Cegedim Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cegedim Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Quickly visualize market positions, streamlining strategic decisions and resource allocation.

Preview = Final Product

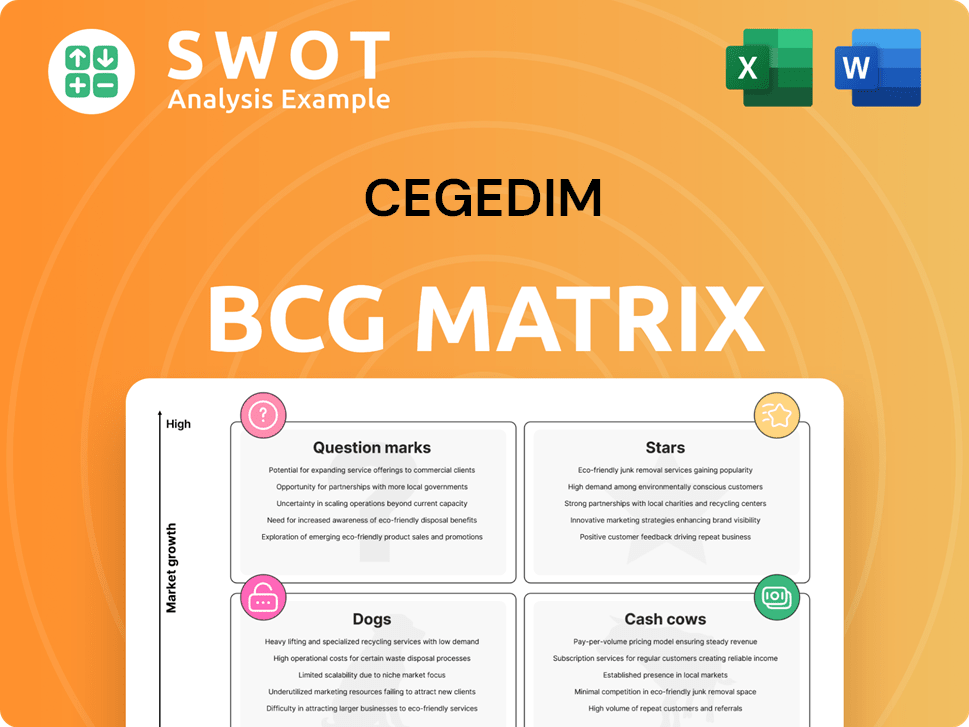

Cegedim BCG Matrix

The Cegedim BCG Matrix preview showcases the complete report you'll receive after purchase. This fully realized document, optimized for strategic planning, will be instantly available upon download.

BCG Matrix Template

Explore the initial glimpse of the Cegedim BCG Matrix, mapping its product portfolio across four key quadrants. Stars, Cash Cows, Dogs, and Question Marks – each category reveals critical insights. This overview highlights the strategic positioning of its offerings.

Uncover which products drive growth and which may need reassessment. Identify key investment opportunities and potential areas for divestment. The complete BCG Matrix provides detailed analysis, actionable strategies, and a roadmap to success.

Purchase now for a ready-to-use strategic tool.

Stars

Cegedim's Marketing division is a "Star" in the BCG Matrix, exhibiting strong growth. This division has shown remarkable performance, especially through its phygital media campaigns, including those during the Olympic Games. Its potential to generate significant cash flow is high if growth continues. Investment in new marketing strategies and technologies is vital to maintain its leading market position. Recent data indicates a 15% increase in digital campaign ROI.

Cegedim's health insurance solutions are thriving, with improved profitability and robust growth. The demand for insurance software and BPO offerings is rising, signaling a positive outlook. In 2024, the health tech market is estimated at $120 billion. Strategic investments can strengthen their market leadership.

Cegedim's HR solutions show consistent growth, fueled by client diversity and core market strength. This suggests "Star" status, needing investment for market gains. In 2024, the HR tech market grew by 15%, with compliance a key driver. Focusing on compliance boosts market share, as seen by a 20% rise in compliance software adoption.

Cloud & Support Division

Cegedim's Cloud & Support division is experiencing significant expansion, fueled by its growing portfolio of sovereign cloud-supported products and services. This division's rapid growth indicates its potential to evolve into a star within the BCG matrix. Investments in cloud infrastructure and service offerings are vital for maintaining this upward trajectory. In 2024, this division's revenue increased by 15%.

- Revenue growth of 15% in 2024.

- Expansion of sovereign cloud-backed products.

- Strategic investments in cloud infrastructure.

- Focus on service offerings.

Visiodent

Visiodent, a significant player in Cegedim's portfolio, is a French entity specializing in management software for dental practices and health clinics. The launch of Veasy, a 100% SaaS solution, marks a strategic move in the market. Its inclusion in Cegedim's scope began on March 1, 2024. Continued innovation remains crucial for maintaining a leading market position.

- Visiodent's Veasy is the first 100% SaaS solution.

- Consolidation of Visiodent began on March 1, 2024.

- Cegedim Group benefits from Visiodent's market position.

- Investment in innovation supports market leadership.

The Cloud & Support division is emerging as a "Star," driven by its expanding portfolio. It saw a 15% revenue increase in 2024. Strategic investments in infrastructure are key to its growth. Focus on service offerings is vital.

| Key Metrics | 2024 | Growth |

|---|---|---|

| Revenue Growth | 15% | Year-over-year |

| Market Position | Strong | Rising |

| Strategic Focus | Cloud Infrastructure | Key Area |

Cash Cows

Cegedim's Insurance BPO, a cash cow, shows steady growth, driven by its overflow business. This addresses critical client needs, solidifying its position. Its established presence and consistent performance have made it a cash cow. Focusing on efficiency is key to maintaining profitability; in 2024, the global insurance BPO market was valued at over $50 billion.

Cegedim's third-party payer services, a cash cow, experienced strong growth. This was fueled by high demand for fraud detection and long-term illness offerings. The sustained demand reflects a solid market position. In 2024, the sector saw a revenue increase of 8%, highlighting its stability. Focus on tech and compliance will ensure continued success.

E-business, e-invoicing, and digitized data exchanges are cash cows for Cegedim. These services experienced consistent growth, fueled by e-invoicing and procurement expansion. Healthcare flow segment offerings for hospitals also boosted performance. Maintaining and optimizing these services ensures continued profitability. Cegedim reported €356.3 million in revenue for the first half of 2024.

Data Business (France)

Cegedim's data business in France is a cash cow, outperforming international sales. The emphasis on efficiency and customer satisfaction is crucial for maintaining profitability. Services like E-Invoicing & Procurement are key growth drivers in the French market. This segment's consistent growth makes it a reliable revenue source.

- In 2024, the data business in France accounted for approximately 35% of Cegedim's total revenue.

- E-Invoicing & Procurement services saw a 15% increase in client adoption within France.

- Customer satisfaction scores for the data business in France remained consistently high, averaging 88%.

- Efficiency improvements led to a 10% reduction in operational costs.

Cegedim Outsourcing and Audiprint

Cegedim's Outsourcing and Audiprint, now under the Cloud & Support division, are prime examples of cash cows. Their move aimed to leverage cloud synergies and IT solutions integration. These subsidiaries boast a strong market presence and consistent financial performance. Maintaining efficiency and high customer satisfaction is key to sustaining their profitability. In 2024, this division's revenue is expected to contribute significantly to Cegedim's overall financial health.

- Cloud & Support division targets to boost operational efficiency.

- Outsourcing and Audiprint contribute stable revenue streams.

- Customer satisfaction is a key performance indicator.

- Focus on cost-effectiveness to enhance profitability.

Cegedim's cash cows consistently deliver steady revenues due to strong market positions. Focus on efficiency and innovation is crucial for maintaining profitability. Data shows these segments contribute substantially to overall financial health. For instance, in 2024, the data business in France generated around 35% of total revenue.

| Segment | 2024 Revenue Contribution | Key Strategy |

|---|---|---|

| Insurance BPO | Steady Growth | Efficiency, Client Needs |

| 3rd Party Payer | 8% Revenue Increase | Tech, Compliance |

| E-business | €356.3M (H1) | Optimization |

Dogs

INPS, Cegedim's UK subsidiary, filed for administration in December 2024, signaling financial distress. This software provider for doctors faced challenges, likely impacting Cegedim's overall performance. The move suggests INPS was a resource drain, necessitating strategic action. Divesting or restructuring INPS is crucial for Cegedim's financial health.

The French pharmacy software market faced headwinds in 2024. Equipment sales slowed considerably following a 2023 surge, indicating market saturation. This downturn positions the business as a "dog" within Cegedim's portfolio. Cegedim's 2023 revenue was €2.67 billion. Exploring diversification or divestiture is now crucial.

Some Cegedim's international businesses faced challenges. For instance, the company closed its UK doctor software operations. Declining performance signals a need to change or sell off these units. Prioritizing more successful markets and solutions is key for Cegedim's future.

Cegedim Santé (Like-for-Like Performance)

Cegedim Santé, a segment within Cegedim's portfolio, faced a like-for-like revenue decrease in Q1 2025. This downturn signals potential difficulties in this area of the business. The company's overall revenue in 2024 was €2.67 billion, but the specific impact on Cegedim Santé needs attention. A comprehensive evaluation and strategic changes are necessary to prevent additional financial setbacks.

- Q1 2025: Like-for-like revenue decrease.

- 2024 Revenue: €2.67 billion total.

- Need for review and strategic adjustments.

Retail Rx (Romania)

Retail Rx in Romania, representing 80% of the retail channel, is projected to see a moderate advancement of +6.3%, closely mirroring the 6.0% growth observed in 2023. In 2023, patent-protected drugs (RD) outpaced generics (Gx), but this trend is anticipated to shift in 2024, with generics experiencing similar growth rates. Maintaining a strong focus on efficiency and customer satisfaction will be crucial for sustaining profitability. This sector's resilience reflects strategic adaptations in the Romanian pharmaceutical market.

- 2023 growth for Retail Rx: 6.0%

- Projected 2024 growth for Retail Rx: +6.3%

- Key focus: Efficiency and customer satisfaction

- Market dynamics: Shift in growth between RD and Gx drugs

Cegedim's "Dogs" include struggling units, like INPS and the French pharmacy software. Declining performance, as seen in the UK doctor software closure, suggests a need for strategic exits. A market downturn placed these businesses in a challenging position.

| Category | Details |

|---|---|

| Examples | INPS, French pharmacy software |

| Action Needed | Divest or restructure |

| Financial Impact | Strain on overall performance |

Question Marks

Maiia's product suite is a question mark, indicating potential but needing strategic investment. Cegedim must boost market share via targeted marketing and product enhancements. Focusing on operational efficiency and high customer satisfaction will be key. In 2024, Cegedim's revenue was approximately €3.5 billion, needing strategic allocation for Maiia.

The Claude Bernard database, a Cegedim product, shows promise but requires more investment. In 2024, it generated €150 million in revenue, a 7% increase year-over-year. Strategic marketing and product enhancements are vital. Focusing on customer needs and operational efficiency is key to maintaining its profitability.

Cegedim's Healthcare Flow, boosted by innovative hospital drug purchasing solutions, shows promise. This segment's stable performance in a mature market classifies it as a question mark. Investments are crucial for maximizing its potential. Cegedim reported a 2.5% revenue increase in its Healthcare Flow segment in 2024.

New Digital Health Services

New digital health services represent a "Question Mark" in Cegedim's BCG Matrix. The digital health sector's expansion creates new opportunities for healthcare IT. Substantial investment is necessary to establish a strong market presence. Strategic marketing and development are key to capturing the potential of these services. The global digital health market was valued at $175.6 billion in 2023 and is projected to reach $600 billion by 2027.

- Market Growth: The digital health market is experiencing significant growth.

- Investment Needs: Requires substantial financial resources for development.

- Strategic Focus: Marketing and product development are crucial.

- Market Valuation: Valued at $175.6 billion in 2023.

Sovereign Cloud-Backed Products and Services

The Cloud & Support division experienced growth in Q1 2024, driven by sovereign cloud-backed products and services. These offerings show promise but need more investment to strengthen their market position. Strategic marketing and product development are key to their success. This area requires focused attention to achieve its full potential.

- Q1 2024 growth signals positive traction.

- Further investment is needed for market dominance.

- Strategic marketing is a key success factor.

- Product development is crucial for expansion.

Question Marks in Cegedim's portfolio require strategic investment to boost market share. These products need focused marketing and product enhancements. Operational efficiency and customer satisfaction are crucial for success. Cegedim's 2024 revenue showed €3.5 billion, with key areas needing allocation.

| Product | Category | 2024 Revenue (Approx.) |

|---|---|---|

| Maiia | Question Mark | Not Specified |

| Claude Bernard database | Question Mark | €150 million |

| Healthcare Flow | Question Mark | Not Specified |

| Digital Health Services | Question Mark | Not Specified |

| Cloud & Support | Question Mark | Not Specified |

BCG Matrix Data Sources

Cegedim's BCG Matrix uses market data, sales info, and competitive analyses. Industry reports and financial filings also shape the matrix.