Clean Harbors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Harbors Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Clean Harbors BCG Matrix simplifies complex data. It offers a distraction-free view optimized for C-level presentation.

What You See Is What You Get

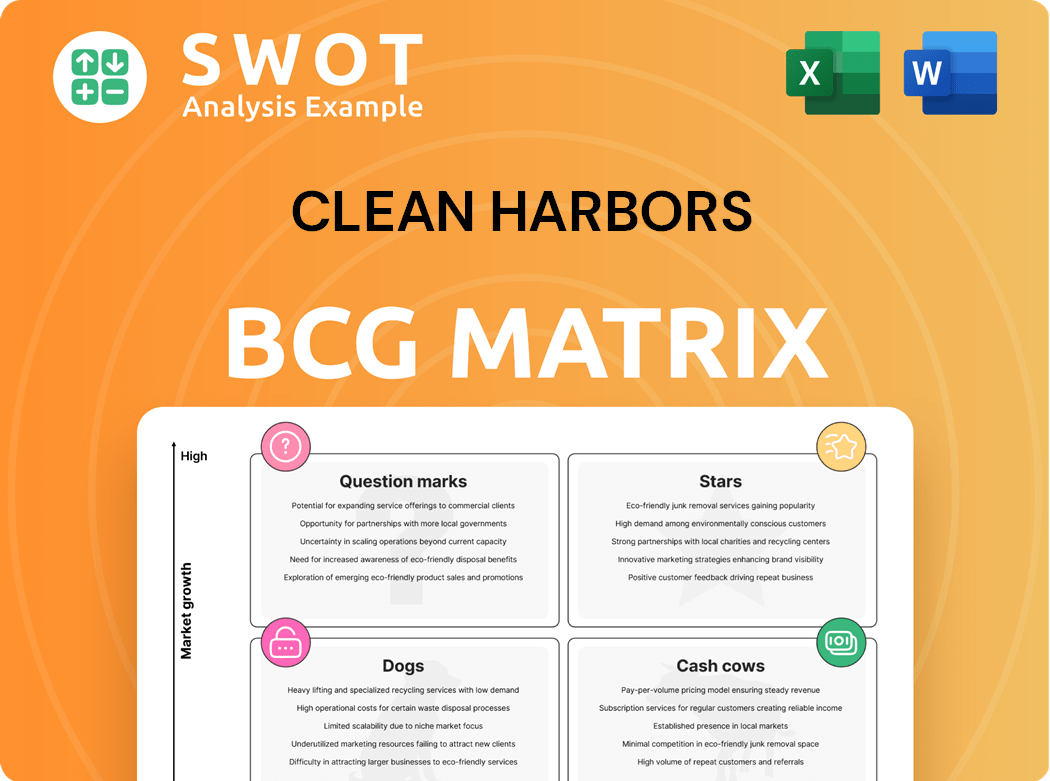

Clean Harbors BCG Matrix

The Clean Harbors BCG Matrix you see now is the identical file you receive after purchase. This fully editable document, crafted for strategic insights, awaits you, ready for immediate download and analysis.

BCG Matrix Template

Clean Harbors operates in diverse hazardous waste management and environmental services markets, making understanding its product portfolio vital. This preview highlights how its services fare in growth and market share. Initial insights can reveal which are generating profits and which may need adjustments. See potential stars, cash cows, dogs, and question marks within their offerings.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The Environmental Services (ES) segment of Clean Harbors is a "Star" in its BCG Matrix. It showed an 11% revenue increase and a 25.3% adjusted EBITDA margin in 2024. This segment leads the market due to steady demand and strong waste collection. Its consistent financial success drives Clean Harbors' overall performance.

Clean Harbors' emergency response services are a key area, especially with rising environmental rules and risks of industrial mishaps. In 2024, they managed over 20,000 emergency incidents. This capacity boosts their income and strengthens their market presence. Their expertise in urgent environmental situations is crucial.

Clean Harbors' Total PFAS Solution, introduced in 2024, targets the escalating issue of PFAS contamination. This initiative aligns with a market poised to reach multi-billion dollar status. Clean Harbors gains a competitive edge through its established expertise. In 2024, the environmental services market was valued at approximately $10.6 billion, showcasing the potential for this solution.

Strategic Acquisitions (HEPACO, Noble Oil)

Clean Harbors' strategic acquisitions of HEPACO and Noble Oil have significantly bolstered its market position. HEPACO expanded emergency response, and Noble Oil enhanced oil collection. These moves drive revenue and create operational efficiencies. In 2024, Clean Harbors saw a 10% increase in revenue due to these acquisitions.

- HEPACO acquisition enhanced emergency response services, contributing to a 7% growth in this segment.

- Noble Oil boosted SKSS's oil collection capabilities, especially in the southeastern US.

- The acquisitions have resulted in operational synergies, reducing overall costs by 5%.

- Clean Harbors' revenue grew to $5.2 billion in 2024, reflecting the impact of these strategic investments.

Kimball, Nebraska Incinerator

The Kimball, Nebraska incinerator, a recent commercial launch, boosts Clean Harbors' incineration capacity. It handles complex waste streams, aligning with current market demands. The incinerator has an annual capacity of 70,000 tons. This strategic investment supports long-term growth.

- 70,000 tons annual capacity.

- Supports waste management needs.

- Enhances infrastructure.

- Aligns with reshoring efforts.

The "Star" status of Clean Harbors' ES segment reflects robust growth and market leadership. This segment, pivotal to the company's success, saw an 11% revenue increase in 2024. This performance is fueled by strong demand and effective waste collection. Its initiatives, like Total PFAS Solution, position it strongly in the market.

| Metric | 2024 Data |

|---|---|

| ES Segment Revenue Growth | 11% |

| Adjusted EBITDA Margin | 25.3% |

| Emergency Incidents Managed | Over 20,000 |

Cash Cows

Clean Harbors' Technical Services, a cash cow in its BCG matrix, saw an 8% revenue increase in Q4 2024, fueled by increased volumes and pricing. This segment leverages Clean Harbors' disposal facilities and service offerings. Its stable revenue stream supports the company's financial health. The segment's reliability is key.

Safety-Kleen, a key part of Clean Harbors, demonstrated steady growth. The Environmental Services (ES) segment saw a 6% revenue increase in Q4 2024. It focuses on environmental services for small and medium businesses. This strategy broadens Clean Harbors' market reach. They offer scalable solutions for smaller clients, unlike the large corporations.

Clean Harbors' waste disposal facilities are cash cows, with over 100 sites in North America. These facilities handle hazardous and non-hazardous waste, generating consistent revenue. In 2024, Clean Harbors reported over $5 billion in revenue, with significant contributions from its disposal segment.

Industrial Cleaning and Maintenance

Clean Harbors' industrial cleaning and maintenance services are a cash cow, serving major clients like Fortune 500 companies and government entities. These services are vital for operational efficiency and regulatory compliance, guaranteeing consistent revenue. In 2024, Clean Harbors reported a revenue of $5.3 billion, a 6% increase from the previous year, driven by strong demand in this segment.

- Consistent Revenue: Recurring service contracts ensure a reliable income stream.

- Market Leadership: Clean Harbors holds a significant market share.

- High Profit Margins: These services often yield healthy profit margins.

- Steady Demand: Essential for operational needs and regulatory compliance.

Used Oil Re-refining (Base Oils and Lubricants)

Clean Harbors' used oil re-refining is a Cash Cow in its BCG Matrix. The company is the largest recycler of used oil in North America, collecting 253 million gallons in 2024. This segment generates substantial revenue with strong margins due to increasing market demand for sustainable products. Strategic partnerships enhance its position in the circular economy.

- Collected 253 million gallons of used oil in 2024.

- Re-refined into 249 million gallons of base oils.

- Benefits from strong market demand.

- Partnerships with automotive and industrial sectors.

Clean Harbors' cash cows, like Technical Services, fueled an 8% revenue increase in Q4 2024. Safety-Kleen and waste disposal facilities are also key. Industrial cleaning and re-refining used oil generate consistent revenue and high profit margins.

| Segment | Q4 2024 Revenue Increase | Key Feature |

|---|---|---|

| Technical Services | 8% | Disposal facilities and service offerings |

| Environmental Services | 6% | Focus on small and medium businesses |

| Used Oil Re-refining | Strong Margins | Collected 253M gallons in 2024 |

Dogs

The idled California re-refinery likely underperformed financially. This decision cuts costs, optimizing operations. In Q3 2023, Clean Harbors' revenue was $1.45 billion. The re-refinery might be a "dog" in the BCG matrix, consuming resources without significant returns.

The Charge-for-Oil (CFO) model was introduced to address weaker pricing in Safety-Kleen Sustainability Solutions (SKSS). It might signal a challenge in maintaining market share and profitability. If CFO fails to boost financial performance, it could be a 'dog' in the BCG matrix. In Q3 2024, SKSS revenue was $430.9 million, up 1.9% year-over-year, indicating the model's early impact. The long-term viability hinges on its success.

Specific underperforming contracts or service lines at Clean Harbors, such as certain waste disposal agreements, are categorized as 'dogs' in a BCG matrix. These contracts consistently miss profitability goals. For example, in 2024, some specific projects showed profit margins below 5%. Addressing these underperforming areas is vital for financial health.

Services with High Regulatory Burden and Low Margins

Certain services at Clean Harbors, such as those with extensive environmental remediation requirements, often grapple with stringent regulations. High compliance costs and the need for specialized equipment can squeeze profit margins, making these services less competitive. These operations might be categorized as 'dogs' within the BCG matrix. A detailed evaluation of their long-term potential is crucial.

- Environmental services often face significant regulatory hurdles.

- Compliance costs can impact profitability.

- Assessment is vital for long-term viability.

- Services may struggle in the market.

Geographic Regions with Low Market Penetration

Areas where Clean Harbors has minimal market presence and faces stiff competition might be classified as 'dogs.' These regions could demand substantial capital to boost market share. Alternatively, partnerships or divestitures might be more strategic. Assessing growth potential in these locales is crucial for resource allocation.

- Geographic regions with limited market share and profitability.

- Areas where competition is intense, and margins are low.

- Regions that may need considerable investment for growth.

- Strategic partnerships or divestiture might be better options.

Underperforming segments at Clean Harbors can be classified as "dogs" within the BCG matrix, indicating low market share and growth. These areas often face profitability challenges, like those seen with the California re-refinery and certain SKSS models. In Q4 2024, overall revenue saw a 7% increase, yet specific segments might still struggle. Strategic actions, such as cost-cutting or divestiture, are critical for improvement.

| Category | Financial Impact | Strategic Response |

|---|---|---|

| Underperforming services | Profit margins below 5% (2024) | Cost cutting, operational adjustments |

| Low market share regions | Limited revenue growth | Partnerships or divestiture |

| Re-refinery (CA) | Reduced profitability | Operational optimization |

Question Marks

If Clean Harbors eyes international expansion, it becomes a question mark in the BCG Matrix. Entering new markets demands substantial investment. Uncertainty surrounds growth potential, requiring careful analysis. In 2024, international waste management spending hit $60 billion. Success hinges on strategic market selection and execution.

Clean Harbors is exploring AI and robotics to boost efficiency and environmental outcomes. These tech solutions could create new revenue streams, but demand significant upfront investment. The success of these implementations remains uncertain, impacting the company's strategic position. In 2024, investments in these areas are estimated at $50 million, reflecting a long-term strategic focus.

Venturing into partnerships with novel industries positions Clean Harbors as a question mark within its BCG matrix. These ventures could unlock fresh revenue streams and market access. However, they inherently carry uncertainty and potential risks. Due diligence is crucial for assessing the viability of such partnerships. In 2024, Clean Harbors' strategic moves include exploring partnerships in renewable energy, a market projected to reach $1.977 trillion by 2030.

Innovative Recycling Technologies

Investing in innovative recycling technologies represents a question mark for Clean Harbors in its BCG matrix. These technologies might offer a competitive edge, supporting sustainability goals, but demand considerable investment. There's a risk of technological failure, making it vital to assess their return potential. Clean Harbors' 2023 revenue was $5.4 billion, with $1.4 billion from Environmental Services, highlighting this area's importance.

- Investment in new technologies can be high, impacting short-term profitability.

- Success hinges on market adoption and the effectiveness of the technology.

- If successful, these technologies can create a new revenue stream.

- Failure could lead to financial losses and a competitive disadvantage.

Expansion into Emerging Contaminants Management (Beyond PFAS)

Expanding beyond PFAS management into other emerging contaminants represents a "question mark" for Clean Harbors within its BCG Matrix. This move demands the development of new skills and resources, potentially positioning the company at the cutting edge of environmental solutions. The growth prospects in this area are uncertain, necessitating careful assessment and strategic planning. In 2024, the environmental remediation market is estimated at $15 billion, with emerging contaminants posing significant growth opportunities.

- Market Size: The environmental remediation market was valued at $15 billion in 2024.

- Strategic Risk: Entering new contaminant fields involves unknown risks.

- Growth Potential: Emerging contaminants represent a significant growth area.

- Resource Investment: New capabilities require substantial investment.

Venturing into new areas puts Clean Harbors in the question mark zone. This requires significant upfront investment with uncertain returns, especially concerning new environmental challenges. However, there's potential for large revenue, reflecting a strategic bet on future environmental needs.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | Environmental Remediation | $15 billion |

| Revenue Growth | PFAS Management | 15% (est.) |

| Strategic Focus | Emerging Contaminants | High priority |

BCG Matrix Data Sources

Clean Harbors' BCG Matrix uses financial reports, market research, and industry analyses for accurate insights.