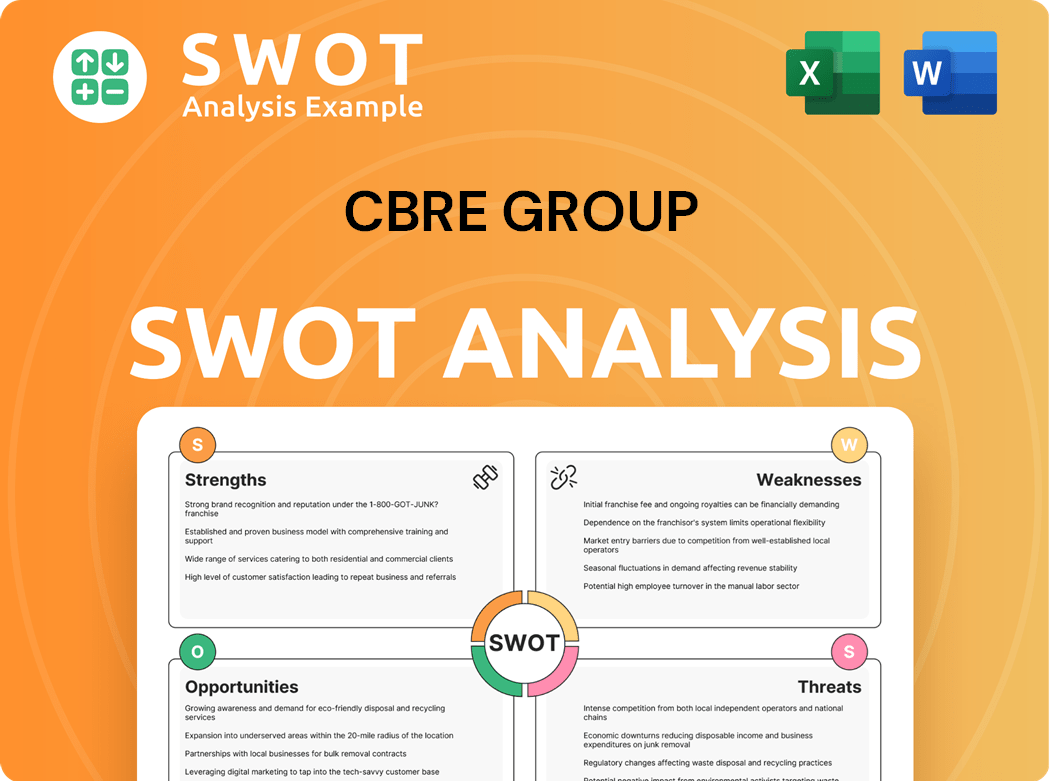

CBRE Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBRE Group Bundle

What is included in the product

Analyzes CBRE Group’s competitive position through key internal and external factors.

Ideal for executives needing a snapshot of CBRE Group's strategic positioning.

Preview Before You Purchase

CBRE Group SWOT Analysis

You are seeing the actual CBRE Group SWOT analysis report. The very same professional-quality document is provided to you following your purchase.

SWOT Analysis Template

CBRE Group's real estate dominance comes from its global presence and diverse service offerings. However, rising interest rates and market volatility present notable challenges. A SWOT analysis helps navigate such complex landscapes.

This overview highlights key strengths, weaknesses, opportunities, and threats shaping CBRE.

Want the full story behind their strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CBRE is the top global commercial real estate services and investment firm. Its vast network spans over 100 countries, showcasing its global reach. In 2024, CBRE's revenue was around $30.8 billion, highlighting its market dominance. This leadership is supported by its strong brand and reputation.

CBRE's strength lies in its diverse service offerings. This includes property leasing, sales, and management, allowing them to serve various client needs. Their diversified approach reduces dependency on a single service. In 2024, CBRE's revenue reached $30.1 billion, showcasing the success of this strategy.

CBRE's strong financial performance is a key strength, showcasing robust profitability. The company's solid financial foundation enables investment in strategic initiatives. In 2024, CBRE reported a revenue of $30.8 billion. A strong balance sheet and consistent cash flow provide stability.

Technological Advancements

CBRE leverages cutting-edge technological advancements to enhance its service offerings and operational efficiency. They utilize data analytics and AI to provide clients with valuable market insights and optimize real estate decisions. This includes platforms for property management, transaction management, and client relationship management. CBRE invests in proptech to stay ahead of industry trends and improve client experiences.

- CBRE's tech investments reached $140 million in 2024, focusing on data analytics and AI.

- Their tech platforms processed over $300 billion in transactions in 2024.

- CBRE's AI-driven tools improved property valuation accuracy by 15% in 2024.

Experienced Talent and Culture

CBRE Group's experienced talent pool and well-established culture are significant strengths. The company boasts a broad range of services, from property leasing to project management. This diversification allows CBRE to meet various client needs and generate revenue from multiple sources. These end-to-end solutions strengthen client relationships.

- CBRE's revenue in 2023 was $30.8 billion.

- CBRE operates in over 100 countries.

- CBRE's global workforce exceeds 130,000 employees.

CBRE's vast global presence and brand reputation underpin its strong market position. Its diverse service offerings and financial strength provide stability and adaptability. Technological investments and skilled professionals enhance services.

| Strength | Details | 2024 Data |

|---|---|---|

| Global Leader | Operates worldwide, strong brand. | Revenue: ~$30.8B, Tech invest: $140M |

| Diversified Services | Leasing, sales, and management. | $30.1B Revenue, across multiple sources. |

| Financial Strength | Strong profitability and cash flow. | Revenue: ~$30.8B, Strong balance sheet. |

Weaknesses

CBRE's reliance on the real estate market's cycles is a key weakness. During downturns, like the slowdown in 2023, transaction volumes and property values decrease, impacting revenue. In 2023, CBRE's revenue decreased by 17% in the Americas. This market sensitivity makes financial planning difficult.

CBRE faces headwinds from the office sector's struggles, including high vacancy rates. Remote work and changing space use hurt leasing and property management revenues. In Q3 2023, office vacancy in major U.S. markets reached 19.2%, a significant challenge. Adapting to these trends is crucial for CBRE's success.

CBRE's vast size and global presence create a complex structure, possibly slowing down decisions. Bureaucracy can hinder efficiency across its worldwide operations. Managing a diverse workforce and coordinating across regions poses challenges. Streamlining and better communication are key to boosting responsiveness. In Q3 2023, CBRE's Americas revenue decreased by 17% due to market conditions.

Limited Presence in Emerging Markets

CBRE's expansion in emerging markets has been slower compared to some competitors. This limited presence can restrict growth opportunities in regions experiencing rapid real estate development. CBRE's revenue is significantly exposed to market volatility and economic downturns. For example, in 2024, CBRE's revenue was $30.4 billion.

- CBRE's revenue in 2024: $30.4 billion.

- Geographic diversification is key for risk mitigation.

- Emerging markets offer high-growth potential.

Debt Levels

CBRE faces headwinds due to challenges in the office sector, marked by high vacancy rates and weak demand. The shift to remote work impacts leasing and property management revenues. Addressing this requires adaptation to workplace trends.

- Office vacancy rates in major U.S. markets reached over 19% in Q4 2023, a multi-year high.

- CBRE's Q3 2023 revenue decreased by 8% year-over-year, partly due to lower office leasing activity.

- The company is focusing on diversifying its service offerings to mitigate risks.

CBRE's susceptibility to market cycles is a major weakness, causing revenue fluctuations, with a 17% decrease in Americas revenue in 2023. Office sector struggles, like high vacancy rates exceeding 19% in Q4 2023, challenge leasing. Bureaucracy within the massive, global structure may reduce agility.

| Issue | Impact | Data Point |

|---|---|---|

| Market Cyclicality | Revenue volatility | 2023 Americas Revenue Down 17% |

| Office Sector Weakness | Reduced leasing activity | Q4 2023 US Vacancy: >19% |

| Organizational Complexity | Slower Decision-making | Global operations |

Opportunities

The rising focus on sustainability and ESG offers CBRE significant chances. Demand for eco-friendly real estate is increasing. Companies are aiming to cut carbon emissions, driving demand for green buildings and sustainable practices. CBRE can expand its services to help clients meet their ESG targets. In 2024, the green building market is valued at over $300 billion.

The data center market is booming, fueled by AI, cloud computing, and the digital economy, presenting significant growth chances for CBRE. Demand for data center space is expected to keep rising, creating opportunities in leasing, property management, and development. CBRE can capitalize on its expertise and global network in this expanding market. In Q3 2024, data center investment volume reached $8.2 billion globally.

CBRE's tech investments boost efficiency, client service, and revenue. AI, machine learning, and blockchain can reshape real estate. CBRE can lead with innovative tech solutions. In 2024, CBRE invested heavily in tech, increasing its tech-related revenue by 15%. This strategic focus is vital.

Strategic Acquisitions and Partnerships

CBRE can seize chances through strategic acquisitions and partnerships, especially in the growing field of sustainable real estate. The push for ESG compliance and green building practices is rising, opening doors for CBRE to boost its sustainability services. This could mean integrating more energy-efficient tech and offering specialized consulting.

- In 2024, ESG-related investments in real estate are projected to hit $1 trillion globally.

- CBRE's revenue in Q3 2024 was $8.2 billion, indicating financial strength for acquisitions.

- Partnerships with green tech firms could boost service offerings.

Growth in Resilient Sectors

CBRE can capitalize on the flourishing data center market. The rise of AI, cloud computing, and the digital economy fuels this expansion. This creates chances for leasing, management, and development services. CBRE's global network can secure a significant market share.

- Data center investments in 2024 are projected to reach $50 billion globally.

- CBRE's data center services revenue grew by 25% in 2023.

- The demand for data center space is expected to grow by 15% annually through 2028.

CBRE benefits from sustainability and ESG trends, with the green building market exceeding $300 billion in 2024. Growth in data centers, fueled by AI, presents significant opportunities, projected to reach $50 billion in investments in 2024. Strategic tech investments and acquisitions enhance services and revenue, boosting tech-related income by 15% in 2024, with Q3 2024 revenue at $8.2 billion.

| Opportunity | 2024 Data | Strategic Implication |

|---|---|---|

| ESG and Sustainability | $1T ESG real estate investments globally projected, green building market over $300B | Expand ESG service offerings, integrate green tech. |

| Data Center Growth | $50B in data center investments, 25% revenue growth in 2023 | Leverage expertise in leasing, property management, and development |

| Tech Investments | 15% increase in tech-related revenue, Q3 revenue $8.2B | Lead with tech solutions and boost operational efficiency |

Threats

Global economic uncertainty, including potential recessions and geopolitical risks, threatens CBRE. Economic downturns decrease transaction volumes and property values. In 2024, global commercial real estate investment volumes fell, reflecting economic concerns. Monitoring trends and preparing for disruptions is crucial.

Rising interest rates pose a significant threat to CBRE. Increased borrowing costs can reduce property values. This can make it harder for developers to finance new projects. In 2024, the Federal Reserve maintained high interest rates. CBRE needs strategies to navigate these challenges.

The commercial real estate sector is fiercely competitive. CBRE faces pressure on pricing and margins due to rivals. Staying ahead demands constant tech investment and talent development. In Q3 2023, CBRE's revenue decreased by 11% year-over-year, reflecting competitive pressures.

Disruptive Technologies

Disruptive technologies like AI and automation threaten traditional real estate practices. These advancements could reshape how properties are managed, valued, and transacted. CBRE must adapt to stay competitive, as the global proptech market was valued at $26.3 billion in 2023. Failure to integrate these technologies could lead to market share erosion.

- AI-driven property valuation tools could decrease reliance on traditional brokerage services.

- Automated property management systems could reduce demand for on-site staff.

- Blockchain technology could streamline real estate transactions, potentially disintermediating brokers.

Climate Change Risks

Climate change presents significant threats to CBRE. Increased frequency of extreme weather events, such as hurricanes and floods, can damage properties and disrupt business operations. Changing climate regulations and the transition to a low-carbon economy could increase operational costs and necessitate investments in more sustainable buildings. CBRE must address these risks to maintain its competitive edge and adapt to evolving market demands. The global cost of climate disasters in 2024 reached approximately $280 billion.

- Increased frequency of extreme weather events.

- Changing climate regulations.

- Transition to a low-carbon economy.

- Damage to properties and disruption of business operations.

Economic volatility, including recessions, hurts transaction volumes and property values. Competition pressures pricing, while technological advancements like AI reshape practices, affecting revenue. Climate change and extreme weather pose major risks, demanding adaptation to maintain market position.

| Threat | Impact | 2024 Data |

|---|---|---|

| Economic Uncertainty | Decreased transaction volumes | Global CRE investment volumes declined. |

| Competitive Pressure | Reduced pricing and margins | Q3 2023 revenue decrease by 11% YOY. |

| Technological Disruption | Reshaping property management | Global proptech market valued at $26.3B in 2023. |

| Climate Change | Property damage & increased costs | $280B global cost of climate disasters. |

SWOT Analysis Data Sources

The SWOT analysis draws from company financials, market reports, expert opinions, and industry analysis to offer a precise overview.