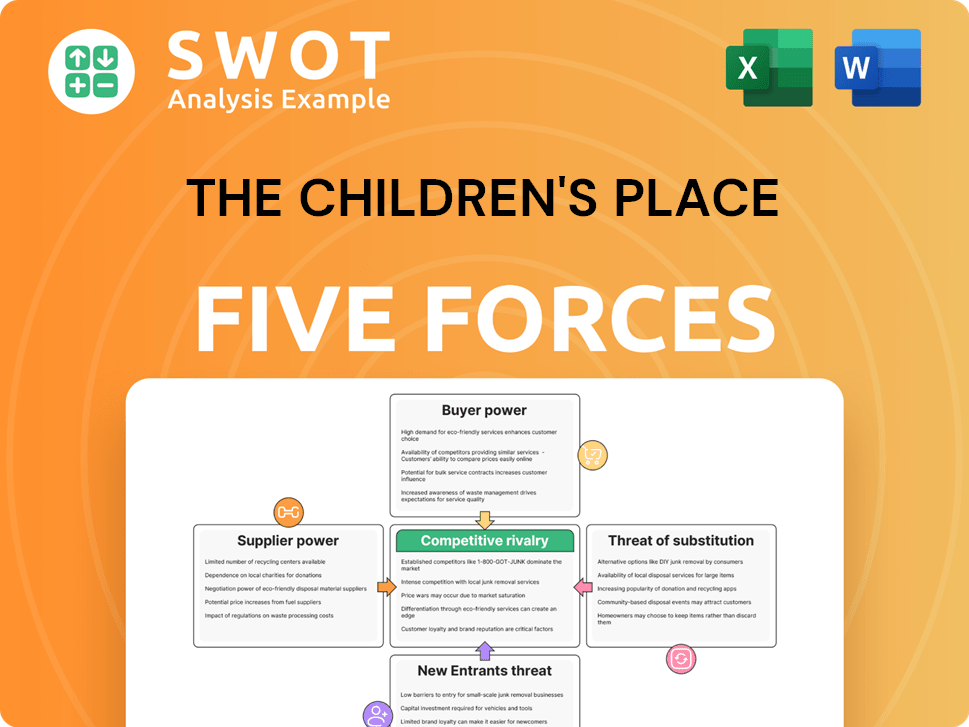

The Children's Place Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Children's Place Bundle

What is included in the product

Tailored exclusively for The Children's Place, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

Same Document Delivered

The Children's Place Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for The Children's Place. The document you're viewing is the identical, ready-to-download version you'll receive immediately after your purchase. It's a fully formatted and professionally written analysis. This includes all the detail and insights. No revisions are needed.

Porter's Five Forces Analysis Template

The Children's Place faces moderate rivalry, influenced by established retailers and online competitors. Buyer power is high, with price-sensitive consumers. Suppliers hold limited power due to readily available materials. The threat of new entrants is moderate, with high initial costs. Substitute products, like secondhand clothing, pose a threat.

Ready to move beyond the basics? Get a full strategic breakdown of The Children's Place’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The Children's Place faces supplier concentration challenges. A few key suppliers, like those for textiles, could exert significant influence. This limited number of suppliers boosts their bargaining power, potentially impacting costs. For instance, in 2024, raw material price fluctuations affected margins. This situation demands careful supplier relationship management.

The Children's Place faces moderate supplier power due to input differentiation. Suppliers offering unique or specialized inputs, like specific fabrics or designs, can command higher prices. This is especially true if these inputs are crucial for the brand's identity. In 2024, The Children's Place's cost of goods sold (COGS) was approximately $970 million, indicating the significant impact of supplier costs on profitability.

Switching costs significantly influence The Children's Place's supplier relationships. High switching costs, such as those related to specialized materials or unique manufacturing processes, empower suppliers. For instance, if changing a fabric supplier requires extensive testing and redesign, it increases the supplier's bargaining power. In 2024, the company's reliance on specific vendors for branded merchandise could create high switching costs.

Forward integration potential

The Children's Place faces a threat from suppliers with the potential for forward integration, meaning they could enter the retail market themselves. This would significantly weaken The Children's Place's position. Consider the apparel industry where some manufacturers have already started selling directly to consumers, bypassing traditional retailers. For instance, in 2024, direct-to-consumer sales are projected to reach $175 billion in the US apparel market. This shift could squeeze margins and reduce The Children's Place's control over its supply chain.

- Supplier entry into retail reduces The Children's Place's market share.

- Direct-to-consumer sales growth poses a substantial risk.

- The Children's Place would face heightened competition.

- Margin compression is a likely outcome.

Impact on product quality

The Children's Place (TCP) depends on suppliers for critical inputs like fabrics and trims, which directly impact product quality. When these inputs are essential and suppliers are concentrated, their influence rises. This can lead to increased costs or reduced quality if TCP cannot negotiate favorable terms. In 2023, TCP's cost of goods sold was around $769 million, highlighting the impact of supplier costs.

- Fabric and trim costs significantly affect the final product quality.

- Concentrated supplier markets increase supplier power.

- TCP's profitability is vulnerable to supplier pricing.

- Negotiating favorable terms is crucial for managing costs.

Supplier bargaining power affects The Children's Place due to input concentration. Key suppliers of fabrics and trims hold significant influence. High switching costs also empower suppliers. In 2024, the apparel industry saw fluctuating raw material costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Increases supplier power | Raw material cost fluctuations |

| Switching Costs | Empowers suppliers | Reliance on specific vendors |

| Forward Integration | Threat to TCP | DTC sales projected at $175B |

Customers Bargaining Power

Customer price sensitivity significantly influences The Children's Place's pricing power. High sensitivity amplifies customer influence, potentially pressuring prices downward. In 2024, the apparel industry faced fluctuating consumer demand and price wars. The Children's Place's Q3 2024 earnings show this pressure with a 1.2% decrease in net sales, reflecting customer sensitivity to pricing and promotions.

The Children's Place faces strong customer bargaining power due to the availability of many substitutes. Competitors like Gap, Old Navy, and H&M offer similar products. This reduces the company's pricing power and increases price sensitivity. In 2024, The Children's Place's revenue was approximately $1.5 billion, showing the impact of competitive pressures.

Large buyers significantly shape The Children's Place's market position. In 2024, major retail partners accounted for a substantial portion of sales. This concentration gives these buyers considerable leverage in price negotiations and terms. This impacts profitability and strategic decisions.

Switching costs for customers

The Children's Place faces moderate customer bargaining power. Low switching costs allow customers to easily choose competitors. This dynamic influences pricing and product offerings. The company must differentiate itself to retain customers.

- Competitors like Gap and Old Navy offer similar products.

- Online retailers provide convenient alternatives.

- The Children's Place's revenue in 2024 was approximately $1.5 billion.

Customer information

The Children's Place faces moderate customer bargaining power due to readily available information and choices. Informed customers, armed with online price comparisons and reviews, can negotiate better deals. This pressure is somewhat offset by brand loyalty and the focus on children's apparel, where parents prioritize quality and convenience. In 2024, online sales accounted for approximately 40% of The Children's Place's revenue, highlighting the impact of informed online shoppers.

- Online price comparison tools empower customers.

- Brand loyalty can mitigate bargaining power.

- The children's apparel niche has some protection.

- Online sales influence customer negotiation.

Customer bargaining power moderately affects The Children's Place. Competitors and online options provide alternatives, influencing pricing. In 2024, approximately 40% of sales came from online channels, highlighting customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Substitutes | High | Gap, Old Navy, H&M |

| Online Sales | Significant | ~40% of revenue |

| Revenue | Impacted | ~$1.5 billion |

Rivalry Among Competitors

The Children's Place faces intense rivalry due to numerous competitors in the children's apparel market. This crowded landscape includes major retailers like Target and Walmart, which reported billions in apparel sales in 2024. These competitors constantly vie for market share, intensifying price wars and promotional activities. This high level of competition directly impacts The Children's Place's profitability.

Slower industry growth intensifies competitive rivalry as companies vie for a larger slice of a shrinking pie. The children's apparel market, valued at $32.8 billion in 2024, saw modest growth, increasing competition. This means businesses like The Children's Place must fight harder to attract and retain customers.

Low product differentiation in the children's apparel market intensifies price wars. The Children's Place, facing this, competes with brands like Carter's. In 2024, promotional activity was high to drive sales, signaling price competition. The company's gross margin fluctuations reflect this pressure.

Switching costs

Low switching costs heighten competitive rivalry. Customers can easily shift between The Children's Place and its competitors due to minimal financial or logistical barriers. This ease of switching compels companies to compete aggressively on price, product offerings, and marketing. For instance, in 2024, the children's apparel market saw intense promotional activity, reflecting this rivalry.

- Price wars can occur, reducing profit margins.

- Product innovation is crucial to attract and retain customers.

- Marketing and branding become vital for differentiation.

- Customer loyalty is difficult to secure in the face of easy switching.

Exit barriers

High exit barriers intensify competitive rivalry. The Children's Place faces significant exit barriers, including specialized assets and long-term contracts. These barriers make it costly for the company to leave the market, thus increasing competition. Consequently, this leads to price wars and reduced profitability. In 2024, The Children's Place's net sales decreased by 15% demonstrating the impact of competitive pressures.

- Specialized Assets: Store locations and distribution networks.

- Long-Term Contracts: Leases and supplier agreements.

- High Fixed Costs: Rent and employee salaries.

- Low Salvage Value: Difficult to repurpose assets.

The Children's Place battles intense rivalry due to many competitors. This competition, including players like Walmart and Target, fuels price wars and promotional activities. The children's apparel market, valued at $32.8 billion in 2024, faces pressure to innovate. This environment squeezes profit margins and intensifies the need for customer loyalty.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Number of Competitors | High | Many, incl. Walmart & Target |

| Market Growth | Modest | $32.8B market size |

| Differentiation | Low | Intense promotional activity |

SSubstitutes Threaten

The Children's Place faces threats from substitute products, especially due to the wide availability of children's clothing from various retailers. This abundance heightens price sensitivity among consumers. Competitors like Amazon and Walmart offer similar products at competitive prices. In 2024, the online clothing market grew, intensifying the impact of substitutes. This makes it crucial for The Children's Place to differentiate itself.

The Children's Place faces threats from substitutes with attractive price-performance ratios. Competitors offering similar products at lower prices can lure customers. For example, fast-fashion retailers like Shein and Temu have grown rapidly in 2024, impacting traditional retailers. In 2024, Shein's revenue reached $32 billion, showcasing the impact of affordable substitutes on the market.

Low switching costs amplify the threat of substitutes for The Children's Place. In 2024, the children's apparel market saw consumers easily shifting to competitors due to minimal barriers. The Children's Place's Q3 2024 sales decreased by 10.5% reflecting this vulnerability. Online retailers offer similar products with easy returns further increasing this threat.

Customer loyalty

Strong customer loyalty significantly diminishes the threat of substitutes for The Children's Place. Loyal customers are less likely to switch to other brands, even if alternatives are available at lower prices or offer slightly different features. The Children's Place benefits from this loyalty, particularly among parents who trust the brand for quality and value. Data from 2024 shows that repeat customers account for a significant portion of sales, indicating strong brand loyalty.

- Repeat customers drive a large percentage of sales.

- Brand trust is a key factor in customer retention.

- Loyalty programs enhance customer stickiness.

- The Children's Place's ability to maintain customer loyalty is crucial to its success.

Propensity to substitute

The Children's Place faces the threat of substitutes, primarily due to customer willingness to explore alternatives. This is heightened by the availability of various children's clothing brands and retailers. In 2024, the children's apparel market was highly competitive. The company's ability to differentiate itself, perhaps through unique designs or superior customer service, is crucial. This threat is moderate, but requires constant attention.

- Competition from online retailers like Amazon.

- Availability of discount stores such as Walmart.

- Growing popularity of resale platforms.

- Changing fashion trends impacting demand.

The Children's Place confronts substitute threats due to numerous children's clothing options. Competitors like Shein and Temu offer low-cost alternatives. In 2024, the global online clothing market reached $700 billion, intensifying competition.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Substitute Products | High | Shein's revenue: $32B |

| Customer Switching | Moderate | Online clothing market: $700B |

| Differentiation | Crucial | T.C.P Q3 sales down 10.5% |

Entrants Threaten

High barriers to entry significantly reduce the threat of new competitors in The Children's Place's market. These barriers include the need for substantial capital to establish retail locations and build brand recognition. The Children's Place benefits from established supplier relationships and economies of scale, making it difficult for smaller players to compete. In 2024, the company's strong brand presence and extensive distribution network provided a competitive advantage. This advantage is reflected in its 2024 revenue of $1.5 billion.

Economies of scale present a significant barrier for new entrants. Established firms like The Children's Place benefit from lower per-unit costs due to large-scale production, distribution, and marketing. In 2024, The Children's Place reported a gross margin of approximately 35%, reflecting cost efficiencies. New entrants struggle to match these advantages. Thus, established firms deter new competitors.

The Children's Place benefits from established brand loyalty, making it tough for new entrants. Customers often stick with familiar brands. In 2024, The Children's Place's net sales were approximately $1.6 billion, showing consistent customer preference. This loyalty provides a significant barrier.

Capital requirements

The Children's Place faces threats from new entrants, particularly due to high capital requirements. Establishing a retail presence, like The Children's Place, demands significant initial investment in stores, inventory, and marketing. These substantial capital needs act as a barrier, deterring smaller companies from entering the market. For example, in 2024, opening a single retail store can cost hundreds of thousands of dollars.

- High initial investment in stores.

- Significant inventory costs.

- Marketing and advertising expenses.

- Operational costs.

Access to distribution channels

New entrants to the children's apparel market face challenges in accessing distribution channels. The Children's Place, with its established retail presence and online platforms, holds a significant advantage. This makes it difficult for new competitors to secure shelf space in physical stores or gain visibility online. The company's extensive network, including over 400 stores in the US as of 2024, provides robust distribution.

- Established Retail Network: The Children's Place operates a vast network of stores.

- Online Presence: Strong online sales and e-commerce platforms.

- Market Share: The Children's Place has a significant share in the children's apparel market.

- Distribution Advantage: Difficult for new entrants to compete with established distribution.

The threat of new entrants for The Children's Place is moderate due to high capital needs and established brand loyalty. New competitors face substantial investment to match existing retail networks. While the market is competitive, established players hold advantages such as economies of scale.

| Factor | Description | Impact |

|---|---|---|

| Capital Requirements | High costs to establish retail stores. | Barrier to entry. |

| Brand Loyalty | Established brand presence. | Competitive advantage. |

| Distribution Channels | Established retail and online presence. | Competitive advantage. |

Porter's Five Forces Analysis Data Sources

Our analysis uses financial reports, competitor strategies, and industry research. We draw data from SEC filings, market analyses, and news outlets.