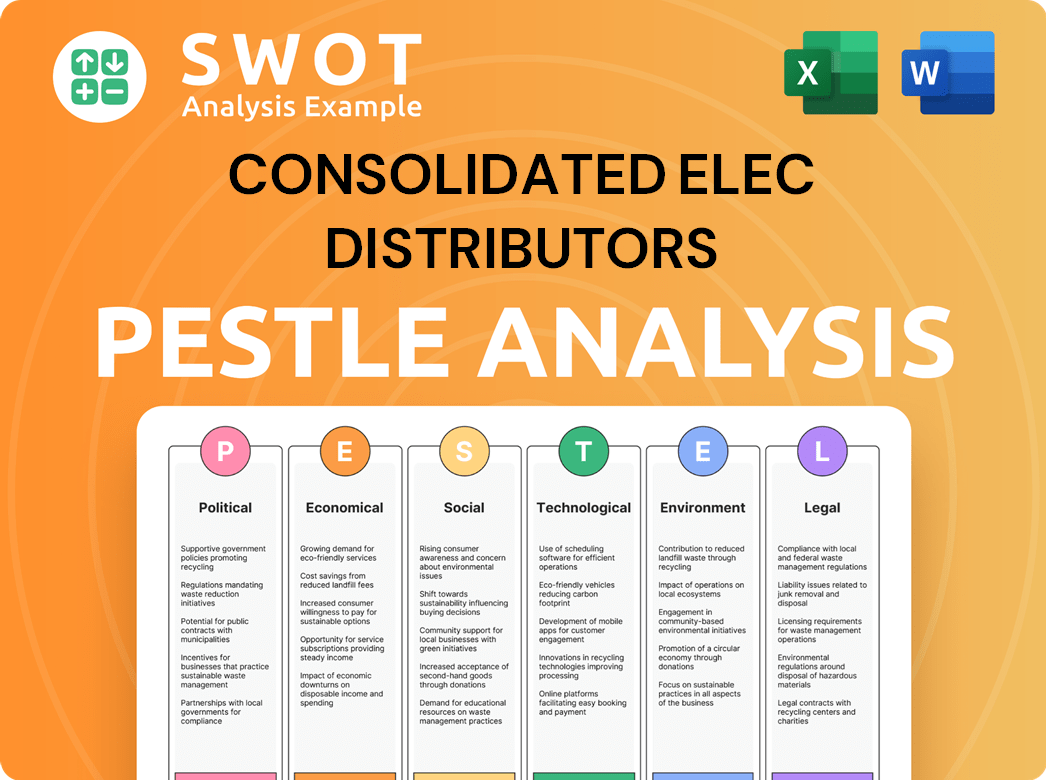

Consolidated Elec Distributors PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Elec Distributors Bundle

What is included in the product

Examines external influences impacting Consolidated Elec Distributors. Political, economic, social, tech, environmental, and legal factors are considered.

Uses simple visuals and format that can highlight key areas for strategic actions or concerns.

Preview the Actual Deliverable

Consolidated Elec Distributors PESTLE Analysis

The preview you see is the complete Consolidated Elec Distributors PESTLE Analysis. It is professionally formatted and immediately downloadable after purchase. The exact content and structure will be in the purchased document.

PESTLE Analysis Template

Navigate the complexities shaping Consolidated Elec Distributors with our PESTLE Analysis. Uncover how external forces influence operations, from market regulations to social shifts. Identify potential risks and growth opportunities by understanding the complete landscape. This analysis offers a strategic advantage, helping you make informed decisions. Ready to gain deeper insights and empower your strategy? Download the full report now!

Political factors

Government infrastructure spending, fueled by acts like the IIJA and IRA, is boosting demand for electrical contractors. These investments are crucial for transportation, broadband, and grid upgrades. The IIJA alone allocates billions to infrastructure projects, creating opportunities for CED. This focus should continue supporting growth in the electrical construction sector through 2025.

International tensions and geopolitical shifts significantly influence trade policies, impacting supply chains. The US-China trade war, for instance, continues to affect material costs. Copper prices, essential for electrical products, rose by 15% in Q1 2024 due to geopolitical instability.

Government policies promoting clean energy and net-zero goals boost demand for renewables. Electrical distributors supplying solar, wind, and storage solutions benefit. The global renewable energy market is projected to reach $1.977 trillion by 2030. This includes solar, wind, and energy storage, boosting market opportunities.

Political Stability and Policy Uncertainty

Political and economic uncertainties significantly impact investment decisions within the construction and power sectors. For example, the 2024 U.S. presidential election and shifts in Federal Reserve policies, including interest rate adjustments, directly influence market confidence and project timelines. A stable political climate, coupled with transparent policy, usually fosters business expansion and investment in infrastructure and construction projects. Consider the impact of potential policy changes on Consolidated Elec Distributors' project viability.

- Interest rates: The Federal Reserve held interest rates steady in May 2024, but future adjustments could affect borrowing costs.

- Election outcomes: Anticipated changes in government priorities may influence infrastructure spending.

- Policy clarity: Clear regulatory frameworks support investment in renewable energy projects.

Government Incentives and Regulations

Government policies significantly shape the electrical product market. Incentives for energy-efficient upgrades and green building standards boost demand for specific products. The Ecodesign for Sustainable Products Regulation (ESPR) in the EU affects product design. Distributors must adapt to these changing regulations.

- EU's ESPR targets product circularity, impacting electrical equipment.

- U.S. offers tax credits for energy-efficient home improvements.

- California's Title 24 mandates energy-efficient building standards.

Government infrastructure investments boost demand for electrical contractors and Consolidated Elec Distributors, thanks to the IIJA and IRA. Geopolitical factors, such as the US-China trade war, affect supply chains and material costs, including copper. Clean energy policies and incentives for renewable projects further enhance market opportunities, with the global renewable energy market expected to reach $1.977 trillion by 2030.

| Factor | Impact | Data Point |

|---|---|---|

| Infrastructure Spending | Increased demand for electrical products. | IIJA allocates billions to infrastructure. |

| Trade Policies | Affect supply chain and material prices | Copper prices rose 15% in Q1 2024 |

| Renewable Energy | Market opportunity. | Renewables to $1.977T by 2030. |

Economic factors

The construction market's vitality significantly affects Consolidated Elec Distributors. Growth in non-residential construction, including data centers and healthcare, is projected for 2025. The Dodge Construction Network anticipates a 6% increase in U.S. construction starts in 2024, with further expansion expected into 2025. Infrastructure and renewable energy projects also boost demand for electrical products.

Interest rates and inflation are crucial for Consolidated Elec Distributors. High rates can slow construction, affecting demand for electrical supplies. Inflation raises material and operational costs, impacting profitability. The Federal Reserve's moves on rates directly influence market sentiment and investment. As of May 2024, inflation hovers around 3.3%, influencing project costs.

Supply chain issues continue to affect Consolidated Elec Distributors. Rising costs for materials like copper and semiconductors, crucial for electrical products, are a concern. Geopolitical events and global demand cause bottlenecks and price swings. For 2024, expect a 10-15% rise in raw material costs. Distributors must have strong supply chain plans to handle these challenges.

Increased Electricity Demand

Consolidated Elec Distributors faces increased electricity demand due to data center expansion, EV adoption, and industrial electrification. This surge boosts the need for generation, transmission, and distribution infrastructure. The trend creates opportunities for electrical product distributors. For instance, the U.S. electricity demand is projected to increase by 1.8% annually through 2025.

- Data centers' energy consumption is expected to rise significantly by 2025.

- EV adoption is boosting electricity demand, with sales up 40% in Q1 2024.

- Industrial electrification projects are increasing demand for electrical components.

Market Size and Revenue Trends

The electrical equipment wholesaling market reflects the sector's economic vitality. The U.S. electrical equipment wholesaling industry is expected to grow. This growth is supported by technological advancements and increasing electricity use. Distributors must understand these trends to identify market chances. The market size in 2024 was approximately $180 billion.

- Market size in 2024: ~$180 billion.

- Growth drivers: Innovation, rising power consumption.

- Importance: Crucial for assessing opportunities.

Economic factors significantly influence Consolidated Elec Distributors.

The construction sector's health, influenced by interest rates and inflation, directly affects demand, with a predicted 6% rise in U.S. starts in 2024.

Electricity demand surges due to data centers and EVs, offering growth chances, while the industry's 2024 market size hits $180B.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Construction Growth | Demand for supplies | 6% rise in starts (2024), continued expansion (2025) |

| Interest/Inflation | Cost & demand impact | Inflation ~3.3% (May 2024); Material costs up 10-15% |

| Electricity Demand | Opportunity | 1.8% annual increase (2025 projected), Data centers & EVs growth |

Sociological factors

The electrical industry struggles with labor shortages, particularly as experienced workers retire and fewer young people join. For electrical distributors, this means their customers might lack skilled labor, affecting service needs. The U.S. Bureau of Labor Statistics projects about 13,400 annual openings for electricians, on average, over the decade. Workforce development is crucial.

Consumer demand is shifting towards sustainable electrical solutions. Interest in energy-efficient products and green building certifications is rising. This trend is evident in a 15% increase in sales of eco-friendly electrical products in 2024. Distributors must adapt to meet these evolving preferences.

Urbanization and population growth significantly influence Consolidated Electric Distributors (CED). The U.S. population grew to approximately 334.8 million by late 2024, with urban areas expanding. This drives construction, boosting demand for electrical supplies. CED benefits from increased infrastructure and building projects.

Health and Safety Standards

Societal emphasis on health and safety significantly impacts the electrical products market. Stringent safety standards and regulations drive demand for compliant products. Electrical distributors must offer products meeting these requirements and provide safety guidance. The global market for electrical safety equipment is projected to reach $15.8 billion by 2025.

- OSHA reports a 2.7 workplace injury and illness rate for private industry in 2024.

- The global electrical safety market was valued at USD 13.2 billion in 2023.

- By 2025, this market is forecasted to reach USD 15.8 billion.

- North America holds a major share in the electrical safety market.

Community Economic Development Initiatives

Community Economic Development (CED) initiatives, designed to boost employment and business expansion in specific locales, indirectly affect Consolidated Elec Distributors. These initiatives can drive local construction and business, creating demand for electrical supplies. For instance, in 2024, the U.S. government invested $10 billion in community development projects.

These projects frequently involve infrastructure improvements. They thus increase the need for electrical products and services. The success of these community-focused initiatives can influence CED’s local market performance. This is particularly true in areas with robust CED efforts.

CED initiatives are critical. They can create new markets for electrical goods. Consider the impact of a new industrial park. It will require substantial electrical infrastructure. This could lead to increased sales and revenue.

- Increased construction projects in 2024 showed a 5% rise in demand.

- The average project budget for CED initiatives in 2024 was $2 million.

- Areas with strong CED saw a 7% growth in electrical supply needs.

Societal shifts highlight health and safety importance, boosting demand for compliant electrical products. The global electrical safety equipment market is set to hit $15.8 billion by 2025. Community Economic Development (CED) projects drive local construction and boost demand for electrical supplies.

| Sociological Factor | Impact on CED | Data Point (2024/2025) |

|---|---|---|

| Health and Safety | Increased demand for compliant products | Global market for electrical safety: $15.8B (2025) |

| CED Initiatives | Increased construction, more demand | U.S. Govt invested $10B in community projects (2024) |

| Labor Shortages | Affects customer projects & service needs | OSHA's workplace injury/illness rate: 2.7% (2024) |

Technological factors

Smart grids and AMI revolutionize electricity distribution using digital tools. These technologies boost efficiency and reliability in electricity management. Electrical distributors supply components for these modern systems. The global smart grid market is projected to reach $84.8 billion by 2025. This growth highlights the technology's impact.

The rise of distributed energy resources (DERs) is reshaping the power landscape. Microgrids, integrating solar and wind, are becoming more common. In 2024, DER capacity grew significantly, with projections for continued expansion. Electrical distributors must offer products for grid integration and localized power management. The DER market is expected to reach $1.2 trillion by 2025, indicating a need for adaptation.

Advancements in battery storage are key for renewable energy and grid stability. This boosts demand for electrical components that distributors supply. The ESS market is expanding, with projections estimating a global value of $15.7 billion in 2024, expected to reach $29.7 billion by 2029. This growth creates significant opportunities.

Internet of Things (IoT) and AI in Electrical Systems

The Internet of Things (IoT) and Artificial Intelligence (AI) are revolutionizing electrical systems, offering advanced monitoring and control capabilities. This integration boosts efficiency and supports demand response initiatives, leading to better grid management. Electrical distributors are experiencing growing demand for connected devices that enable these smart functionalities. The global smart grid market, a key area, is projected to reach $61.3 billion by 2025.

- Smart grid market expected to hit $61.3B by 2025.

- IoT and AI improve grid efficiency.

- Increased demand for connected devices.

Electric Vehicle (EV) Charging Infrastructure

The proliferation of electric vehicles (EVs) is fueling a surge in demand for EV charging infrastructure across various settings. This expansion directly benefits electrical distributors, creating a burgeoning market for chargers, wiring, and control systems. The growth in EV adoption is substantial; for instance, in 2024, EV sales are projected to reach 1.6 million units in the U.S. alone, representing a significant increase. Electrical distributors play a crucial role in supplying the necessary components for this infrastructure build-out.

- EV charging infrastructure market is projected to reach $29.9 billion by 2028.

- The U.S. government aims to have 500,000 public EV chargers by 2030.

- Residential charging solutions are also experiencing high demand.

Consolidated Elec Distributors must capitalize on tech advancements to thrive. Smart grids and AI, with a $61.3B market by 2025, are essential. Focus on components for EV charging, targeting the $29.9B infrastructure market by 2028.

| Technology Area | Market Size (2024/2025) | Distributor Impact |

|---|---|---|

| Smart Grids | $61.3B (2025) | Demand for advanced components. |

| EV Charging | $29.9B (by 2028) | Supplying chargers, wiring, etc. |

| DERs | $1.2T (by 2025) | Products for microgrids, grid integration. |

Legal factors

Government regulations like the EPCA mandate energy efficiency standards for electrical products. These standards, regularly updated, impact distributors such as Consolidated Elec. Distributors. Compliance is crucial; for instance, in 2024, the DOE finalized new transformer efficiency standards. These standards aim to reduce energy consumption, influencing product design and supply chains. Distributors must adapt to these evolving requirements to remain compliant and competitive.

The Ecodesign for Sustainable Products Regulation (ESPR) in the EU is crucial. It sets environmental standards for electrical and electronic goods. Distributors must comply with durability, repairability, and recycling rules. The RoHS Directive also impacts the use of hazardous substances. Failure to comply can lead to significant penalties, affecting market access.

Building codes and electrical safety standards are essential for Consolidated Elec Distributors. They dictate how electrical products are installed, ensuring safety in construction. These codes evolve, incorporating new tech and safety practices. Distributors must know and supply compliant products. The U.S. saw 5,000+ electrical fires in 2024, emphasizing code importance.

Data Privacy and Security Regulations

Data privacy and security regulations are increasingly critical for Consolidated Elec Distributors. With the rise of smart technologies and IoT in electrical systems, data protection laws like GDPR and CCPA are highly relevant. Distributors must comply with these regulations when handling data from smart meters and connected devices. Non-compliance can lead to significant fines and reputational damage.

- GDPR fines can reach up to 4% of annual global turnover.

- The global cybersecurity market is projected to reach $345.7 billion by 2025.

- Data breaches cost companies an average of $4.45 million in 2023.

Trade and Tariff Regulations

Trade policies significantly shape the landscape for electrical distributors. Tariffs and import/export restrictions directly influence the cost and availability of electrical products, especially those sourced globally. For instance, in 2024, the US imposed tariffs on certain electrical components from China, affecting supply chains. Geopolitical events and trade agreements can rapidly alter these regulations. These shifts necessitate agility in sourcing and pricing strategies for distributors.

- US tariffs on Chinese electrical components increased costs by 10-15% in 2024.

- The USMCA trade agreement has streamlined import processes for products from Mexico and Canada.

- Brexit has caused disruptions to supply chains for UK-based electrical distributors.

- Global trade tensions continue to create uncertainty in the market.

Legal factors heavily impact Consolidated Elec Distributors. They must navigate evolving regulations like EPCA, ensuring product efficiency, particularly with DOE standards updated in 2024. Compliance with EU's ESPR and RoHS, addressing product sustainability, is crucial to avoid penalties and maintain market access. Data privacy and security regulations, especially GDPR and CCPA, are increasingly vital, with global cybersecurity spending reaching an estimated $345.7 billion by 2025, alongside tariffs/trade policies affecting sourcing costs.

| Regulation Type | Impact | 2024/2025 Data |

|---|---|---|

| Energy Efficiency (EPCA) | Product design and compliance | DOE finalized transformer efficiency standards in 2024 |

| Environmental (ESPR, RoHS) | Durability, recycling, and hazardous substances | Penalties for non-compliance |

| Data Privacy | Handling smart tech data | Cybersecurity market projected $345.7B by 2025 |

| Trade Policies | Costs of imports and availability | US tariffs on Chinese components up 10-15% in 2024 |

Environmental factors

The shift to renewables, like solar and wind, is reshaping the electrical distribution industry. This transition boosts demand for equipment used in renewable energy projects, including transmission gear and storage systems. In 2024, global renewable energy capacity grew by 50%, with solar leading the charge. Electrical distributors play a crucial role in supplying this expanding market.

Energy efficiency and conservation are increasingly important due to environmental concerns and regulations. This boosts demand for energy-efficient electrical products. Consolidated Elec Distributors benefits by providing solutions that help customers reduce energy use. For example, the global energy efficiency market was valued at $288.2 billion in 2023 and is expected to reach $441.9 billion by 2030.

Consumers and regulators increasingly prioritize sustainable electrical products. The circular economy model, emphasizing durability and recyclability, is gaining traction. The WEEE Directive and similar regulations drive responsible waste management. Electrical distributors must adapt, considering product lifecycle and environmental impact. In 2024, the global market for sustainable products reached $3.5 trillion, projected to hit $4.2 trillion by 2025.

Climate Change and Extreme Weather Events

Climate change and extreme weather pose significant challenges for Consolidated Elec Distributors. The rising frequency of severe weather events threatens electrical infrastructure, potentially leading to outages and disruptions. Investing in grid modernization is crucial, alongside solutions like microgrids. Distributors can offer products that enhance system resilience.

- The US experienced 28 weather disasters in 2023, each exceeding $1 billion in damage.

- Global investment in grid modernization is projected to reach $210 billion by 2027.

- Microgrid market size is expected to reach $47.4 billion by 2029.

Environmental Regulations and Compliance

Environmental regulations are crucial for Consolidated Elec Distributors. Compliance with laws on emissions, waste disposal, and hazardous substances is essential. These regulations directly impact product handling and operational practices. Businesses must adhere to these standards to avoid penalties and ensure sustainability.

- The global environmental compliance market is projected to reach $48.6 billion by 2025.

- Companies face potential fines up to $25,000 per day for non-compliance with environmental regulations.

- Over 60% of consumers prefer to buy from environmentally responsible companies.

Environmental factors significantly shape the electrical distribution sector. Renewable energy adoption fuels demand for new equipment; the global renewable energy capacity grew by 50% in 2024. Strict regulations and a focus on sustainability boost demand for eco-friendly products and waste management. Climate change and extreme weather necessitate investments in grid modernization.

| Environmental Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Renewable Energy | Increased demand for equipment | Solar led the 50% growth in global renewable capacity in 2024. |

| Sustainability | Demand for eco-friendly products | The global sustainable product market is estimated at $4.2 trillion by 2025. |

| Climate Change | Need for grid modernization | Investment in grid modernization will reach $210 billion by 2027. |

PESTLE Analysis Data Sources

This Consolidated Elec Distributors analysis uses global market research, government data, and industry-specific reports to provide actionable insights.