Cielo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cielo Bundle

What is included in the product

Tailored exclusively for Cielo, analyzing its position within its competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview the Actual Deliverable

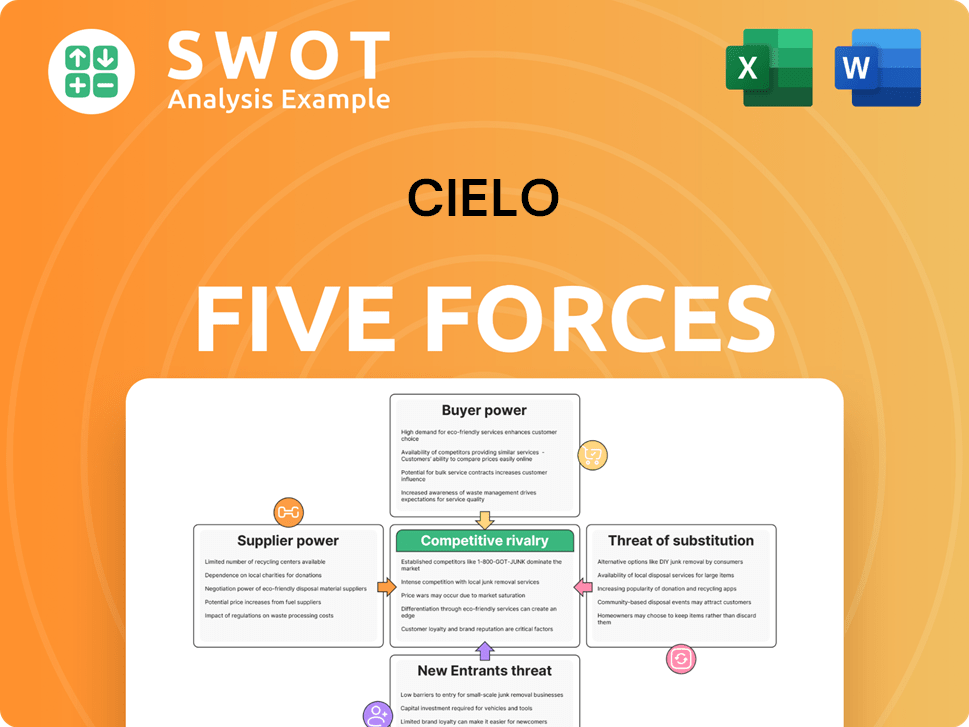

Cielo Porter's Five Forces Analysis

This preview presents the complete Cielo Porter's Five Forces analysis you'll receive upon purchase. It's the same professionally crafted document, fully accessible immediately. No alterations or edits are needed—it's ready for your review and application. The format and content are identical to the final download. You get precisely what you see here.

Porter's Five Forces Analysis Template

Cielo faces diverse industry forces. Its bargaining power of suppliers impacts costs. Buyer power can influence pricing strategies. New entrants pose a threat, increasing competition. Substitute products may erode market share. Competitive rivalry within the industry is intense.

Ready to move beyond the basics? Get a full strategic breakdown of Cielo’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Cielo's bargaining power with suppliers, like POS hardware makers, hinges on market concentration. If few suppliers exist, they gain leverage; switching costs matter too. Specialized tech needs can boost supplier power. In 2024, the POS market saw significant consolidation, potentially shifting the balance.

Cielo's switching costs significantly influence supplier bargaining power. If changing suppliers is costly, existing suppliers gain leverage. These costs involve integration, compatibility, and contracts. For instance, in 2024, switching payment processors often incurs setup fees and data migration expenses. The higher these costs, the more power suppliers like Cielo's current partners have.

Cielo's dependence on key tech suppliers, like those providing encryption, grants these suppliers considerable bargaining power. Disruptions or price hikes from such suppliers could severely affect Cielo's operations. For instance, in 2024, cybersecurity costs increased by 15% for financial institutions. Strong supplier relationships and diversified tech sources are crucial for Cielo.

Data Security Compliance

Suppliers of data security and compliance services, like those ensuring PCI DSS adherence, exert significant power over Cielo. Since Cielo must meet strict security standards, these suppliers are critical, giving them negotiating leverage. Non-compliance could result in hefty penalties and reputational harm, increasing Cielo's reliance on these specialized suppliers. The global cybersecurity market was valued at $202.8 billion in 2023 and is projected to reach $345.7 billion by 2030, according to Fortune Business Insights.

- PCI DSS compliance is mandatory for any entity processing, storing, or transmitting cardholder data.

- The average cost of a data breach in 2023 was $4.45 million, according to IBM.

- Cybersecurity spending is expected to increase as businesses face more sophisticated threats.

- Specialized suppliers can offer tailored solutions, but at a premium.

Supplier Forward Integration

Supplier forward integration significantly impacts Cielo's bargaining power. If suppliers, such as hardware providers, move into payment processing, they compete directly with Cielo. This poses a threat, compelling Cielo to offer competitive pricing and maintain high service quality. For example, in 2024, hardware vendors increased their payment solutions, directly challenging payment processors. This shift forces Cielo to adapt to retain its market share.

- Competitive Pricing: Suppliers entering the market force Cielo to adjust pricing strategies.

- Service Quality: Maintaining high service standards becomes crucial to retain customers.

- Market Adaptation: Cielo must innovate and adapt to stay competitive.

- Supplier Control: Increased supplier power can limit Cielo's control over the value chain.

Cielo's supplier power is influenced by market concentration; fewer suppliers mean more leverage. High switching costs, like setup fees for processors, boost supplier power. Dependence on key tech suppliers, especially for cybersecurity, also increases their influence. Specialized suppliers, offering PCI DSS compliance, hold significant bargaining power over Cielo.

| Factor | Impact on Cielo | 2024 Data |

|---|---|---|

| Market Concentration | Fewer suppliers = higher power | POS hardware market consolidation |

| Switching Costs | High costs = supplier leverage | Setup fees and data migration costs |

| Tech Dependence | Critical for encryption/security | Cybersecurity costs increased by 15% |

| Compliance Suppliers | PCI DSS needs, more power | Cybersecurity market: $202.8B (2023) |

Customers Bargaining Power

Merchants closely watch payment processing fees, always aiming for the best rates. This vigilance gives them strong bargaining power, especially big merchants handling lots of transactions. In 2024, average merchant service fees hovered around 2-3% per transaction. Cielo needs to balance profits and competitive pricing to keep these major clients happy.

The rise of alternative payment solutions like digital wallets and mobile platforms boosts customer bargaining power. Merchants can readily shift to competitors providing superior terms or innovative features. In 2024, the global digital payments market is projected to reach $10.8 trillion. This makes it easier for merchants to negotiate.

Cielo's bargaining power of customers is influenced by merchant concentration. If a few major merchants generate most revenue, they wield significant power. For instance, in 2024, a loss of a key client could severely impact Cielo's earnings. Diversifying the merchant base is key to mitigating this risk. Data shows that customer concentration directly affects profit margins.

Demand for Integrated Solutions

Merchants are increasingly demanding integrated payment solutions that easily fit into their current systems, like point-of-sale or accounting software. Cielo needs to provide adaptable and customizable solutions to meet these needs. Failing to do so could lead merchants to competitors with better integration. In 2024, the market for integrated payments grew by 15%, showing this demand.

- The market for integrated payments grew by 15% in 2024.

- Merchants seek solutions that work with existing systems.

- Cielo must offer flexible and customizable options.

- Competitors offer more comprehensive integration.

Transparency and Contract Terms

Merchants are becoming more savvy about hidden fees and contract details. Clear pricing and simple contracts can boost customer loyalty, lowering their bargaining power. Cielo must build trust through honest practices and open communication. The payment processing industry saw a 15% increase in contract disputes in 2024.

- Increased transparency in pricing models.

- Simplified contract terms.

- Ethical business practices.

- Proactive customer communication.

Merchants leverage their transaction volume and market alternatives to negotiate favorable terms. The average merchant service fees in 2024 remained at 2-3% per transaction, making price a key factor. Customer concentration and integration needs further shift the balance of power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Pricing Pressure | High, due to alternatives | Digital payments market: $10.8T |

| Merchant Base | Concentration weakens Cielo | Integrated payments market: 15% growth |

| Contract Terms | Transparency builds trust | Contract disputes: +15% |

Rivalry Among Competitors

The Brazilian payment solutions market is fiercely competitive. Cielo faces pressure to offer competitive prices and services due to many rivals. Innovation is crucial for Cielo to survive. In 2024, the market included StoneCo and PagSeguro, among others. The competition impacts Cielo's profitability.

In Brazil's payment processing market, Cielo faces tough competition, especially from Rede and Stone. These major players, backed by significant resources, create strong rivalry. Established customer relationships make it hard for Cielo to expand its market presence. Strategic moves like partnerships and acquisitions are vital for Cielo's competitive edge. In 2024, Stone reported a revenue of BRL 10.7 billion, reflecting the intensity of competition.

Fintech firms are reshaping payment processing with innovation and lower fees. These nimble rivals quickly gain market share by serving niche markets. In 2024, fintech transaction values surged, with global fintech funding at $113.7 billion. Cielo needs to adapt by investing in new tech and business models to stay competitive.

Price Wars and Margin Erosion

Cielo Porter, operating within a competitive landscape, could face price wars. These battles can squeeze profit margins, affecting Cielo's financial health. To counter this, differentiating through value-added services is essential. Consider data analytics or loyalty programs to stand out. Customer retention becomes crucial in such environments.

- Price wars can reduce profit margins by as much as 10-15% in highly competitive markets.

- Loyalty programs can increase customer lifetime value by up to 25%.

- Companies investing in data analytics see a 10-20% improvement in operational efficiency.

- Customer retention can significantly boost revenue; a 5% increase in retention can increase profits by 25-95%.

Consolidation Trends

The payment processing sector is seeing consolidation, with mergers and acquisitions changing the game. Cielo needs to be ready to join in or react to these changes. Strategic alliances could open doors to new markets and tech. In 2024, the M&A activity in fintech reached $140.2 billion globally.

- M&A Activity: Fintech M&A reached $140.2B globally in 2024.

- Strategic Alliances: Key for market and tech access.

- Competitive Landscape: Reshaped by consolidation.

The Brazilian payment solutions market is defined by intense competition, with Cielo facing rivals like StoneCo and PagSeguro. Competitive rivalry demands competitive pricing, service excellence, and continuous innovation. The market saw significant M&A activity in 2024, reflecting the need for strategic moves to maintain a competitive edge.

| Metric | 2024 Data | Impact |

|---|---|---|

| StoneCo Revenue | BRL 10.7 billion | Shows market competition. |

| Fintech M&A | $140.2 billion (Globally) | Highlights industry consolidation. |

| Global Fintech Funding | $113.7 billion | Indicates sector growth. |

SSubstitutes Threaten

Digital wallets, such as PicPay and Mercado Pago, are becoming increasingly popular in Brazil, presenting a challenge to Cielo. These platforms offer consumers alternative payment options, potentially bypassing traditional card transactions. This shift could directly impact Cielo's revenue streams, as digital wallets gain traction. To counter this, Cielo needs to integrate with these evolving payment methods or create its own competitive digital wallet solutions; in 2024, the digital payments market in Brazil is estimated to reach $150 billion.

Mobile payment solutions, like contactless payments and QR codes, are growing fast. They offer convenience and security, drawing in users and businesses. Cielo needs to adopt these technologies to stay ahead. The Brazil mobile payment market is predicted to hit USD 224.32 billion by 2033, with a 16.30% CAGR from 2025-2033 [2].

Cryptocurrencies present a growing alternative to traditional payment systems. While adoption in Brazil is currently limited, this could change. As regulations solidify and trust increases, crypto could challenge Cielo's dominance. In 2024, Bitcoin's market cap hit highs, showing potential. Cielo must watch this and consider crypto opportunities.

Increased Use of Pix

The rise of Pix, Brazil's instant payment system, presents a significant threat to Cielo. Pix allows for real-time transfers, directly competing with Cielo's card transaction services. This shift could lead to reduced transaction volumes for Cielo if not addressed strategically. To counteract this, Cielo must integrate with Pix to stay relevant. Pix's impact is evident, representing a substantial portion of payments in Brazil.

- Pix's share of all payments in Brazil reached 45% in 2024.

- Pix accounted for a third of all e-commerce purchases in 2024.

- Cielo's challenge is to adapt and integrate with Pix.

- Cielo may need to offer complementary services to remain competitive.

Barter and Credit Systems

Informal barter and store credit can act as substitutes, though their impact varies. These methods are more common in specific sectors or communities, offering alternatives to standard payments. To mitigate this, Cielo should prioritize unique value propositions. This strategy helps Cielo stand out against these alternative payment systems.

- Barter systems might be more active in niche markets.

- Store credit usage can fluctuate based on economic conditions.

- Cielo's value-added services could include enhanced security features.

- Focusing on customer service is key.

Digital wallets, like PicPay and Mercado Pago, threaten Cielo, with the Brazilian market estimated at $150B in 2024.

Mobile payments, including contactless and QR codes, challenge Cielo, with a projected USD 224.32B market by 2033.

Pix, Brazil's instant payment system, poses a major threat; it held 45% of payments in 2024.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Digital Wallets | Bypass traditional cards | $150B market |

| Mobile Payments | Convenience & security | 16.30% CAGR (2025-2033) |

| Pix | Real-time transfers | 45% of all payments |

Entrants Threaten

Stringent Brazilian financial sector regulations pose a challenge for new entrants. Licensing, compliance, and security standards create entry barriers, favoring established firms like Cielo. Regulatory compliance requires constant monitoring. In 2024, the Brazilian Central Bank imposed stricter cybersecurity rules, increasing operational costs for new players.

Establishing payment processing infrastructure demands substantial capital, including tech, security, and compliance. This high capital need restricts the number of potential new market entrants. Cielo's existing infrastructure offers a significant competitive edge. Industry data indicates that the capital expenditure for setting up a payment processing system can range from $5 million to $50 million, depending on the scale and complexity.

Building brand recognition and trust in payment processing is challenging. Cielo, an established player, benefits from its strong reputation and customer relationships. New entrants need substantial marketing investment. Cielo S.A. has been a Sustainability Yearbook Member, enhancing its brand. In 2024, the payment processing market was valued at $100 billion.

Network Effects

Cielo's payment processing business benefits from strong network effects, increasing in value as more users join. New entrants struggle to compete with established networks like Cielo, which already has a large base of merchants and consumers. Building and maintaining a large user base is crucial for sustained success in this industry. This advantage is critical for keeping new competitors at bay. In 2024, the global payment processing market was valued at over $80 billion, highlighting the scale of these network effects.

- Network effects increase the value of payment processing services as more users join.

- Cielo's existing network provides a significant barrier to entry for new competitors.

- Expanding the network and maintaining strong relationships are vital for Cielo.

- The 2024 global payment processing market was valued at over $80 billion.

Technological Innovation

Technological innovation poses a significant threat to Cielo's market position. The payment industry is undergoing rapid advancements, demanding continuous investment in new technologies. New competitors could leverage cutting-edge solutions to enter the market.

To mitigate this risk, Cielo must cultivate a strong culture of innovation. This includes investing in R&D and forming strategic partnerships. A focus on emerging technologies like blockchain and AI is crucial for maintaining a competitive edge.

- Investment in fintech globally reached $51.7 billion in the first half of 2024.

- The global digital payments market is projected to reach $10.86 trillion by 2024.

- Blockchain technology adoption in financial services is expected to grow by 30% annually.

New entrants face significant barriers due to regulatory hurdles and substantial capital needs. Established firms like Cielo, benefit from existing infrastructure and brand recognition. Rapid technological innovation poses a constant threat, requiring continuous adaptation.

| Factor | Impact | 2024 Data |

|---|---|---|

| Regulations | High compliance costs | Brazil's cybersecurity rules increased operational costs. |

| Capital Needs | Significant investment | Setting up a system: $5M-$50M. |

| Technology | Continuous investment | Fintech investment globally: $51.7B. |

Porter's Five Forces Analysis Data Sources

The analysis uses company filings, market reports, economic indicators and industry-specific databases. These sources underpin assessment of all five forces.