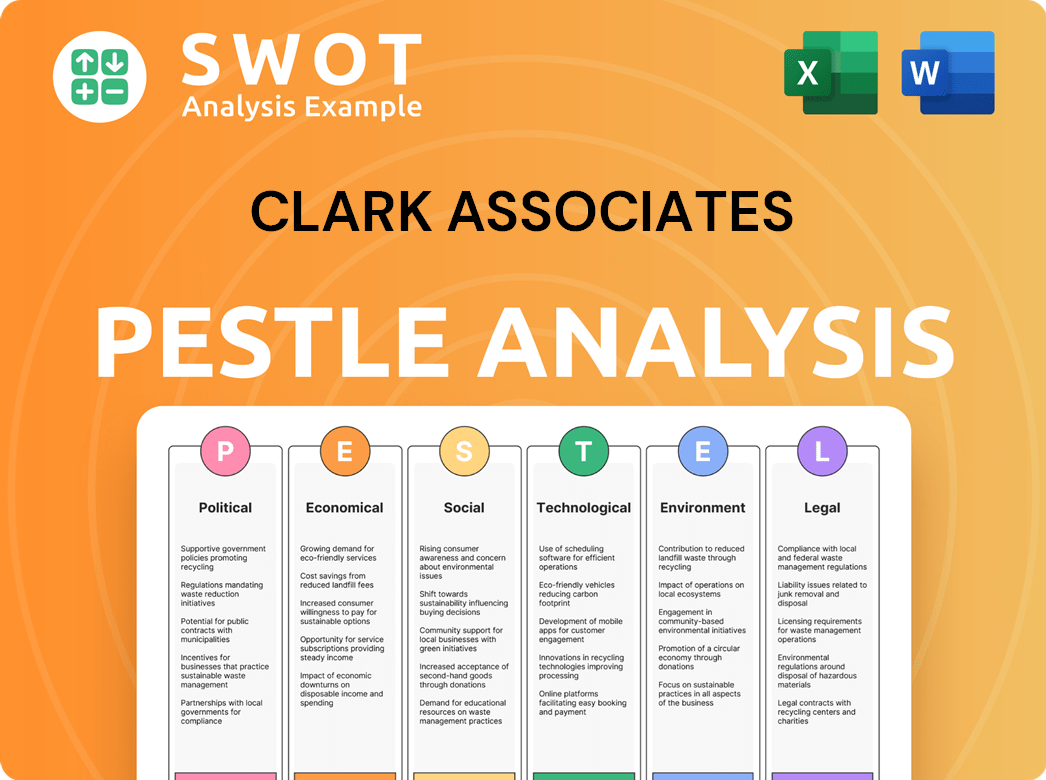

Clark Associates PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clark Associates Bundle

What is included in the product

The PESTLE analysis identifies threats and opportunities, impacting Clark Associates. It uses relevant data and trends.

Helps teams identify threats and opportunities for Clark Associates in strategic business reviews.

Preview the Actual Deliverable

Clark Associates PESTLE Analysis

Examine the comprehensive Clark Associates PESTLE analysis previewed. The displayed strategic insights accurately reflect the purchased document's contents.

What you see now, including the structure and content, will be downloadable upon successful payment.

Receive the exact file presented here: a fully-prepared analysis of Clark Associates.

Every detail in this preview is present in the purchased PESTLE document.

This is the exact analysis you'll receive.

PESTLE Analysis Template

Navigate Clark Associates' future with our PESTLE Analysis, unlocking key insights into external forces. Explore political, economic, social, technological, legal, and environmental impacts. Make informed decisions and adapt to the changing market landscape. Ready to unlock actionable intelligence? Download the full version now and gain a competitive edge.

Political factors

Government regulations and policies significantly influence the foodservice equipment sector. Health and safety rules, labor laws, and trade policies directly impact companies like Clark Associates. Updated regulations, such as stricter food safety standards, might necessitate equipment upgrades. Compliance costs can rise due to these policy changes; however, new markets can also emerge. For instance, the U.S. government's recent focus on reducing carbon emissions could create opportunities for energy-efficient equipment, with the market for sustainable foodservice equipment projected to reach $2.5 billion by 2025.

Political stability is critical for Clark Associates' operations and sourcing. Geopolitical events significantly affect trade, potentially disrupting supply chains and raising costs. For instance, in 2024, rising tariffs impacted food service, increasing prices. Elections also introduce uncertainty, influencing investment decisions. Businesses in the foodservice sector are sensitive to political shifts.

Labor law adjustments, such as minimum wage hikes and rules for tipped employees, significantly affect restaurant operating costs, crucial for Clark Associates' clients. These shifts can impact customer profitability, influencing their need for new equipment and supplies. For instance, the federal minimum wage remained at $7.25 in 2024, but many states and cities have raised their minimums, with some exceeding $15 per hour. These increases can lead to higher labor costs for restaurants, potentially reducing their investment in new equipment.

Public Health Initiatives

Government public health initiatives significantly shape the food service industry. Regulations promoting healthier eating or restricting ingredients directly impact the types of operations that succeed. For instance, policies favoring plant-based options could increase demand for specific kitchen equipment. These changes are reflected in evolving consumer preferences and market trends. In 2024, the global market for plant-based meat alternatives reached approximately $5.5 billion, with projections to reach $11.8 billion by 2028.

- Regulations on trans fats and sodium content have led to menu modifications and equipment upgrades.

- Increased interest in healthier food options is driving demand for equipment like combi ovens and blenders.

- Government campaigns promoting healthy eating can influence consumer choices and business strategies.

Support for Small Businesses

Government backing for small businesses, like restaurants and hotels, can boost Clark Associates' client base. Support such as financial aid and tax breaks allows these businesses to expand and invest, which increases supplier sales. In 2023, the Small Business Administration (SBA) approved over $25 billion in loans. These initiatives create a favorable environment for Clark Associates.

Political factors strongly shape Clark Associates' operational environment, influencing its performance and strategic planning. Government policies, regulations, and trade agreements directly affect equipment demand, compliance expenses, and supply chain dynamics, impacting costs and market opportunities. Political stability, particularly in sourcing locations, remains essential for continuous operations, as geopolitical instability can disrupt trade and increase prices.

Changes in labor laws, like minimum wage increases, substantially influence restaurant client operations and thus their purchasing decisions for new equipment and supplies. Public health initiatives and consumer-driven dietary trends supported by government actions can drive demand for specific equipment types.

Government backing, such as loans or tax benefits, helps smaller hospitality businesses grow, which bolsters supplier revenue and creates a positive atmosphere for business development.

| Political Aspect | Impact on Clark Associates | 2024/2025 Data/Examples |

|---|---|---|

| Regulations | Higher compliance costs, new market opportunities | US focus on emission reduction, sustainable equipment market projected to $2.5B by 2025. |

| Political stability | Influences sourcing, trade, supply chain | Tariffs impacted food service increasing prices in 2024. |

| Labor Laws | Impact client operating costs, demand for equipment | Many states and cities have raised minimum wages over $15 per hour in 2024. |

Economic factors

Inflation poses a considerable challenge to Clark Associates, affecting both its operational costs and those of its clients. The Consumer Price Index (CPI) for food away from home increased by 5.1% in March 2024. This impacts the cost of raw materials and manufacturing. Restaurants face rising expenses, potentially reducing their spending on new equipment.

Consumer spending and confidence significantly impact Clark Associates. High consumer confidence, fueled by a robust economy, boosts demand for dining and travel. This increased activity directly benefits Clark Associates' customers, driving up sales of their products. For instance, in 2024, consumer spending in the U.S. restaurant sector reached approximately $997 billion, reflecting a strong consumer appetite for dining out and hospitality. This positive trend is expected to continue into 2025, with projections indicating further growth in these sectors.

The foodservice industry relies heavily on labor, making its availability and cost crucial. Labor shortages, as seen in 2024, can hinder restaurant operations and expansion. Increased labor costs, driven by rising wages, directly elevate operating expenses. These conditions drive restaurants to explore labor-saving technology, impacting distributors like Clark Associates. In 2024, the National Restaurant Association reported a labor shortage of nearly 750,000 workers.

Interest Rates and Investment

Interest rates are crucial for Clark Associates, impacting investments in the hospitality sector. High rates can hinder expansion due to increased borrowing costs, while lower rates often spur investment. In 2024, the Federal Reserve maintained its benchmark interest rate, influencing business decisions. Equipment and supply distributors benefit from increased hospitality investments when rates are favorable.

- 2024: The Federal Reserve held the benchmark interest rate steady.

- Lower interest rates typically increase investment in new construction and renovations.

- Higher interest rates can increase borrowing costs for businesses.

- Equipment and supply distributors benefit from increased hospitality investments.

Industry Growth Projections

The economic outlook significantly impacts the foodservice and hospitality sectors, crucial for Clark Associates' growth. Projections for 2024 and 2025 indicate moderate expansion in these industries, driven by consumer spending and business investments. This suggests rising demand for equipment and supplies, positively affecting Clark Associates' sales and market share.

- The National Restaurant Association projects a 4.5% sales increase for the restaurant industry in 2024.

- The U.S. hotel industry is forecasted to see revenue per available room (RevPAR) growth of 3-5% in 2024.

- Foodservice equipment sales are expected to grow by 3-4% annually through 2025.

Economic factors significantly influence Clark Associates' operations and customer base. Inflation, with the CPI for food away from home at 5.1% in March 2024, increases costs. Consumer spending, boosted by strong confidence and $997B in 2024 restaurant sales, drives demand. Labor shortages and interest rates, as held steady by the Federal Reserve, impact expansion and investment.

| Economic Factor | Impact on Clark Associates | 2024 Data |

|---|---|---|

| Inflation | Increases costs, affects client spending. | CPI for food away from home: +5.1% (March) |

| Consumer Spending | Drives demand for foodservice equipment. | Restaurant sector spending: ~$997B |

| Labor | Impacts operational costs, and client expences. | Labor shortage: ~750,000 workers |

Sociological factors

Consumer dining habits are shifting, with a rising preference for convenience. This includes more takeout, delivery, and healthier food choices. Restaurants now need equipment and supplies that support these trends. For example, the U.S. restaurant industry's off-premises sales reached $944 billion in 2024. Clark Associates must adjust its offerings to stay relevant.

The rising emphasis on health and wellness significantly influences the foodservice sector. This trend boosts demand for equipment and supplies that facilitate healthy meal preparation. For example, the global health and wellness market is projected to reach $7 trillion by 2025. Plant-based food sales continue to grow, with a 6.3% increase in 2024.

Busy lifestyles fuel demand for convenient food, like ready-to-eat meals and takeout. This boosts quick-service and fast-casual restaurants, key clients for foodservice suppliers. In 2024, the U.S. fast-food market is valued at $300 billion, reflecting this trend. This market is expected to grow by 4-5% annually through 2025.

Labor Force Demographics and Expectations

The foodservice workforce is evolving, with changing demographics and expectations. These shifts, including the need for user-friendly equipment to boost efficiency, directly affect product design. Clark Associates must adapt its offerings to meet these needs, ensuring relevance in a changing market. This includes integrating technology and simplifying operations.

- Labor shortages in the foodservice industry are projected to persist.

- Demand for automation and ease-of-use in kitchen equipment is increasing.

- Millennials and Gen Z are a growing segment of the workforce.

- These groups prioritize technology and efficiency in their work environment.

Social Responsibility and Ethical Consumerism

Consumer preferences are shifting towards businesses with strong ethical and social responsibility standards. This trend impacts purchasing choices in the foodservice sector. Customers are increasingly drawn to suppliers like Clark Associates that prioritize fair labor practices and sustainable sourcing. This shift is fueled by heightened environmental and social awareness among consumers. For example, in 2024, ethical consumer spending in the US reached $175 billion, reflecting this growing demand.

- Ethical consumerism has grown by 15% annually since 2020.

- 70% of consumers say they would pay more for sustainable products.

- Companies with strong ESG (Environmental, Social, and Governance) ratings often see higher customer loyalty.

Consumer preferences for ethical and sustainable practices significantly influence purchasing decisions. Ethical consumer spending reached $175 billion in 2024. Businesses prioritizing fair labor and sustainable sourcing are increasingly favored.

Foodservice workforce demographics are changing, leading to demands for efficient, tech-integrated equipment. Labor shortages drive the need for automation, with millennials and Gen Z prioritizing tech-friendly work environments.

Busy lifestyles drive demand for convenience. This includes ready-to-eat meals and fast-casual options. The U.S. fast-food market reached $300 billion in 2024, fueled by this trend. Growth is expected at 4-5% annually through 2025.

| Factor | Impact on Clark Associates | Data Point (2024) |

|---|---|---|

| Ethical Consumerism | Increased demand for sustainable products | $175B Ethical Consumer Spending |

| Workforce Demographics | Demand for automated, user-friendly equipment | Labor shortages in foodservice |

| Convenience Trend | Growth in fast-casual/quick-service restaurants | $300B U.S. Fast-Food Market |

Technological factors

Automation and AI are reshaping foodservice. Robotics and AI address labor shortages, boosting efficiency. This drives demand for automated kitchen tech. The global food robotics market is projected to reach $3.7 billion by 2025. Clark Associates can capitalize on this trend.

E-commerce is reshaping foodservice supply chains. Clark Associates must enhance its digital presence. Online platforms are vital distribution channels. The global e-commerce market reached $2.7 trillion in 2023, growing 8.4% year-over-year. This trend demands investment in digital capabilities.

Supply chain technology is crucial for Clark Associates. Real-time inventory tracking and logistics optimization are key. These technologies boost efficiency and cut costs significantly. For example, in 2024, supply chain tech reduced delivery times by 15% for similar companies, according to a Gartner report. This enhances delivery reliability for customers.

Data Analytics and Business Intelligence

Data analytics and business intelligence are increasingly vital in foodservice, helping with sales forecasting and cutting waste. Clark Associates can use these tools internally and possibly offer them to customers. The global business intelligence market is projected to reach $96.9 billion by 2025. This shift allows for data-driven decisions, enhancing efficiency and customer service.

- Market growth: The business intelligence market is predicted to be worth $96.9 billion in 2025.

- Internal use: Clark Associates can optimize its operations through data analysis.

- Customer solutions: Offering data-driven insights can provide a competitive advantage.

Development of New Equipment Technologies

Ongoing technological advancements in foodservice equipment are creating new opportunities for Clark Associates. Innovations like energy-efficient appliances and smart kitchen equipment drive replacement cycles. The global smart kitchen appliances market is projected to reach $43.5 billion by 2025, presenting significant growth potential. These technologies can enhance operational efficiency and reduce costs for Clark Associates' customers.

- Energy-efficient appliances can reduce operational costs by up to 30%.

- The smart kitchen appliances market is expected to grow by 12% annually through 2025.

- Specialized cooking technologies offer new product lines.

Technological shifts, including AI and e-commerce, reshape foodservice significantly. Supply chain tech boosts efficiency, cutting costs by up to 15%. Data analytics, with a $96.9 billion market by 2025, drives smarter decisions, enhancing services and offering new product lines with specialized technologies.

| Technological Factor | Impact | Data |

|---|---|---|

| Automation and AI | Labor savings, efficiency | Food robotics market: $3.7B by 2025 |

| E-commerce | Enhanced digital presence | E-commerce market grew 8.4% in 2023 |

| Supply Chain Tech | Logistics optimization | Reduced delivery times by 15% (2024) |

| Data Analytics | Data-driven decisions | BI market: $96.9B by 2025 |

| Smart Kitchens | Energy efficiency | Appliances market: $43.5B by 2025 |

Legal factors

Stringent food safety regulations, overseen by agencies such as the FDA and USDA, are crucial in foodservice. Clark Associates must ensure its products meet these standards, impacting design and materials. Customers' adherence to food handling rules is also vital. Non-compliance can lead to penalties; in 2024, FDA fines averaged $10,000 per violation.

Clark Associates must adhere to labor laws like minimum wage and overtime. These laws, alongside workplace safety standards set by OSHA, directly affect operational costs. For instance, the federal minimum wage hasn't changed since 2009, remaining at $7.25 per hour, but many states and localities have higher rates, impacting businesses' payrolls. Any shifts in these regulations, such as potential increases in the federal minimum wage or changes to overtime eligibility, could necessitate adjustments in Clark Associates' business strategies and financial planning.

Clark Associates, as a foodservice distributor, must navigate complex licensing and permitting. These requirements vary by location, impacting operational costs. In 2024, compliance costs for small businesses averaged $1,500-$3,000 annually. Failure to comply can lead to hefty fines and business disruptions. These regulations ensure food safety and operational standards.

Data Privacy and Security Laws

Data privacy and security laws are crucial for Clark Associates, especially with its digital presence. Compliance with regulations like GDPR and CCPA is essential to protect customer data. Failure to comply can lead to hefty fines and reputational damage. Stricter data protection requirements are emerging globally. For example, the EU's GDPR can impose fines up to 4% of annual global turnover.

- GDPR fines can reach up to 4% of global turnover.

- CCPA ensures California residents' data privacy.

- Data breaches cost companies millions annually.

- Cybersecurity incidents are on the rise.

Accessibility Standards

Accessibility standards, particularly those outlined in the Americans with Disabilities Act (ADA), are crucial for Clark Associates. These regulations directly influence the design and functionality of foodservice equipment and establishment layouts. Compliance ensures that Clark Associates' customers, including restaurants and other food service providers, can serve all patrons effectively. Non-compliance can lead to significant fines, with penalties potentially reaching up to $75,000 for a first violation and $150,000 for subsequent violations, as of 2024.

- ADA compliance is non-negotiable for businesses.

- Equipment must meet specific accessibility requirements.

- Failure to comply results in substantial financial risk.

- Accessibility impacts customer service and satisfaction.

Legal factors heavily influence Clark Associates. Food safety regulations and labor laws affect product design, costs, and compliance. Data privacy and accessibility standards also play vital roles, potentially affecting profitability. Penalties in 2024 average $10,000 per violation.

| Area | Regulation | Impact |

|---|---|---|

| Food Safety | FDA/USDA | Product design, materials, and handling |

| Labor | Minimum wage, OSHA | Operational costs, safety standards |

| Data Privacy | GDPR/CCPA | Customer data protection and cybersecurity |

| Accessibility | ADA | Design of equipment and customer access |

Environmental factors

Environmental sustainability is a key trend. The foodservice industry sees rising demand for eco-friendly products and waste reduction. In 2024, the global sustainable packaging market was valued at $300 billion. Clark Associates can offer sustainable choices to meet this demand.

Regulations and incentives drive demand for energy-efficient kitchen equipment. Restaurants are adopting energy-saving appliances to cut costs and reduce their carbon footprint. The global market for energy-efficient commercial kitchen equipment is projected to reach $10.5 billion by 2025. This shift creates opportunities for companies like Clark Associates.

Environmental concerns are driving changes in packaging. Regulations are increasing for single-use plastics. There's a growing demand for biodegradable and recyclable options. Clark Associates must adapt its supplies to meet these evolving preferences. The global market for sustainable packaging is projected to reach $466.8 billion by 2027.

Supply Chain Environmental Impact

Clark Associates' supply chain faces growing pressure to reduce its environmental footprint. Transportation and logistics are key areas for improvement, with a focus on lowering carbon emissions. Strategies include optimizing routes, enhancing fuel efficiency, and exploring electric vehicle adoption. These initiatives align with the rising demand for sustainable practices.

- The global supply chain accounts for ~11% of greenhouse gas emissions.

- Companies like Amazon are investing heavily in electric delivery vehicles, aiming for a significant reduction in their carbon footprint by 2030.

- The European Union's Carbon Border Adjustment Mechanism (CBAM) will impact businesses importing goods, increasing the emphasis on supply chain emissions.

Responsible Sourcing

Responsible sourcing is becoming increasingly important, focusing on environmental impact and ethical labor. Clark Associates could see higher demand for products from sustainable suppliers. Businesses prioritizing environmental, social, and governance (ESG) factors are growing. The global ESG investment market is projected to reach $53 trillion by 2025.

- ESG investments are expected to continue their upward trajectory, with a projected growth of 15% annually through 2025.

- Consumers are increasingly favoring brands with strong ethical and environmental records.

- Supply chain transparency is a key factor, with 70% of consumers willing to pay more for sustainable products.

Environmental factors greatly shape the foodservice industry's future. Sustainability trends drive demand for eco-friendly products; the global sustainable packaging market was $300B in 2024. Energy-efficient equipment is booming, with a $10.5B market forecast by 2025.

| Aspect | Impact | Data |

|---|---|---|

| Sustainable Packaging | Rising Demand | $466.8B market by 2027 |

| Supply Chain | Reducing footprint | ~11% of emissions from global supply chains |

| ESG Investments | Growing influence | $53T projected by 2025 |

PESTLE Analysis Data Sources

Clark Associates' PESTLE uses diverse sources. It gathers info from market research, government reports, industry publications & financial institutions.