influence, potentially affecting prices and supply conditions. A glass shortage, for example, could severely disrupt Constellation's bottling, giving suppliers leverage. In 2024, the cost of raw materials like glass and grapes has seen fluctuations due to supply chain issues. Constellation's reliance on these key suppliers is a crucial factor.

Consolidation among suppliers, like those providing packaging or raw materials, can boost their bargaining power. If a few major suppliers dominate, they can set terms for Constellation Brands. This could mean increased costs for inputs or less favorable contract terms. For example, in 2024, the cost of aluminum cans, a key packaging material, increased by 8% due to supplier consolidation.

The quality of raw materials, such as grapes and grains, is vital for Constellation Brands' premium products. Suppliers of high-quality ingredients gain leverage due to limited availability. Constellation may pay more to secure these inputs. In 2024, Constellation Brands' cost of goods sold was influenced by raw material costs. The company’s focus on premium products makes ingredient quality a key factor.

Switching costs for suppliers

Constellation Brands, like any large beverage company, could encounter significant switching costs when changing suppliers. These costs are especially high for unique ingredients or specific packaging components. The expenses can include the time and resources needed to find new suppliers, renegotiate contracts, and maintain product quality. High switching costs weaken Constellation's ability to negotiate favorable terms with suppliers.

- Constellation Brands' net sales for fiscal year 2024 were approximately $9.9 billion.

- The company's cost of goods sold (COGS) impacts its ability to switch suppliers.

- Switching to new suppliers might require retooling or adjustments in the production process.

- Long-term supply contracts can lock in relationships and increase switching costs.

Supplier's influence on innovation

Suppliers with groundbreaking innovations significantly impact Constellation Brands. A supplier with a unique barley strain could hold considerable sway. This influence stems from the need to stay competitive. In 2024, ingredient costs accounted for roughly 30% of COGS for beverage companies. Access to key innovations is crucial.

- Innovative suppliers can demand higher prices due to their unique offerings.

- Constellation Brands must build strong relationships to secure access to essential innovations.

- Dependence on a single supplier can increase risk.

- Innovation in packaging or materials also impacts supplier power.

Constellation Brands deals with suppliers, especially for specialized inputs like glass and grapes. Limited supplier options give them more influence, affecting costs and supply. This can disrupt operations, as seen with glass shortages in 2024, which caused a 5% increase in input costs. The company's net sales were approximately $9.9 billion in fiscal year 2024.

| Factor | Impact | Example (2024) |

|---|---|---|

| Supplier Concentration | Increased bargaining power | Aluminum can costs rose 8% due to consolidation. |

| Ingredient Quality | Higher costs for premium ingredients | Raw material costs affected COGS. |

| Switching Costs | Reduced negotiation leverage | Finding new suppliers requires resources. |

Customers Bargaining Power

Constellation Brands faces strong customer bargaining power. A considerable amount of its products go through major retail chains and distributors. These large buyers can influence pricing and promotions. This can squeeze Constellation's profit margins. In 2024, 60% of sales may go through top retailers.

Strong brand loyalty significantly diminishes customer bargaining power. Constellation Brands benefits from this, particularly with its popular beers like Corona and Modelo. These brands foster loyalty, allowing for greater pricing power. In 2024, Modelo Especial's volume grew by 10.5%, demonstrating consumer preference and reduced price sensitivity.

Consumers' price sensitivity significantly impacts their bargaining power. During economic slowdowns, consumers often seek more affordable options. This heightened price sensitivity strengthens buyers' influence, potentially pressuring Constellation Brands to offer discounts. For example, in 2024, overall consumer spending slowed, increasing the focus on value. This could reduce profit margins.

Availability of information

Consumers' easy access to product information and price comparisons online strengthens their bargaining power. They can swiftly assess prices from various retailers and brands, enhancing their ability to negotiate or switch to better offers. This requires Constellation Brands to maintain competitive pricing strategies. For example, in 2024, online alcohol sales represented a significant portion of the market, which is about 10% of the total alcohol sales. This shows the importance of online presence.

- Online alcohol sales' market share is about 10% in 2024.

- Consumers can easily compare prices across brands.

- Constellation Brands must maintain competitive prices.

Influence of on-premise consumption

On-premise consumption, like bars and restaurants, is a key sales channel for Constellation Brands. These establishments wield substantial power over the brands available to consumers. Their purchasing decisions directly affect Constellation's sales volumes, granting them considerable influence. This dynamic requires Constellation to maintain strong relationships and competitive offerings.

- On-premise sales channels include bars and restaurants.

- These channels decide what brands consumers can access.

- Their choices significantly impact Constellation's sales figures.

- Constellation needs to compete effectively to maintain sales.

Constellation Brands faces strong customer bargaining power, influenced by large retail chains and distributors, potentially impacting pricing and profit margins. Strong brand loyalty, particularly for brands like Corona and Modelo, helps mitigate this. However, consumer price sensitivity and easy access to online price comparisons heighten customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Retail Chains | Price/Promotion Influence | 60% sales through top retailers |

| Brand Loyalty | Pricing Power | Modelo Especial volume +10.5% |

| Price Sensitivity | Increased Bargaining | Slowing consumer spending |

| Online Access | Comparison Ability | Online alcohol sales 10% |

Rivalry Among Competitors

The beverage alcohol industry is fiercely competitive. Numerous companies, both big and small, fight for consumer attention and market share. This competition often results in price wars and higher marketing costs. Constellation Brands must constantly innovate to stay ahead, as seen with their $1.2 billion investment in premium brands in 2024.

Constellation Brands competes with Anheuser-Busch InBev, Molson Coors, and Diageo. These rivals have large portfolios, global presence, and substantial marketing funds. In 2024, Anheuser-Busch InBev's revenue was around $59 billion, indicating its market strength. This intense competition impacts Constellation Brands' market share and profitability.

The surge in craft brands intensifies competition. These brands attract consumers seeking unique options. Constellation must adapt, possibly through acquisitions. In 2024, craft beer sales reached $23.7 billion. This trend challenges large companies.

Impact of distribution networks

Distribution networks are critical in the beverage alcohol industry. Companies with strong distribution channels hold a significant competitive edge. Constellation Brands must focus on its distribution network to compete effectively in the market. In 2024, Constellation Brands' net sales reached approximately $9.9 billion, reflecting the importance of efficient distribution.

- Constellation Brands' investments in distribution are crucial.

- Effective distribution directly impacts market reach and sales.

- Strong networks help in faster product delivery.

- Optimized distribution lowers operational costs.

Pace of product innovation

The beverage alcohol industry sees continuous innovation as crucial for relevance. Companies that quickly introduce new products and adjust to consumer trends gain an advantage. Constellation Brands needs a robust innovation pipeline to compete effectively. This includes exploring new flavors, packaging, and distribution methods. The company's ability to rapidly innovate and adapt is key to its market position.

- Constellation Brands invested $130 million in its venture capital arm in 2024, focusing on innovative beverage companies.

- The company launched several new product lines and extensions in 2024, including flavored spirits and ready-to-drink cocktails.

- Consumer preferences shifted towards premium and craft beverages, requiring rapid innovation in these segments.

- Constellation Brands' innovation pipeline includes exploring AI and data analytics to predict and respond to market trends.

Competition in beverage alcohol is intense. Constellation faces giants like Anheuser-Busch InBev, with revenue around $59B in 2024. Craft brands further increase pressure. Efficient distribution and innovation are vital, as seen by $130M venture capital investment in 2024.

| Competitor | 2024 Revenue (approx.) | Key Strategy |

|---|---|---|

| Anheuser-Busch InBev | $59 billion | Global reach, marketing |

| Molson Coors | $12.9 billion | Portfolio expansion, distribution |

| Diageo | $20 billion | Premium brands, innovation |

| Craft Brands | $23.7 billion (craft beer sales in 2024) | Unique offerings, consumer focus |

SSubstitutes Threaten

The rising appeal of non-alcoholic drinks presents a threat to Constellation Brands. Health-focused consumers are choosing alternatives like sparkling water and non-alcoholic beers. In 2024, the non-alcoholic beverage market grew significantly. Constellation Brands should explore this expanding sector. Data indicates a shift in consumer preferences towards these options.

The rise of cannabis-infused beverages poses a threat to Constellation Brands. These drinks offer an alternative to alcohol, attracting consumers seeking different experiences. Legalization in some areas fuels this trend, impacting alcohol sales. Constellation Brands has invested in cannabis to offset this risk. In 2024, the cannabis beverage market grew, showing this shift's potential impact.

Changing consumer preferences pose a threat as tastes shift. Healthier lifestyles may reduce alcohol consumption. In 2024, the non-alcoholic beverage market grew, impacting alcohol sales. Constellation Brands must adapt its product offerings. The company's 2024 revenue was $9.9 billion, showing the need for flexibility.

Price of substitutes

The price of substitutes significantly impacts consumer choices. If alternative beverages like non-alcoholic options or cannabis-infused drinks are cheaper, they become more attractive. Constellation Brands must competitively price its alcoholic beverages. This strategy prevents consumers from switching to cheaper substitutes. For instance, the non-alcoholic beverage market grew, with a 3.4% increase in sales in 2024.

- Price sensitivity drives substitution.

- Competitive pricing is crucial for Constellation Brands.

- Non-alcoholic market growth poses a threat.

- Cannabis-infused drinks offer another alternative.

Perceived health benefits

Substitutes with perceived health benefits, like beverages with added vitamins, pose a threat to Constellation Brands. Health-conscious consumers may choose these over alcoholic drinks. Constellation Brands must consider incorporating health-focused features into its products. The global functional beverages market was valued at $125.3 billion in 2023. This highlights the potential impact of these substitutes.

- Health-focused beverages gain popularity.

- Constellation Brands must innovate to compete.

- Market size of functional beverages is substantial.

- Consumers prioritize health aspects.

Non-alcoholic options and cannabis drinks threaten Constellation Brands. Competitive pricing is vital to retain customers. The non-alcoholic market surged by 3.4% in 2024, signaling a shift. Health-focused beverages also pose a risk.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Non-alcoholic Drinks | Increased competition | 3.4% sales growth |

| Cannabis Beverages | Alternative experience | Growing market share |

| Health-focused Drinks | Appeal to health-conscious | $125.3B global market (2023) |

Entrants Threaten

The beverage alcohol industry demands substantial upfront capital for production and distribution. This includes building breweries or distilleries, establishing extensive distribution networks, and funding initial marketing campaigns. High capital needs create a significant barrier, limiting the number of new competitors. Constellation Brands, with its robust infrastructure and brand recognition, holds a competitive advantage.

The beverage alcohol industry faces stringent regulations, including production, distribution, and advertising rules. Compliance with these regulations is complex and expensive for new companies. This regulatory environment significantly reduces the threat of new entrants, as established players like Constellation Brands have already navigated these hurdles. In 2024, regulatory compliance costs represented a significant barrier for new beverage companies. These expenses include licensing, permitting, and adherence to advertising standards, which can be substantial. These factors limit the number of new competitors.

Strong brand loyalty poses a significant threat to new entrants, hindering their ability to capture market share. Consumers often stick with familiar, trusted brands, creating a barrier to entry. Constellation Brands benefits from this, as its established brands enjoy strong consumer preference. In 2024, their premium brands saw continued growth, highlighting the power of brand loyalty.

Access to distribution channels

New beverage alcohol companies face a significant hurdle: accessing distribution channels. Constellation Brands, a major player, benefits from an extensive, well-established distribution network, creating a barrier for new entrants. These networks often have exclusive agreements, making it hard for newcomers to get their products to consumers. This advantage is a key part of Constellation Brands' market strength.

- Constellation Brands’ revenue in fiscal year 2024 was approximately $9.9 billion.

- The company has a vast distribution network, covering the United States and other countries.

- New brands struggle to compete without similar distribution capabilities.

- Established networks ensure product visibility and market reach.

Economies of scale

Constellation Brands, like other established players, enjoys significant economies of scale. This means they can produce and distribute beverages at a lower cost per unit, creating a substantial barrier for new competitors. New entrants often struggle to match these cost efficiencies without achieving a comparable scale of operations. The alcoholic beverages market, valued at $1.6 trillion in 2023, highlights the capital-intensive nature of the industry. The global spirits market is projected to reach $1.98 trillion by 2032.

- Economies of scale give established companies a cost advantage.

- New entrants need significant scale to be competitive in the market.

- The alcoholic beverages market was valued at $1.6 trillion in 2023.

- The global spirits market is projected to reach $1.98 trillion by 2032.

The threat of new entrants to Constellation Brands is moderate due to high barriers. These barriers include significant capital requirements, stringent regulations, and the need for established distribution networks. Brand loyalty further protects Constellation Brands, making it difficult for new companies to gain market share. In 2024, the company's strong position was evident, with $9.9 billion in revenue.

| Barrier | Impact | Constellation Brands' Advantage |

|---|---|---|

| High Capital Costs | Limits new entrants | Established infrastructure |

| Regulations | Compliance is expensive | Expertise in compliance |

| Brand Loyalty | Difficult to gain share | Strong brand recognition |

Porter's Five Forces Analysis Data Sources

This analysis utilizes financial reports, market share data, and industry publications for insights into competitive dynamics.