Choice Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choice Hotels Bundle

What is included in the product

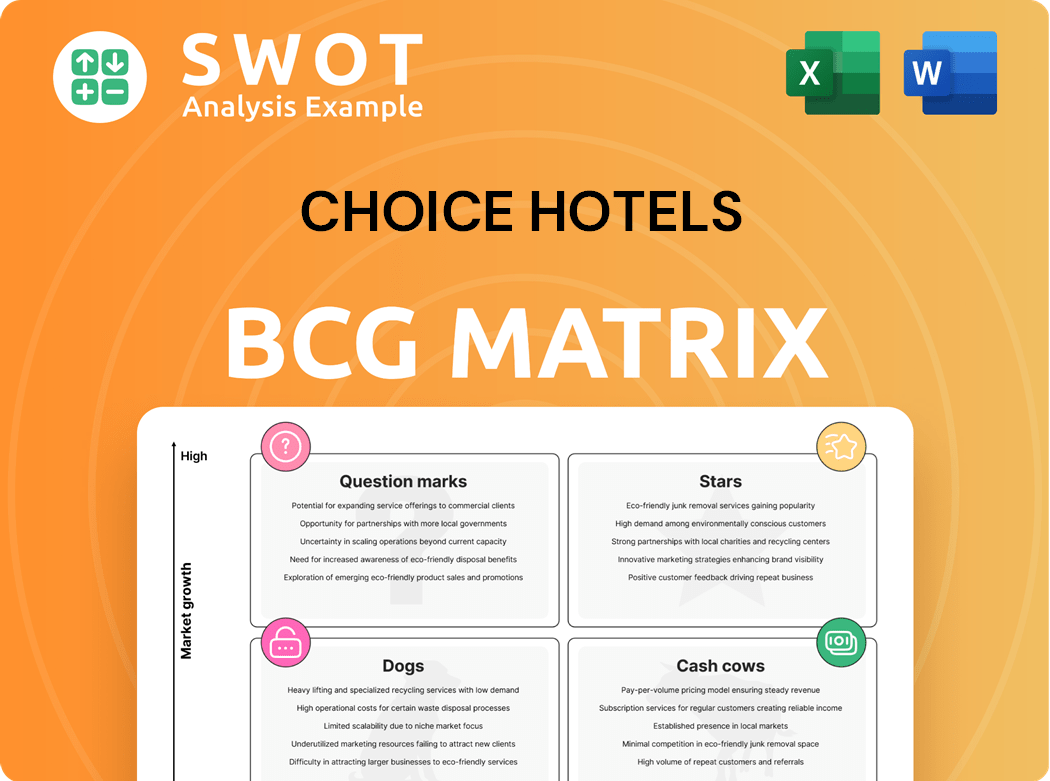

Choice Hotels' BCG Matrix showcases investments, holds, & divests based on market growth & share, guiding resource allocation.

Clean, distraction-free view optimized for C-level presentation, making the BCG matrix a powerful tool.

Preview = Final Product

Choice Hotels BCG Matrix

What you see here is the complete Choice Hotels BCG Matrix, identical to the file you'll receive upon purchase. This ready-to-use strategic tool provides clear insights, formatted for your immediate analysis and planning. No hidden extras – download and apply it right away.

BCG Matrix Template

Choice Hotels’ diverse portfolio, from budget-friendly to upscale, presents a fascinating landscape for analysis. Its brands compete in varied market segments, each with unique growth rates and market shares. Understanding where each brand sits in the BCG Matrix is crucial for strategic planning. This framework helps assess resource allocation and investment priorities across their offerings. A peek at their Stars, Cash Cows, Dogs, and Question Marks will reveal much. Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Choice Hotels' upscale brands, including Radisson, Cambria, and Ascend Hotel Collection, are thriving. These brands are seeing solid RevPAR growth and are well-placed for rising travel demand. In 2024, the global upscale net rooms portfolio grew by 43.9% year-over-year. This expansion shows Choice Hotels' focus on the upscale market.

Choice Hotels views its extended stay segment as a strong performer, particularly with brands like WoodSpring Suites and Everhome Suites. This segment offers cycle-resilient performance and higher growth rates compared to the broader industry. In 2024, Choice added over 4,500 extended stay rooms to its portfolio. With nearly 43,000 rooms in the pipeline, Choice is strategically positioned for future expansion in this area.

Choice Hotels' strategic partnership with Westgate Resorts boosted its upscale presence and the Choice Privileges program. This collaboration introduced 21 properties and 14,471 rooms to Choice's domestic portfolio. The deal offers Choice Privileges members access to over 180,000 upscale rooms globally. In 2024, Choice Hotels saw a 7.3% increase in revenue per available room (RevPAR).

Franchise Conversion Capability

Choice Hotels excels in converting existing hotels, rapidly expanding its portfolio. This capability is a key driver of growth, providing value to owners through efficient branding transitions. In 2024, Choice opened 164 conversion hotels domestically. The company's opening speed has accelerated by nearly 25% over the last two years, showcasing its efficiency.

- Best-in-class hotel conversion capability.

- 22% increase in conversion hotel openings in 2024 compared to 2023.

- Nearly 25% faster opening speed over two years.

- Core competency for portfolio expansion.

Choice Privileges Program

Choice Privileges, a "Star" within Choice Hotels' BCG matrix, is thriving. The program's membership grew to 69 million in 2024, showcasing strong expansion. Enhanced features and partnerships boost engagement and occupancy rates. This growth is fueled by expanded redemption choices, like music and sports events.

- 69 million members in 2024

- 8% year-over-year growth

- Extended booking window

- Partnerships for redemption

Choice Privileges, a "Star" in the BCG Matrix, shows strong growth. Membership hit 69 million in 2024, an 8% increase year-over-year. New partnerships and expanded redemption options enhance its appeal and drive occupancy.

| Metric | 2023 | 2024 |

|---|---|---|

| Members | 64M | 69M |

| YoY Growth | N/A | 8% |

| RevPAR Growth | 6.3% | 7.3% |

Cash Cows

Comfort Brand, a cash cow for Choice Hotels, remains a key revenue driver. In 2024, it added 26 properties, solidifying its upper midscale segment presence. Choice emphasizes core brand growth, including Comfort. This strategy aims to sustain financial stability. The brand's performance is critical for overall portfolio success.

Quality Inn, an 85-year-old brand under Choice Hotels, is a classic Cash Cow. In 2024, it added 41 new properties. This brand consistently generates solid revenue in the midscale market. Quality Inn's established presence ensures a steady income stream for Choice Hotels.

Choice Hotels' franchise model is a cash cow, generating reliable revenue from franchise fees. This model ensures a steady income stream, allowing for strategic financial planning. Choice Hotels supports franchisees with resources and tools, fostering their success. In 2024, franchisee satisfaction was 85%, highlighting strong partnerships.

Domestic Market Strength

Choice Hotels demonstrates robust domestic market strength, underscored by its extensive network of properties and rooms. This strong domestic presence is a key driver for the company, contributing significantly to its financial performance. In 2024, Choice Hotels achieved an adjusted EBITDA of $604.1 million, reflecting a 12% increase compared to the previous year, mainly due to the focus on revenue-generating domestic rooms. The company's ability to outperform the industry average, with a 4.5% growth in domestic RevPAR, highlights its competitive advantage.

- Significant number of properties and rooms in the domestic market.

- Adjusted EBITDA of $604.1 million in 2024.

- 12% year-over-year increase in adjusted EBITDA.

- 4.5% growth in domestic RevPAR in 2024.

Midscale Segment

Choice Hotels excels in the midscale segment, a key area for its success. This segment provides a reliable source of revenue, showcasing the company's market leadership. In 2024, Choice opened 41 new Quality Inn hotels, demonstrating its focus. Strong development in the upper midscale portfolio further boosts their performance.

- Midscale hotels often offer a balance of quality and affordability, attracting a broad customer base.

- Choice Hotels' established brand recognition and operational efficiency contribute to steady returns.

- The midscale segment's consistent performance makes it a cash cow for Choice Hotels.

- In 2023, Choice Hotels reported a revenue of $1.4 billion.

Choice Hotels strategically leverages cash cows like Comfort and Quality Inn for steady income. The franchise model also functions as a cash cow. In 2024, Choice Hotels' focus on domestic rooms led to a 12% increase in adjusted EBITDA.

| Cash Cow | Description | 2024 Performance |

|---|---|---|

| Comfort Brand | Key revenue driver in the upper midscale segment. | Added 26 properties |

| Quality Inn | Classic brand in the midscale market. | Added 41 properties |

| Franchise Model | Generates reliable revenue from franchise fees. | Franchisee satisfaction at 85% |

Dogs

Econo Lodge, a budget brand within Choice Hotels, operates in a competitive segment. It might struggle to meet modern traveler demands, potentially needing investment for image updates. Choice Hotels is shifting focus, with 2024 seeing a move toward city hotels and extended-stay options, signaling a strategic pivot. In 2023, Choice Hotels reported a revenue of $1.4 billion, with a focus on brand diversification.

Rodeway Inn, like Econo Lodge, faces challenges in the low-growth economy segment. Its position might be a cash trap, consuming resources without substantial returns. Choice Hotels is shifting focus, moving away from roadside chains such as Rodeway Inn. In 2024, the hotel chain's strategy emphasizes urban hotels and extended-stay options.

Outdated properties, a "Dog" in Choice Hotels' BCG Matrix, suffer from lack of renovations. These hotels struggle to attract guests. In 2024, properties needing updates faced revenue declines. Consistent upgrades are vital. Choice Hotels invested $300 million in property enhancements in 2024.

Underperforming Locations

Specific Choice Hotels locations consistently underperform, regardless of brand, fitting the "Dogs" category in the BCG Matrix. Factors such as weak local demand or poor management contribute to this. These hotels need strategic intervention to boost profitability. For example, in 2024, some locations saw occupancy rates below 50%.

- Poor occupancy rates and low revenue per available room (RevPAR) are key indicators.

- Locations in areas with economic downturns or increased competition struggle.

- Inefficient operations and high operating costs further hurt profitability.

- These hotels might require brand repositioning or potential sale.

Brands with Limited Differentiation

Brands with limited differentiation in Choice Hotels' portfolio often struggle to compete effectively. These brands lack a unique value proposition, making it hard to attract customers amidst strong competition. Successful hotels differentiate themselves through unique amenities or design; otherwise, they risk becoming less relevant. In 2024, Choice Hotels' revenue was around $1.4 billion.

- Value propositions are key for customer attraction.

- Differentiation through unique features is essential.

- Lack of distinct identity can hinder growth.

- Competitive markets require standout offerings.

Dogs in Choice Hotels' BCG Matrix include outdated properties, with low occupancy, and locations struggling in competitive markets. These hotels underperform due to poor demand or inefficient operations. Strategic interventions or potential sales are considered for these underperforming assets. In 2024, Choice Hotels aimed to improve profitability.

| Criteria | Details |

|---|---|

| Occupancy Rates (2024) | Below 50% in some locations |

| RevPAR (2024) | Low in underperforming hotels |

| 2024 Revenue | $1.4 billion |

Question Marks

Park Inn by Radisson, relaunched as an innovative conversion brand, finds itself in the Question Mark quadrant of the BCG matrix. Despite its repositioning, it currently holds a lower market share. The brand's strategy to capture a bigger market share is still evolving. In 2024, Choice Hotels reported a strategic focus on brand growth.

Everhome Suites, a fresh extended-stay brand under Choice Hotels, is currently positioned as a Question Mark in the BCG Matrix. Despite its potential for high growth, its market share remains low, requiring strategic investments. In Q2 2024, Everhome Suites saw expansion with new developments and openings, indicating growth efforts. The brand's future hinges on successful market penetration and increased visibility to move towards a Star position.

Radisson Individuals, a Choice Hotels soft brand, aims to capture the upper upscale market. Being relatively new, it needs investments to grow and gain market share. Its success hinges on attracting independent hotels and building brand awareness. Choice is relaunching it alongside refreshed designs for Radisson Blu and Radisson. In 2024, Choice Hotels reported a 4.9% increase in total revenues.

International Expansion

Choice Hotels' international expansion strategy, particularly in Europe and Latin America, positions it as a "Question Mark" in the BCG matrix. These markets offer high-growth potential but also carry considerable risk and require substantial investment. The company's approach involves adapting to local market conditions and establishing brand recognition. Choice Hotels' master franchise agreement with Strawberry and distribution partnership with Sercotel highlight this strategy.

- Master Franchise: Choice Hotels extended its agreement with Strawberry, indicating a commitment to European expansion.

- Distribution Partnership: The agreement with Sercotel aims to enhance distribution and market presence in key regions.

- Strategic Alliances: Partnerships like the one with Zenitude Hotel-Residences contribute to expansion efforts.

- Investment: Significant capital is allocated to establish a foothold and support growth in these markets.

New Technology Initiatives

New technology initiatives at Choice Hotels are positioned as Question Marks in the BCG matrix. These involve investments in digital platforms and AI-driven revenue management, aiming for growth. Despite the potential, returns are not immediate, requiring continuous financial commitment. In 2024, Choice Hotels fully migrated to AWS, becoming the first major hotel company to do so.

- Focus on new technology and digital platforms.

- AI-powered revenue management solutions.

- Requires ongoing investment for future returns.

- Choice Hotels migrated entirely to AWS in 2024.

Question Marks require strategic investment for high growth potential. Brands like Park Inn and Everhome Suites aim to capture market share. Choice Hotels focuses on strategic growth initiatives, with total revenues up 4.9% in 2024.

| Brand | Market Position | Strategy |

|---|---|---|

| Park Inn | Question Mark | Conversion brand; growth-focused |

| Everhome Suites | Question Mark | Extended-stay; expansion |

| Radisson Individuals | Question Mark | Upper upscale; brand awareness |

BCG Matrix Data Sources

The Choice Hotels BCG Matrix utilizes financial statements, market analysis, industry publications, and competitor benchmarks.