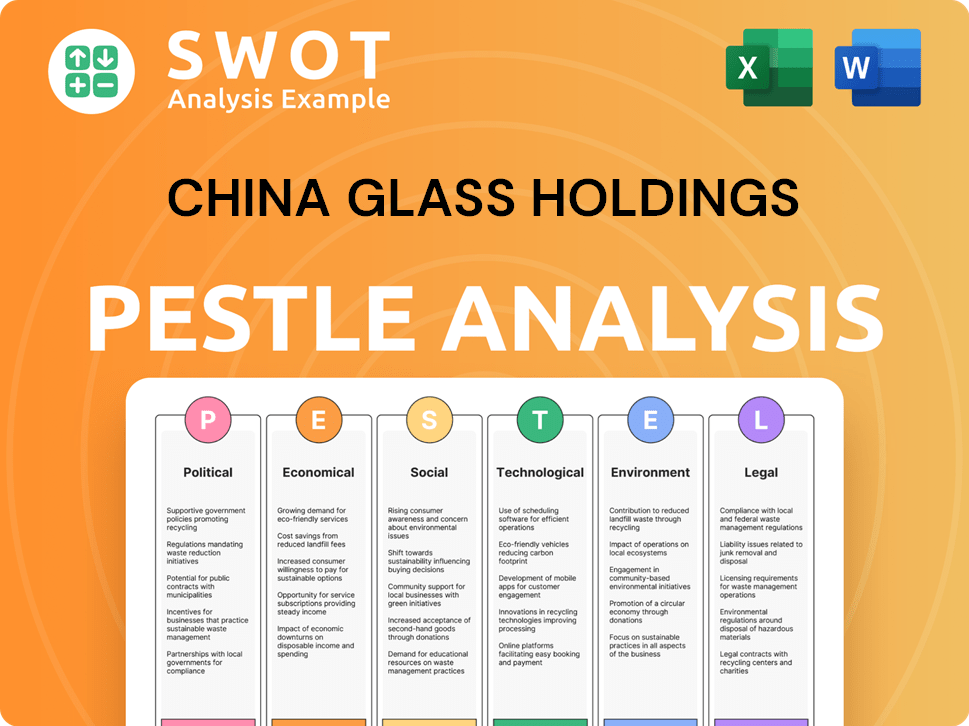

China Glass Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Glass Holdings Bundle

What is included in the product

Unpacks external influences on China Glass Holdings, covering political, economic, social, tech, environmental, and legal factors.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

China Glass Holdings PESTLE Analysis

What you’re previewing is the real China Glass Holdings PESTLE analysis document. This comprehensive analysis details Political, Economic, Social, Technological, Legal, and Environmental factors. The content you see—including data and format—is precisely what you'll receive. Download the finished file right after your purchase.

PESTLE Analysis Template

Explore China Glass Holdings's external landscape with our focused PESTLE Analysis. Discover key political and economic factors influencing their market position. Uncover the impact of social trends, and environmental challenges. Understand legal and technological forces shaping their operations. Equip yourself with crucial market intelligence for strategic planning. Download the complete PESTLE Analysis for detailed insights now!

Political factors

The Chinese government's backing is crucial for the glass industry. The 'Thirteenth Five-Year Plan' boosts industry expansion. Government infrastructure projects fuel glass demand. In 2024, infrastructure spending increased by 8% driving demand. This support creates a favorable environment for China Glass Holdings.

Geopolitical instability and shifting trade policies pose risks to China Glass Holdings. Uncertainties can disrupt overseas operations and export markets. Trade protectionism and currency volatility could reduce international production profitability. In 2024, China's exports of glass and glassware totaled $12.5 billion, a 5% decrease from 2023, due to global economic slowdown.

China's Belt and Road Initiative (BRI) offers China Glass Holdings significant expansion prospects. The company strategically aligns with BRI, expanding into countries like Nigeria and Kazakhstan. New projects are underway in Egypt, further leveraging the initiative. In 2024, BRI investments totaled over $100 billion, indicating its continued importance for companies like China Glass Holdings.

State Ownership Influence

As a state-owned enterprise, China Glass Holdings faces political influences. Government directives can shape business decisions and strategic direction. This could include access to financial assistance. In 2024, state-owned enterprises (SOEs) in China accounted for about 20% of the country's GDP.

- Government influence on strategic decisions.

- Access to state financial support.

- Alignment with national economic goals.

- Potential for policy-driven operational changes.

Local Government Support

Local government support significantly impacts China Glass Holdings. Initiatives fostering industry growth create a favorable business environment. These measures can include tax incentives and infrastructure development. Such support can boost operational efficiency and competitiveness. This is vital for navigating the dynamic Chinese market.

- Tax incentives for green technology adoption.

- Infrastructure development grants for factory upgrades.

- Streamlined permitting processes for expansion projects.

- Financial subsidies for research and development.

Political factors significantly affect China Glass Holdings. Government policies drive industry expansion, including initiatives like the 'Thirteenth Five-Year Plan', fostering growth. Geopolitical tensions, as seen by a 5% decrease in glass exports in 2024 to $12.5B, pose risks.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Government Support | Boosts Industry | Infrastructure spending up 8% |

| Geopolitical Risk | Disrupts Operations | Glass exports $12.5B, -5% |

| BRI Influence | Expansion Potential | Over $100B in BRI investments |

Economic factors

The slump in China's real estate market significantly impacts China Glass Holdings. Demand for architectural glass, a core product, decreases due to reduced construction activities. This leads to lower market prices for clear glass, affecting the company's revenue. In 2024, the sector saw a decrease in new construction starts, contributing to a 10-15% drop in glass demand.

China Glass Holdings navigates a highly competitive domestic flat glass market. This intense rivalry stems from external factors, economic conditions, and government policies. The company must focus on upgrading its industrial structure, decreasing costs, and differentiating its products to stay ahead. According to recent reports, the flat glass market in China has seen a 5% increase in competition in 2024.

China Glass Holdings faces global economic uncertainties. Complex international dynamics and economic shifts can impact its business. Geopolitical instability and currency fluctuations affect overseas profits. For example, in 2024, the yuan's volatility influenced international transactions. These factors necessitate careful risk management.

Growth in Energy-Saving and New Energy Sectors

China Glass Holdings benefits from the growth in energy-saving and new energy sectors. National policies and rising demand boost sales of photovoltaic glass and solar reflectors. These products command higher prices, positively impacting the average selling price. This sector's expansion supports the company's financial performance.

- Photovoltaic glass market reached $15.6 billion in 2024.

- Solar reflector sales grew by 18% in 2024.

- Average selling price increased by 12% due to new energy products.

Raw Material and Fuel Costs

China Glass Holdings faces production cost impacts from raw material and fuel price shifts. Soda ash and mineral raw materials are key, alongside natural gas and petroleum coke. Domestic gas prices have shown stability; however, other cost elements may fluctuate. These fluctuations directly influence profitability and operational expenses.

- Soda ash prices in China saw a 10-15% increase in early 2024.

- Natural gas prices in China are projected to remain relatively stable through 2025.

- Petroleum coke costs are influenced by global oil prices, which are subject to volatility.

China Glass Holdings is heavily influenced by China's real estate market and faces significant competition in the domestic flat glass sector, impacting revenue and profitability. Global economic uncertainties and currency fluctuations, especially regarding the yuan, also affect its international transactions. However, the company benefits from the expanding energy-saving and new energy sectors.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Real Estate | Decreased demand | Construction starts down 10-15% (2024) |

| Competition | Intense | 5% increase in competition (2024) |

| New Energy | Growth opportunity | Photovoltaic glass market: $15.6B (2024), Solar reflector sales +18% (2024) |

Sociological factors

China's ongoing urbanization fuels construction, boosting demand for glass. In 2024, urban population reached ~65% of the total, spurring building projects. This trend directly benefits China Glass Holdings, increasing demand for architectural glass. Construction spending in China is projected to grow, offering more opportunities.

Changing consumer preferences significantly shape China Glass Holdings' market. Demand is rising for energy-efficient glass, driven by environmental concerns. Lightweight automotive glass is also gaining traction, reflecting modern vehicle designs. In 2024, the market for smart glass is expected to reach $1.5 billion.

Growing public awareness and a strong emphasis on environmental protection in China are driving demand for energy-efficient products. This includes a rising need for energy-saving glass, such as Low-E glass, which China Glass Holdings produces. In 2024, the market for green building materials in China is projected to reach over $100 billion, highlighting the substantial opportunities in this sector. This trend supports China Glass Holdings' focus on energy-saving glass.

Labor Availability and Costs

China Glass Holdings' manufacturing heavily relies on labor, making labor availability and cost crucial. The company must efficiently recruit to meet its human resource demands. The average monthly wage in China's manufacturing sector was approximately 6,800 yuan in 2024. Labor costs can affect production costs and competitiveness, influencing operational decisions.

- Manufacturing wages in China are influenced by regional economic development and skill levels.

- Recruitment strategies must adapt to changing labor market conditions.

- Labor costs are a significant factor in production cost calculations.

Safety and Security Concerns

Safety and security concerns significantly shape demand for specialized glass products. For instance, the market for laminated glass in automotive applications and fire-resistant glass in buildings is driven by these concerns. China Glass Holdings must adapt its product offerings to meet these evolving safety standards to remain competitive. The global fire-resistant glass market was valued at USD 3.1 billion in 2023 and is projected to reach USD 4.5 billion by 2028.

- Laminated glass demand is tied to automotive safety regulations.

- Fire-resistant glass sales are influenced by building codes.

- China Glass Holdings needs to align with these safety trends.

- The company's product development must prioritize safety features.

China's evolving societal attitudes towards environmental protection and safety significantly affect China Glass Holdings. Demand for sustainable products grows, boosted by green building initiatives. Changes in lifestyle preferences further shape market dynamics. The rising focus on both eco-friendliness and security, fuels the development of advanced glass products.

| Sociological Factor | Impact on China Glass | 2024/2025 Data |

|---|---|---|

| Environmental Awareness | Drives demand for energy-efficient glass. | Green building material market in China projected over $100B in 2024. |

| Safety Concerns | Increases demand for laminated and fire-resistant glass. | Global fire-resistant glass market value $3.1B in 2023, $4.5B projected by 2028. |

| Consumer Preferences | Influences adoption of smart and lightweight glass. | Smart glass market expected to reach $1.5B in 2024. |

Technological factors

Technological advancements are pivotal in the glass industry, impacting production efficiency and product quality. China Glass Holdings focuses on upgrading traditional industries, emphasizing new quality productivity through intelligent and digital transformation. This includes investments in advanced manufacturing techniques to enhance operational efficiency. The company's adoption of these technologies aims to boost output and competitiveness. In 2024, the glass industry saw a 5% increase in the adoption of automated manufacturing processes.

China Glass Holdings benefits from energy-saving glass tech advancements. The company's patents in online Low-E and TCO glass give it an edge. In 2024, the energy-efficient glass market grew by approximately 12% in China. This growth is fueled by government policies promoting sustainable construction. China Glass Holdings' innovative products are well-positioned to capitalize on this trend.

Technological advancements in photovoltaic glass and solar reflector glass are boosting China Glass Holdings' energy-saving and new energy segment. Production efficiency improvements lead to higher sales volumes. For instance, in Q1 2024, this segment saw a 15% increase in sales, driven by these tech upgrades.

Digital Transformation and Intelligent Manufacturing

China Glass Holdings must navigate the digital transformation wave, integrating intelligent manufacturing. This involves using big data, cloud computing, IoT, and AI to boost efficiency and reduce costs. Such technologies can streamline processes, improve product quality, and potentially increase profitability. According to a 2024 report, the smart manufacturing market in China is projected to reach $400 billion by 2025, signaling significant growth potential.

- Enhance operational efficiency

- Reduce costs through automation

- Improve product quality

- Increase profitability

Development of Ultra-Thin Glass

China Glass Holdings benefits from the technological advancements in ultra-thin glass production. The demand for this glass is rising across consumer electronics, automotive, and solar energy sectors. Research indicates the global ultra-thin glass market was valued at USD 7.2 billion in 2023 and is projected to reach USD 12.5 billion by 2030. This growth is driven by the increasing use of flexible displays and lightweight automotive components. Innovations in manufacturing processes are crucial for producing high-strength, thin glass efficiently.

- Market size: USD 7.2 billion (2023)

- Projected market size: USD 12.5 billion (2030)

- Growth drivers: Flexible displays, automotive components

China Glass Holdings boosts efficiency with smart tech, aligning with China's $400B smart manufacturing market by 2025. They benefit from energy-efficient glass tech, growing at 12% in 2024, backed by green policies. Ultra-thin glass production, a key area, eyes a USD 12.5B market by 2030.

| Technological Aspect | Impact | Data (2024) |

|---|---|---|

| Automated Manufacturing | Boosts Output, Competitiveness | 5% Increase in Adoption |

| Energy-Saving Glass | Market Growth and Innovation | 12% Growth in Energy-Efficient Glass |

| Ultra-Thin Glass | Expanded Application & Market Size | USD 7.2B (2023) to USD 12.5B (2030) |

Legal factors

China Glass Holdings and its suppliers must adhere to national environmental policies and safe production standards. This involves securing environmental protection qualifications and fulfilling associated responsibilities. In 2024, China's Ministry of Ecology and Environment intensified enforcement, with 13,000+ penalties issued. Companies face significant fines for non-compliance.

Stringent building energy efficiency regulations, especially in developed areas, drive demand for energy-saving construction glass. This benefits China Glass Holdings' eco-friendly products. The global green building materials market is projected to reach $498.1 billion by 2025. China's government is increasing green building standards, creating a positive legal climate for the company.

China Glass Holdings must comply with production and distribution laws across its operational regions. This includes adhering to quality and safety standards for its glass products. Failure to comply can lead to penalties or operational disruptions. The company must monitor and adapt to evolving legal requirements. In 2024, stricter environmental regulations impacted glass production, increasing compliance costs.

Corporate Governance Regulations

China Glass Holdings, as a Hong Kong-listed entity, is bound by stringent corporate governance regulations. The company adheres to the Hong Kong Stock Exchange's listing rules, ensuring transparency and accountability. Recent shifts in board composition and committee assignments underscore a focus on robust governance practices. These changes aim to enhance oversight and protect shareholder interests, reflecting the evolving regulatory landscape. The company's commitment to governance is vital for investor confidence.

- Compliance with listing rules.

- Emphasis on board composition.

- Commitment to investor protection.

- Enhancement of oversight.

Labor Laws and Regulations

China Glass Holdings must adhere to China's labor laws, covering employment policies, working conditions, and worker rights. Non-compliance can lead to significant penalties, including fines and operational disruptions. Recent regulations emphasize stricter enforcement, especially concerning minimum wage and overtime pay. These regulations directly impact labor costs and operational efficiency.

- In 2024, China's minimum wage increased in several regions, potentially raising labor costs for China Glass Holdings.

- Overtime regulations are strictly enforced, affecting production schedules and labor expenses.

- Compliance with workplace safety standards is critical to avoid accidents and legal issues.

China Glass Holdings navigates complex legal requirements including environmental and labor laws. Stricter environmental enforcement resulted in 13,000+ penalties in 2024, impacting production. The company also faces stringent corporate governance, impacting its operations.

| Regulatory Area | Impact | 2024/2025 Data |

|---|---|---|

| Environmental | Increased Compliance Costs | 13,000+ penalties issued |

| Labor | Increased Costs, Production Shifts | Minimum wage increased in several regions |

| Governance | Enhanced Oversight, Transparency | Focus on board composition |

Environmental factors

China's 'carbon neutrality and peak carbon dioxide emissions' initiative directly affects China Glass Holdings. This policy restricts new float glass production, pushing the company towards eco-friendly practices. The government aims for peak carbon emissions by 2030. This influences sustainable development within the glass sector.

China's environmental policies affect manufacturing. They mandate clean energy and emission controls. In 2024, China invested $160 billion in green projects. Compliance impacts costs and operational strategies.

Glass manufacturing is energy-intensive, producing significant CO2 emissions. China Glass Holdings must adopt energy-saving and emission-reducing strategies. These include boosting furnace efficiency and using cleaner fuels. In 2024, China's glass industry aimed to cut emissions by 10% through tech upgrades. China's 14th Five-Year Plan targets green manufacturing.

Waste Management and Recycling

China Glass Holdings must manage production waste, including broken glass and refractory materials. Recycling glass reduces environmental impact and conserves resources. Increased recycling rates can lower operational costs and enhance sustainability. The Chinese government's focus on environmental protection impacts waste management practices.

- China's recycling rate for construction waste was around 10% in 2023, with goals to increase this.

- The global recycled glass market was valued at $3.9 billion in 2024 and is projected to reach $5.1 billion by 2029.

- The cost of landfill disposal has increased in China, incentivizing recycling.

- China's 14th Five-Year Plan (2021-2025) emphasizes green development and waste reduction.

Development of Environmentally Friendly Products

There's a growing global push for eco-friendly products, including glass. This shift boosts demand for low-carbon glass. China Glass Holdings' focus on energy-saving and new energy glass meets this need. This helps lessen the environmental footprint of structures and vehicles. The global green building materials market is projected to reach $460.2 billion by 2027.

- China's green building market is expanding rapidly.

- Demand for sustainable glass is increasing.

- Energy-efficient glass reduces carbon emissions.

- China Glass Holdings can capitalize on this trend.

Environmental factors critically influence China Glass Holdings' strategies. China's carbon neutrality goals by 2060, impacting the glass industry, drive emission reductions and promote sustainable practices. In 2024, the government invested $160 billion in green projects. Addressing waste management, especially with China's low construction waste recycling rate of approximately 10% in 2023, is crucial.

| Factor | Impact | Data |

|---|---|---|

| Carbon Emission Targets | Limits new float glass, favors eco-friendly tech | Peak carbon by 2030; Industry aimed to cut emissions by 10% by 2024 |

| Green Investment | Increases costs of compliance with energy, emission norms | China invested $160 billion in 2024 green projects |

| Waste Management | Focus on glass recycling reduces environmental impact | Recycled glass market valued at $3.9B in 2024 |

PESTLE Analysis Data Sources

China Glass Holdings PESTLE analysis relies on financial reports, government stats, industry journals, and economic forecasts. Global and local market data provide the basis.