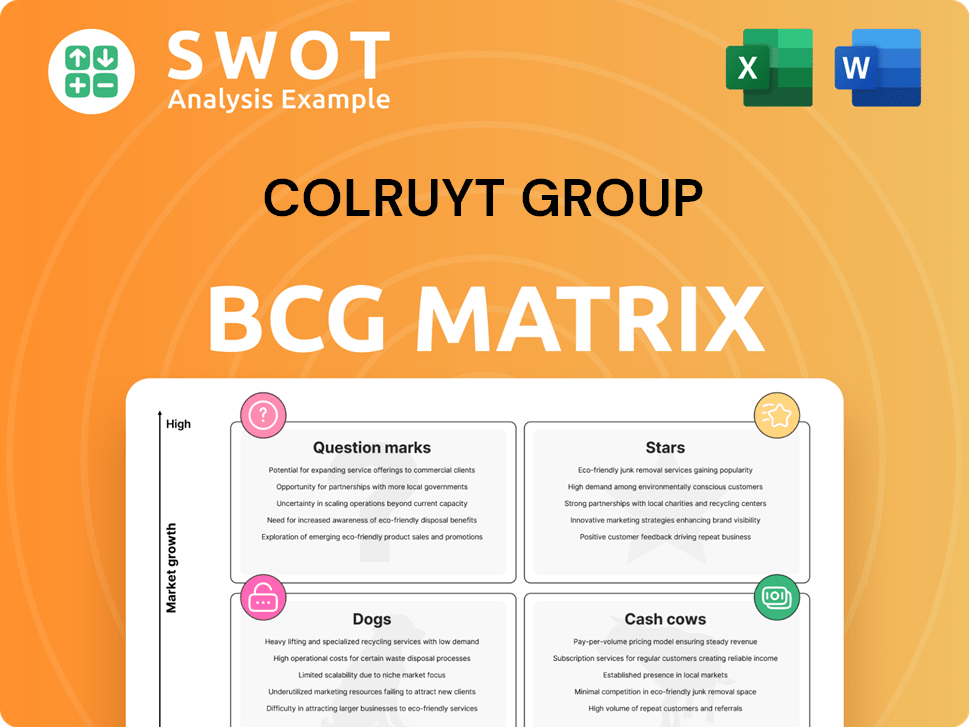

Colruyt Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

What is included in the product

Colruyt Group's BCG Matrix explores its diverse portfolio, revealing optimal investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs, making internal strategy discussions easy.

What You’re Viewing Is Included

Colruyt Group BCG Matrix

This Colruyt Group BCG Matrix preview is identical to the purchased document. You'll receive the fully editable analysis, free of watermarks and ready for immediate strategic application.

BCG Matrix Template

The Colruyt Group likely juggles a diverse portfolio across its various brands and services. Consider the positioning of its core supermarkets, wholesale, or renewable energy divisions in the BCG matrix. Understanding each business's market share and growth potential is vital for strategic allocation. The full BCG Matrix unveils detailed quadrant placements and data-driven recommendations.

This report goes beyond theory. The full version includes strategic moves tailored to the company’s actual market position—helping you plan smarter, faster, and more effectively.

Stars

Okay City stores, a key part of Colruyt Group's urban growth strategy, aim to open up to eight new stores annually. The focus is on expanding in Brussels, Antwerp, and Ghent. Colruyt aims to increase its market share in cities from 20% to at least 30%. This is due to growing urban populations needing accessible stores.

Colruyt Group is actively expanding in the B2B sector. Solucious's acquisition of Délidis in 2024 enhanced its catering industry presence. This aligns with Colruyt's strategy to capitalize on B2B growth. The group anticipates significant expansion in services for professional clients, aiming to boost overall revenue.

Colruyt Group is boosting its sustainability efforts. They plan 100% recyclable packaging for private-label products by 2025. The company aims to use rainwater/wastewater for half of its water needs. They're also investing in electric trucks by 2030. This shows their dedication to environmental responsibility.

Newpharma's Growth

Newpharma, Colruyt Group's online pharmacy, shines as a Star in its BCG matrix. It boasts impressive revenue growth, with a 20% increase in comparable sales. This growth is fueled by successful international expansion, particularly in France, Switzerland, and the Netherlands. Newpharma's performance strengthens Colruyt Group's position in the health sector.

- 20% comparable revenue growth.

- Expansion into France, Switzerland, and the Netherlands.

- Strengthening Colruyt Group's health sector presence.

Innovation Hub Projects

Colruyt Group's innovation hub, Smart Technics, is actively developing solutions like smart fridges for various clients. These initiatives showcase Colruyt's investment in innovation. The company is also exploring sustainable potato farming techniques. This includes soil sensors, drones, and advanced seeds, aligning with its sustainability goals.

- Smart Technics develops smart fridge solutions.

- The company tests sustainable potato farming methods.

- Colruyt Group is committed to innovation and sustainability.

- This strategy aligns with Colruyt's long-term goals.

Newpharma, as a Star, leads with 20% revenue growth, fueled by international expansion, particularly in France, Switzerland, and the Netherlands. This drives Colruyt Group's health sector presence. Newpharma's success boosts Colruyt's revenue, solidifying its market position.

| Metric | Value |

|---|---|

| Revenue Growth | 20% |

| Expansion | France, Switzerland, Netherlands |

| Sector Impact | Health |

Cash Cows

Colruyt Lowest Prices exemplifies a cash cow, driven by its strong market presence and cost leadership strategy. The brand's promise of the lowest prices ensures customer loyalty and sustained market share. In 2024, Colruyt's revenue reached €10.8 billion. Colruyt is expanding into the hospitality sector, offering tailored product ranges.

Boni Selection, Colruyt Group's private label, is a cash cow. It offers a diverse product range, appealing to a broad customer base. In 2024, private labels like Boni Selection accounted for a significant portion of Colruyt's sales. The introduction of the Eco-Score enhances customer loyalty. This focus on sustainability supports long-term profitability.

Collect&Go, Colruyt Group's online grocery service, is a cash cow. It benefits from established market leadership and a wide network of collection points. With over 200 locations in Belgium and Luxembourg, it highlights consistent performance and a strong customer base. Since its start in 2000, the service has been growing. Colruyt continues to invest in it.

DATS 24 Filling Stations

DATS 24 filling stations are cash cows for Colruyt Group, providing consistent revenue. In 2024, they benefited from the group's infrastructure and expanded B2B fuel card sales. DATS 24 is investing in sustainability. This includes green energy and emission-free transport to ensure long-term profitability.

- Consistent Revenue: DATS 24 offers stable income.

- B2B Expansion: Fuel card sales to businesses boost revenue.

- Sustainability Focus: Investments in green energy are ongoing.

- Integrated Operations: Part of Colruyt Group's network.

Spar and Comarkt Stores

Spar and Comarkt stores, acquired by Colruyt Group, are cash cows in their BCG matrix. These stores generate steady cash flow because of their established market presence. Colruyt's resources help maintain their market position and revenue. The group's strategic acquisitions are beneficial.

- Spar and Comarkt stores contribute to Colruyt's consistent revenue stream.

- These stores benefit from Colruyt's operational efficiencies.

- The acquisitions enhance Colruyt's market coverage.

- They provide a stable source of income for the group.

Colruyt Group's cash cows consistently generate revenue. In 2024, these brands contributed significantly to the group's total sales. They leverage Colruyt's established market position for sustainable growth. This ensures financial stability.

| Cash Cow | Revenue Driver | 2024 Impact |

|---|---|---|

| Colruyt Lowest Prices | Cost Leadership | €10.8B Revenue |

| Boni Selection | Private Label | Significant Sales |

| Collect&Go | Online Grocery | 200+ Locations |

| DATS 24 | Filling Stations | B2B Fuel Cards |

| Spar & Comarkt | Acquisitions | Steady Cash Flow |

Dogs

Bike Republic faced a tough year, with sales decreasing by 8.9% in 2024 amid a tough bicycle market. This performance contrasts with the Colruyt Group's overall growth. The sales decline indicates a challenging market position for Bike Republic. It might be classified as a 'dog' in the BCG matrix, needing strategic reassessment.

If Colruyt Group primarily uses print ads, it's a 'dog' in its BCG Matrix. Print's reach is shrinking; digital is key. In 2024, print ad spending decreased, while digital rose. Without digital, Colruyt risks wasted ad dollars.

Colruyt Group's use of non-recyclable packaging could be a 'dog' if not addressed. Failing to meet its 2025 goal for 100% recyclable packaging is risky. This could damage its reputation and alienate eco-conscious customers. In 2024, sustainable packaging made up 90% of Colruyt's total.

Inefficient Energy Consumption (Legacy Systems)

Inefficient energy consumption in older Colruyt Group stores, due to legacy systems, positions them as 'dogs' in the BCG matrix, especially if not updated. These outdated systems drive up operational costs and expand the carbon footprint, affecting both profits and sustainability. Colruyt's 2024 report shows energy expenses represent a significant portion of their operational spending, underlining the impact. Upgrading to energy-efficient systems becomes crucial.

- High operational costs from outdated systems.

- Increased carbon footprint, affecting sustainability targets.

- Significant energy expenses impacting profitability.

- Need for investment in energy-efficient upgrades.

Outdated Inventory Management Systems (Isolated Cases)

Some Colruyt Group stores using outdated inventory systems without computer vision could be classified as 'dogs' in a BCG matrix. These systems can result in inventory errors and inefficiencies, impacting operational costs. For example, outdated systems might lead to a 5% increase in stockouts, as reported by a 2024 retail operations study. This situation directly affects customer satisfaction and profitability.

- Stockouts impact customer satisfaction and profitability.

- Outdated systems may increase operational costs.

- A 2024 study shows a potential 5% increase in stockouts.

- Inefficient restocking negatively affects profitability.

Colruyt Group's ventures facing challenges or low growth rate are 'dogs' in the BCG matrix.

These ventures may include those with decreasing sales or those that are not meeting sustainability targets.

Inefficiencies like outdated systems or packaging lead to higher costs and potential reputational damage.

| Aspect | Impact | 2024 Data/Examples |

|---|---|---|

| Sales Decline | Lower Revenue | Bike Republic sales down 8.9% |

| Inefficiency | Higher costs, lower profit | Outdated inventory systems |

| Sustainability | Reputational damage | Non-recyclable packaging |

Question Marks

Yoboo Health Platform is a question mark, as Colruyt ventures into health prevention. Its integration with retail and health services needs investment. Colruyt's 2024 revenue was €10.09 billion. The platform's future market share is uncertain.

Colruyt Professionals stores, targeting the hospitality sector, are question marks. The B2B expansion in Bruges and Aalst is monitored closely. In 2024, the B2B market showed a 3% growth. Its success hinges on profitability in a competitive landscape.

Colruyt Group's vertical farming, growing basil with little environmental impact, is a question mark. It needs more investment and development. The success depends on scalability, cost-effectiveness, and consumer acceptance. In 2024, the global vertical farming market was valued at $7.8 billion.

Plant-Based Sub-Brands

Plant-based sub-brands for Colruyt Group are question marks. They are entering a competitive market, requiring substantial investment in marketing and distribution. Success hinges on effectively capturing market share against established brands. Colruyt must navigate this growth area carefully.

- Colruyt Group's revenue in 2024 was approximately €10.3 billion.

- The plant-based food market is projected to reach $77.8 billion by 2025.

- Marketing costs can range from 5% to 20% of revenue.

Home Delivery Services

Colruyt Group's home delivery services, utilizing electric cargo bikes and vans, represent a question mark in its BCG Matrix. This venture's success hinges on achieving logistical efficiency, managing costs effectively, and gaining customer acceptance. It requires continuous investment and optimization to mature. The home delivery market is competitive, with established players and evolving consumer preferences.

- Expansion into home delivery is a strategic move by Colruyt.

- Success depends on efficient logistics and cost control.

- Customer adoption is crucial for the venture's growth.

- Ongoing investment and optimization are essential.

Home delivery is a question mark for Colruyt, focused on efficiency and customer adoption. The 2024 home delivery market grew by 15%, with logistics costs a major factor. Success needs efficient logistics, customer acceptance, and cost management.

| Aspect | Details | Implication |

|---|---|---|

| Market Growth (2024) | 15% | Indicates potential, but also heightened competition. |

| Logistics Costs | Significant variable expense | Efficiency crucial for profitability. |

| Customer Adoption | Key for revenue growth | Focus needed on customer satisfaction and marketing. |

BCG Matrix Data Sources

The Colruyt Group BCG Matrix draws from financial statements, market reports, and expert analyses to guide strategic decisions.