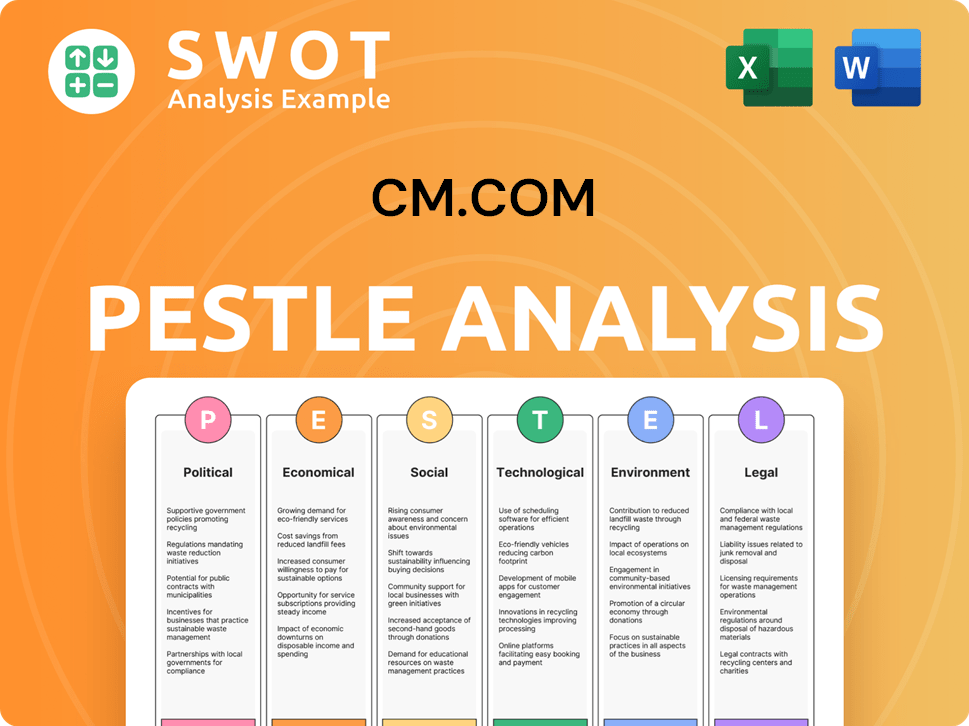

CM.com PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CM.com Bundle

What is included in the product

Evaluates the external macro-environment's impact on CM.com across six dimensions. Backed by data, it supports strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

CM.com PESTLE Analysis

Preview the CM.com PESTLE Analysis here! This provides insights on Political, Economic, Social, Technological, Legal, and Environmental factors. The preview you see showcases the complete, ready-to-use document you'll download. The content you see is precisely what you get after purchasing.

PESTLE Analysis Template

Explore the external forces impacting CM.com's performance with our detailed PESTLE analysis. We uncover key political, economic, and social factors affecting the company. Gain strategic insights and understand the competitive landscape.

Our analysis dives into technological advancements and legal challenges that CM.com faces. This research helps you anticipate future trends, and identify both risks and opportunities. Download the full PESTLE analysis today!

Political factors

Changes in telecom regulations, data privacy laws like GDPR, and consumer protection directly affect CM.com. Political stability in operational regions is crucial. For instance, GDPR non-compliance can incur fines up to 4% of global turnover; in 2024, these fines totaled billions.

International trade agreements and potential sanctions are crucial for CM.com. These factors directly influence its global operations and supply chains. For example, Brexit continues to reshape trade dynamics in Europe. In 2024, the EU's trade with the UK was valued at around €650 billion. Changes in trade policies can create both opportunities and challenges for CM.com's market expansion.

CM.com's operational success is closely tied to political stability in its operating regions. Political instability can lead to regulatory changes and economic uncertainties, which can disrupt operations. For example, in 2024, countries with unstable governments saw a 15% decrease in tech sector investments. This can directly impact CM.com's ability to operate smoothly and predictably.

Government Support for Digital Transformation

Government backing significantly influences CM.com's market position. Initiatives promoting digital transformation, like those seen in the EU, can boost cloud communication tech adoption. These programs often provide financial aid, such as grants, to accelerate digital solutions integration. The European Commission has allocated over €130 billion for digital transformation initiatives.

- EU's Digital Decade targets include digital skills and infrastructure improvements.

- Government policies can mandate digital communication for specific sectors.

- Subsidies lower the cost of adopting cloud-based services.

- Favorable policies boost CM.com's market expansion.

Cybersecurity Policies and National Security Concerns

Governments worldwide are intensifying their focus on cybersecurity and national security, which directly impacts CM.com. This increased scrutiny results in stricter regulations regarding data handling, potentially raising compliance costs. CM.com must adapt its platform to meet these evolving standards to maintain customer trust and avoid penalties. These adjustments are crucial for continued operation and market access.

- Global cybersecurity spending is projected to reach $270 billion in 2024, reflecting the growing emphasis on digital security.

- The EU's NIS2 Directive, fully enforceable by 2025, demands stringent cybersecurity measures for essential services, influencing CM.com's operational requirements.

- Data breaches cost businesses an average of $4.45 million in 2023, emphasizing the financial risks of non-compliance.

Political factors significantly shape CM.com's operations and strategy. Changes in regulations, especially regarding data privacy (e.g., GDPR fines potentially reaching billions), influence compliance costs and market access. International trade and political stability, like the €650 billion EU-UK trade in 2024, directly affect expansion and operational predictability.

Government policies and backing, such as digital transformation initiatives (EU allocating over €130 billion), create market opportunities. Increased cybersecurity focus (projected $270 billion spending in 2024) and directives (NIS2 by 2025) lead to stringent regulations and compliance needs for CM.com.

| Political Factor | Impact on CM.com | Data Point (2024-2025) |

|---|---|---|

| Regulations & Compliance | Increased costs; market access | GDPR fines: Billions; NIS2 compliance |

| Trade Agreements/Sanctions | Global Operations; Supply chains | EU-UK Trade: €650B (2024) |

| Digital Transformation Initiatives | Market Opportunities; growth | EU Funding: €130B+ |

Economic factors

Global and regional economic health directly impacts CM.com's business. Strong economic growth often boosts demand for its communication and digital transformation services. For instance, in 2024, the global digital transformation market is valued at approximately $767.8 billion, with expected growth. Regions with robust economies are key for CM.com's expansion.

Inflation, a key economic factor, directly affects CM.com's operational costs. Rising prices in areas like cloud services and salaries can squeeze profit margins. Interest rate hikes, as seen in late 2024, increase borrowing costs. This impacts CM.com's investment strategies and potentially reduces client spending, especially for SMS marketing services.

As a global tech firm, CM.com faces currency exchange rate risks. These fluctuations directly impact revenue and profit conversions. For example, a strong euro can reduce the value of revenues from outside the Eurozone. In 2024, currency volatility has increased, affecting international tech transactions.

Recessionary Pressures and Business Spending

Economic downturns and recessionary pressures can significantly curb business spending. This shift might affect demand for CM.com's services, as businesses focus on cost-cutting measures. For example, in 2023, global IT spending growth slowed to 3.2%, reflecting budget constraints. Companies often delay non-essential investments during economic uncertainty.

- Global IT spending growth slowed to 3.2% in 2023.

- Businesses prioritize cost savings during economic downturns.

- Non-essential investments are often delayed.

- Reduced spending impacts demand for non-essential services.

Investment in Digital Infrastructure

Investment in digital infrastructure is crucial for CM.com's growth. It impacts their platform's reach and efficiency. Increased investment enables better service delivery. Regions with advanced infrastructure see higher adoption rates. For instance, in 2024, the EU invested €113 billion in digital infrastructure.

- EU investment in digital infrastructure reached €113B in 2024.

- Improved infrastructure enhances CM.com's service capabilities.

- Higher adoption rates correlate with better infrastructure.

Economic factors substantially influence CM.com. Global economic health drives demand, with the digital transformation market valued at approximately $767.8B in 2024. Inflation and interest rates affect operational costs and investments. Currency exchange rates introduce financial risks. Economic downturns reduce business spending.

| Factor | Impact on CM.com | Data |

|---|---|---|

| Economic Growth | Boosts demand for services | Global digital transformation market: ~$767.8B (2024) |

| Inflation & Interest Rates | Affect operational costs & investments | Late 2024 saw increased rates, raising borrowing costs |

| Currency Exchange Rates | Influence revenue & profit conversions | Increased volatility affecting international tech transactions in 2024 |

Sociological factors

Consumer communication is rapidly changing, with mobile messaging and digital channels becoming dominant. This shift impacts CM.com's services. In 2024, mobile messaging saw a 20% increase in business interactions. Businesses must adapt to these new preferences to stay relevant.

Shifts in demographics directly impact communication preferences. The rise of digital natives favors platforms like CM.com. Globally, mobile internet users reached 5.16 billion in 2024, highlighting digital literacy's importance. In 2024, the global average age is about 30 years old. These trends influence CM.com's service demand.

Consumers now want personalized interactions, pushing businesses to adapt. CM.com helps deliver tailored experiences. In 2024, 78% of consumers preferred personalized ads. CM.com's solutions meet this demand, enabling better customer engagement. This trend boosts demand for CM.com's services.

Trust and Privacy Concerns

Societal concerns regarding data privacy and security significantly impact digital communication platforms like CM.com. User trust hinges on strong security measures and transparent data handling. Recent surveys show that 79% of consumers are very or somewhat concerned about their data privacy. CM.com must address these concerns to maintain user confidence.

- Data breaches cost businesses an average of $4.45 million in 2023.

- 79% of consumers are concerned about data privacy.

- EU's GDPR and other regulations mandate data protection.

Remote Work Trends

The rise in remote and hybrid work has significantly altered business communication strategies. This shift fuels the need for robust digital tools. CM.com's voice and messaging solutions are crucial for maintaining connectivity. Remote work boosts demand for these tools, regardless of location. The global remote work market is projected to reach $1.2 trillion by 2028.

- Increased reliance on digital communication platforms.

- Demand for unified communication solutions.

- Need for secure and reliable messaging services.

- Growth in cloud-based communication tools.

Societal attitudes towards data privacy and remote work significantly influence CM.com. Increased security demands arise with 79% of consumers worried about data breaches. The global remote work market will hit $1.2T by 2028, spurring demand for digital tools. CM.com must meet these changing societal needs to succeed.

| Factor | Impact | Data |

|---|---|---|

| Data Privacy | Increased scrutiny, need for security | Avg. breach cost: $4.45M (2023) |

| Remote Work | Growing demand for digital tools | Remote market: $1.2T (by 2028) |

| User Trust | Dependent on transparent data handling | 79% consumer concern over privacy |

Technological factors

Rapid advancements in AI and Machine Learning are directly relevant to CM.com's offerings. CM.com actively incorporates AI into its platform for chatbots and automation. This includes data analysis for personalized communication strategies. The global AI market is projected to reach $1.81 trillion by 2030. In 2024, the market was valued at $255.6 billion.

The continuous evolution of communication channels, including new messaging apps, offers both chances and hurdles for CM.com. Integrating and supporting these channels, like RCS on iOS, is crucial. In 2024, global RCS business messaging revenue is estimated at $1.2 billion, growing to $5 billion by 2027. CM.com must adapt to stay competitive.

The rise of agentic AI platforms, like CM.com's HALO, is transformative. These AI systems automate tasks, enhancing customer engagement and operational efficiency. For instance, the global AI market is projected to reach $1.8 trillion by 2030. This technology significantly impacts CM.com's strategic focus.

Data Security and Encryption Technologies

Data security and encryption are pivotal for CM.com. They must protect sensitive customer data and adhere to regulations. Strong security builds customer trust. In 2024, the global cybersecurity market is valued at over $200 billion. CM.com's investment in these technologies is vital.

- Cybersecurity market to exceed $250 billion by 2025.

- Data breaches cost companies millions annually.

- Encryption is essential for GDPR compliance.

Cloud Computing Infrastructure

Cloud computing is vital for CM.com's operations. It directly impacts platform delivery and scaling capabilities. This reliance on cloud services necessitates robust, secure infrastructure. CM.com's efficiency and cost-effectiveness are heavily influenced by cloud technology. The global cloud computing market is projected to reach $1.6 trillion by 2025.

- Cloud infrastructure is key for scalability.

- Security is a top priority in cloud operations.

- CM.com depends on cloud providers for services.

- Cloud tech affects operational costs.

Technological factors heavily influence CM.com. The company utilizes AI, with the AI market projected to hit $1.81T by 2030. Adapting to new communication channels, like RCS, is key; RCS business messaging could reach $5B by 2027. Security, crucial for data, and cloud computing affect operational costs.

| Factor | Impact | Data |

|---|---|---|

| AI | Automation & Chatbots | AI market worth $255.6B in 2024. |

| Communication | Channel Adaptation | RCS revenue forecast $5B by 2027. |

| Cybersecurity | Data Protection | Cybersecurity market to exceed $250B by 2025. |

Legal factors

CM.com must comply with data protection laws like GDPR, crucial for handling customer data. These laws dictate how data is collected, stored, and processed, impacting operations. In 2024, GDPR fines reached €1.1 billion across EU, highlighting the importance of compliance. Failure to comply can result in substantial penalties and reputational damage. Therefore, CM.com must prioritize robust data protection measures.

CM.com navigates complex global telecom regulations. Compliance with messaging and voice service rules is crucial for operations. Regulations differ per nation, affecting service delivery methods. These factors impact operational costs and market access. Staying current with evolving laws is essential for CM.com's financial health.

CM.com's payment services face stringent regulations. These include compliance with financial regulations and payment industry standards. Crucially, this encompasses rules for payment processing, security, and AML. The global payment processing market is projected to reach $7.6 trillion by 2025. CM.com must navigate these to operate legally and securely.

Consumer Protection Laws

Consumer protection laws significantly influence CM.com's clients' communication strategies. These laws, like GDPR in Europe, dictate how businesses interact with consumers. They cover unsolicited marketing, requiring consent for promotional messages. CM.com's platform must support these regulations to ensure clients' compliance.

- GDPR fines reached €1.6 billion in 2023.

- Over 60% of consumers want more control over data.

- EU's Digital Services Act impacts messaging platforms.

Intellectual Property Laws

CM.com must navigate intellectual property laws to protect its tech and respect others' IP. This includes patents, trademarks, and copyrights. In 2024, global spending on IP protection reached $200 billion. Infringement lawsuits can be costly; in 2023, the average IP lawsuit cost over $5 million. CM.com's software and services require robust IP management.

- Patents: Securing rights to unique innovations.

- Trademarks: Branding and brand protection.

- Copyrights: Protecting software code and content.

- Legal Compliance: Avoiding IP infringement.

CM.com faces legal scrutiny across various fronts, from data privacy to consumer protection. Compliance with GDPR is critical, with fines continuing to rise. Telecom and payment regulations add to the legal complexity. Non-compliance may harm business prospects.

| Regulation Area | Impact | Fact |

|---|---|---|

| Data Privacy | GDPR, data breaches | GDPR fines could reach €2B by 2025. |

| Telecoms | Licensing, compliance costs | Global telecom market $2T in 2024. |

| Payments | Security, AML rules | Payment market size by 2025: $8T |

Environmental factors

CM.com's cloud platform's data centers' energy use is an environmental factor. Data centers globally consumed ~2% of total electricity in 2022. There's pressure to cut environmental impact & use sustainable energy. The EU's Green Deal aims for climate neutrality by 2050, influencing tech firms.

CM.com's e-waste, from discarded servers to outdated phones, poses an environmental challenge. Proper disposal and recycling are crucial to mitigate pollution risks. Globally, e-waste generation reached 53.6 million metric tons in 2019, with projections to exceed 74 million tons by 2030. Effective e-waste management is increasingly a key element of corporate social responsibility.

Although CM.com's business isn't directly climate-sensitive, extreme weather could disrupt digital networks. In 2023, weather-related outages cost businesses billions. For example, Hurricane Idalia caused significant infrastructure damage. These events highlight the need for resilient digital infrastructure. CM.com must consider these risks in its operational planning, especially in vulnerable regions.

Sustainability Reporting Requirements

CM.com faces growing demands for environmental sustainability reporting. This is due to rising pressure from regulators and stakeholders regarding carbon emissions and energy use. The trend aligns with Environmental, Social, and Governance (ESG) principles. Companies are increasingly assessed on their environmental impact, influencing investment decisions. This impacts CM.com's operations and reporting requirements.

- 2024: EU's CSRD requires expanded sustainability reporting.

- 2024: Global ESG assets hit $40 trillion.

- 2025: SEC climate disclosure rules could affect CM.com.

- 2025: Stakeholders increasingly prioritize environmental performance.

Customer and Investor Focus on Sustainability

Customer and investor focus on sustainability is increasing. Businesses like CM.com must address environmental concerns. This can affect partnerships and investments. Companies showing commitment can gain an advantage.

- In 2024, sustainable investing reached $19 trillion in the U.S.

- A 2024 study shows 70% of consumers prefer eco-friendly brands.

- CM.com could attract investors with green initiatives.

Environmental factors are crucial for CM.com, including its data centers' energy usage, with global consumption at around 2% of electricity in 2022. E-waste management is also critical; global e-waste exceeded 53.6 million metric tons in 2019, and is expected to grow further by 2030.

Extreme weather events pose a risk to digital infrastructure, causing outages. Sustainability reporting, impacted by regulations like the EU's CSRD, is another factor. Both customers and investors now prioritize eco-friendly practices.

The pressure for CM.com includes, reducing environmental impacts and disclosing relevant details in its financial and operational reporting. As a result, investments and partnerships may rely on such information. Companies must adopt environmentally friendly policies in line with ESG principles to achieve the best business results.

| Aspect | Details | Impact on CM.com |

|---|---|---|

| Energy Use | Data centers globally use 2% of electricity in 2022. | Must focus on energy efficiency; EU's Green Deal matters. |

| E-waste | 53.6 million metric tons generated globally in 2019. | Proper disposal and recycling are key; CSR practices are important. |

| Reporting and Disclosure | CSRD and ESG factors require transparency. | Investor sentiment and corporate strategies will influence it. |

PESTLE Analysis Data Sources

The PESTLE analysis uses data from global databases, legal frameworks, economic indicators, and industry reports to guarantee reliable insights.