Coinbase PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coinbase Bundle

What is included in the product

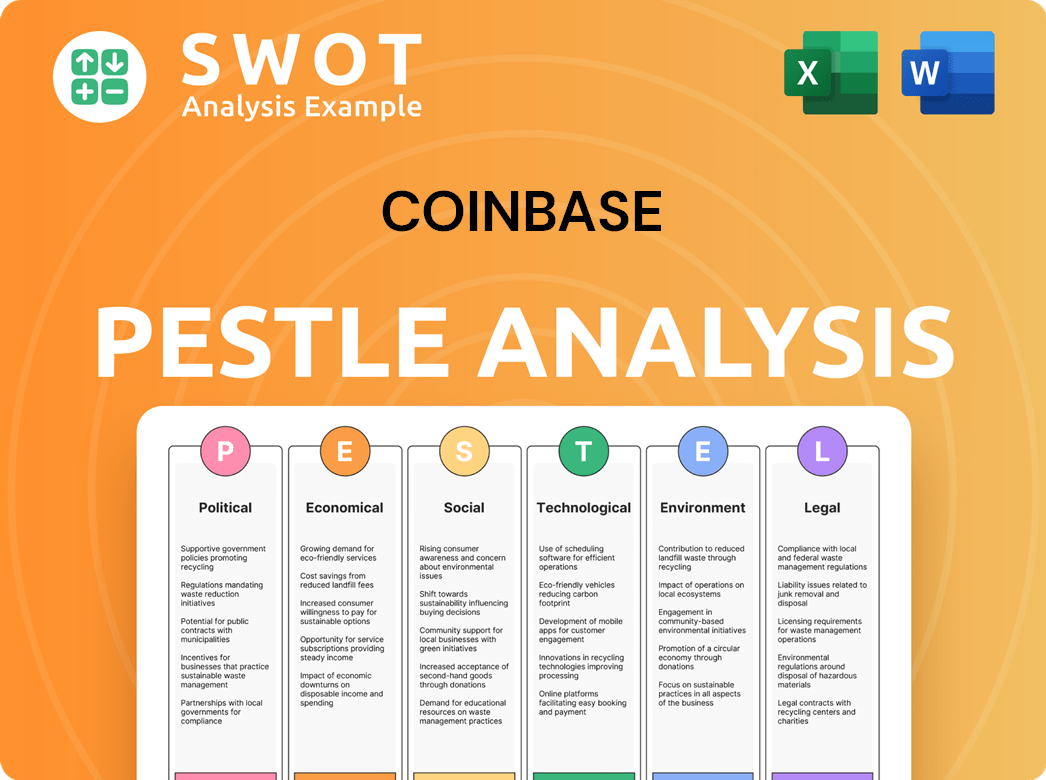

Analyzes Coinbase's external environment across six factors: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Coinbase PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

This is a detailed Coinbase PESTLE analysis. It assesses the Political, Economic, Social, Technological, Legal, and Environmental factors affecting the company.

See the document’s organized sections with key insights. Access detailed analysis to understand the opportunities & risks. The preview shows exactly the complete version to be downloaded.

PESTLE Analysis Template

Uncover Coinbase's future with our in-depth PESTLE Analysis. Explore the political & economic factors influencing its operations, & how social trends impact user adoption. This analysis helps forecast risks, understand growth opportunities & strengthen your strategy. Gain a competitive advantage by purchasing the full version. Get deep dive insights instantly!

Political factors

Government regulations worldwide heavily influence Coinbase. The regulatory environment is dynamic, with countries using different tactics, including supportive structures and outright bans. These policies affect Coinbase's operations, market entry, and global growth plans. For example, in 2024, regulatory clarity in the EU led to increased institutional interest. Coinbase's compliance costs rose by 15% in 2024 due to new regulations.

Political stability significantly affects the crypto market and Coinbase. Geopolitical events can drive interest in crypto as an alternative asset. Market volatility may increase due to political uncertainties. For example, the cryptocurrency market cap reached $2.6 trillion in early 2024, influenced by global events.

Government attitudes significantly impact Coinbase. Positive policies, like El Salvador's Bitcoin adoption, attract investment. Conversely, regulatory uncertainty, as seen in the US, can hinder growth. Supportive stances, such as those promoting crypto hubs, foster a better environment. For instance, in 2024, countries actively regulating crypto saw increased trading volumes.

Influence of Lobbying and Political Contributions

Cryptocurrency firms, including Coinbase, actively lobby and make political contributions to shape regulations. These actions carry both legal and reputational risks, potentially causing instability if viewed unfavorably by the public or regulators. Coinbase spent $1.2 million on lobbying in 2024. In 2023, the crypto industry spent $25.2 million on lobbying efforts.

- Coinbase's lobbying spend in 2024 was $1.2 million.

- The crypto industry's lobbying expenditure in 2023 reached $25.2 million.

Development of Central Bank Digital Currencies (CBDCs)

The exploration of Central Bank Digital Currencies (CBDCs) presents both challenges and opportunities for Coinbase. Governments worldwide are actively researching and piloting CBDCs; for example, the Digital Euro project is in its investigation phase as of May 2024. The introduction of CBDCs could potentially reshape the financial landscape, impacting the demand for and use of existing cryptocurrencies. However, there's also the possibility of integration, where platforms like Coinbase could facilitate the exchange or management of CBDCs.

- Digital Euro project is in its investigation phase as of May 2024.

- CBDCs could coexist with existing crypto infrastructure.

Political factors significantly influence Coinbase's operational and strategic decisions. Government regulations globally vary, affecting Coinbase's compliance costs, which increased by 15% in 2024. Political stability and attitudes towards crypto impact market volatility and growth opportunities. Coinbase allocated $1.2 million for lobbying in 2024, while the crypto industry spent $25.2 million in 2023.

| Aspect | Impact | Data |

|---|---|---|

| Regulations | Compliance Costs | Coinbase's compliance costs rose by 15% in 2024. |

| Lobbying | Political Influence | Coinbase spent $1.2M, crypto industry $25.2M (2023). |

| CBDCs | Future Market | Digital Euro in investigation (May 2024). |

Economic factors

Coinbase's revenue is heavily influenced by crypto market volatility, impacting trading volumes. In Q1 2024, Bitcoin's price fluctuated significantly. This volatility directly translates into unpredictable earnings. High volatility can both attract and deter traders. This unpredictability presents a key financial risk for Coinbase.

Inflation and interest rates are key macroeconomic factors impacting crypto investment. Lower rates and inflation can boost crypto market liquidity, potentially spurring rallies. In 2024, the Federal Reserve held rates steady, affecting market sentiment. Conversely, rate hikes can curb growth. As of May 2024, inflation stood at 3.3%.

Institutional investment is rising, with Bitcoin ETFs attracting billions. This boosts market stability and trading volumes. In Q1 2024, Bitcoin ETF inflows hit $12 billion. Coinbase benefits from increased institutional activity.

Global Economic Conditions

Global economic conditions significantly impact the cryptocurrency market. Economic uncertainty can drive some investors toward crypto as a hedge, but a downturn can stifle market growth. In 2024, the IMF projected global growth at 3.2%, a slight increase from 2023, indicating moderate expansion. This growth is crucial for investor confidence and market activity.

- IMF projects global growth of 3.2% in 2024.

- Economic downturns can decrease investor participation.

- Crypto can be seen as a hedge during uncertainty.

Competition in the Cryptocurrency Exchange Market

Coinbase navigates a highly competitive crypto exchange landscape. Crypto-native platforms like Binance and Kraken vie for market share, while traditional financial institutions are increasingly entering the crypto space. This competition pressures Coinbase to offer competitive trading fees and expand its service offerings. In 2024, Binance's trading volume was significantly higher than Coinbase's, illustrating the intensity of competition. Coinbase must continuously innovate to maintain its market position.

- Binance's trading volume often surpasses Coinbase's.

- Traditional financial institutions are entering the crypto market.

- Competition impacts trading fees and service offerings.

- Innovation is essential for market share.

Coinbase faces significant economic influences. Crypto market volatility impacts trading revenue unpredictably. Inflation and interest rates affect crypto investment, with the Federal Reserve holding rates steady in 2024. Global economic growth, projected at 3.2% by the IMF in 2024, is crucial.

| Factor | Impact on Coinbase | Data (2024) |

|---|---|---|

| Market Volatility | Unpredictable revenue | Bitcoin fluctuated significantly in Q1 |

| Inflation/Interest Rates | Affects liquidity and investment | Inflation: 3.3% (May) |

| Global Growth | Influences investor confidence | IMF: 3.2% growth |

Sociological factors

Public trust is key for crypto adoption, impacting platforms like Coinbase. Scandals and safety issues can damage confidence. A 2024 survey showed only 20% of Americans fully trust crypto. This lack of trust hinders wider acceptance and investment. Coinbase's success depends on addressing these concerns.

Cryptocurrencies are increasingly adopted worldwide, with Bitcoin's market cap at $1.3 trillion in early 2024. Institutional adoption is growing, boosting demand for crypto platforms. Coinbase's user base benefits from this trend, with over 100 million verified users reported in 2023. However, regulatory changes and market volatility remain key factors.

Consumer preferences are shifting towards decentralized systems, fueled by distrust in traditional finance. This is boosting interest in cryptocurrencies and platforms like Coinbase. The global cryptocurrency market was valued at $1.11 billion in 2023 and is projected to reach $4.94 billion by 2030. Integration of crypto with mainstream services impacts consumer behavior.

Influence of Social Media and Online Communities

Social media and online communities heavily influence the crypto market, impacting platforms like Coinbase. These platforms drive trends and discussions, affecting trading activities and investment narratives. In 2024, social media sentiment analysis showed a 20% correlation between positive posts and increased trading volume on major exchanges. The impact is substantial.

- Coinbase's user base grew by 30% in Q1 2024, partly due to social media trends.

- The "meme coin" phenomenon, driven by social media, saw a 500% increase in trading volume in Q2 2024.

- Regulatory scrutiny of social media's influence is increasing, with the SEC monitoring influencers.

Awareness and Understanding of Cryptocurrency

Many people still don't fully understand cryptocurrency, which holds them back from participating. Coinbase and others are working to simplify things. Education and easy-to-use platforms are key for more people to use crypto. According to a 2024 study, 32% of Americans have a basic understanding of cryptocurrency.

- 2024: Only 32% of Americans show basic crypto understanding.

- Coinbase focuses on user-friendly interfaces to address this.

- Educational initiatives are crucial for wider acceptance.

Social trust and education are critical; as of early 2024, only 20% of Americans fully trust crypto, which impacts platforms such as Coinbase. Cryptocurrency is expanding, influenced by social media and decentralized systems. Coinbase's growth correlates with shifting consumer behavior, and regulatory scrutiny of social media is on the rise.

| Factor | Impact | Data (2024) |

|---|---|---|

| Trust | Affects Adoption | 20% American crypto trust |

| Trend | Drives Activity | 30% Coinbase user growth (Q1) |

| Understanding | Limits Participation | 32% Basic crypto understanding |

Technological factors

Continuous advancements in blockchain technology are vital for Coinbase. Scalability upgrades and new protocols are key. These improve transaction speeds and cut costs. In 2024, Ethereum's upgrades aim to handle more transactions. This could significantly boost Coinbase's operational efficiency and user experience. Coinbase's revenue for 2024 is projected to be around $3.7 billion.

Coinbase benefits from AI and machine learning. These technologies improve automated trading and fraud detection. For example, AI-driven fraud detection reduced losses by 40% in 2024. Predictive market analysis also enhances decision-making. Coinbase invested $50 million in AI research in 2024, boosting platform efficiency.

Coinbase faces both opportunities and challenges from Web3 and DeFi. These sectors foster crypto innovation, potentially increasing user engagement and trading volumes. However, decentralized platforms could compete with centralized exchanges. In 2024, DeFi's total value locked (TVL) reached $50 billion, reflecting this growth. Coinbase must adapt to stay relevant.

Security Measures and Cybersecurity Threats

Coinbase prioritizes advanced security to safeguard user assets, a critical aspect given the increasing cyber threats. The exchange invests heavily in cybersecurity, allocating significant resources to protect against potential attacks. In 2024, the company reported spending $250 million on security measures. Continuous investment is essential, as cyber threats are constantly evolving. Maintaining user trust hinges on robust security protocols and proactive threat mitigation.

- Security spending: $250 million in 2024.

- Cybersecurity threats: constant evolution.

Innovation in Payment Solutions and Tokenization

Coinbase benefits from technological advancements in payment solutions. Innovation in crypto payments, including stablecoins, expands cryptocurrency use. Tokenization of real-world assets also increases crypto utility. These trends could boost Coinbase's user base and transaction volume.

- Stablecoin market cap reached $150B in early 2024.

- Tokenized assets projected to reach $16T by 2030.

- Coinbase processed $154B in trading volume in Q1 2024.

Coinbase's success depends on blockchain, AI, and Web3. Enhancements to blockchain like Ethereum's upgrades are key. These could improve transactions and cut costs, boosting user experience. In Q1 2024, trading volume hit $154 billion, underlining tech's impact.

| Technology Factor | Impact on Coinbase | 2024 Data |

|---|---|---|

| Blockchain Scalability | Faster Transactions, Lower Fees | Ethereum upgrades continue. |

| AI & ML | Improved Trading & Fraud Detection | 40% drop in fraud losses, $50M AI investment. |

| Web3 & DeFi | Growth in crypto adoption | DeFi TVL: $50B in 2024. |

Legal factors

Coinbase faces regulatory uncertainty due to inconsistent crypto laws globally. They must navigate varying rules across countries, impacting operations and compliance costs. For example, in 2024, Coinbase spent approximately $650 million on compliance. This includes anti-money laundering and consumer protection. Staying compliant with evolving regulations is crucial.

Coinbase faces legal uncertainty due to ongoing battles over digital asset classification. The SEC's stance on cryptocurrencies as securities directly affects Coinbase's listing practices. For instance, the SEC's case against Ripple has major implications. The outcomes of these cases influence Coinbase's operational scope and asset offerings. Regulatory clarity is essential for the company's future.

Coinbase must secure licenses across many jurisdictions. This includes money transmitter licenses in the U.S., and virtual asset service provider licenses elsewhere. These regulatory hurdles influence its global strategy. As of late 2024, Coinbase operates in over 100 countries, with licensing costs varying widely.

Taxation of Cryptocurrency Activities

Tax regulations significantly impact cryptocurrency activities, influencing how users trade and invest on platforms such as Coinbase. Many regions still lack clear tax guidelines, causing uncertainty for investors. The IRS treats crypto as property, subject to capital gains tax, which can reach up to 20% for long-term holdings. For instance, in 2023, the IRS collected over $3.5 billion in back taxes and penalties related to cryptocurrency.

- Capital gains tax rates can vary, potentially affecting trading decisions.

- Lack of clear guidelines can lead to compliance challenges and potential penalties.

- Tax implications are a key consideration for all Coinbase users.

Consumer Protection Laws

Consumer protection laws are rapidly changing for cryptocurrency users. Coinbase needs to adjust its operations to meet these new rules, prioritizing user safety and security. Regulatory actions, such as those by the SEC, continue to shape the legal landscape. Coinbase's legal and compliance costs rose to $105 million in Q1 2024, reflecting these challenges.

- Consumer protection frameworks are developing, impacting crypto platforms.

- Coinbase must comply with regulations to protect users.

- Legal and compliance costs have increased.

- SEC and other regulatory bodies actions.

Coinbase navigates legal hurdles from global crypto law inconsistencies, increasing compliance expenses. The company faces uncertainty due to digital asset classification battles, influencing listing and operations. Securing licenses and adhering to tax regulations are also critical aspects for its business strategy and users. In Q1 2024, Coinbase's legal and compliance costs were $105 million.

| Legal Factor | Impact | Example/Data |

|---|---|---|

| Regulatory Uncertainty | High operational & financial impact | Coinbase spent ~$650M on compliance in 2024. |

| Digital Asset Classification | Affects listing & asset offerings | SEC's Ripple case impact, operational scope. |

| Licensing Requirements | Global strategy & operational costs | Operates in 100+ countries; licensing costs vary. |

Environmental factors

Cryptocurrency mining, especially Proof-of-Work, consumes substantial energy, sparking environmental worries. Coinbase, as an exchange, isn't a miner, yet the market's perception and regulations influence investor sentiment. Bitcoin mining's yearly energy use is comparable to some countries. In 2024, Bitcoin's energy consumption was estimated at around 150 TWh annually.

Coinbase's environmental impact includes carbon emissions. Crypto mining, particularly Bitcoin, often relies on electricity from fossil fuels. This results in a considerable carbon footprint for the industry. As of late 2024, the Bitcoin network's annual energy consumption is estimated to be around 150 TWh.

Cryptocurrency mining hardware has a limited life, leading to e-waste. This poses an environmental challenge for the crypto industry. In 2023, global e-waste hit 62 million tons, a concern for Coinbase's reputation. This issue indirectly affects Coinbase.

Shift Towards More Sustainable Protocols

Coinbase must navigate the environmental landscape of the crypto industry. The shift towards sustainable blockchain protocols, like Proof-of-Stake, is accelerating. This move aims to reduce the crypto industry's carbon footprint and enhance its public perception. For instance, Ethereum's transition to Proof-of-Stake has significantly decreased its energy consumption. This is crucial for Coinbase's long-term sustainability and brand image.

- Ethereum's shift decreased energy use by over 99%.

- Proof-of-Stake is seen as more eco-friendly than Proof-of-Work.

- Coinbase is exploring carbon offsetting initiatives.

Environmental Regulations and Reporting

Environmental regulations are becoming stricter, with some regions mandating crypto platforms to report their energy use and environmental effects. Coinbase might encounter escalating demands to reveal and possibly diminish its environmental impact. This could lead to higher operational costs. The company is likely to invest in sustainable practices to meet these requirements.

- Increased scrutiny of energy consumption.

- Potential for higher operational costs.

- Need for investments in sustainable practices.

Coinbase faces environmental challenges from crypto's energy use and e-waste, particularly from Bitcoin mining's high energy demand. Regulatory pressures are increasing for transparency and sustainability. Ethereum's transition to Proof-of-Stake shows potential for reducing the industry's environmental footprint.

| Environmental Aspect | Impact on Coinbase | Data/Facts (2024/2025) |

|---|---|---|

| Energy Consumption | Reputational risk, regulatory scrutiny | Bitcoin uses ~150 TWh/yr; Ethereum’s PoS reduces energy use by over 99%. |

| Carbon Emissions | Indirect carbon footprint from crypto mining | Crypto mining often relies on fossil fuels, contributing to carbon emissions. |

| E-waste | Indirect impact; industry issue affecting perception | Global e-waste reached 62 million tons in 2023. |

PESTLE Analysis Data Sources

Coinbase's PESTLE draws on market reports, regulatory updates, economic data, tech trends, and public policy from leading agencies.