CNH Industrial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

What is included in the product

BCG matrix analysis of CNH Industrial's units. Outlines investment, holding, & divestment strategies.

Export-ready design allows quick insertion into presentations.

Full Transparency, Always

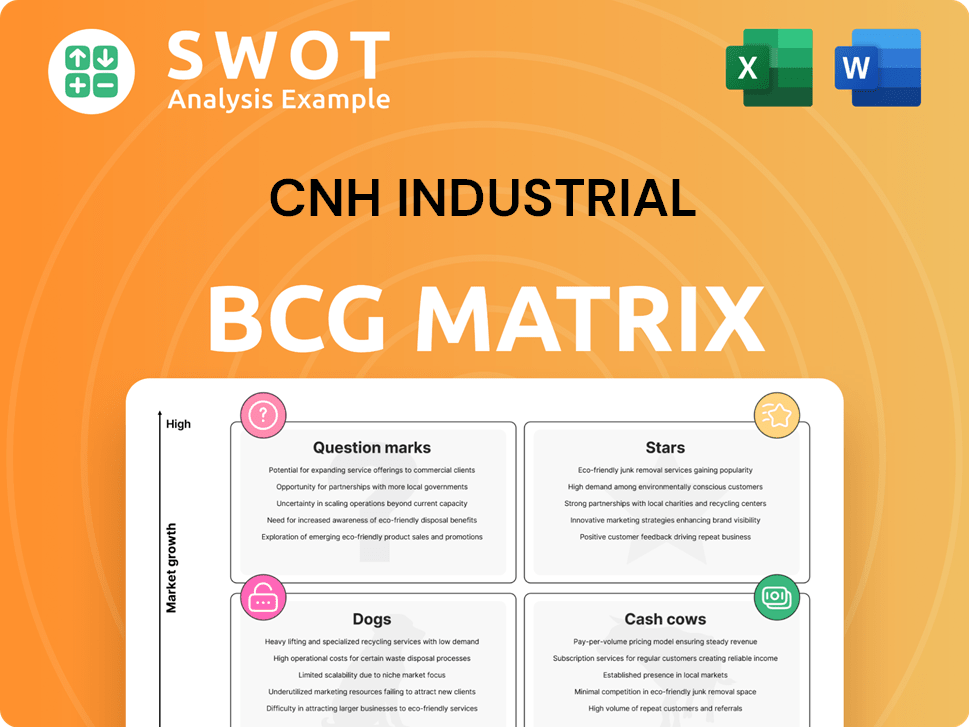

CNH Industrial BCG Matrix

The displayed preview is identical to the CNH Industrial BCG Matrix you'll receive. Fully formatted and prepared for immediate use, the complete document is ready to enhance your strategic analysis. Download the full, unedited version, no different from this preview, after purchase.

BCG Matrix Template

CNH Industrial navigates a complex market. Their BCG Matrix reveals product positioning—Stars, Cash Cows, etc. This snapshot offers a glimpse of their strategic landscape.

Understanding these placements is vital for informed decisions. Analyze product portfolios and allocate resources effectively. Gain a competitive edge by assessing their strategic positioning.

Unlock the full BCG Matrix to discover detailed insights and actionable strategies. Purchase now for a complete analysis in an easy-to-use format.

Stars

CNH Industrial strategically invests in precision agriculture, notably through Raven, signaling high growth. These technologies meet the rising need for efficient, sustainable farming. AI-driven automation boosts productivity and resource use, making CNH a market leader. In 2024, the precision ag market hit $12.5B, growing 11% YoY. Continued innovation and adoption are key.

Sustainable Powertrain Solutions is a "Star" for CNH Industrial. The focus is on alternative propulsion systems like biomethane tractors. Environmental concerns and regulations drive this growth. CNH's commitment aligns with global sustainability goals. Success hinges on tech advancements and infrastructure; in 2024, the alternative fuel market is valued at $40 billion.

CNH Industrial's financial services are a "Star" in its BCG matrix, supporting equipment sales. This segment's growth directly correlates with the agriculture and construction markets. Attractive financing boosts equipment purchases, increasing revenue for both. In 2024, CNH Industrial's financial services saw strong performance due to robust equipment demand and financing penetration.

Global Expansion in Key Markets

CNH Industrial's global expansion, especially in regions with booming agriculture and construction, presents significant growth prospects. Strategic alliances and tailored products can boost revenue and market share. Success hinges on adapting to local rules and customer needs. This approach needs careful planning across varied business landscapes. For example, CNH Industrial's revenue for 2024 was approximately $24 billion.

- Focus on high-growth regions: Asia-Pacific and Latin America.

- Adapt products: Offer models suited for local farming methods.

- Strategic partnerships: Collaborate with local distributors.

- Regulatory compliance: Ensure adherence to local standards.

Innovative Construction Equipment

The construction equipment segment is a Star for CNH Industrial, fueled by brands like CASE and New Holland Construction. Innovations such as new loader models and smart wheel loaders are boosting market share. CNH Industrial's construction equipment revenue in 2023 was $10.9 billion, a 14% increase year-over-year. This growth is driven by strong demand and product innovation.

- Revenue from construction equipment reached $10.9B in 2023.

- Year-over-year revenue growth was 14% in 2023.

- CASE and New Holland Construction drive the segment.

- Continuous innovation is key to maintaining Star status.

Stars in CNH Industrial's BCG matrix include Precision Agriculture, Sustainable Powertrain Solutions, Financial Services, Global Expansion, and Construction Equipment. These segments show high growth potential and require significant investment. Their success is vital for CNH's overall performance.

| Segment | 2024 Revenue (approx.) | Growth Drivers |

|---|---|---|

| Precision Ag | $12.5B | AI, automation, sustainable farming |

| Sustainable Powertrain | $40B (alt. fuels market) | Regulations, biomethane tech |

| Financial Services | Strong performance | Equipment demand, financing |

| Global Expansion | $24B (total revenue) | Strategic alliances, local products |

| Construction Equip. | $10.9B (2023) | Product innovation, demand |

Cash Cows

Case IH, a CNH Industrial brand, is a Cash Cow. Case IH holds a strong market share in agriculture. In Q3 2024, CNH Industrial's Agriculture segment generated $5.4 billion in revenue. Case IH's focus on quality and service fosters customer loyalty, supporting consistent revenue. Maintaining market share necessitates continuous product and service investment.

New Holland, a key CNH Industrial brand, is a Cash Cow due to its strong position in agriculture. It offers various products and generates stable revenue. New Holland's global presence and dealer network ensure consistent performance. In 2024, CNH Industrial's Agriculture segment, which includes New Holland, reported $19.5 billion in revenue.

FPT Industrial, a Cash Cow in CNH Industrial's portfolio, supplies engines and powertrains. The segment boasts stable demand, driven by agriculture and construction. In 2024, FPT Industrial's revenue showed consistent performance. Continuous innovation is vital to meet emissions standards.

North American Market Presence

CNH Industrial maintains a robust presence in North America, a key market for its agricultural and construction equipment. This region offers a steady, established market for CNH Industrial's offerings. Their expansive dealer network and strong brand recognition support consistent revenue generation. However, competition and market cycles demand careful financial management.

- In 2024, North American revenues accounted for approximately 40% of CNH Industrial's total revenue.

- CNH Industrial's market share in North America for tractors remained around 25% in 2024.

- The company's operating margin in North America was roughly 15% in 2024, reflecting profitability.

- The North American construction equipment market is expected to grow by 3-5% in 2024.

Service and Parts Operations

Service and parts operations at CNH Industrial represent a stable revenue stream, crucial for maintenance and repairs. This segment thrives on the existing machinery base, ensuring consistent demand for parts. Customer satisfaction and loyalty are boosted by reliable, timely service offerings. Optimizing parts distribution and expanding service offerings can enhance profitability.

- In 2024, CNH Industrial's service revenue grew, reflecting the importance of this segment.

- Parts and service contribute significantly to overall revenue, highlighting their value.

- Customer satisfaction scores are a key metric, reflecting service quality.

- Investments in digital service platforms are ongoing to improve efficiency.

Cash Cows in CNH Industrial's portfolio, like Case IH, New Holland, and FPT Industrial, deliver consistent revenue and hold strong market shares. These segments generate stable profits, fueled by established customer bases and dependable demand. Key to success is maintaining product quality, service excellence, and efficient operations.

| Segment | Revenue in 2024 (USD Billions) | Operating Margin in 2024 |

|---|---|---|

| Agriculture (Case IH, New Holland) | $19.5 | ~17% |

| FPT Industrial | ~$5.0 | ~14% |

| Service & Parts | Significant Contribution | High |

Dogs

Eurocomach mini and midi excavators, a part of CNH Industrial, could be classified as a Dog if market share and growth are low. These excavators target a specific construction niche. In 2024, CNH Industrial's revenue was approximately $24 billion. If Eurocomach underperforms, it might need a turnaround. Focus on differentiation and market penetration to improve its position.

Flexi-Coil, a CNH Industrial brand, focuses on tillage and seeding systems within the agricultural sector. Its classification as a Dog in the BCG matrix hinges on its market share and growth potential. If the brand struggles to compete effectively or innovate, it could face divestiture. In 2024, CNH Industrial's net sales were around $25 billion, and Flexi-Coil's contribution would be a fraction of that. A turnaround would require strategic marketing and product enhancements to cater to farmers' changing demands.

Miller Application Equipment, part of CNH Industrial, could be a Dog due to slow growth. This segment makes specialized equipment for applying fertilizers and pesticides. It faces challenges if it doesn't adapt to new farming methods. In 2024, CNH Industrial's net sales were around $24 billion.

Certain Legacy Construction Equipment

Certain legacy construction equipment, such as older models that struggle to compete, falls into the "Dog" category within CNH Industrial's BCG Matrix. These products often see low sales and limited growth prospects, requiring careful management to minimize their impact. The strategic decision involves phasing out these products to concentrate on more profitable, innovative offerings, like the latest electric models. Proper inventory control and disposal strategies are key to managing these assets effectively.

- In 2024, CNH Industrial reported a decrease in net sales in the construction segment compared to the previous year, indicating potential challenges in certain product lines.

- The company has been actively investing in new product development, including electric construction equipment, to boost its market position.

- Inventory management is a key focus, with strategies to reduce excess inventory of older models.

Regions with Declining Market Share

Specific geographic regions where CNH Industrial's market share is consistently declining are classified as Dogs in the BCG Matrix. These areas might struggle due to economic slowdowns or rising competition. For instance, CNH's sales in South America decreased by 15% in 2024. Tailoring strategies to local market conditions is key to reversing this. If unsuccessful, reallocating resources to better-performing markets becomes vital.

- Decline in South American sales by 15% in 2024.

- Economic downturns in specific regions.

- Increased competition impacting market share.

- Need to adapt strategies or reallocate resources.

Dogs within CNH Industrial represent underperforming areas with low market share and growth. These include specific product lines, like older construction equipment models, or geographic regions experiencing sales declines. Strategic decisions involve potential divestiture or reallocation of resources. CNH's focus includes electric models and geographic market tailoring.

| Category | Example | Strategy |

|---|---|---|

| Product Lines | Older construction equipment | Phasing out, inventory control |

| Geographic Regions | South America (15% sales decline in 2024) | Local adaptation, reallocation |

| Overall | Low market share, slow growth | Turnaround, divestiture, innovation |

Question Marks

CNH Industrial's autonomous farming technologies, while promising, currently hold a smaller market share, making them a Question Mark in the BCG Matrix. These technologies, like autonomous tractors and precision planting systems, boast high growth potential, but their adoption is still in early stages. The company invested $400 million in R&D in 2024. Key hurdles include regulations and farmer's acceptance.

CNH Industrial's electric construction equipment is a Question Mark in its BCG Matrix. Market penetration is low, reflecting a nascent stage. The shift to sustainable solutions is key, yet battery tech and costs pose challenges. To succeed, CNH needs innovation and partnerships. In 2024, the electric construction equipment market was valued at approximately $2.5 billion.

CNH Industrial's digital agriculture platforms, offering data-driven insights, are in the Question Mark quadrant. These platforms, with high growth potential but low market share, provide tools for farmers. In 2024, the precision agriculture market was valued at approximately $9.2 billion, growing steadily. Success hinges on demonstrating value and seamless integration. Addressing data security and user-friendliness is crucial for adoption.

Biomethane Powered Tractors

Biomethane-powered tractors fit the "Question Mark" quadrant due to their potential but uncertain future. They provide a sustainable alternative to diesel, offering environmental benefits and potentially lower operating costs. However, their market share remains small, and significant hurdles exist. Expanding their presence needs infrastructure and incentives.

- Market share is limited, with biomethane tractors representing a tiny fraction of the overall tractor market in 2024.

- Operating costs could be lower, with biomethane fuel potentially costing less than diesel, as seen in some regions in 2024.

- Infrastructure development, including fueling stations, is crucial but currently underdeveloped, particularly in rural areas in 2024.

- Range limitations and fuel availability pose challenges, as biomethane tractors may have shorter ranges than diesel models in 2024.

Emerging Markets in Africa and Asia

Expanding into African and Asian emerging markets offers CNH Industrial significant growth potential, especially with growing agricultural and construction sectors in these regions. However, CNH Industrial's market share in these areas remains relatively low, indicating a need for strategic focus. Success hinges on adapting products and services to local needs and establishing robust partnerships. Navigating the diverse regulatory environments and economic challenges is crucial for achieving sustainable growth.

- In 2024, the agricultural machinery market in Asia is projected to reach $35 billion.

- The construction equipment market in Africa is estimated to grow by 6% annually through 2028.

- CNH Industrial's revenue from emerging markets accounted for 28% of total revenue in 2023.

- Strategic partnerships are key: CNH Industrial has partnerships with local distributors in key African countries.

CNH Industrial faces hurdles in emerging markets despite growth potential. Low market share requires strategic efforts to capture opportunities. Adaptations and partnerships are key to navigating the challenges.

| Market | Market Size (2024) | CNH Share (2024) |

|---|---|---|

| Asia Agriculture | $35B | ~10% |

| Africa Construction | $15B, 6% Growth | ~8% |

| Emerging Markets Rev. (2023) | $7.3B (28% Total) | - |

BCG Matrix Data Sources

The CNH Industrial BCG Matrix uses company filings, industry reports, and financial data. These inputs are crucial for robust market position evaluation.