CNP Assurances Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNP Assurances Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs. It helps stakeholders digest complex data on the go.

Preview = Final Product

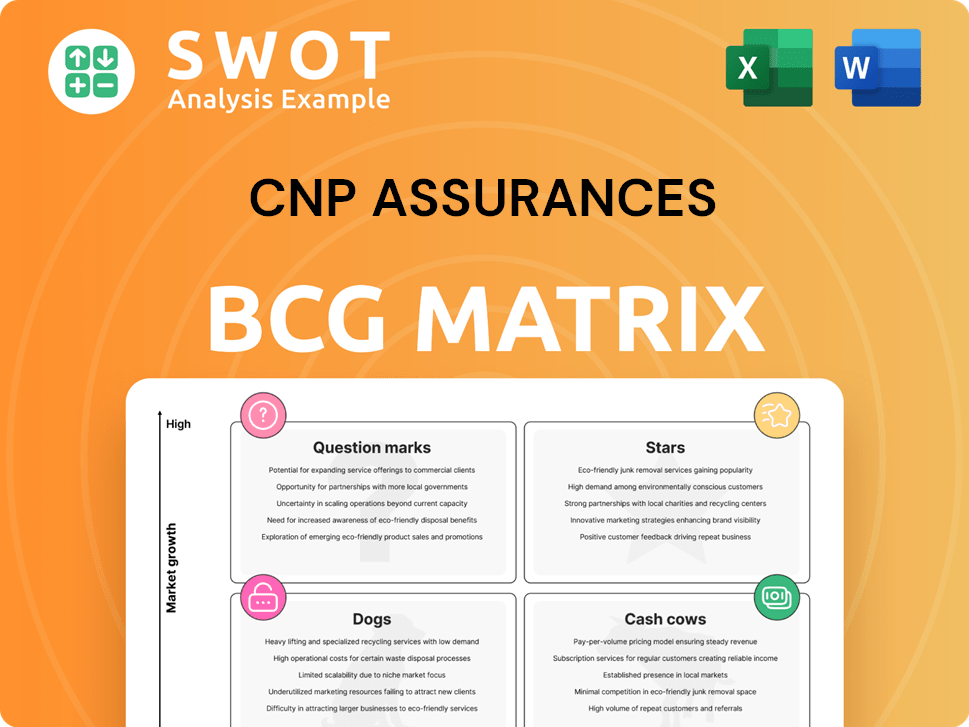

CNP Assurances BCG Matrix

The CNP Assurances BCG Matrix preview mirrors the purchased document. It's a ready-to-use strategic tool, delivering the same insightful analysis. Expect zero alterations: the full, professional-grade report is yours instantly.

BCG Matrix Template

CNP Assurances' product portfolio is complex. This sneak peek hints at its market dynamics: Stars, Cash Cows, Dogs, and Question Marks. Understanding this is key to strategic decisions. The limited view makes it hard to act decisively.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Social Protection Partnership, established in December 2024 with La Mutuelle Générale, is a strategic move for CNP Assurances. This partnership created a leader in social protection in France. It currently protects 1.4 million individuals. The venture aims for substantial growth, utilizing combined resources.

CNP Assurances positions green investments as a star in its BCG matrix. In 2024, the portfolio reached €29.4 billion, with a 2025 target exceeding €30 billion. These investments boost renewable energy and sustainable projects. The focus on reducing the carbon footprint aligns with global sustainability goals.

La Banque Postale network, a crucial partner, generated 31% of CNP Assurances' group premium income. This bancassurance model ensures the Group's financial stability and offers a wide distribution network. In 2024, this segment's growth continues to bolster CNP's performance, contributing to overall profitability.

Innovation and Digital Transformation

CNP Assurances is actively pursuing innovation and digital transformation, leveraging AI and generative AI to enhance both efficiency and customer experiences. In 2024, the company ramped up its digital initiatives, deploying over 80 AI services. These services have facilitated millions of API calls, showcasing a significant investment in technological advancement. This digital push aims to streamline operations, reduce fraud, and improve overall customer service.

- Over 80 AI services implemented.

- Millions of API calls processed.

- Focus on streamlining processes and fraud reduction.

- Improvement of customer service through AI.

Leading Position in France

CNP Assurances dominates the French life insurance market, solidifying its 'Star' status. It's the leader in term creditor insurance, a crucial segment. The acquisition of La Banque Postale's P&C business has boosted its full-service capabilities. This strong local presence supports expansion and leverages expertise across insurance lines. In 2023, CNP Assurances reported €32.9 billion in gross written premiums.

- No. 1 in term creditor insurance in France.

- Full-service insurer after integrating La Banque Postale's P&C business.

- Reported €32.9 billion in gross written premiums in 2023.

- Strong domestic presence provides a stable growth foundation.

CNP Assurances' 'Stars' include green investments and leadership in life insurance. Green investments grew to €29.4B in 2024, targeting over €30B in 2025. The company's strong domestic presence and focus on innovation solidifies its leading market position.

| Category | Key Data (2024) | Strategic Focus |

|---|---|---|

| Green Investments | €29.4B Portfolio | Sustainable Projects, Renewable Energy |

| Life Insurance | Market Leader, €32.9B (2023) | Expansion, Full-Service Capabilities |

| Digital Initiatives | 80+ AI Services | Efficiency, Customer Experience |

Cash Cows

CNP Assurances has long relied on traditional savings products, like life insurance, for steady income. These products are sold to the mass market and are supported by partnerships with La Banque Postale and BPCE. In 2024, these partnerships generated a substantial portion of CNP's revenue, although margins are typically lower. Their high volume ensures a consistent financial contribution.

CNP Assurances thrives in international hybrid debt markets, crucial for managing its debt obligations. The firm's financial leverage stays below 33%, and its EBIT interest coverage is above 8x. This robust financial health, supported by a strong credit rating, allows CNP to operate efficiently. These factors provide stability for CNP's future operations.

CNP Assurances excels in prudent asset and liability management, crucial for its "Cash Cows" status in the BCG matrix. They actively monitor various risk metrics across individual portfolios. This includes setting asset allocation, employing hedging strategies, and modeling liabilities. In 2023, CNP Assurances reported a solvency ratio of 204%, showcasing robust financial health.

Strong Capital Adequacy

CNP Assurances demonstrates strong capital adequacy, a key characteristic of a Cash Cow in the BCG matrix. The firm's robust financial health is underscored by its regulatory Solvency II ratio, which stood at 237% at the end of 2024. This solid capital base is a result of the company's consistent ability to generate capital through retained earnings and policyholder surplus. This financial strength underpins the company's resilience against market volatility.

- Solvency II ratio of 237% in 2024.

- Capital generation through retained earnings.

- Policyholder surplus reserves contribute to capital.

- Financial stability in fluctuating markets.

Long-Term Partnerships

CNP Assurances thrives on enduring partnerships in the cash cow quadrant. Key alliances with La Banque Postale and BPCE ensure a robust distribution network. These collaborations significantly boost premium income, providing a steady revenue stream. The stability of these partnerships is a cornerstone of their success.

- La Banque Postale contributed significantly to CNP Assurances' distribution in 2024.

- Partnerships with BPCE provided a stable source of premiums.

- These long-term relationships are crucial for consistent financial performance.

- The strength of these partnerships is reflected in CNP's financial stability.

CNP Assurances leverages traditional savings products and key partnerships for consistent revenue, solidifying its cash cow status. Their focus on prudent asset and liability management, with a 237% Solvency II ratio in 2024, ensures financial stability. Strong capital adequacy, supported by retained earnings, underpins their resilience and market strength.

| Key Feature | Impact | 2024 Data |

|---|---|---|

| Solvency II Ratio | Financial Health | 237% |

| Partnerships | Revenue Stability | La Banque Postale, BPCE |

| Capital Generation | Financial Strength | Retained Earnings, Policyholder Surplus |

Dogs

In 2024, CNP Assurances sold CNP Cyprus Insurance Holdings (CIH) to Hellenic Bank. CIH represented under 1% of CNP Assurances' total premium income. This move allows CNP to concentrate on key markets.

Traditional savings products, while safe, offer minimal growth. They typically have low margins, impacting profitability. CNP Assurances has been emphasizing life-protection and unit-linked products. In 2024, the shift aims to boost new business margins, reflecting a strategic pivot.

CNP Assurances confronts hurdles in unstable regions, where political and economic volatility directly impacts its operations. Instability and eroded trust hinder goal achievement and global partnerships. Emerging risks in these areas can dampen growth and potentially destroy capital. For instance, in 2024, political unrest in certain regions led to a 15% decrease in new business opportunities for insurance providers, like CNP Assurances, indicating the severity of these challenges.

Products with Low Market Share in Competitive Markets

In competitive markets, CNP Assurances might have products with low market share. These products may yield low returns, needing substantial investment for growth. Without quick market share gains, these products risk becoming cash traps, diverting resources. For instance, in 2024, certain insurance lines faced stiff competition, impacting their market share growth.

- Low market share means less revenue generation.

- High competition demands constant investment.

- Failure to grow share traps capital.

- Strategic review and potential divestment may be needed.

Underperforming International Ventures

CNP Assurances' international ventures, spanning 19 countries, aren't all high-flyers. Some face issues like market saturation and tough competition. These underperforming units can drag down overall profitability. Consider the impact of local regulations, a common challenge.

- 2024 data shows varying profitability across CNP's international operations.

- Market saturation in certain regions may limit growth potential.

- Regulatory changes in specific countries can hinder performance.

- Underperforming ventures can strain capital allocation.

In the BCG matrix, "Dogs" represent business units with low market share in slow-growth markets. These units often generate minimal profits or even losses. They may require significant investment to improve or sustain them, becoming a drain on resources.

They typically have negative or low cash flow, warranting careful consideration for divestiture. In 2024, CNP Assurances might have identified certain underperforming international ventures as "Dogs."

These were strategically reviewed for their impact on overall profitability, with potential actions like restructuring or disposal.

| Category | Characteristics | CNP Assurances Impact |

|---|---|---|

| Market Share | Low | Limited Revenue |

| Market Growth | Slow | Low Profitability |

| Cash Flow | Negative/Low | Resource Drain |

| Strategic Action | Divest, Restructure | Focus on Core Areas |

Question Marks

CNP Assurances is strategically focusing on unit-linked products to boost new business margins. These products, while offering growth, present higher risk and demand strong marketing. In 2024, unit-linked sales accounted for a significant portion of new business, reflecting this shift. Their success hinges on market dynamics and consumer uptake.

CNP Assurances is expanding its open-model distribution via new partnerships. These alliances, including CNP Vita Assicura and CNP Seguradora, present growth prospects. However, significant investments are needed for market penetration and expansion. Success hinges on effective collaboration; the ventures' outcomes are uncertain. In 2024, CNP Assurances reported a net income of €1.4 billion.

Following the 2023 integration, CNP Assurances entered the property and casualty market. This segment is competitive, requiring investment for market share and brand building. CNP faces established players like AXA and Generali. In 2024, the French insurance market saw premiums of around €250 billion.

Cybersecurity Insurance

CNP Assurances' cybersecurity insurance addresses rising cyber threats. This area shows high growth potential, yet faces uncertainty from evolving risks. Continuous adaptation of offerings and risk management is crucial. Cyber insurance premiums rose significantly in 2024. This reflects the increasing demand and the evolving threat landscape.

- Cyber insurance premiums surged in 2024.

- High growth potential exists within this sector.

- Evolving cyber threats pose significant uncertainties.

- CNP Assurances must adapt its strategies.

Products for Vulnerable Populations

CNP Assurances offers 14 products tailored for vulnerable populations, reflecting its commitment to inclusivity. These products aim to provide solutions for a broad spectrum of people. While these offerings have a positive social impact, their financial performance is still developing. Ongoing support is crucial to enhance market share and ensure their long-term viability.

- Product Focus: 14 specialized products.

- Strategic Goal: Promote an inclusive society.

- Current Status: Developing financial performance.

- Requirement: Ongoing support for growth.

In the BCG Matrix, Question Marks represent ventures with high market growth but low market share, requiring significant investment.

CNP Assurances' cybersecurity insurance and products for vulnerable populations fit this category.

Success demands strategic investments and agile adaptation to capitalize on growth prospects and manage inherent uncertainties. In 2024, the cybersecurity insurance market was worth $22 billion.

| Aspect | Cybersecurity Insurance | Products for Vulnerable Populations |

|---|---|---|

| Market Growth | High | High |

| Market Share | Low | Low |

| Investment Needs | Significant | Significant |

| 2024 Market Data | $22B | Developing |

BCG Matrix Data Sources

The CNP Assurances BCG Matrix uses financial statements, market analysis, and expert assessments for data-driven quadrant placements.