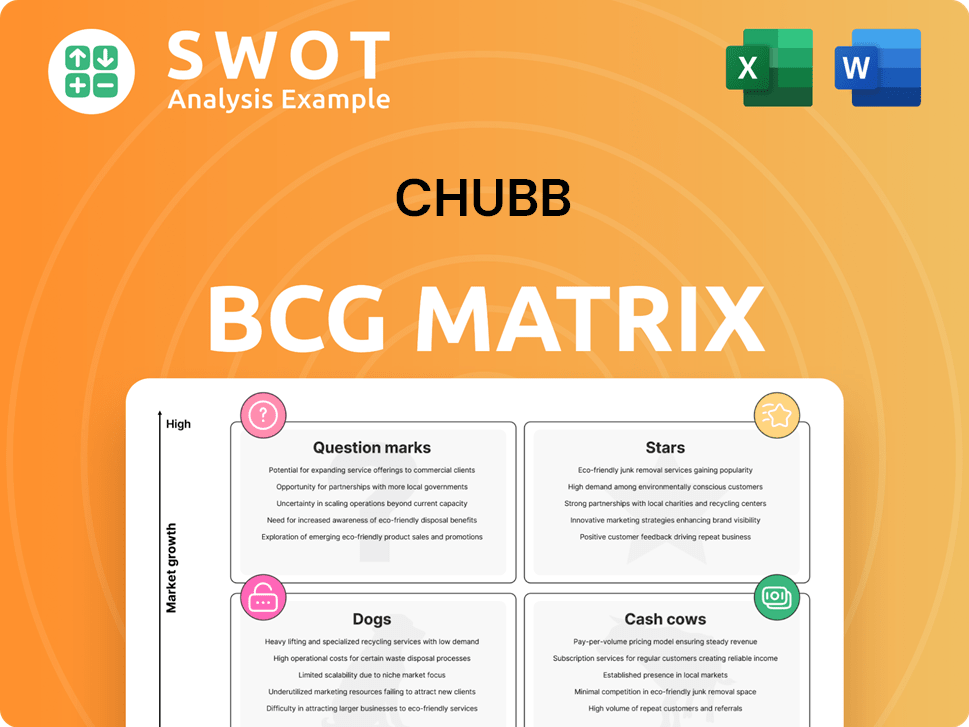

Chubb Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chubb Bundle

What is included in the product

Chubb's BCG Matrix analysis reveals strategic direction for its business units, highlighting investment, holding, or divestment opportunities.

Export-ready design for quick drag-and-drop into PowerPoint, providing a seamless presentation workflow.

Preview = Final Product

Chubb BCG Matrix

This preview showcases the full Chubb BCG Matrix you'll receive post-purchase. The downloadable document is complete—no hidden content or editing limitations—ready for immediate strategic application.

BCG Matrix Template

The Chubb BCG Matrix helps visualize its diverse business segments. See how their offerings fare across market share and growth. Are they Stars, generating high revenue, or Dogs, requiring careful evaluation? This snapshot reveals strategic opportunities and potential challenges. For a complete understanding of Chubb's positioning and actionable insights, secure the full BCG Matrix report now!

Stars

Chubb's High-Net-Worth Personal Lines, part of its Personal Risk Services (PRS), holds a commanding position. It boasts a substantial 60% market share in North America. This segment saw an impressive 11% premium growth in 2024, underscoring its robust performance. Continuous investment is crucial to sustain this leadership.

Chubb's global commercial P&C insurance shines. It benefits from strong underwriting and growth. This segment excels in risk management. In 2024, Chubb's net premiums written rose, reflecting its market leadership.

Chubb's cyber insurance solutions are a star in its BCG matrix, fueled by the rise in cyberattacks. In 2024, cyber insurance premiums reached approximately $7.2 billion in the U.S. market, reflecting significant growth. Chubb's focus includes its Premier Life Science package, indicating strategic investment to expand market reach. This segment is vital for addressing the unique needs of businesses facing evolving cyber threats.

Asia-Pacific P&C Insurance

Chubb's Asia-Pacific P&C insurance arm is a Star in its BCG Matrix. It saw a remarkable 22.2% increase in FY2024. This highlights strong growth and investment potential. The company is expanding its regional footprint.

- FY2024 revenue surge: 22.2%

- Strategic focus: Regional expansion

- Market: Growing insurance demand

- Investment: Further capital needed

Embedded Insurance Partnerships

Chubb's focus on embedded insurance, like its deal with Smartpay in Japan, is a strategic move into a high-growth area. The embedded insurance market is expected to grow substantially. The global market is forecasted to achieve a compound annual growth rate (CAGR) of 11.6% from 2024 to 2030. By 2030, this market could hit $175.25 billion.

- Chubb is strategically investing in technology.

- Partnerships are key to expanding market share.

- Embedded insurance is a rapidly expanding sector.

- The market is projected to reach $175.25 billion by 2030.

Chubb's Stars, including cyber and Asia-Pacific P&C, drive growth. These segments require ongoing investments to maintain their leadership. High growth is fueled by market expansion and strategic partnerships. Strong premium growth and market share gains indicate strong future potential.

| Segment | Growth Rate (FY2024) | Key Strategy |

|---|---|---|

| Cyber Insurance | Significant premium growth | Premier Life Science package; Market reach |

| Asia-Pacific P&C | 22.2% | Regional Expansion |

| Embedded Insurance | CAGR 11.6% (2024-2030) | Strategic partnerships |

Cash Cows

Chubb's North America commercial lines are a cash cow, being the largest commercial lines insurer in the U.S. This segment is a mature market, consistently profitable. In 2024, Chubb's North America commercial lines generated substantial cash flow, requiring limited reinvestment. This supports a strong market position.

Chubb's global reinsurance business acts as a cash cow, generating consistent profits and diversifying risk. Its strong underwriting capabilities ensure stable cash flow. In 2024, Chubb's reinsurance segment showed solid performance, with a combined ratio of around 90%. This indicates profitability and efficient risk management. The segment's premiums reached $4.5 billion, highlighting its significant contribution.

Chubb's personal accident and supplemental health insurance is a "Cash Cow" in its BCG Matrix. This segment provides a steady stream of profits with minimal reinvestment needs. For instance, in 2024, Chubb reported a combined ratio consistently below 90% in these lines. The consistent profitability and cash generation make it a stable contributor to Chubb's overall financial health.

Europe P&C Insurance

Chubb's Europe P&C insurance is a cash cow, showing consistent growth and profit. This segment benefits from Chubb's solid market presence and solid client and partner relationships, ensuring stability. For instance, in 2024, Chubb reported a combined ratio of approximately 90% in its European operations, indicating strong underwriting profitability. The company's strategic focus on specialized insurance products further strengthens its market position.

- Steady revenue growth in the European P&C sector.

- High underwriting profitability, as shown by the combined ratio.

- Strong client and partner relationships.

- Focus on specialized insurance products.

International Life Insurance

Chubb's international life insurance, especially in Asia, is a cash cow, consistently providing earnings. This segment, emphasizing regular-paid and protection-focused policies, offers stable cash flow, vital for the company. Strategic management is key to maintaining its growth, contributing significantly to Chubb's overall financial health. For example, in 2024, the Asian life insurance market showed a 7% increase.

- Focus on stable, regular-paid policies.

- Generates consistent, reliable cash flow.

- Requires strategic management for growth.

- Asian life insurance market experienced growth.

Chubb's "Cash Cows" deliver consistent profits with minimal reinvestment. These segments generate strong cash flows, ensuring financial stability. Key examples include North America commercial lines and reinsurance, crucial for Chubb's financial health.

| Segment | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| North America Comm. Lines | $20B+ | Mature, Profitable Market |

| Global Reinsurance | $4.5B | Consistent Profits, Diversification |

| Personal Accident/Health | $3B+ | Steady Profits, Low Reinvestment |

Dogs

Chubb's exit from Australian home insurance in 2024 signifies a "dog" in their BCG matrix. This decision reflects low market share and growth, exacerbated by natural disasters. Chubb's home insurance operations in Australia experienced significant losses. The segment's drain on resources with limited recovery potential solidified the decision.

In some areas, Chubb's financial lines are facing challenges. Net premiums written have declined, indicating a possible "dog" classification. For instance, in Q1 2024, Overseas General saw a 1.6% decrease in financial lines. These lines might need strategic review, potentially including divestiture.

Chubb's North American Agriculture Insurance is excluded from core operating income. This segment differs due to its public-private partnership structure. Insurance rates, premiums, and risk are not fully market-driven. In 2024, the agriculture sector saw a slight premium growth, around 2%, according to industry reports.

Products Facing High Catastrophe Losses

Products and regions significantly hit by catastrophes, like those affected by the California wildfires in Q1 2024, are categorized as 'dogs'. These segments face high claim costs and potential future losses, diminishing profitability. For instance, in 2024, insured losses from natural disasters totaled $60 billion. Strategic reassessment is crucial for these areas.

- California wildfires caused over $10 billion in insured losses in 2024.

- Catastrophe losses impacted Chubb's profitability in specific regions.

- Strategic reassessment includes pricing adjustments and risk mitigation.

- The goal is to improve the financial performance of affected products.

Underperforming Digital Small Business Initiatives

Underperforming digital small business initiatives within Chubb's portfolio, failing to meet growth targets, are classified as 'dogs'. These initiatives may need restructuring or even divestiture. This strategic move aims to improve resource allocation efficiency. In 2024, Chubb reported a 15% decrease in ROI for certain digital platforms.

- Resource reallocation can redirect funds.

- Divestiture might be considered for underperforming assets.

- Focus shifts to higher-performing segments.

- Chubb's digital strategy is always under review.

Chubb labels segments with low market share and growth as "dogs." This includes areas like Australian home insurance, which was exited in 2024 due to significant losses. Financial lines with declining premiums, such as a 1.6% drop in Overseas General in Q1 2024, also fall under this category. These require strategic reviews.

| Segment | Action | Reason |

|---|---|---|

| Australian Home Insurance | Exit | Low growth, high losses |

| Financial Lines (Certain areas) | Strategic Review | Declining premiums |

| Digital SB Initiatives (Underperforming) | Restructure/Divest | Failed growth targets |

Question Marks

Chubb's Premier Life Science package is a question mark. It needs investment to grow in a changing market.

The life science sector faces evolving risks and digital shifts.

In 2024, the global life science market was valued at over $3 trillion.

Chubb must adapt to these challenges to gain market share.

Success hinges on strategic navigation and innovation.

Chubb's foray into new markets with embedded insurance, such as its partnership with Smartpay in Japan, presents a question mark. These ventures hinge on consumer adoption and seamless integration. The Japanese insurance market was valued at $470 billion in 2024. Success is uncertain.

Chubb's North America Middle Market, merging Lower Middle Market and Digital Small Business, is a question mark. Its success hinges on market adoption and integrating insurance solutions. In 2023, the global insurance market was valued at $6.5 trillion. Effective integration is crucial for capturing a share of this market.

Chubb Masterpiece Signature (Switzerland)

Chubb Masterpiece Signature in Switzerland is a question mark in its BCG Matrix. This new insurance product caters to high-net-worth individuals, representing a niche market. It requires significant investment to gain traction and build a client base. As of 2024, Chubb's global net premiums written reached $25.3 billion.

- Market entry demands substantial capital for marketing and operations.

- Success hinges on attracting and retaining affluent Swiss clients.

- Chubb's global presence supports potential expansion and brand recognition.

- The product's profitability will depend on effective risk management and pricing.

New Digital Distribution Channels

Chubb's foray into digital distribution channels lands squarely in the question mark quadrant of the BCG matrix. These channels, aiming to reach a broader customer base, are still developing. Their success hinges on providing effortless customer experiences and streamlined underwriting, which is crucial for driving growth.

As of 2024, the impact of these digital initiatives is still evolving, requiring careful monitoring. Digital channels can potentially boost Chubb's market share. However, achieving profitability through these channels needs efficient operations.

- Chubb's recent digital investments are a key focus.

- Seamless customer experience is essential.

- Efficient underwriting processes are critical.

- Profitability through these channels needs efficient operations.

The question marks in Chubb's BCG Matrix need strategic investment. These ventures face market uncertainties and require focused resource allocation. Success depends on effective market penetration, customer adoption, and efficient operations.

| Aspect | Details | Data (2024) |

|---|---|---|

| Premier Life Science | Evolving risks and market changes. | Global market over $3T. |

| Embedded Insurance (Japan) | Consumer adoption and integration. | Japan insurance market $470B. |

| North America Middle Market | Market adoption and integration. | Global insurance market $6.5T. |

| Masterpiece Signature (Switzerland) | Niche market and client base. | Chubb's global net premiums $25.3B. |

| Digital Distribution | Customer experience and underwriting. | Digital impact evolving. |

BCG Matrix Data Sources

Our Chubb BCG Matrix uses robust data from company financials, insurance market analysis, and industry expert insights.