Cheniere Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

What is included in the product

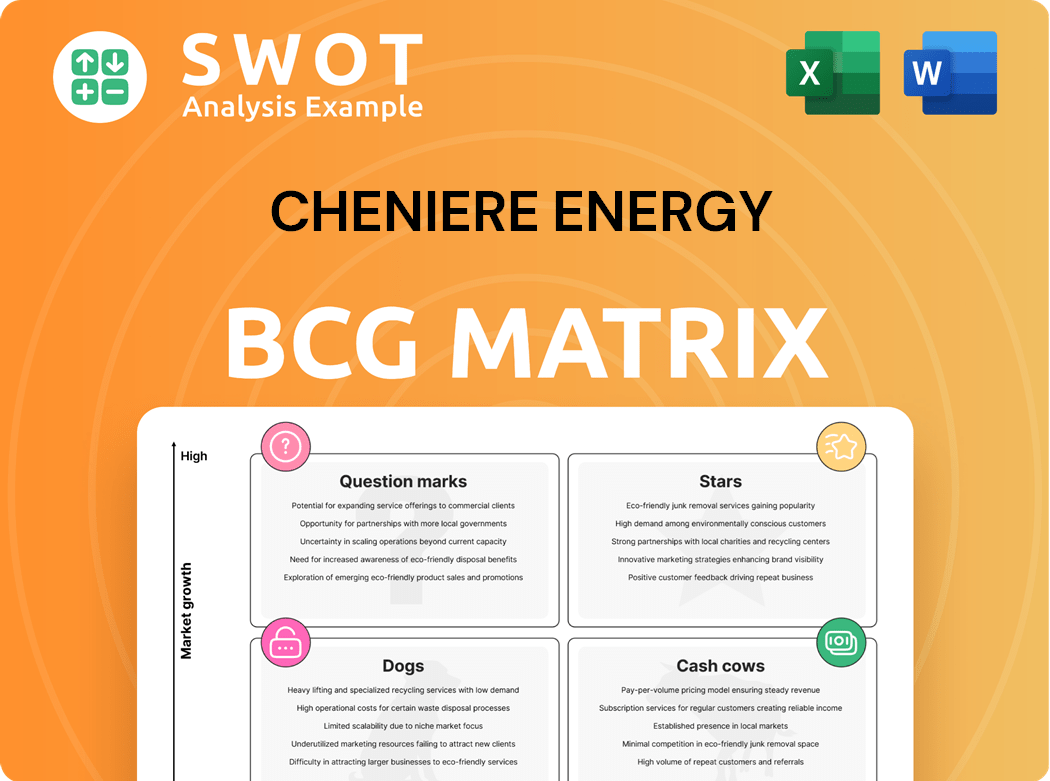

Cheniere's BCG matrix analysis identifies growth opportunities for its LNG business. It evaluates investment, hold, or divest strategies.

Export-ready design for quick drag-and-drop into PowerPoint, making presentations efficient and impactful.

Full Transparency, Always

Cheniere Energy BCG Matrix

The previewed Cheniere Energy BCG Matrix is the complete document you'll receive. It's a ready-to-use analysis, perfect for strategic planning and decision-making. Download it immediately after purchase; no extra steps required.

BCG Matrix Template

Cheniere Energy's BCG Matrix offers a snapshot of its diverse LNG business. Its "Stars" could be expanding LNG exports, capitalizing on global demand. Perhaps a "Cash Cow" is its established liquefaction capacity, providing stable revenue. The "Dogs" might be older projects, and "Question Marks" potentially new ventures. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cheniere Energy shines as a "Star" in the BCG Matrix, owing to its leading U.S. LNG export position. In 2024, Cheniere exported approximately 47.7 million tonnes of LNG. This dominance lets it seize the rising global LNG demand, especially from Asia and Europe. The company's infrastructure and operational know-how solidify its industry leadership.

Corpus Christi Stage 3, vital for Cheniere's growth, is on track. It's expected to add over 10 MTPA of LNG capacity by 2025. This expansion boosts Cheniere's output, enhancing its financial performance significantly. The project strengthens Cheniere's market leadership in the LNG sector. According to the latest reports, Cheniere's revenue in 2024 reached $18.5 billion.

Cheniere Energy’s long-term contracts are a cornerstone of its financial strategy. These contracts, covering about 95% of expected production, extend into the mid-2030s, offering stability. This arrangement insulates Cheniere from short-term market fluctuations. For example, in 2024, this strategy helped secure a consistent revenue stream.

Operational Excellence

Cheniere Energy excels operationally, ensuring it meets its commitments while maintaining high safety standards. This focus on efficiency boosts its reputation as a reliable LNG supplier. Operational excellence supports Cheniere's long-term profitability. In 2024, Cheniere handled over 1,000 LNG cargoes.

- Cheniere's operational excellence is key to its success.

- High safety standards are a priority.

- Reliability strengthens customer trust.

- Operational efficiency drives long-term profits.

Strategic Growth Initiatives

Cheniere Energy is focusing on strategic growth. They plan to expand liquefaction capacity at Corpus Christi and Sabine Pass LNG terminals. The company is also exploring investments like the SPL Expansion Project and CCL Midscale Trains 8 & 9. These initiatives show Cheniere's aim to grow and seize future opportunities. In 2024, Cheniere's revenue was approximately $20.6 billion.

- Expansion Projects: SPL Expansion Project and CCL Midscale Trains 8 & 9.

- 2024 Revenue: Approximately $20.6 billion.

- Focus: Expanding liquefaction capacity.

- Terminals: Corpus Christi and Sabine Pass LNG.

Cheniere Energy's "Star" status is reinforced by robust 2024 performance. Key expansions, like Corpus Christi Stage 3, boost capacity, driving financial growth. Long-term contracts stabilize revenue against market volatility. Strategic initiatives and operational excellence underpin sustained industry leadership.

| Metric | 2024 Data | Details |

|---|---|---|

| LNG Exports | 47.7 million tonnes | Dominates U.S. LNG market. |

| Revenue | $20.6 Billion | Reflects strong operational and contractual performance. |

| Production Coverage | 95% production covered | Secures long-term stability, mitigating risk. |

Cash Cows

Sabine Pass is a cash cow for Cheniere Energy. The terminal has six liquefaction trains. It produces approximately 30 MTPA. Cheniere benefits from long-term contracts. In 2024, Cheniere's revenue was about $22.7 billion.

Cheniere Energy's existing LNG production, totaling about 45 MTPA from Sabine Pass and Corpus Christi, is a cash cow. In 2024, Cheniere's revenue was approximately $20.9 billion. The company focuses on efficient production and supply chain management. This existing base supports Cheniere’s expansion strategies.

Cheniere's integrated model, covering gas, liquefaction, shipping, and delivery, boosts its edge. This structure helps manage costs and streamline LNG operations. The integrated strategy supports steady cash flow and profitability. In Q3 2024, Cheniere reported $3.7B in revenue, highlighting its financial strength.

Strategic Asset Optimization

Cheniere Energy strategically optimizes its assets to enhance efficiency and boost cash flow. This involves projects like debottlenecking, technological upgrades, and operational improvements. The focus is on maximizing existing infrastructure performance, allowing for increased cash flow without large capital outlays. For instance, in 2024, Cheniere's adjusted EBITDA reached $8.3 billion, reflecting these optimization efforts.

- Debottlenecking projects increase throughput.

- Technology upgrades improve operational efficiency.

- Operational improvements reduce costs.

- These efforts boost cash flow.

Strong Financial Discipline

Cheniere Energy excels in financial discipline, evident in its capital allocation and balance sheet management. The company focuses on debt reduction, share buybacks, and dividends, boosting shareholder value. This strategy enables Cheniere to pursue growth while maintaining stability. In 2024, Cheniere's debt-to-equity ratio was approximately 0.6, showcasing its financial health.

- Debt-to-equity ratio around 0.6 in 2024.

- Prioritizes debt repayment.

- Focuses on share repurchases.

- Committed to dividend payments.

Cheniere Energy's LNG operations, like Sabine Pass and Corpus Christi, are cash cows, generating steady revenue. In 2024, Cheniere's revenue was approximately $22.7 billion. The company focuses on efficient operations and integrated strategies. This generates consistent cash flow, as highlighted by a Q3 2024 revenue of $3.7 billion.

| Key Metrics | 2024 Data |

|---|---|

| Revenue | $22.7B |

| Adjusted EBITDA | $8.3B |

| Debt-to-Equity Ratio | ~0.6 |

Dogs

Cheniere's short-term LNG agreements faced challenges in 2024. Reduced volumes led to revenue drops, as these deals are vulnerable to market shifts. In Q1 2024, Cheniere's revenue was $5.54 billion, down from $8.55 billion in Q1 2023. Fluctuating prices created inconsistent income. Cheniere now focuses on long-term contracts for stable finances.

Legacy or inefficient assets at Cheniere Energy, according to the BCG matrix, include those not fitting long-term strategies. These assets might need substantial capital, yet offer limited growth. Cheniere could divest or decommission these, improving overall efficiency. For example, in 2024, Cheniere's focus was on optimizing existing LNG production capacity, indicating a shift away from less efficient segments.

Non-core business ventures at Cheniere Energy, which don't directly support its LNG operations, might be considered Dogs in a BCG Matrix. These ventures may not significantly boost returns or align with Cheniere's main goals. For instance, in 2024, if a small investment didn't perform well, it could be marked as a Dog. Cheniere might sell these assets to concentrate on its core LNG business. In 2024, Cheniere's revenue was $14.6 billion.

Commodity Price Volatility Exposure

Cheniere Energy's profitability faces risks from commodity price volatility. Unhedged LNG volumes are particularly vulnerable to price swings. Lower LNG and natural gas prices can directly reduce Cheniere's revenue. The company uses hedging and long-term contracts to manage these risks.

- In 2024, natural gas prices have shown volatility, impacting LNG sales.

- Cheniere's hedging strategies help stabilize earnings amid price fluctuations.

- Long-term contracts provide price stability for a portion of its volumes.

- Volatility in natural gas could lead to revenue reduction.

Projects Awaiting Final Investment Decision (FID) with Low Probability

Projects awaiting Final Investment Decision (FID) with low probability, or "Dogs," represent ventures with significant uncertainty. These projects might struggle with regulatory approvals or securing adequate financing. Cheniere Energy might delay or cancel these projects, focusing on more promising opportunities. As of 2024, Cheniere's focus remains on existing operational facilities and projects with high certainty. These "Dogs" often lack strong commercial backing, making FID less likely.

- Regulatory hurdles and financing challenges can stall projects.

- Lack of commercial support decreases FID probability.

- Cheniere prioritizes projects with higher success chances.

- Re-evaluation is key for these low-probability ventures.

Dogs in Cheniere's BCG Matrix are ventures with high risk and low returns, needing significant investment without substantial growth. These include underperforming ventures that don't align with LNG operations. Cheniere might sell or shut them down to boost profitability. In 2024, Cheniere's net income was $2.6 billion.

| Category | Description | Impact |

|---|---|---|

| Non-Core Ventures | Investments not aligned with core LNG operations. | May reduce returns, require resources. |

| Low-Probability Projects | Projects with regulatory or funding issues. | Delay or cancellation, hindering growth. |

| Inefficient Assets | Assets not fitting long-term goals. | Need for optimization, possible divestment. |

Question Marks

The SPL Expansion Project, potentially adding 20 MTPA LNG capacity, represents a substantial growth opportunity for Cheniere. This project is currently navigating the permitting stages, and a final investment decision (FID) is pending. Cheniere's 2024 revenue reached $20 billion, underscoring the importance of this expansion. Regulatory approvals and strong commercial backing are vital for the project's progression, potentially turning it into a Star.

The CCL Midscale Trains 8 & 9 Project, aiming for around 3 MTPA LNG capacity, is a potential growth opportunity. It has a positive Environmental Assessment, though regulatory approvals and a final investment decision are still pending. This expansion could significantly boost Cheniere's production. Cheniere's total production in 2024 is expected to be 45 MTPA.

Cheniere Energy is investing in Carbon Capture and Storage (CCS) to lower its carbon footprint. Although promising, CCS projects are in early stages, needing substantial investment. CCS success could boost Cheniere's ESG rating. In 2024, CCS projects have seen a global investment of over $6.5 billion. These projects aim to capture and store CO2 emissions, reducing environmental impact.

Emerging Market Opportunities

Cheniere Energy's expansion into emerging markets, especially in Asia, is a 'Question Mark' in its BCG Matrix. These markets offer substantial growth potential, but also present unique challenges. Navigating regulatory hurdles, political risks, and infrastructure limitations is key. Success in these areas could significantly boost Cheniere's future performance.

- Asia's LNG demand is projected to increase, offering a lucrative market.

- Political instability in some regions poses a threat to investments.

- Infrastructure deficiencies can hinder project development and operations.

- Regulatory compliance costs and complexities could increase.

New LNG Technologies

Investing in new LNG technologies is a question mark for Cheniere Energy. These technologies, potentially reducing emissions or boosting efficiency, could offer a competitive edge. However, they demand substantial research and development investments. Success could significantly improve Cheniere's operational performance and sustainability.

- Cheniere's capital expenditures for 2024 are projected to be between $850 million and $950 million.

- The company has been exploring technologies to reduce emissions.

- New technologies could enhance efficiency at its LNG facilities.

- These investments are crucial for long-term sustainability.

Cheniere's venture into Asian markets is a 'Question Mark', balancing high growth prospects with substantial risks. Political instability and infrastructure challenges are significant hurdles. Yet, successful navigation could unlock considerable future value. Cheniere's market capitalization reached $40 billion in 2024.

| Aspect | Details | Financial Impact |

|---|---|---|

| Market Entry | Asia (e.g., China, India) | Potential Revenue Boost |

| Challenges | Political risks, Infrastructure | Increased Operational Costs |

| 2024 Revenue | $20 billion | Supports Expansion Plans |

BCG Matrix Data Sources

The Cheniere Energy BCG Matrix uses data from financial statements, industry reports, market analysis, and expert opinions.