Celsius Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview to quickly visualize product portfolio performance.

Delivered as Shown

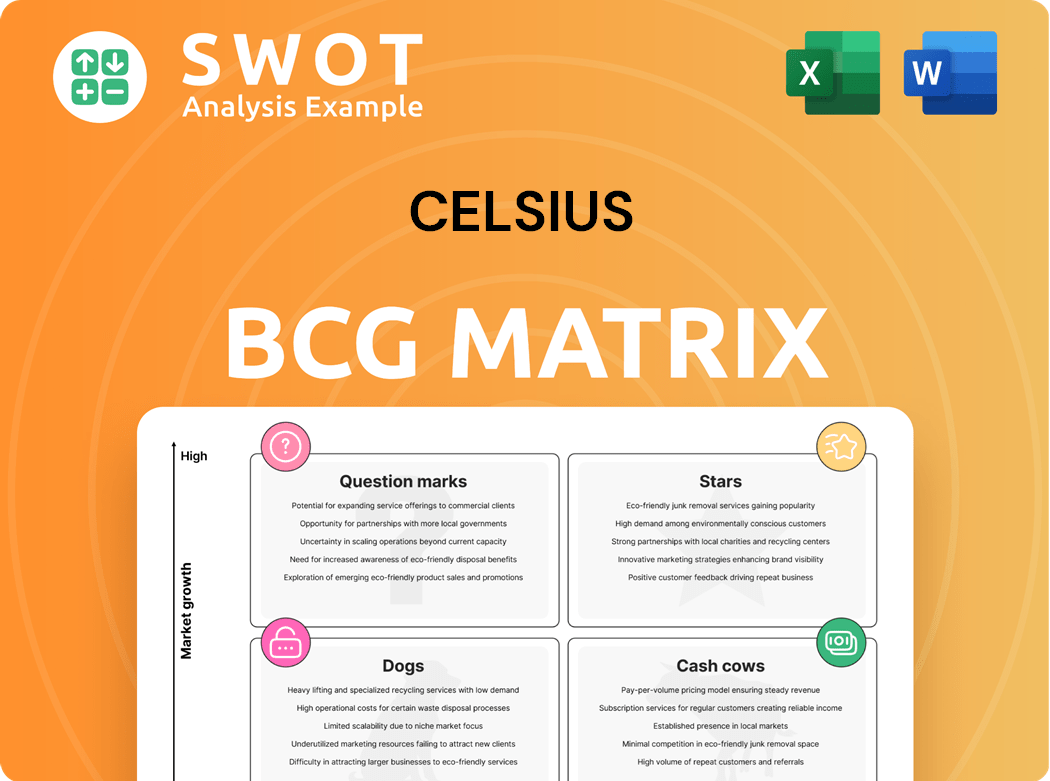

Celsius BCG Matrix

The preview you see is the complete BCG Matrix report you'll receive. It’s a ready-to-use, downloadable document with all the strategic insights. It mirrors the version you'll instantly gain access to after purchase, free of watermarks and limitations. It’s perfect for immediate implementation in your strategic planning.

BCG Matrix Template

The Celsius BCG Matrix categorizes Celsius's products based on market growth and market share, offering a strategic snapshot. This simplified view helps identify "Stars," "Cash Cows," "Dogs," and "Question Marks." Understanding these classifications is key to optimizing resource allocation and maximizing ROI. This preview gives you a glimpse of their product positioning, but there's more.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

The energy drink market is booming, especially for "better-for-you" options. Experts forecast a 10% compound annual growth rate (CAGR) from 2024 to 2029. Celsius is set to benefit, thanks to its health-focused approach. Celsius's acquisition of Alani Nu boosts its innovative edge in this growing sector.

Celsius has built a strong brand, backed by effective marketing and a dedicated customer base. Its connection to fitness and performance has attracted health-focused consumers, boosting its market share. In 2024, Celsius saw its revenue grow significantly, reflecting its brand strength. New flavors and product lines help keep the brand fresh and appealing to more people.

Celsius's expanded distribution strategy is a key driver of its growth. In 2024, they increased points of distribution by 37% year-over-year. This broadened reach, with ACV exceeding 98.7%, ensures product availability. The PepsiCo partnership played a vital role in this North American expansion.

Innovation in Product Lines

Celsius excels in product line innovation, expanding beyond its core offerings to meet varied consumer needs. The launch of CELSIUS ESSENTIALS and CELSIUS Hydration highlights this strategy. These new lines target health-conscious consumers. Innovation is also evident in zero-sugar and natural ingredient formulations.

- Celsius reported a 33% increase in revenue in Q1 2024, driven by new product launches.

- CELSIUS ESSENTIALS now accounts for 15% of total sales.

- The acquisition of Big Beverages has increased production capacity by 20%.

Acquisition Synergies

The acquisition of Alani Nu is poised to unlock substantial synergies for Celsius. This move strengthens Celsius's foothold in the functional lifestyle market. Cost synergies of $50 million are anticipated within two years post-acquisition, boosting profitability. The union merges complementary brands, reaching a broader wellness-focused consumer base.

- Projected cost synergies: $50 million within 2 years.

- Combined brand strength, reaching a broader audience.

- Enhanced market position in the functional lifestyle sector.

Celsius is a "Star" in the BCG matrix, showing high market share in a growing market. Its revenue jumped 33% in Q1 2024, showcasing strong growth. Celsius benefits from effective branding and a broad distribution network.

| Metric | Value | Details |

|---|---|---|

| Revenue Growth (Q1 2024) | +33% | Driven by new product launches. |

| Distribution Expansion (2024) | +37% | Increase in points of distribution YoY. |

| Market CAGR (2024-2029) | 10% | Projected annual growth rate. |

Cash Cows

Celsius has successfully carved out a significant market share in the energy drink sector. In 2024, Celsius held a substantial market share, solidifying its position. Its focus on health-conscious consumers has fueled impressive sales growth. This strong market presence translates into reliable revenue streams for the company.

Celsius demonstrates a robust financial health with a high gross margin. The company's gross margin reached 50.2% by the end of 2024, a rise from 48.0% the previous year. This shows excellent cost management and sustained profitability. Lower freight and material costs mainly drove the gross profit increase.

Celsius's partnership with PepsiCo, initiated in 2022, is a key driver of its success. This strategic distribution agreement enabled Celsius to significantly broaden its market presence, particularly in North America. The collaboration leverages PepsiCo's distribution network, supporting substantial sales growth; in 2023, Celsius's revenue grew to $1.32 billion, a 102% increase. This partnership offers access to resources and expertise.

Growing International Sales

Celsius has seen substantial international sales growth, a key indicator of its success as a Cash Cow. In 2024, international sales surged by 37%, reaching $74.7 million, demonstrating strong demand in foreign markets. This expansion is supported by strategic distribution agreements, such as the deal with Suntory. These partnerships have helped Celsius increase its global presence in regions like the U.K., Ireland, and Canada.

- 2024 International Sales: $74.7 million, up 37%

- Distribution Deal: Suntory (U.K., Ireland, Canada)

- Celsius is a Cash Cow within the BCG Matrix

Focus on Core Products

Celsius concentrates on its core offerings, including CELSIUS Originals, Vibe, ESSENTIALS, and On-the-Go Powder, to fortify its market presence. These product lines meet diverse consumer needs, offering everything from ready-to-drink options to convenient powder formats. This strategy supports consistent sales and profitability. In 2024, Celsius reported net sales of $355.7 million, a 98% increase from the prior year.

- Focus on core products helps maintain a strong market position.

- Product lines cater to various consumer preferences.

- This strategy drives consistent sales and profitability.

- Celsius reported $355.7 million in net sales for 2024.

Celsius, as a Cash Cow, leverages its strong market position and established product lines for steady revenue. The company's high gross margin, at 50.2% in 2024, underscores efficient operations. Strategic partnerships, like PepsiCo's distribution, boost sales and market reach.

| Metric | Value | Year |

|---|---|---|

| Gross Margin | 50.2% | 2024 |

| Net Sales | $355.7M | 2024 |

| International Sales Growth | 37% | 2024 |

Dogs

Celsius, categorized as a "Dog" in the BCG Matrix, saw a 4% revenue decrease in Q4 2024, influenced by increased domestic allowances. This decline, hitting $347.7 million, signals potential issues in sustaining growth. Promotional allowances to PepsiCo and order timing were main factors. The company's stock price has fallen 1.3% in the last 3 months.

The energy drink market is heating up, making it tougher for Celsius. New brands like C4 and ZOA are fighting for space. Celsius admits that competition is slowing its expansion. For example, in 2024, C4 saw its sales increase by 40%. This shows how much pressure Celsius is under.

Celsius, classified as a "Dog" in the BCG matrix, encountered inventory optimization issues in 2024. The third quarter of 2024 saw a noticeable revenue dip, a direct result of adjustments made by PepsiCo, its main distributor. Despite anticipated stabilization in Q4 2024, the company's reliance on a single distribution partner poses a continuing risk. This highlights a key vulnerability in their business model.

Decreased Market Share (Specific Periods)

Celsius, despite overall growth in 2024, saw a 0.5% market share dip in Q4, landing at 10.9%. This shift signals potential challenges in maintaining its competitive edge. The Q3 domestic retail market share was 11.6%, only a 0.1% increase year-over-year. This situation places Celsius within the "Dogs" quadrant of the BCG Matrix, demanding strategic reassessment.

- Q4 2024 market share decrease: 0.5%

- Q4 2024 market share: 10.9%

- Q3 2024 domestic retail market share: 11.6%

- Year-over-year increase in Q3: 0.1%

Dependence on Single Distributor

Celsius faces a significant risk due to its dependence on PepsiCo for distribution. This reliance means any changes in their agreement or disruptions in PepsiCo's network could hurt Celsius's sales. The third quarter of 2024 saw a 31% revenue decline, largely due to inventory adjustments from PepsiCo. This highlights the vulnerability tied to this single distributor.

- PepsiCo is Celsius's main distributor.

- Changes with PepsiCo could hurt sales.

- Q3 2024 had a 31% revenue drop.

- Inventory adjustments impacted sales.

Celsius, as a "Dog," faced a 4% revenue drop in Q4 2024, reaching $347.7M, influenced by promotional allowances and order timing, and a 0.5% market share dip in Q4.

Increased competition, especially from brands like C4, which saw 40% sales growth in 2024, added pressure. PepsiCo's inventory adjustments also impacted Q3 2024 revenue, falling by 31%.

Reliance on PepsiCo poses a key risk.

| Metric | Q4 2024 | Q3 2024 |

|---|---|---|

| Revenue Change | -4% | -31% |

| Market Share | 10.9% | 11.6% |

| C4 Sales Growth (2024) | 40% | N/A |

Question Marks

The CELSIUS Hydration line, a recent addition, targets the growing hydration market. This new product, with zero-sugar and electrolytes, has significant growth potential. However, its current low market share means it's a question mark in the BCG matrix. CELSIUS needs a robust marketing strategy to boost adoption and gain market share. As of late 2024, the hydration market is valued at over $8 billion, offering a lucrative opportunity.

Celsius is aggressively expanding internationally, targeting markets like the U.K., Ireland, and Canada. These regions represent substantial growth potential, yet Celsius currently holds a relatively low market share there. To succeed, significant investments in marketing and distribution are crucial to boost market presence. In 2024, international sales accounted for approximately 15% of Celsius's total revenue, indicating early-stage growth.

The Alani Nu acquisition is a "question mark" in Celsius's BCG Matrix, representing uncertainty. Integration challenges and cannibalization are key risks. Celsius aims to leverage the deal, aiming for $500M+ in 2024 sales with Alani Nu. Successful integration is crucial for synergy realization and market gains.

New Product Categories

Celsius, in 2024, eyes new product categories like protein drinks, a "question mark" in its BCG Matrix. These ventures face high demand but low returns initially, reflecting a low market share. The company must invest significantly in marketing and development to boost its position. Success hinges on capturing market share quickly.

- Celsius's 2024 revenue is projected to be around $1.3 billion.

- Protein drink market growth rate is about 8% annually.

- Marketing costs for new product launches can range from $5 million to $10 million.

- Market share for a new entrant is typically below 5% initially.

Limited Brand Awareness (Certain Demographics)

Celsius, despite its popularity among fitness-focused consumers, faces brand awareness challenges in broader markets. This "question mark" status highlights the need for strategic marketing investments. To expand its reach, Celsius must actively target new consumer segments. Focused campaigns are crucial to boost recognition and drive sales growth.

- Targeted marketing investments are crucial to increase brand awareness.

- Celsius may have limited awareness among non-fitness consumer segments.

- This presents a challenge in expanding market share.

- Strategic initiatives are needed to reach new customers.

Celsius faces "question mark" challenges across various product lines, including hydration, international expansion, the Alani Nu acquisition, and new product categories like protein drinks.

These ventures show high growth potential but low initial market share, indicating the need for strategic marketing and investments. Successful integration and targeted campaigns are key for driving sales growth and expanding market presence.

Celsius must boost brand awareness and capture market share in these areas to leverage its projected $1.3 billion in 2024 revenue.

| Area | Challenge | Strategy |

|---|---|---|

| Hydration | Low market share | Robust marketing |

| International | Low market share | Marketing & Distribution |

| Alani Nu | Integration Risks | Synergy realization |

| New Products | High demand, low returns | Marketing & Development |

BCG Matrix Data Sources

Celsius BCG Matrix is based on financial data, market reports, competitor analyses, and expert projections, providing credible strategic insights.