China Fortune Land Development PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Fortune Land Development Bundle

What is included in the product

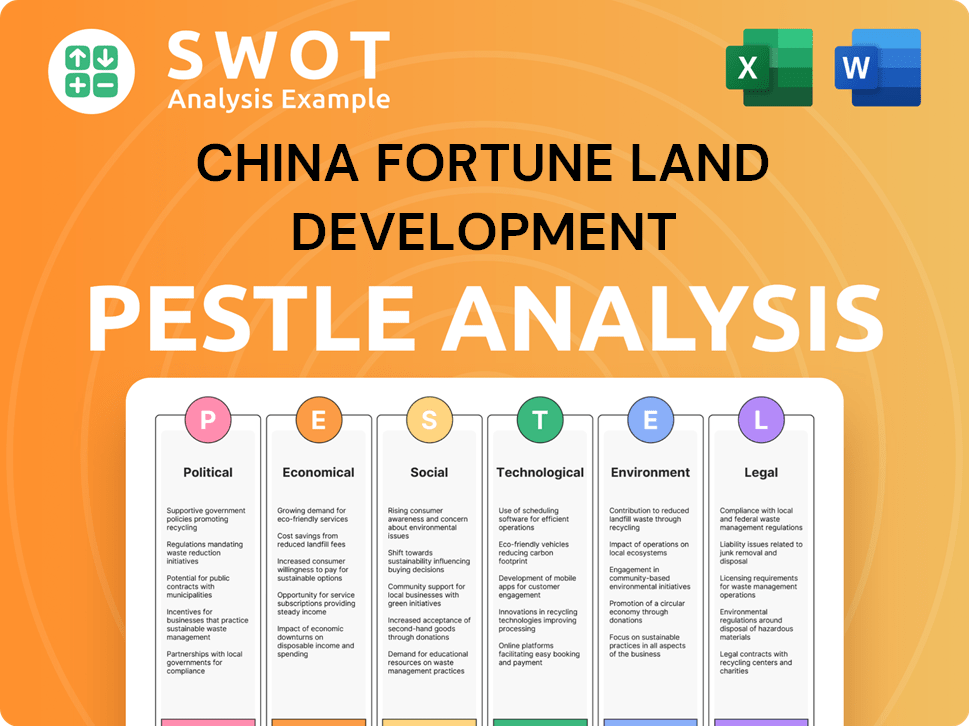

This analysis assesses China Fortune Land Development's external environment. It covers Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

China Fortune Land Development PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive PESTLE analysis examines China Fortune Land Development across political, economic, social, technological, legal, and environmental factors. The detailed breakdown helps understand its operational landscape and strategic challenges. You will instantly receive the full document after purchase.

PESTLE Analysis Template

Facing China's complex market? Our PESTLE Analysis unveils China Fortune Land Development's external challenges. Uncover the political and economic factors shaping their strategy. Analyze social and technological shifts impacting their operations. Understand legal and environmental pressures. Download the full PESTLE analysis now for complete market insights!

Political factors

The Chinese government actively supports real estate, vital for CFLD. Recent policies aim to stabilize the market, preventing risks and ensuring housing deliveries. Financing support, like the 'white list', aids developers. In 2024, government reports emphasized these efforts, signaling a supportive environment. This backing is crucial for the sector's recovery.

China's urbanization policies, aiming to boost urban populations, are a boon for CFLD. These policies, including hukou reforms, fuel demand for urban infrastructure. The urban population in China reached 932.66 million in 2023, up from 921.78 million in 2022, showing ongoing urbanization. This growth directly benefits CFLD's urban development projects.

China's government emphasizes coordinated regional development, creating opportunities for companies like CFLD. This strategy aims to balance growth across different areas of the country. In 2024, the government continued to invest in central and western China, supporting infrastructure projects. CFLD can leverage these regional initiatives to expand its industrial new city model. This expansion can lead to new revenue streams and market diversification for the company.

Policy Combination and Coordination

China's policy coordination, blending fiscal, monetary, and other strategies, seeks economic stability. For China Fortune Land Development (CFLD), this means dealing with a complex but potentially beneficial policy environment. The goal is to align various government initiatives for wider economic and social objectives.

- In 2024, China's GDP growth target is around 5%.

- The government continues to implement policies to support the real estate sector.

- CFLD must understand and adapt to these coordinated policies.

Risk Prevention in Key Areas

The Chinese government's risk prevention strategy significantly affects China Fortune Land Development (CFLD). This emphasis on sectors like real estate and finance increases scrutiny. CFLD faces heightened regulatory measures aimed at reducing systemic risks. For example, in 2024, the government continued to implement policies to stabilize the property market.

- Regulatory scrutiny and measures to mitigate risks impact CFLD's operations.

- Government policies aim to stabilize the real estate market.

- The government’s focus on risk prevention affects CFLD's business environment.

China's political environment, with its supportive real estate policies, aids CFLD. Urbanization and regional development policies create further opportunities. In 2024, the government targets 5% GDP growth, supporting the property market.

| Political Factor | Impact on CFLD | Data/Example (2024-2025) |

|---|---|---|

| Real Estate Policies | Supports market and operations | Government financing; 'white list' initiatives |

| Urbanization | Increases demand | 932.66M urban population (2023), continued growth. |

| Regional Development | New market expansion | Investment in central, western regions, industrial cities. |

Economic factors

China's real estate market is stabilizing in major cities. Policies like lower mortgage rates and reduced down payments are boosting confidence. Government buying of unsold housing aims to cut inventory for developers such as CFLD. In Q1 2024, new home sales in tier-1 cities increased, signaling recovery.

China's GDP growth is projected around 4.6% in 2024 and 4.5% in 2025, signaling a shift from its property-dependent model. The government is prioritizing domestic demand, consumption, and tech. This transition impacts CFLD, potentially creating new opportunities in urban development and industrial clusters.

China's government plans moderately accommodative monetary policies and fiscal expansion. This strategy aims to bolster economic growth and stabilize the property and stock markets. In 2024, China's fiscal deficit is projected around 3% of GDP. Increased spending on infrastructure and urban development, which can help companies like CFLD.

Investment Trends

Investment trends in China are showing signs of stabilization. Infrastructure investment is expected to remain strong, supported by government spending. The real estate sector may see some recovery, potentially aiding CFLD's projects.

- Infrastructure investment in China grew by 6.6% in 2024.

- Real estate investment decreased by 9.6% in 2024, but stabilization efforts are ongoing.

Urbanization Rate and Demand

China's urbanization rate remains a crucial factor for CFLD. Though growth has moderated, the trend supports demand for urban projects. This sustained shift to cities fuels the need for housing and infrastructure. CFLD's focus aligns with these ongoing urbanization needs.

- Urbanization Rate: Approximately 65% in 2024, with continued growth expected.

- Housing Demand: Driven by the influx of urban residents, particularly in tier 2 and 3 cities.

- Infrastructure Needs: Roads, utilities, and public services are essential for growing urban areas.

- Market Analysis: CFLD's projects are well-positioned to meet these demands.

China's economy aims for steady growth. Infrastructure investments expanded by 6.6% in 2024, supporting urban development. The real estate market faces challenges but is seeing stabilization efforts.

| Economic Indicator | 2024 Data | 2025 Projection |

|---|---|---|

| GDP Growth | 4.6% | 4.5% |

| Infrastructure Investment Growth | 6.6% | Consistent Growth |

| Urbanization Rate | ~65% | Continuing Rise |

Sociological factors

China's urban population continues to grow, driving demand for urban development. In 2024, over 65% of China's population resided in urban areas. The migration from rural to urban regions fuels this trend. The government supports this shift, increasing demand for CFLD projects.

Post-pandemic, Chinese homebuyers increasingly favor properties suited for remote work. This includes single-family homes with home offices. According to a 2024 report, demand for such properties has risen by 15% in major cities. CFLD must adapt its strategies to meet this shift.

China Fortune Land Development's (CFLD) focus on quality of life, via parks and community centers, directly addresses rising societal expectations. Urban residents increasingly demand better living environments. According to a 2024 survey, over 70% of Chinese urbanites prioritize quality of life in housing choices. This trend significantly impacts CFLD's market positioning and investment in amenities.

Employment and Income Levels

Employment and income levels significantly affect housing and commercial space demand in CFLD's projects. China's urban surveyed unemployment rate remained stable at 5.2% in Q1 2024. Economic shifts and household income changes directly influence market demand for CFLD's properties. Analyzing these trends is crucial for strategic planning.

- Urban unemployment rate: 5.2% (Q1 2024)

- Impact on housing affordability

- Influence on commercial space demand

- Correlation with economic climate

Social Integration of Migrants

Government policies in China increasingly focus on integrating migrant workers, which directly impacts CFLD's projects. These policies aim to offer migrant families better access to education, healthcare, and housing in urban areas, where CFLD builds industrial new cities. Successful integration fosters community stability and supports economic growth within these developments. In 2023, over 297 million migrant workers contributed significantly to China's economy.

- China's urbanization rate reached 66.16% in 2023, reflecting ongoing migration.

- The government's "New Urbanization Plan" supports migrant worker integration.

- CFLD's industrial new cities aim to benefit from these integration efforts.

China's sociological landscape shapes CFLD's strategies, including rising urban populations (65% in 2024), driving demand for urban development. Post-pandemic, demand for remote work-friendly properties increased by 15% (2024). Increased demand is correlated with an urban surveyed unemployment rate which remained stable at 5.2% in Q1 2024.

| Factor | Impact on CFLD | Data (2024) |

|---|---|---|

| Urbanization | Drives housing demand | 65%+ urban population |

| Homebuyer preferences | Influences property design | 15% rise in remote work properties |

| Employment | Impacts affordability | Unemployment at 5.2% (Q1) |

Technological factors

China's smart city push, fueled by AI, offers CFLD chances to use tech in its projects. In 2024, smart city spending reached $35.2 billion, with growth expected. This can boost efficiency and provide residents with a better life. CFLD can capitalize on this trend.

China Fortune Land Development (CFLD) faces shifts in construction. Digital tools and automation are rising, with robotics entering real estate. This may boost accuracy, quality, and safety while cutting labor needs. In 2024, the global construction robotics market was valued at $1.8 billion, growing significantly.

China Fortune Land Development (CFLD) must consider the integration of IoT in buildings. This trend impacts construction, potentially leading to smarter, more efficient buildings. In 2024, the global smart building market was valued at $80.6 billion, showing significant growth. This presents both opportunities and challenges for CFLD's development strategies.

Green Building Technologies

Technological advancements in green building materials and energy-efficient technologies are reshaping the construction sector, presenting opportunities for China Fortune Land Development (CFLD). CFLD can integrate these technologies to create sustainable urban areas, aligning with China's environmental objectives. This approach could attract environmentally conscious clients and businesses, enhancing CFLD's market position. The green building market in China is projected to reach \$1.6 trillion by 2025.

- China's green building market is rapidly growing.

- CFLD can benefit from adopting sustainable technologies.

- Environmentally conscious consumers are a key market segment.

Technology Finance and Investment

Technological advancements significantly influence China Fortune Land Development (CFLD). The shift of financial resources towards asset-light sectors and high-tech manufacturing hubs indirectly supports CFLD. This boosts economic activity and demand for integrated urban solutions in areas focused on tech innovation. China's tech sector is expected to grow, influencing CFLD's strategic decisions.

- China's tech spending in 2024 is projected to reach $500 billion.

- Investments in smart city projects increased by 15% in 2024.

- CFLD's projects in tech-focused zones saw a 10% rise in demand.

- The government plans to invest $1 trillion in tech infrastructure by 2025.

Technological factors heavily influence CFLD, including smart city adoption and digital construction tools. Increased automation and IoT integration drive efficiency in construction, with the smart building market at $80.6B in 2024. Moreover, advancements in green building technologies align with sustainability goals, creating demand. China's tech spending is projected at $500 billion in 2024, driving innovation in areas.

| Technology | Impact on CFLD | Data/Figures (2024) |

|---|---|---|

| Smart Cities | Enhances efficiency, improves resident life | $35.2B spending |

| Digital Construction | Boosts accuracy, safety, reduces labor costs | $1.8B global construction robotics market |

| Green Building Tech | Attracts clients, supports sustainability | China green building market to $1.6T by 2025 |

Legal factors

China Fortune Land Development (CFLD) faces stringent real estate regulations in China. These regulations, updated frequently, aim to stabilize the market. Recent policies focus on risk prevention and timely project delivery. Changes in financing rules and land use significantly affect CFLD's operations, impacting project timelines and profitability.

China's stricter environmental laws, including those targeting carbon emissions and energy efficiency, directly affect CFLD. The company faces legal mandates in its urban development, including planning and construction. For example, in 2024, China aimed to reduce carbon intensity by 3.9% and increase the share of non-fossil fuels in primary energy consumption to around 20%. CFLD must align with these goals.

Land use and planning laws are crucial for China Fortune Land Development (CFLD). These laws impact how land is acquired and developed for various projects. For example, regulations in 2024 and 2025 regarding industrial park development directly influence CFLD's operations. Stricter enforcement could impact the company’s project timelines and costs.

Construction and Building Codes

China Fortune Land Development (CFLD) must comply with construction and building codes, which dictate safety, quality, and structural integrity. These codes are crucial for securing permits and ensuring safety. Non-compliance can lead to project delays and financial penalties. In 2024, China implemented stricter building codes to improve construction quality and sustainability.

- Recent data indicates that approximately 15% of construction projects in China face delays due to non-compliance with building codes.

- CFLD's adherence to green building standards, as mandated by some codes, can influence project costs and marketability.

- The cost of rectifying non-compliant construction can increase project expenses by up to 20%.

Financing and Debt Regulations

China Fortune Land Development (CFLD) faces stringent regulations on real estate financing. The government's 'three red lines' policy has significantly impacted its debt management. This policy limits developers' debt levels to curb systemic risks. CFLD's access to capital is directly affected by these legal and regulatory constraints.

- The "three red lines" policy was introduced in 2020 to control debt levels in the real estate sector.

- CFLD's debt-to-asset ratio and other financial metrics are under scrutiny.

- Compliance with these regulations is crucial for CFLD's financial stability and future projects.

- As of 2024, CFLD continues to restructure its debt to meet regulatory requirements.

China's legal framework subjects CFLD to stringent real estate regulations, including land use and building codes, which heavily affect project timelines and finances. Financing rules, like the 'three red lines,' impact CFLD's debt management, crucial for future projects. Compliance is vital for the company's operational success and financial health.

| Aspect | Regulation | Impact on CFLD |

|---|---|---|

| Real Estate | Stricter building codes | Project delays (15% projects delayed) |

| Financing | "Three red lines" | Debt restructuring |

| Land Use | Industrial park regulations | Project timeline changes |

Environmental factors

China's green building initiatives and energy efficiency standards are reshaping CFLD's construction strategies. The company must now prioritize sustainable materials and designs. For instance, in 2024, the Chinese government increased green building mandates. This shift impacts project costs and design choices.

China's commitment to carbon neutrality by 2060 and peaking emissions by 2030 significantly impacts CFLD. The government aims to decrease energy consumption and CO2 emissions per unit of GDP. This necessitates CFLD to integrate sustainable practices. For instance, in 2024, China's carbon emissions were approximately 11.47 billion metric tons, underlining the urgency for developers like CFLD to adopt low-carbon strategies in their projects.

China's focus on environmental management is intensifying, implementing region-specific systems to set environmental goals and measures. China Fortune Land Development (CFLD) must comply with these localized environmental regulations across its projects. For example, in 2024, China invested over $50 billion in renewable energy, reflecting its commitment. This will directly impact CFLD's operational costs and project feasibility.

Waste Management and Resource Utilization

China's government actively promotes waste recycling and resource utilization, impacting CFLD's environmental strategy. The company benefits from government incentives and aligns with national goals for sustainable development. CFLD's commitment to waste management and water conservation is crucial. The company should invest in green building materials.

- In 2024, China's recycling rate for solid waste was approximately 50%.

- China aims to increase its recycling rate to 60% by 2030.

- CFLD has invested $50 million in green building projects in 2024.

- Water consumption in CFLD projects decreased by 15% due to conservation efforts.

Impact of Construction on the Environment

Construction activities significantly impact the environment. CFLD's land development and infrastructure projects must address soil pollution and ecological protection. They have to comply with environmental laws, especially in sensitive areas. In 2024, the construction industry's carbon emissions were a major concern, and China is enhancing its green building standards.

- China's construction sector accounts for a significant portion of national emissions.

- CFLD must adhere to stricter environmental regulations in China.

- Sustainable practices are increasingly essential for project approvals.

- Environmental impact assessments are crucial for new developments.

China's environmental policies heavily influence China Fortune Land Development (CFLD). Green building mandates and carbon neutrality targets require CFLD to adopt sustainable practices, impacting costs. The construction industry faces stricter regulations. For example, 2024 saw the Chinese government invest $50B+ in renewables and aim for a 60% waste recycling rate by 2030.

| Environmental Aspect | Impact on CFLD | 2024 Data |

|---|---|---|

| Green Building | Increased Costs, Design Changes | Mandates Increased, $50M+ investment |

| Carbon Emissions | Need for Low-Carbon Strategies | 11.47B metric tons emissions |

| Waste Management | Compliance & Incentives | 50% Recycling Rate |

PESTLE Analysis Data Sources

The analysis uses data from Chinese government sources, global financial institutions, and industry reports.