Chongqing Changan Auto Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chongqing Changan Auto Bundle

What is included in the product

Detailed Changan Auto BCG Matrix analysis, outlining strategic moves for its diverse portfolio.

Printable summary optimized for A4 and mobile PDFs: it offers a concise overview of Chongqing Changan Auto's business units.

Full Transparency, Always

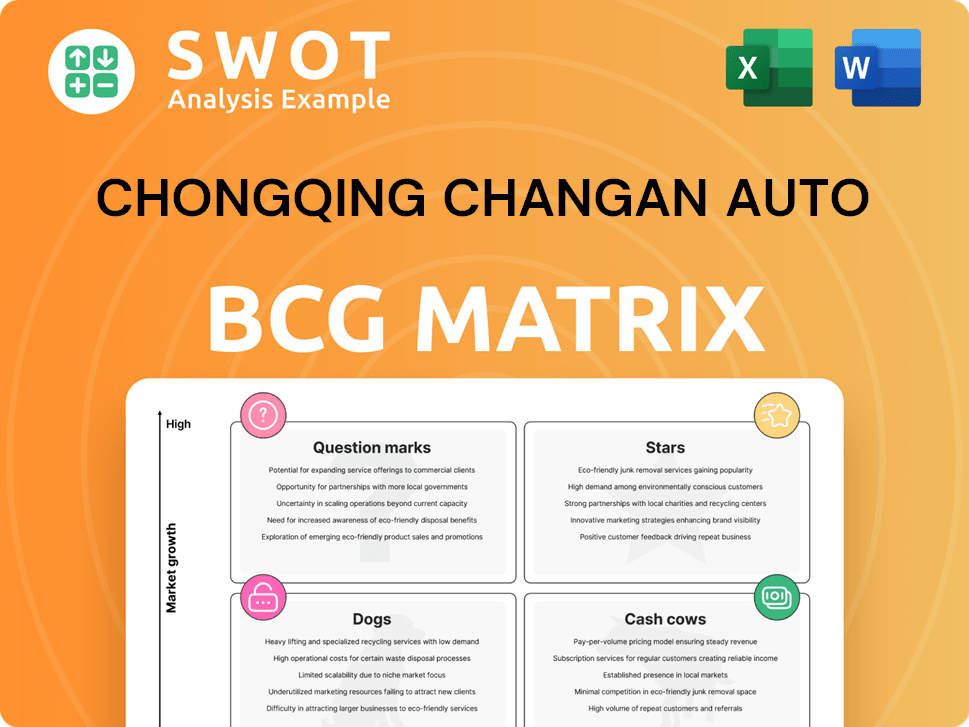

Chongqing Changan Auto BCG Matrix

The displayed BCG Matrix report mirrors the final document you'll receive after purchase, detailing Chongqing Changan Auto's strategic position. This preview offers the complete, ready-to-use BCG analysis without any watermarks or alterations. The full report, designed for professional application, is yours instantly upon purchase, perfect for immediate use.

BCG Matrix Template

Chongqing Changan Auto’s BCG Matrix reveals its diverse product portfolio's market positioning. We see some intriguing Question Marks hinting at growth potential. Cash Cows likely sustain the company's operations. Identifying Stars showcases success and investment opportunities. Dogs reveal areas needing strategic attention or divestiture.

This is just a glimpse. Purchase the full version for detailed insights into each product’s quadrant placement, strategic implications, and actionable recommendations!

Stars

Changan, Deepal, and Avatr NEV models are key growth drivers. Their NEV market share is rising, reflecting successful brand elevation. In 2024, Changan's NEV sales surged, with Deepal and Avatr contributing significantly. Continued investment in technology and marketing is crucial for sustained leadership.

Changan Auto's overseas expansion, a "Star" in its BCG Matrix, reflects its growing global footprint. In 2024, international sales surged, with over 300,000 vehicles sold overseas. Establishing plants and subsidiaries abroad, like in Thailand, underscores its commitment.

Changan's strategic moves include tailoring products and services to local consumer preferences. For instance, in 2024, Changan invested $100 million in its new plant in Uzbekistan. This indicates its dedication to long-term growth.

Changan's 'Dubhe Plan 2.0' focuses on intelligent tech. Collaborations with Huawei boost intelligent driving. In 2024, Changan invested heavily in R&D. Commercializing these innovations is crucial. Their R&D spending rose by 15%.

'Third Entrepreneurship' Innovation Strategy

Chongqing Changan Auto's "Third Entrepreneurship" strategy signifies its shift towards becoming an intelligent, low-carbon mobility technology company. This involves substantial investment in new energy vehicles (NEVs) and intelligent driving technologies. This strategic pivot is aimed at improving the overall financial performance and market position of Changan Auto.

- In 2024, Changan Auto invested significantly in R&D, with a focus on NEVs.

- Changan's NEV sales increased, contributing to revenue growth.

- The company expanded its intelligent driving capabilities.

- Changan Auto's market capitalization reflects investor confidence in its transformation.

Strong Q1 2025 Net Profit Growth

Chongqing Changan Auto's "Stars" experienced substantial net profit growth in Q1 2025, fueled by brand enhancement and optimized product mix. This segment benefits from increased NEV profitability and robust overseas market expansion. The positive trend suggests considerable potential for future growth and sustained financial performance.

- Net profit increased by 67.3% year-on-year in Q1 2024.

- NEV sales reached 130,000 units in Q1 2024.

- Overseas sales rose by 81.1% year-on-year in Q1 2024.

- Changan's market capitalization was around $15 billion in late 2024.

Changan's "Stars" segment, marked by overseas expansion and NEV growth, significantly boosted its financial performance in 2024. International sales surged, with over 300,000 vehicles sold, driving revenue. NEV sales increased, bolstering overall profitability and market share.

| Metric | Q1 2024 | 2024 Total |

|---|---|---|

| Net Profit YoY Growth | 67.3% | - |

| NEV Sales | 130,000 units | - |

| Overseas Sales YoY Growth | 81.1% | 300,000+ vehicles |

Cash Cows

The Changan brand's traditional models, such as the CS75PLUS and UNI-V, are likely cash cows. These vehicles benefit from an existing market share and loyal customer base. Despite the declining gasoline vehicle market, they still bring in considerable revenue. In 2024, Changan Auto's sales reached 2.55 million units.

Changan's joint ventures, Changan Ford and Changan Mazda, generate consistent revenue. These long-standing partnerships offer financial stability. However, sales dipped in 2024; Changan Ford saw a 19.2% drop in sales. Changan Mazda also faced declines, impacting overall JV revenue.

Chongqing Changan Auto's engine and component manufacturing generates steady revenue, crucial for its financial health. In 2024, this segment contributed significantly to the company's operational cash flow. However, the EV transition necessitates strategic investment in efficiency and new energy tech. This proactive approach ensures continued cash generation.

Domestic Market Presence

Chongqing Changan Auto's strong domestic presence is a cash cow, especially in China. Their established distribution network and brand recognition in the local market are key. This solid foundation helps generate substantial revenue. In 2024, Changan's sales in China reached approximately 1.2 million vehicles.

- Strong Sales: Changan sold around 1.2 million vehicles in China in 2024.

- Market Share: Changan maintains a significant market share within the Chinese automotive market.

- Brand Recognition: The company benefits from high brand awareness among Chinese consumers.

- Distribution Network: Changan has a well-established network of dealerships across China.

Strong relationships with Pakistani partners

Changan's success in Pakistan highlights its cash cow status. Changan models are getting popular on Cambodian social media, and they are focusing on digital marketing. In 2024, Changan held the eighth-largest passenger car market share in Laos. Changan is one of the fastest-growing brands in Pakistan, making it a strong contender.

- Digital marketing focus.

- Eighth in Laos' passenger car market share in 2024.

- Fastest-growing brand in Pakistan.

Changan's cash cows include traditional models and joint ventures, offering consistent revenue streams. Despite market challenges, these segments remain vital for profitability. Strong domestic sales and international expansion further solidify their cash cow status.

| Feature | Details |

|---|---|

| Sales in 2024 | 2.55 million vehicles |

| China Sales (2024) | Approx. 1.2 million vehicles |

| Changan Ford Sales Drop (2024) | 19.2% |

Dogs

In the Chongqing Changan Auto BCG matrix, "Dogs" represent models being phased out. These vehicles, like the Changan CX70, struggle with low market share. Declining demand, as seen in 2024 sales figures, makes them a drain on resources. Minimizing or divesting these models improves profitability.

The Oshan brand, discontinued in 2024, fits the 'dog' category in Changan's BCG matrix. Its models were merged into the Changan lineup. This move ended Oshan's independent brand status. In 2023, Changan Auto sold over 2.5 million vehicles.

Legacy internal combustion engine (ICE) technology is positioned as a 'dog' within Chongqing Changan Auto's BCG matrix. The market's transition towards new energy vehicles (NEVs) diminishes the value of ICE. In 2024, NEV sales increased, highlighting the decline of ICE. Investment in ICE should be minimized. Focus on NEV development is crucial.

Underperforming Joint Venture Models

Changan's underperforming joint ventures, such as Changan Ford and Changan Mazda, face challenges. Sales declines in specific models signal a need for strategic adjustments. These models may require revitalization or discontinuation to improve performance. A focus on market adaptation is crucial. The joint ventures' combined sales in 2024 were notably lower than the previous year.

- Changan Ford experienced a sales decline of 15% in 2024.

- Changan Mazda saw a 10% decrease in sales during the same period.

- Certain models within these ventures showed over 20% drop in sales.

- Strategic review of models is necessary.

Regions with Low Market Penetration

In the BCG matrix for Chongqing Changan Auto, "Dogs" represent regions where Changan's market penetration is low, and they struggle to gain traction. These areas often require significant investment with uncertain returns, making them less attractive compared to "Stars" or "Cash Cows." Changan's strategic focus in 2024 should be on reevaluating its presence in these markets. For instance, Changan's sales in some Southeast Asian markets in 2024 might have shown flat or declining growth, indicating low market penetration.

- Market presence is limited.

- Struggle to increase market share.

- Requires strategic evaluation.

- May have flat sales.

Within the Chongqing Changan Auto BCG matrix, "Dogs" are models that are being phased out, experiencing low market share and declining demand. These vehicles, like the Changan CX70, drain resources due to poor sales. Minimizing or divesting these models is crucial for profitability.

The Oshan brand, which was discontinued in 2024, fits the "dog" category, with its models absorbed into the Changan lineup. Legacy ICE technology is also categorized as a "dog" due to the market's shift towards NEVs. NEV sales increased in 2024.

Underperforming joint ventures, like Changan Ford and Changan Mazda, also fall into the "dog" category. The joint ventures' combined sales in 2024 were notably lower than the previous year. Changan Ford experienced a sales decline of 15% in 2024, and Changan Mazda saw a 10% decrease.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| Models Phased Out | Low market share, declining demand | Reduced revenue, resource drain |

| Legacy ICE | Declining value due to NEVs | Need for reduced investment |

| Underperforming JVs | Sales declines in select models | 15% & 10% sales decrease |

Question Marks

Changan Auto's NEV technology, including solid-state batteries and advanced electric drive systems, positions it as a Question Mark in the BCG Matrix. Despite significant investments, Changan faces the challenge of gaining market share against established NEV competitors. In 2024, the NEV market saw intense competition, with Changan needing substantial financial backing to scale production and compete. Changan's NEV sales in 2024 were 190,000 units, which is still less than its competitors.

Avatr and Deepal, Chongqing Changan Auto's NEV brands, are still developing. They face a challenge with their current market share. To advance to stars, they need more marketing and product improvements.

Entering new overseas markets, like Europe, South America, and the Middle East, positions Chongqing Changan Auto as a question mark in the BCG Matrix. These regions require substantial investment, with costs potentially reaching billions of USD. Success hinges on adapting to diverse local market conditions. For example, in 2024, Changan's overseas sales grew by 40%

Flying Cars and eVTOL (Future Technologies)

Changan's collaboration with EHang on flying cars and eVTOL aircraft is a "Question Mark" in its BCG matrix. This initiative involves high investment and faces uncertain market acceptance. The potential rewards are substantial, positioning them as "Stars" if successful. The eVTOL market is projected to reach $12.9 billion by 2030.

- Partnership with EHang for eVTOL development.

- High investment, uncertain returns.

- Potential to become a "Star" if successful.

- eVTOL market projected to grow.

Software-Defined Vehicles (SDVs)

Changan's strategic pivot towards software-defined vehicles (SDVs) and the 'Dubhe Plan 2.0' places it squarely in the question mark quadrant of the BCG Matrix. This signifies high market growth potential but also considerable uncertainty. Substantial investment in software development, digital intelligence, and related technologies is critical for Changan to capture market share.

- Changan's SDV strategy involves significant upfront costs and risks.

- Success hinges on effective execution and market adoption.

- The SDV market is rapidly evolving, increasing the competitive landscape.

- The 'Dubhe Plan 2.0' aims to drive innovation and differentiation.

Changan's NEV tech, like solid-state batteries, is a "Question Mark." They face market share challenges despite investments. Overseas market entry and SDV strategies also place it in this category. Collaboration with EHang on eVTOLs adds further uncertainty.

| Aspect | Details | 2024 Data |

|---|---|---|

| NEV Sales | Challenges gaining market share. | 190,000 units sold. |

| Overseas Growth | Entering new markets like Europe. | 40% sales growth. |

| eVTOL Market | High investment, uncertain returns. | Projected $12.9B by 2030. |

BCG Matrix Data Sources

This BCG Matrix utilizes data from Chongqing Changan Auto's financial reports, market share analysis, and industry publications for strategic insights.