Chipotle Mexican Grill Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chipotle Mexican Grill Bundle

What is included in the product

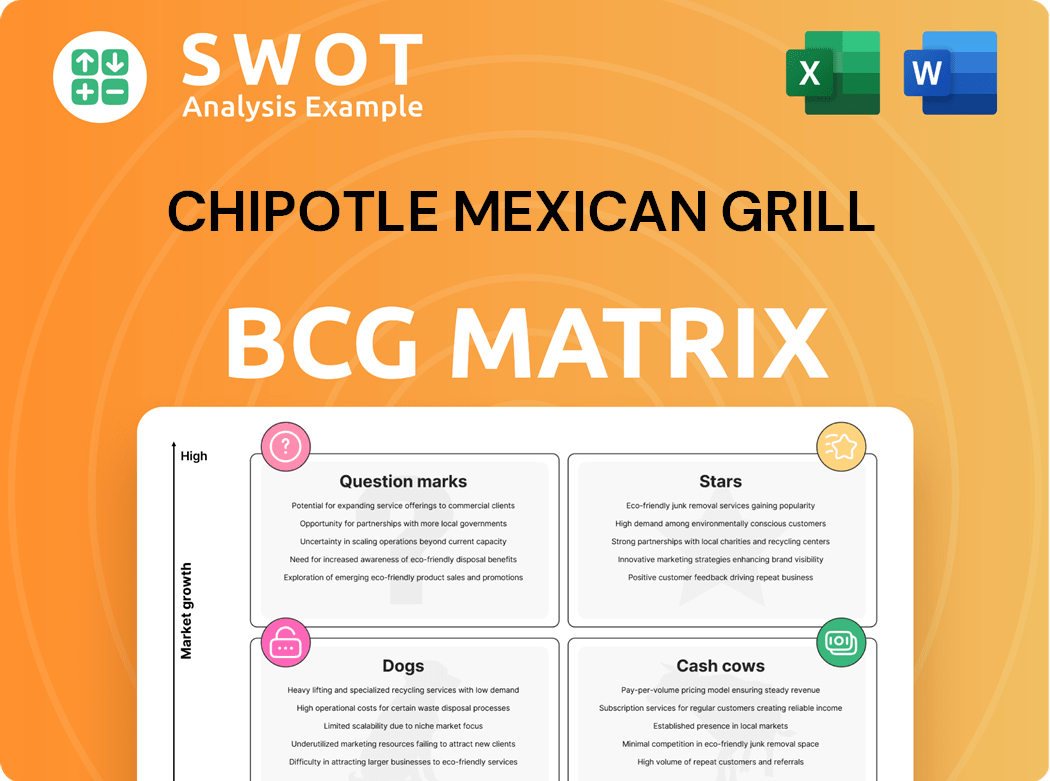

Chipotle's BCG Matrix analysis shows investment opportunities, focusing on growth, and highlighting competitive threats.

Printable summary optimized for A4 and mobile PDFs to quickly communicate Chipotle's strategy.

Preview = Final Product

Chipotle Mexican Grill BCG Matrix

This preview is the complete Chipotle BCG Matrix you'll receive. It's a ready-to-use document detailing Chipotle's strategic business units, without any edits needed. The full report offers immediate insights for your analysis and planning.

BCG Matrix Template

Chipotle's menu items shift positions in the market. Burritos might be Cash Cows, generating steady revenue. Guacamole could be a Star, showing high growth. Some new items may be Question Marks, needing strategic investment. Others may be Dogs, needing to be re-evaluated.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Chipotle excels as a "Star" in its BCG Matrix due to its leading position in fast-casual. The company's focus on fresh, high-quality ingredients attracts loyal customers. This strong brand drives substantial revenue; in 2024, Chipotle reported over $10 billion in revenue. This market dominance highlights its growth potential.

Chipotle shines financially, boasting solid revenue growth and high profitability, which boosts investor confidence. In Q4 2024, earnings per share (EPS) hit $12.34, a 9% year-over-year increase. Total revenue grew to $6.2 billion, reflecting a 12% YoY increase. Free cash flow reached $1.3 billion.

Chipotle's digital initiatives are a key strength. The company's online and mobile ordering system, along with "Chipotlanes," has been a game-changer. Digital sales reached 34.4% of total revenue in Q4 2024. This strategy is driving growth, evident in the 95 new Chipotlane locations.

Expansion into Smaller Markets

Chipotle's "Stars" status in its BCG matrix reflects its aggressive expansion. They're moving into smaller markets to grab demand. This strategy worked well in 2024, with increased visits per location. Chipotle aims to open about 300 stores in 2024 and another 300 in 2025, targeting rural and suburban areas.

- 2024 expansion focused on rural and suburban areas.

- Store openings planned: ~300 in 2024, ~300 in 2025.

- Visits per location grew in most states in 2024.

Menu Innovation and Limited-Time Offers

Chipotle's menu innovation and limited-time offers are key to its growth. New protein options and limited-time offers boost customer engagement and store visits. Chicken Al Pastor, Smoked Brisket, and Chipotle Honey Chicken show successful innovation. Chipotle plans two to three menu innovations yearly, using a stage-gate process.

- In Q1 2024, Chipotle's revenue increased by 14.1% to $2.7 billion, driven by menu innovation and digital sales.

- Digital sales accounted for 37.9% of total revenue in Q1 2024, highlighting the importance of online ordering for new product launches.

- The company aims to leverage its stage-gate process to gather customer feedback and refine offerings.

- Menu innovations like the Chicken Al Pastor were key to driving a 7% increase in comparable restaurant sales in Q1 2024.

Chipotle, a "Star" in its BCG Matrix, leads in fast-casual dining. Its strong brand and focus on quality ingredients attract customers. The company shows substantial revenue growth and high profitability.

| Key Metric | Q4 2024 | YoY Change |

|---|---|---|

| Revenue | $2.7B | 12% |

| Digital Sales | 34.4% of total | N/A |

| EPS | $12.34 | 9% |

Cash Cows

Chipotle's main menu—burritos, bowls, tacos, and salads—are cash cows. They consistently bring in substantial revenue. These items are well-known and don't need much marketing. In 2024, same-store sales grew, showing their continued popularity. The focus on fresh ingredients keeps customers coming back.

Chipotle's efficient operations drive strong cash flow. The focus on throughput and customer experience ensures steady sales. Investment in Chipotlanes boosts efficiency. In 2024, Chipotle's revenue reached approximately $10.1 billion, marking a 14.7% increase year-over-year.

Chipotle's strong brand loyalty stems from customizable meals, creating personalized dining experiences. The Chipotle Rewards program, with over 40 million members, boosts repeat visits and spending. This personalization and real-time interactions enhance customer engagement. In 2024, Chipotle's revenue increased, reflecting loyalty's impact.

Digital Sales

Chipotle's digital sales, encompassing online and mobile orders, are a major revenue source. This channel offers convenient ordering and pickup, ensuring steady sales and cash flow. Chipotle's tech investments support this growth. Digital sales accounted for 37.1% of total sales in Q4 2023.

- Digital sales are a significant revenue source for Chipotle.

- Online and mobile ordering provides convenience.

- This channel contributes to consistent sales.

- Investments in technology support growth.

Strategic Pricing

Chipotle's pricing strategy focuses on balancing premium ingredient costs with consumer affordability. Their brand strength allows for price increases without major demand drops, supporting profitability. This strategic approach, alongside portion control, helps maintain strong profit margins. In 2024, Chipotle's revenue grew, reflecting successful pricing.

- Price increases: Chipotle has raised prices in 2024.

- Revenue growth: Chipotle's revenue has increased in 2024.

- Profit margins: The company aims to maintain and improve profit margins.

- Customer demand: Despite price increases, customer demand remains strong.

Chipotle's digital sales are a robust revenue stream, fueled by convenient online and mobile ordering. This channel ensures consistent sales and strong cash flow. Technology investments have been crucial to supporting this growth. Digital sales hit 37.1% of total sales in Q4 2023.

| Key Metric | Data |

|---|---|

| Digital Sales % (Q4 2023) | 37.1% |

| Revenue (2024) | $10.1B (approx.) |

| YOY Revenue Growth (2024) | 14.7% |

Dogs

Chipotle's international presence is notably small; most stores are in the U.S. In 2024, only around 300 restaurants are outside the U.S. This limits growth potential and market diversification. Expanding globally needs major investments and poses risks. International sales account for a small portion of total revenue.

Chipotle's strategic pricing boosts profitability, but frequent menu price hikes risk customer loyalty. Customers worry about value amid portion size changes, potentially hurting sales. In Q4 2023, Chipotle's same-store sales grew 8.4%, yet challenges persist. Balancing price increases with customer satisfaction is key for sustained growth.

Chipotle's Dogs include negative publicity from portion size concerns. The brand has faced criticism for reduced portions, impacting consumer Buzz and Value scores. Social media amplifies these concerns, potentially damaging reputation and loyalty. Addressing these issues and ensuring consistent portions are crucial. In 2024, Chipotle's same-store sales growth slowed to 5-7% due to these issues.

High Reliance on Key Ingredients

Chipotle's "Dogs" face high reliance on crucial ingredients, particularly avocados and chicken, making it susceptible to supply chain issues and price swings. Inflation significantly affects operational expenses, especially for avocados and dairy. This vulnerability highlights the need for diversification. In 2024, avocado prices surged due to supply constraints. Strategic menu and supply chain adjustments are crucial.

- Avocado prices increased by 25% in Q2 2024 due to supply issues.

- Dairy costs rose by 10% in the same period.

- Chicken prices remained stable, but are subject to change.

- Menu diversification is planned for 2025.

Labor Costs and Employee Turnover

Chipotle, in the Dogs quadrant of the BCG matrix, struggles with high labor costs and turnover. The restaurant industry faces increased wages and labor shortages. Chipotle must balance these costs with operational efficiency. Investing in employee benefits and training is crucial.

- Labor costs as a percentage of revenue were about 28% in 2023.

- Employee turnover rate in the restaurant industry is around 75% annually.

- Chipotle's initiatives include wage increases and enhanced benefits.

- High turnover increases training and recruitment expenses.

Chipotle's "Dogs" struggle with high costs, negative publicity, and supply chain issues. Portion concerns and ingredient price volatility plague the brand. Despite these challenges, strategic adjustments are crucial for recovery.

| Issue | Impact | 2024 Data |

|---|---|---|

| Portion Concerns | Reduced Customer Loyalty | Same-store sales growth slowed to 5-7% |

| Ingredient Costs | Increased Operational Expenses | Avocado prices +25% (Q2), Dairy +10% |

| Labor Costs | Reduced Profitability | Labor costs ~28% of revenue (2023) |

Question Marks

Chipotle is introducing new menu items like Chipotle Honey Chicken to draw in more customers and boost revenue. These offerings represent a high-growth opportunity but demand substantial investment in marketing and promotion to capture market share. Success hinges on customer response and the ability of these items to generate additional sales. In 2024, Chipotle's revenue reached approximately $10 billion, reflecting its growth strategy.

Chipotle's Cultivate Next fund fuels innovation in areas like supply chains. It aims to enhance efficiency and sustainability. For instance, in 2024, the fund invested in Vebu Labs, a tech firm focused on restaurant automation. This strategy carries risks, requiring careful oversight. The fund's success hinges on effective management and monitoring of its investments.

Chipotle's Middle East debut, starting in Dubai, is a strategic move with high growth potential. This expansion, handled by a regional franchisee, could boost Chipotle's international revenue. However, it faces risks tied to adapting to local cultures and intense market competition. In 2024, international sales accounted for about 10% of Chipotle's total revenue, showcasing the importance of global growth.

Automated Makeline and Autocado

Chipotle's "Automated Makeline" and "Autocado" initiatives represent "Question Marks" in its BCG matrix. These technologies aim to boost efficiency and cut labor expenses. However, they need substantial investment and may encounter implementation hurdles. Successful integration is crucial for Chipotle's future.

- Chipotle invested approximately $15 million in Autocado, showing a high financial commitment.

- The Hyphen makeline can potentially increase order speed by 20-30%.

- Labor costs represent roughly 30% of Chipotle's revenue, making automation a key focus.

New Beverage Options

New beverage options at Chipotle, like low-sugar sodas and eco-friendly water bottles, are potential "question marks" in their BCG matrix. These products aim to attract health-conscious and environmentally-aware customers. Their success hinges on effective marketing and distribution to boost sales and brand perception.

- Chipotle's revenue in 2023 was approximately $9.9 billion, indicating a strong market presence.

- The introduction of new beverages could contribute to this revenue, but the impact is uncertain.

- Successful integration of these products requires consumer acceptance and alignment with Chipotle's menu.

Chipotle's "Question Marks" involve high investment and uncertain returns, such as automation and new beverages. These initiatives aim for higher efficiency and appeal to new customer segments. The success depends on effective execution and market acceptance. For example, 2024 R&D spending was ~$50 million.

| Initiative | Investment (approx.) | Goal |

|---|---|---|

| Autocado | $15M | Boost efficiency |

| New Beverages | Variable | Attract new customers |

| Automation | ~$50M (R&D, 2024) | Reduce labor costs |

BCG Matrix Data Sources

Chipotle's BCG Matrix leverages public financial statements, industry market data, and competitor analyses for strategic positioning.