Chewy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chewy Bundle

What is included in the product

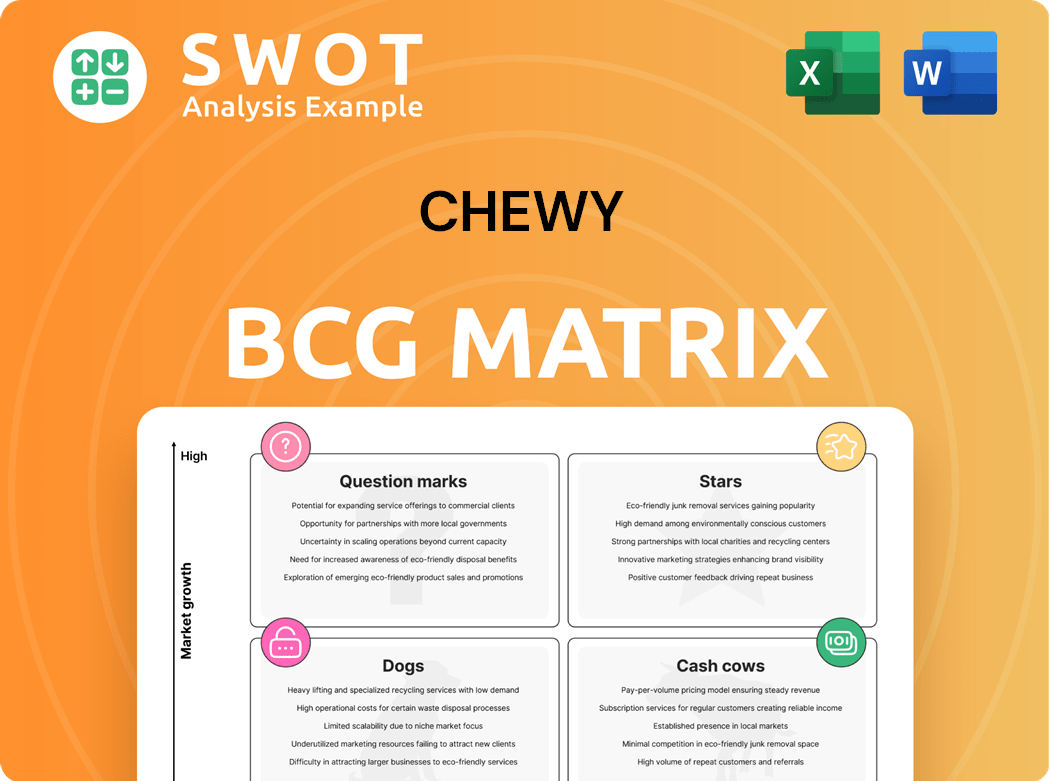

Chewy's BCG Matrix analyzes its pet product portfolio with insights on investments, holds, or divestments.

Clean and optimized layout for sharing or printing to present Chewy's business strategies!

What You See Is What You Get

Chewy BCG Matrix

The BCG Matrix preview is the complete document you'll receive. This is the final, ready-to-use strategic analysis tool. There are no hidden versions or watermarks; it's yours to use directly.

BCG Matrix Template

Chewy's BCG Matrix showcases its diverse product offerings across market growth and share. This snapshot provides a glimpse into its Star, Cash Cow, Dog, and Question Mark categories. Understanding these placements unlocks strategic investment potential. This report gives you an edge in understanding Chewy's position. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Chewy's Autoship program, a Star in its BCG Matrix, generated approximately 80.6% of Chewy's Q4 2024 sales. This subscription model drives recurring revenue and boosts customer retention. Autoship sales growth exceeded overall revenue growth in 2024, showcasing its strong market position. The program's success is fueled by the expanding e-commerce sector.

Chewy's pet health services, like telehealth and clinics, are a Star. The pet health market is expanding, with a projected value of $50 billion by 2024. Chewy's strategic moves aim to grab a bigger slice of this growing market. Positive customer feedback and increased online shopping during in-store visits support its Star status.

Chewy's private label products, like American Journey, fit the "Stars" category. They boast higher profit margins and growing customer popularity. This strategy sets Chewy apart from rivals. In 2024, private label sales contributed significantly to Chewy's revenue growth.

Mobile App Engagement

Chewy's mobile app has become a key driver of engagement. The app's user-friendly design has boosted customer interaction. It has successfully driven sales and customer loyalty. This positions the app as a "Star" in Chewy's strategy.

- In 2024, mobile app sales continue to grow, contributing significantly to overall revenue.

- Customer retention rates are higher among app users compared to non-app users.

- The app's features, such as easy reordering and personalized recommendations, are key to its success.

Sponsored Ads Platform

Chewy's sponsored ads platform is a growing Star, enabling brands to target pet owners. This platform boosts gross margins and may expand to offsite advertising. Its scalability supports revenue growth, making it a key asset. In 2024, advertising revenue increased, reflecting its impact.

- First-party sponsored ads platform.

- Gross margin improvement.

- Potential for offsite advertising.

- Scalability and revenue growth.

Chewy's "Stars" include Autoship, health services, private labels, and the mobile app. These areas show high growth in expanding markets. Strong performance in 2024 highlights their key role. They drive revenue, customer loyalty, and competitive advantage.

| Feature | Description | 2024 Data |

|---|---|---|

| Autoship | Subscription service | 80.6% of Q4 sales |

| Pet Health | Telehealth, clinics | $50B market value |

| Private Label | American Journey, etc. | Significant revenue growth |

| Mobile App | User engagement | Sales growth |

Cash Cows

Chewy's pet food and treat sales are a Cash Cow. This segment offers a steady revenue stream due to consistent pet owner demand. In 2024, pet food and treats accounted for a significant portion of Chewy's sales. The focus remains on maintaining market share and profitability in this essential product category.

Chewy's e-commerce platform is a Cash Cow, known for its user-friendly interface and efficient logistics. The platform's ability to handle a large volume of orders supports customer retention. In 2024, Chewy reported $11.1 billion in net sales. Continuous platform improvements ensure competitiveness and efficiency.

Chewy's outstanding customer service is a Cash Cow, fostering loyalty and repeat business. Their customer-focused approach, including personalized notes, sets them apart. High satisfaction scores and referrals fuel revenue. In 2024, Chewy's net sales reached $2.83 billion, reflecting the impact of customer retention.

Strong Brand Recognition

Chewy's robust brand recognition solidifies its Cash Cow status. They've fostered customer loyalty through quality and service. This strong reputation lowers marketing expenses. It guarantees a consistent customer base. In 2024, Chewy's net sales reached $2.83 billion in Q1.

- Customer retention rates are high, indicating brand loyalty.

- Marketing costs are optimized due to strong brand awareness.

- Consistent revenue streams support financial stability.

- Chewy's stock performance reflects investor confidence.

Subscription-Based Model

Chewy's subscription-based model, especially its Autoship program, is a prime example of a Cash Cow. This model delivers reliable, recurring revenue, which is a key characteristic. It also boosts customer retention and streamlines inventory management, boosting efficiency. In 2024, Autoship sales likely made up a significant portion of Chewy's revenue, showcasing its success.

- Autoship provides predictable revenue streams.

- Enhances customer loyalty.

- Improves inventory management.

- Generates consistent cash flow.

Chewy's Cash Cows, like pet food and autoship, consistently generate revenue. Customer service and brand recognition drive loyalty and optimize costs. In 2024, Chewy's net sales were supported by these key elements. This solidifies its position within the BCG matrix.

| Feature | Impact | 2024 Data |

|---|---|---|

| Autoship | Recurring Revenue | Significant portion of sales |

| Customer Service | Loyalty | Net Sales: $2.83B (Q1) |

| Brand Recognition | Low Marketing Costs | Positive Customer Ratings |

Dogs

Non-strategic hard goods on Chewy's BCG matrix are items with low turnover. These products don't significantly boost revenue or growth. They might include slow-selling pet supplies. In 2024, Chewy's net sales reached $11.1 billion. Divestiture or discontinuation could be considered.

If Chewy's international expansions falter, they risk becoming "Dogs" in their BCG Matrix. These ventures, like the 2023 Canada launch, might demand hefty investments without yielding profits. For example, Chewy's 2023 revenue was $10.1 billion, but international ventures could strain resources. Strategic adjustments are crucial to prevent resource wastage.

Outdated technology or inefficient processes at Chewy fall into the "Dogs" category. These bottlenecks can hurt Chewy's competitive edge and profitability. For instance, if their fulfillment centers lag, costs could rise. In 2024, Chewy reported a gross margin of 28.4%, which could be improved by streamlining operations.

Unprofitable Marketing Campaigns

Unprofitable marketing campaigns, classified as Dogs in Chewy's BCG Matrix, fail to generate customer acquisition or engagement. These campaigns drain resources without a positive ROI. For instance, Chewy's marketing spend in 2024 was roughly $800 million, with some campaigns underperforming. Careful strategy analysis and optimization are crucial.

- Ineffective ads.

- Low customer engagement.

- Poor ROI.

- Wasted resources.

Low-Margin, Slow-Moving Inventory

In the Chewy BCG matrix, low-margin, slow-moving inventory items are considered "Dogs." These products, which include items like certain dog beds or specialized treats, often have slim profit margins and sit in storage for extended periods. This ties up capital and warehouse space, hindering overall profitability. For instance, in 2024, Chewy reported that slow-moving inventory negatively affected its gross margin by 1.5%. Effective inventory management, including potential discontinuation, is crucial.

- Low-margin items have slim profit margins.

- Slow-moving inventory ties up capital.

- Inventory management is crucial.

- In 2024, slow-moving items cut Chewy's gross margin by 1.5%.

In Chewy's BCG matrix, "Dogs" are products with low market share and growth potential. This includes low-margin goods and slow-moving inventory, negatively impacting profitability. For instance, inefficient technology and unprofitable marketing campaigns also fall in this category. Ultimately, strategic adjustments are crucial to prevent resource wastage and improve financial performance.

| Issue | Impact | 2024 Data |

|---|---|---|

| Slow-moving inventory | Ties up capital | Gross margin down 1.5% |

| Unprofitable marketing | Drains resources | Marketing spend ~$800M |

| Inefficient processes | Hurts competitive edge | Gross margin of 28.4% |

Question Marks

Chewy+ is a Question Mark in Chewy's BCG Matrix. It's a paid membership program that aims to boost customer engagement and sales. Although early data shows promise, its financial impact is still small. In 2024, Chewy's net sales grew 8.2% year-over-year, indicating potential for Chewy+ to contribute significantly. Further investment could transform Chewy+ into a Star.

Chewy's Vet Care clinics, classified as a Question Mark in the BCG matrix, face uncertain prospects. While current clinics enjoy positive feedback, broader expansion success is unclear. Chewy's 2024 revenue was around $11.1 billion. Further investment requires close monitoring of customer satisfaction and profitability. This expansion strategy will determine long-term market positioning.

Chewy's expansion into new sectors, like pet insurance, classifies as a Question Mark in its BCG Matrix. The pet insurance sector is expanding, with projections estimating the U.S. market to reach $7.8 billion by 2028. However, Chewy's success is uncertain. Strategic investments and effective marketing are crucial for capturing market share, as they compete with established players.

International Expansion

Chewy's international expansion, specifically into Canada, positions it as a Question Mark in the BCG Matrix. This signifies high growth potential but also significant uncertainty. Entering new markets requires substantial investment and faces competition. Success hinges on effective strategies and adapting to local market dynamics.

- Chewy launched in Canada in 2023.

- International e-commerce sales are projected to reach $8.1 trillion by 2026.

- Chewy's Q3 2023 net sales grew by 10.3% to $2.78 billion.

- The pet care market in Canada is valued at over $4 billion.

Same-Day Delivery Services

Investment in same-day delivery services for Chewy aligns with the Question Mark quadrant of the BCG Matrix. This venture presents opportunities to boost customer satisfaction and gain market share. However, it demands substantial capital for logistics and operational infrastructure. The success hinges on carefully evaluating customer demand and ensuring profitability.

- Chewy's net sales in 2023 were $11.1 billion.

- Same-day delivery could increase customer retention rates.

- Logistics investments include warehouse space and delivery fleets.

- Profitability depends on order volume and delivery efficiency.

Chewy+ faces uncertain returns, despite potential for sales boosts. Vet Care expansion is a Question Mark, needing careful investment monitoring. Pet insurance and international expansion present high growth with market share uncertainty.

| Initiative | BCG Status | Key Consideration |

|---|---|---|

| Chewy+ | Question Mark | Customer engagement and sales boost |

| Vet Care Clinics | Question Mark | Customer satisfaction, profitability |

| Pet Insurance | Question Mark | Market share, competition |

| International Expansion | Question Mark | Market dynamics, investment |

BCG Matrix Data Sources

Chewy's BCG Matrix uses financial statements, market data, sales trends, and competitive analysis for a robust framework.