China Development Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

What is included in the product

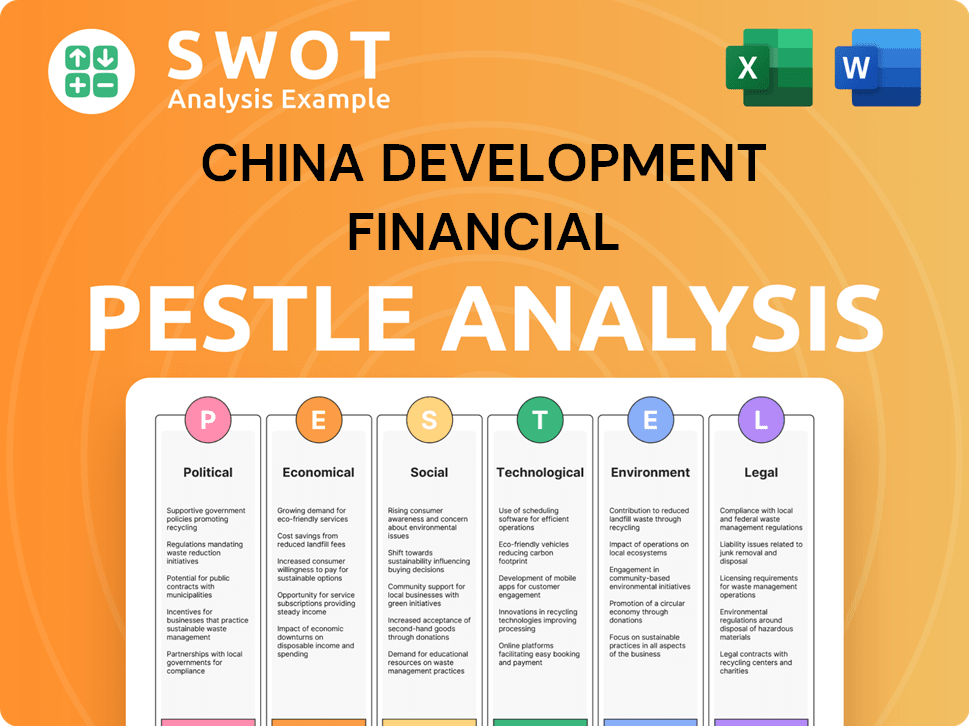

Analyzes how political, economic, social, technological, environmental, and legal factors impact China Development Financial.

Provides a concise version for rapid understanding of critical external factors.

Preview the Actual Deliverable

China Development Financial PESTLE Analysis

What you're seeing here is the complete China Development Financial PESTLE analysis. It offers a comprehensive look at the firm's external environment. The detailed analysis, covering political, economic, social, technological, legal, and environmental factors, is included. The preview accurately reflects the entire downloadable document. After purchase, the document is ready for you.

PESTLE Analysis Template

Assess the external factors influencing China Development Financial. Our PESTLE analysis examines the political climate, economic trends, social shifts, technological advancements, legal frameworks, and environmental concerns affecting the company. This thorough analysis is essential for understanding the challenges and opportunities China Development Financial faces. Leverage this information to make informed decisions. Download the full analysis now!

Political factors

Taiwan's FSC is boosting the financial sector's global edge, possibly easing rules and boosting product variety. This strategy aims to make Taiwan a key Asian asset hub. In 2025, the FSC targets tougher anti-fraud measures and better risk management. They also plan to channel more capital into infrastructure and boost investor safeguards.

Geopolitical tensions between the US and China significantly influence Taiwan's economic climate, possibly deterring foreign investment. Taiwan's government has tightened investment rules for PRC entities. In 2024, investments from China into Taiwan decreased by 20%. Expect fewer PRC-backed deals in 2025 due to regulatory caution. This impacts financial strategies.

Taiwan's Financial Supervisory Commission (FSC) is driving a multi-year plan to establish Taiwan as a major asset management hub in Asia. The initiative aims to boost the domestic asset management sector and attract foreign capital. In 2024, the FSC is expanding wealth management services. The goal is to increase the scale of domestic asset management.

Political Stability and Elections

Taiwan's financial stability faces political challenges. Presidential and legislative elections shape policy. The legislature's focus on local government revenue could affect national defense. In 2024, Taiwan's defense budget was approximately $19.4 billion, representing 2.5% of GDP. Policy shifts could influence these allocations.

- 2024 Defense Budget: $19.4 billion (2.5% of GDP)

- Election Impact: Policy Direction Changes

- Legislative Focus: Local vs. National Spending

Government Support for Industries

The Chinese government heavily supports strategic industries like semiconductors and IT, aiming to boost technological self-sufficiency. This includes policies that incentivize capital spending and attract investment. Moreover, the government is directing capital towards infrastructure projects, potentially offering financial institutions lucrative investment avenues. In 2024, China's investment in high-tech manufacturing grew by 9.9%. This strategic focus reflects broader economic goals.

- Policy focus on strategic industries.

- Incentives for capital expenditure.

- Infrastructure investment opportunities.

- High-tech manufacturing investment growth in 2024.

Political factors in Taiwan and China strongly affect financial markets. Elections and legislative focus reshape policy, with Taiwan's defense spending around $19.4 billion. China's support for tech industries and infrastructure presents financial chances.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Taiwan Elections | Policy shifts; local revenue focus | Defense budget $19.4B (2.5% GDP) |

| China Policies | Strategic industry growth, investment | High-tech manufacturing up 9.9% |

| US-China Tensions | Investment impact | China's investment in Taiwan -20% |

Economic factors

Global economic growth is anticipated to be steady in 2024 and 2025, despite regional differences. Taiwan's economy is forecasted to grow, fueled by the need for AI-related products. For instance, Taiwan's GDP is projected to grow by 3.1% in 2024. However, export market slowdowns and rising energy costs could affect this growth.

Global inflation is anticipated to decrease, though core inflation might stay high due to persistent service costs. In Taiwan, inflation should lessen by 2025, but adjustments in utility rates and minimum wage hikes could still affect consumers. Taiwan's CPI rose 1.8% in March 2024. The Central Bank is expected to remain cautious with monetary policy.

Taiwan's financial market is quite fragmented. There are many institutions competing, which can squeeze profits. Consolidation is happening but it's a slow process. For example, in 2024, the top 5 banks held about 40% of total assets, showing the fragmentation. This intense rivalry impacts pricing and efficiency.

Foreign Exchange and Trade

Taiwan's economy is significantly impacted by foreign exchange and trade, given its strong reliance on exports. This dependence makes it sensitive to global trade fluctuations and protectionist measures. In 2024, Taiwan's exports reached $436.5 billion, showing its significant role in international trade. Furthermore, foreign exchange settlement quotas are adjusted to boost Taiwan's status as an Asian asset management hub.

- 2024 exports: $436.5 billion

- Focus on becoming an Asian asset management center

Investment Trends

Investment trends in China are shifting towards sustainability. This is fueled by growing environmental awareness globally. Financial products and services that consider Environmental, Social, and Governance (ESG) factors are gaining traction. In 2024, ESG-focused assets in China are projected to reach $2 trillion.

- ESG investments in China are forecasted to grow significantly.

- Global interest in sustainable finance is influencing Chinese markets.

- China's focus on green finance is accelerating.

China's economic growth faces shifts due to both global conditions and internal initiatives. The push for sustainable investments is creating new avenues. Inflation and interest rate policies remain critical, influencing financial strategies and markets.

| Economic Factor | Description | Impact |

|---|---|---|

| Global Growth | Expected steady growth, though with regional variations. | Taiwan's export-dependent economy affected by trade flows. |

| Inflation | Global inflation easing but core inflation persists; utility and wage changes. | Influences monetary policy decisions; impact on consumer behavior and spending. |

| Trade | Significant impact of trade with rising foreign exchange settlements. | Shapes growth prospects; currency market influence. |

Sociological factors

Taiwan faces a shrinking and aging population. This trend fuels growth in retirement planning and healthcare sectors. The aging population presents workforce challenges, potentially affecting economic productivity. In 2024, Taiwan's old-age dependency ratio is about 24%, rising from 20% in 2020. This shift impacts domestic consumption and investment patterns.

Consumer behavior in China is shifting towards digital financial services. Fintech adoption continues to rise, with over 900 million digital payment users in 2024. Financial literacy is crucial, especially with increased fraud risks. China's financial institutions are enhancing consumer protection measures to combat fraud and promote responsible financial practices.

Taiwan grapples with stagnant wages and widening income inequality, posing socio-economic challenges. Despite nominal wage growth, real wages have lagged, impacting consumer spending. The unemployment rate in Taiwan was 3.44% in March 2024, potentially affecting private demand. Addressing these issues is critical for sustainable economic growth and social stability.

Social Responsibility and ESG Awareness

China Development Financial (CDF) faces growing pressure related to social responsibility and ESG (Environmental, Social, and Governance) factors. There's a rising societal focus on how companies behave and their impact on the environment and society. This is leading to stricter reporting rules and efforts to support sustainable development in finance. CDF must adapt to these changes to maintain its reputation and attract investors.

- China's green bond issuance reached $70.9 billion in 2023, reflecting the importance of sustainable finance.

- ESG-related assets under management in China are increasing, indicating investor interest in responsible investing.

- The government is implementing policies to promote green finance and corporate social responsibility.

Talent Development

Taiwan's asset management industry is focusing on talent development. This is part of a broader plan to establish Taiwan as a key Asian asset management hub. The goal is to enhance the skills and expertise of professionals. Support includes training programs and educational initiatives. The aim is to boost the industry's competitiveness and attract more investment.

- 2024: The Financial Supervisory Commission (FSC) is promoting talent training programs.

- 2024: Investment in training programs increased by 15% compared to 2023.

- 2025 (projected): Expecting a 20% increase in the number of certified professionals.

China's increasing focus on digital financial services impacts consumer behavior and requires higher financial literacy to counter fraud. Societal expectations around social responsibility and ESG are growing, pushing CDF towards greater sustainable practices. Meanwhile, talent development is essential in Taiwan’s asset management industry, aiming for regional competitiveness.

| Sociological Factor | Description | Impact on CDF |

|---|---|---|

| Digital Finance | Rise in fintech; over 900M digital payment users in 2024 | Adapt services, boost consumer protection, fight fraud |

| ESG & CSR | Growing focus on company social behavior and sustainability. | Integrate ESG into operations, improve reporting, ensure sustainable growth. |

| Talent Development | Focus on training for a better asset management sector. | Focus on upskilling workforce to adapt to digital transformation. |

Technological factors

Taiwan's financial sector is seeing a digital shift. The Financial Supervisory Commission (FSC) supports innovation and digital services. For example, open banking is gaining traction. In 2024, the FSC set up a FinTech and innovation unit. The goal is to modernize Taiwan's financial landscape.

Artificial Intelligence (AI) is set to revolutionize China's financial sector. In 2024, investments in AI by Chinese financial institutions reached $2.5 billion. Banks are using AI for chatbots and fraud detection, aiming to cut costs by 20% by 2025. These advancements improve customer experiences and streamline operations.

Taiwan is developing its stance on digital assets; while not yet fully regulated, stricter AML rules have been introduced. A special law for digital assets is currently being drafted. Blockchain technology is expected to improve the speed, security, and efficiency of financial transactions. In 2024, the global blockchain market was valued at $16.3 billion, and is projected to reach $94.0 billion by 2029.

Cybersecurity

Cybersecurity is a critical technological factor influencing China Development Financial. Taiwan's financial regulators are emphasizing stronger cybersecurity measures. Financial holding companies must create dedicated cybersecurity units, appointing Chief Information Security Officers. This focus reflects the increasing threat of cyberattacks targeting financial institutions. In 2024, the financial sector in Taiwan saw a 15% increase in reported cyber incidents.

- Cybersecurity spending in Taiwan's financial sector is projected to reach $1.2 billion by the end of 2025.

- The government has increased its cybersecurity budget by 20% for the 2024-2025 period.

- New regulations require quarterly cybersecurity audits for all financial institutions.

Cloud Computing

Cloud computing significantly impacts China Development Financial. It provides scalable and cost-effective infrastructure, vital for new services and data management. The adoption of cloud solutions in China's financial sector is rapidly increasing, with significant investments expected. This shift enhances data storage and processing capabilities, crucial for modern financial operations.

- China's cloud computing market grew by 36.2% in 2023, reaching $45.5 billion.

- The financial services industry is a major driver of cloud adoption.

- Investments in cloud infrastructure are expected to continue growing through 2025.

China Development Financial must navigate rapid technological advancements in Taiwan. AI investments by Chinese financial institutions reached $2.5 billion in 2024. Cybersecurity spending is projected to reach $1.2 billion by the end of 2025.

Cloud computing, vital for new services, continues to expand, and the cloud market grew 36.2% in 2023 to $45.5 billion.

| Technology | Impact | Data |

|---|---|---|

| AI | Enhanced customer experience | 20% cost cut by 2025 |

| Cybersecurity | Critical for security | $1.2B spending by 2025 |

| Cloud Computing | Scalable infrastructure | 36.2% growth in 2023 |

Legal factors

China Development Financial Holding Corporation (CDF) operates under Taiwan's Financial Holding Company Act. This law oversees financial holding companies like CDF. The act ensures proper establishment, operations, and supervision. It aims to enhance consolidation benefits and strengthen oversight. As of 2024, CDF's total assets were approximately NT$2.3 trillion.

China Development Financial (CDF) operates under stringent banking and securities regulations. The Banking Act and Securities Transaction Act heavily influence its activities. CDF must adhere to licensing, operational, and compliance requirements. In 2024, regulatory changes impacted CDF's risk management protocols. These rules aim to ensure financial stability.

China Development Financial (CDF) faces legal scrutiny due to its life insurance services, governed by the Insurance Act. In 2024, the regulatory landscape saw adjustments in risk capital ratios, impacting insurance investments in public infrastructure. These changes influence CDF's strategic asset allocation and capital management. For instance, the People's Bank of China (PBOC) has been refining regulations to stabilize financial markets.

Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT)

Taiwan's financial institutions, including China Development Financial (CDF), must adhere to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations. These rules are crucial for maintaining financial system integrity. Recent measures include stricter registration for virtual asset service providers, reflecting global efforts to combat financial crimes. CDF's compliance costs for AML/CFT were approximately NT$100 million in 2023.

- AML/CFT compliance is essential for CDF's operations.

- Stricter regulations impact virtual asset services.

- Compliance costs are significant.

- These regulations aim to prevent financial crimes.

ESG and Climate-Related Disclosure Regulations

Taiwan mandates more ESG and climate disclosures. Listed firms and financial institutions must now report sustainability data. This involves submitting detailed reports and revealing climate-related financial risks. For example, the Financial Supervisory Commission (FSC) in Taiwan is actively updating its guidelines.

- FSC mandates climate risk disclosure for financial institutions.

- Sustainability reports are increasingly required.

- Focus on alignment with international standards like TCFD.

China Development Financial adheres to Taiwan's Financial Holding Company Act, ensuring operational integrity. Regulatory scrutiny extends to the Banking Act, Securities Transaction Act, and Insurance Act, shaping risk management. Recent AML/CFT measures increased compliance costs; approximately NT$100 million in 2023. Mandatory ESG and climate disclosures affect reporting.

| Regulation | Impact on CDF | 2024/2025 Status |

|---|---|---|

| Financial Holding Company Act | Governs establishment, operations, supervision | Ongoing compliance |

| Banking/Securities Acts | Dictate licensing, operational standards | Constant adjustments to meet updated regulatory compliance |

| Insurance Act | Influences strategic asset allocation and capital management | Ongoing adjustments, risk capital ratios |

| AML/CFT Regulations | Dictate operational standards and internal controls | Stricter registration rules, increased compliance costs. |

Environmental factors

Taiwan's government and FSC are pushing green finance for sustainability and lower carbon emissions. They have action plans to get financial institutions involved in sustainable projects. In 2024, Taiwan's green bond market saw significant growth, with over $2 billion in issuances. The FSC aims for further expansion by 2025.

Taiwan is dedicated to net-zero emissions by 2050, as mandated by the Climate Change Adaptation Act. This impacts sectors like energy and industry. In 2024, Taiwan's renewable energy share was around 8%, aiming for 20% by 2025. The government is investing heavily in green technologies, offering financial incentives. This shift influences investment decisions and operational strategies.

Taiwan is actively addressing environmental concerns. A carbon pricing mechanism, involving carbon fees, began in 2025 for significant emitters. This initiative aligns with global efforts to reduce emissions. Furthermore, a legal framework supports domestic carbon credit trading. This will create a market for carbon credits, encouraging emission reductions.

ESG Reporting and Transparency

China Development Financial (CDF) faces rising pressure to enhance environmental, social, and governance (ESG) reporting. Stricter regulations demand greater transparency on environmental impacts, particularly greenhouse gas emissions. This includes detailed disclosures about carbon footprints and sustainability initiatives. Compliance necessitates robust data collection and public reporting.

- In 2024, the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) updated their ESG reporting guidelines, enhancing disclosure requirements.

- Companies in China are increasingly adopting ESG frameworks, with a 20% rise in ESG-related disclosures in 2024.

- Failure to comply can lead to penalties, reputational damage, and investor scrutiny.

Environmental Risk Management

China Development Financial (CDF) faces growing pressure to manage environmental risks. Regulatory bodies now mandate financial institutions to reveal climate-related financial risks. This includes integrating environmental factors into risk management. CDF must adapt to evolving environmental standards to ensure sustainability.

- The Task Force on Climate-related Financial Disclosures (TCFD) framework is increasingly adopted by financial institutions.

- China's Green Finance Initiative promotes environmentally friendly investments.

- In 2024, global green bond issuance reached $600 billion.

Environmental factors significantly influence China Development Financial (CDF). Taiwan's government promotes green finance and targets net-zero emissions by 2050, impacting energy and industry investments.

Stringent ESG reporting is now crucial. The Shanghai and Shenzhen Stock Exchanges updated ESG guidelines in 2024, alongside a 20% rise in ESG-related disclosures. Penalties arise from non-compliance.

CDF must manage environmental risks, integrating factors like climate-related financial disclosures following the TCFD framework. Green bond issuance reached $600B in 2024.

| Factor | Details | Impact on CDF |

|---|---|---|

| Green Finance | Taiwan's focus on green initiatives and renewable energy. | Incentivizes CDF's sustainable investments and operational changes. |

| ESG Reporting | Enhanced disclosure demands by SSE and SZSE. | Requires compliance and detailed public reports on sustainability initiatives. |

| Environmental Risks | Managing climate-related financial disclosures. | Necessitates the adoption of frameworks like TCFD for proper risk management. |

PESTLE Analysis Data Sources

This analysis uses official reports, economic data from global institutions, and insights from leading business publications.