Chemours Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemours Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Easily switch color palettes for brand alignment, allowing you to reflect Chemours' identity.

Delivered as Shown

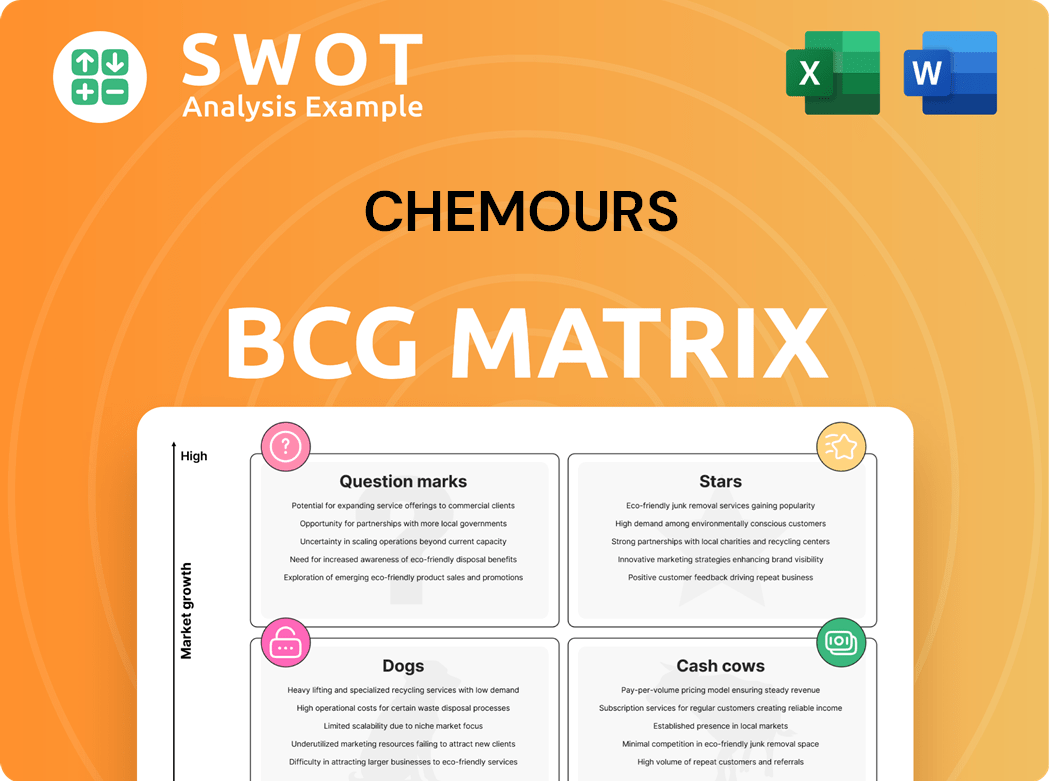

Chemours BCG Matrix

The Chemours BCG Matrix displayed here is identical to the document you receive post-purchase. It’s a complete, ready-to-use strategic tool for your analysis.

BCG Matrix Template

Chemours' portfolio spans diverse chemical segments, each vying for market share. Analyzing them through a BCG Matrix lens reveals strategic strengths and weaknesses. Identifying "Stars" showcases growth drivers, while "Cash Cows" fund innovation. Understanding "Dogs" and "Question Marks" is vital for resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Opteon Refrigerants are a star in Chemours' portfolio, showing strong growth. Demand is soaring due to regulations promoting low-GWP refrigerants. Chemours invested heavily, expanding capacity. In 2024, Chemours' Fluoroproducts segment, which includes Opteon, saw sales of $3.1 billion. Continued focus should solidify their market leadership.

Titanium Technologies, a Star in Chemours' BCG Matrix, boasts a robust market share within a steadily expanding market. This segment leverages cost efficiencies and strategic transformation initiatives, enhancing its profitability. Focusing on innovation and broadening applications, particularly in high-growth sectors like electric vehicle batteries and infrastructure coatings, can further solidify its stellar status. In 2024, Chemours' Titanium Technologies segment saw revenue of $1.09 billion.

Chemours' data center cooling solutions are a star in its BCG matrix, capitalizing on the booming data center market. The global data center cooling market was valued at $17.6 billion in 2023, projected to reach $34.5 billion by 2028. Innovation and strategic partnerships drive this growth.

Advanced Electronics Materials

Advanced electronics materials, crucial for high-performance computing and AI, represent significant growth opportunities. Chemours' chemical expertise positions it well to innovate in this area. Strategic R&D and collaborations can enhance Chemours' market standing. The global semiconductor market, a key consumer, was valued at $526.8 billion in 2023.

- High-Growth Potential: Driven by AI and HPC demands.

- Chemours' Advantage: Leveraging chemical expertise for innovation.

- Strategic Focus: Prioritizing R&D and collaborations.

- Market Context: Semiconductor market reached $526.8B in 2023.

Next-Generation Semiconductor Fabrication Materials

Chemours' materials for next-generation semiconductor fabrication are in the "Stars" quadrant due to the semiconductor industry's ongoing expansion. This growth is driven by increasing demand for advanced electronics. Strategic investments in this area can boost Chemours' market share. Their focus on innovation is vital for success.

- Semiconductor market size was valued at USD 527.27 billion in 2023.

- The market is projected to reach USD 1,380.77 billion by 2032.

- Chemours' R&D spending was $195 million in 2023.

Chemours' advanced electronics materials segment is positioned as a "Star," capitalizing on the explosive growth of the AI and high-performance computing sectors. The company's chemical expertise allows for significant innovation. The segment's success is driven by its R&D investments.

| Key Metric | Value | Year |

|---|---|---|

| Semiconductor Market Size | $527.27B | 2023 |

| Projected Market Value | $1,380.77B | 2032 |

| Chemours R&D Spend | $195M | 2023 |

Cash Cows

Freon refrigerants, despite regulatory challenges, remain a significant cash cow for Chemours, benefiting from a strong market position. Managing this product line strategically, emphasizing efficiency and cost control, is crucial for maximizing cash flow. In 2023, Chemours reported $6.1B in net sales. Gradual transition to sustainable alternatives is key to managing future risks.

Titanium Dioxide (TiO2) is a mature product for Chemours, holding a strong market position in coatings and plastics. Chemours' focus on cost savings and operational excellence boosts this segment's profitability. The company's strategy centers on preserving its market share and refining production economics. The adjusted EBITDA has been improved, with $299 million in the first quarter of 2024.

Chemical solutions for gold production are cash cows due to consistent gold demand. These solutions leverage strong customer ties and a dependable income stream. Chemours's revenue in 2023 was approximately $6.0 billion, showing financial stability. Effective management and partnerships boost profits and cash flow.

Chemical Solutions for Oil Refining

Chemical solutions for oil refining represent a stable revenue source, essential for the oil and gas sector's constant needs. Chemours can maintain operational efficiency and foster strong customer relationships to ensure consistent cash flow. The energy sector's evolution impacts the long-term outlook, but these solutions are currently reliable cash cows. In 2024, the global oil refining chemicals market was valued at approximately $10 billion.

- Steady demand from the oil and gas industry ensures consistent revenue.

- Focus on operational excellence and customer relations is key.

- Long-term viability hinges on energy sector developments.

- The market was valued at $10 billion in 2024.

Industrial Fluoropolymer Resins

Industrial fluoropolymer resins are a cash cow for Chemours, generating consistent revenue across various applications. To boost profitability, Chemours should focus on maintaining its market share and reducing production expenses. Innovation in these resins and tailored solutions for customers can further strengthen their value. In 2024, Chemours reported strong sales in its performance chemicals segment, which includes these resins.

- Steady Revenue: These resins provide a reliable income source for Chemours.

- Cost Optimization: Reducing production expenses is crucial for maximizing profits.

- Innovation: Focusing on innovation can enhance market value.

- Customer-Specific Solutions: Tailoring solutions boosts customer loyalty.

These are cash cows, generating consistent revenue for Chemours. Strategic customer relationships and cost management are key to maintaining profitability. The fluoropolymer resins provide a stable income stream.

| Product | Market Position | Strategy |

|---|---|---|

| Fluoropolymer Resins | Strong market share | Cost optimization, customer solutions |

| Oil Refining Chemicals | Essential for the oil and gas sector | Operational efficiency, customer relations |

| Gold Production Solutions | Reliable income stream | Effective management, partnerships |

Dogs

Chemours divested its Surface Protection Solutions business. This move, driven by low growth and market share, reflects a strategic shift. The company is now focusing on higher-margin markets. Divestiture allows resource reallocation to more promising areas.

Specific Freon refrigerants, like those with high GWP, are becoming obsolete due to environmental regulations. Demand is falling, and costs are up. Chemours needs a strategic phase-out. For instance, the EU's F-Gas Regulation impacts these products.

Legacy chemical solutions at Chemours, like those in the "Dogs" quadrant, often face headwinds. These products, potentially including older refrigerants, may see declining demand or face stricter regulations. Chemours needs to manage these to limit losses and environmental risks. In 2024, Chemours' focus is on transitioning away from these, with divestiture a key strategy.

Commoditized Fluoroproducts

In Chemours' BCG matrix, commoditized fluoroproducts, marked by low margins and slow growth, are classified as Dogs. These products often struggle to generate significant returns. To improve performance, Chemours might focus on cutting production costs or finding specialized uses. If these efforts fail, divesting these products could be a strategic move. For example, in 2024, the fluoroproducts segment faced challenges due to market pressures.

- Low margins indicate profitability issues.

- Limited growth suggests market saturation.

- Cost optimization is a key strategy.

- Divestiture is a potential exit strategy.

Underperforming Advanced Performance Materials

Underperforming Advanced Performance Materials within Chemours' portfolio, characterized by low growth and market share, are categorized as Dogs in the BCG Matrix. A detailed analysis is crucial to determine their strategic value and potential for improvement. If these materials do not support Chemours' long-term objectives, divestiture or discontinuation becomes a viable option.

- Chemours' 2024 revenue was $6.1 billion, a decrease from $6.8 billion in 2023.

- The company's focus is on high-growth areas like advanced materials.

- Dogs may be divested to allocate resources more efficiently.

- Strategic decisions are informed by market analysis and performance reviews.

Dogs in Chemours' BCG matrix represent underperforming businesses. These segments, like commoditized fluoroproducts, show low margins and slow growth. Chemours aims to improve their performance through cost-cutting or divestiture. The 2024 revenue was $6.1B, down from $6.8B in 2023, highlighting the strategic shift.

| Characteristic | Impact | Chemours Strategy |

|---|---|---|

| Low Margins | Profitability Issues | Cost Reduction |

| Slow Growth | Market Saturation | Divestiture |

| Regulatory Pressure | Declining Demand | Strategic Phase-out |

Question Marks

Chemours' new TPFA products, like Tetrafluoropropenes, are positioned as "Question Marks" in its BCG matrix. They promise high growth but currently have a small market share. Chemours must invest heavily in marketing and production. Success hinges on effective market penetration and navigating regulations. In 2024, Chemours reported a net sales decrease of 1% for its Thermal & Specialized Solutions segment, reflecting the challenges these products face.

Emerging fluoroproduct applications signal high-growth potential, yet market share remains uncertain. Substantial R&D investment is vital for proving their feasibility. Chemours must forge strategic partnerships and execute targeted marketing. For example, in 2024, the fluorochemicals market was valued at $20 billion, with a projected annual growth rate of 5-7%.

Advanced Performance Materials for EV batteries represent a high-growth opportunity for Chemours, aligned with the surging EV market. Currently, Chemours' market position in this segment is nascent, necessitating strategic focus. To capitalize, Chemours should prioritize R&D investments and collaborations with battery manufacturers. In 2024, the EV battery market is projected to reach $60 billion, showcasing significant growth potential.

Fluoropolymers for 5G Infrastructure

Fluoropolymers are crucial for 5G infrastructure, offering high-growth potential as 5G networks expand globally. Chemours should invest in tailored products and partnerships within the telecom sector to capture market share. 5G's demanding performance standards are key to success.

- Global 5G market expected to reach $667.1 billion by 2024.

- Demand for high-performance materials in 5G is rising.

- Chemours must focus on innovation and partnerships.

- Competitive landscape includes companies like Solvay.

Specialized Solutions for Semiconductor Manufacturing

Specialized solutions for semiconductor manufacturing present a significant opportunity for Chemours. The ongoing global chip shortage and the increasing intricacy of semiconductor devices drive high demand. Chemours must invest in research and development to stay ahead of the curve. Building strong relationships with manufacturers is crucial for capturing market share. This sector promises substantial growth potential if Chemours delivers innovative and reliable solutions.

- The semiconductor market is projected to reach $1 trillion by 2030.

- Chemours' focus on advanced materials aligns with the industry's need for cutting-edge solutions.

- Strategic partnerships can help Chemours navigate the complexities of the semiconductor supply chain.

- Investing in R&D is critical for maintaining a competitive edge in this rapidly evolving market.

Chemours' Question Marks, like new TPFA products, offer high-growth potential but have small market shares. Success requires significant investment in R&D, marketing, and strategic partnerships. The company faces uncertainty until market penetration occurs and regulations are met. In 2024, Chemours' net sales in the Thermal & Specialized Solutions segment decreased by 1%.

| Product Category | Market Position | Action Required |

|---|---|---|

| New TPFA products | High growth, low share | Invest in marketing and production |

| Fluorochemicals | Emerging, uncertain | R&D, partnerships |

| EV Batteries | Nascent | R&D, collaborations |

| 5G Infrastructure | High growth | Tailored products, partnerships |

| Semiconductors | Significant opportunity | R&D, partnerships |

BCG Matrix Data Sources

The Chemours BCG Matrix is constructed with robust data, drawing upon financial filings, market analyses, and expert industry evaluations.