Comcast Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comcast Corporation Bundle

What is included in the product

Analyzes Comcast's position within its competitive landscape, detailing forces affecting its market share.

Customize pressure levels based on new data and market trends for agile strategy.

Preview Before You Purchase

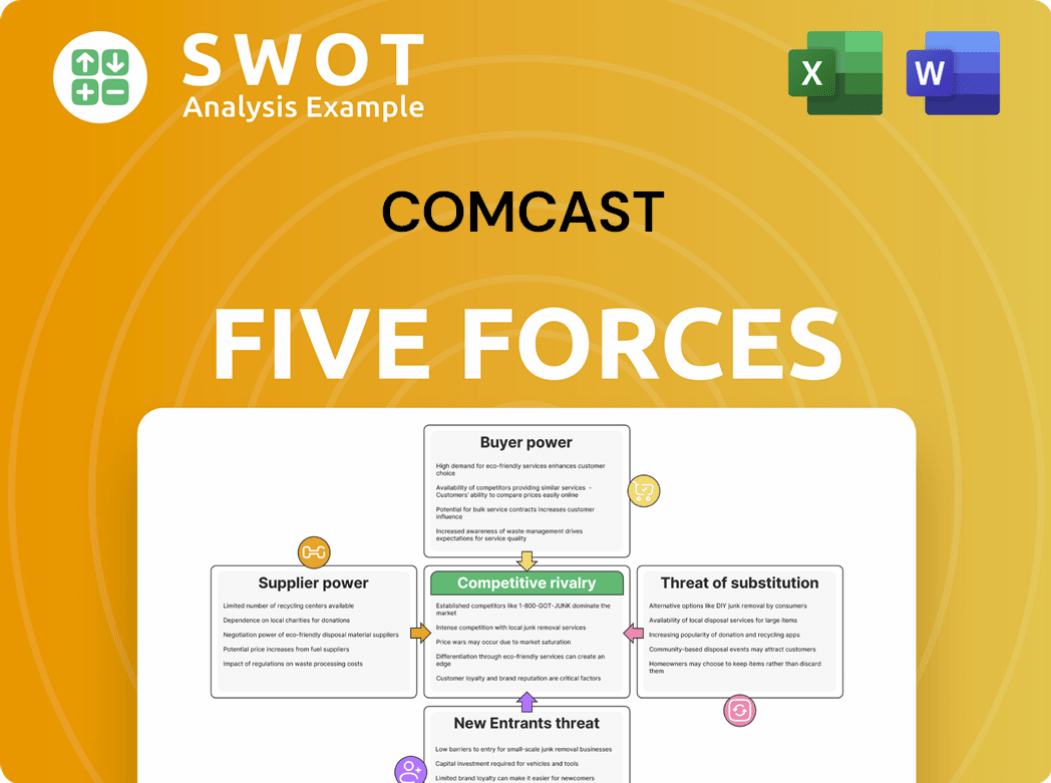

Comcast Porter's Five Forces Analysis

This preview shows the exact Comcast Porter's Five Forces Analysis document you'll get immediately after purchase. Analyze competitive rivalry, supplier power, and more. The document is comprehensive, professionally written, and fully formatted. It provides a clear, concise examination of Comcast's market position. No surprises; what you see is what you download!

Porter's Five Forces Analysis Template

Comcast navigates a complex media landscape. Buyer power is moderate, shaped by consumer choice. Supplier power is influenced by content providers like studios. The threat of new entrants is limited due to high capital costs. Substitute products, such as streaming, pose a notable threat. Competitive rivalry is intense with major players vying for market share.

Ready to move beyond the basics? Get a full strategic breakdown of Comcast’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Comcast depends on suppliers for content, equipment, and services. Strong supplier contracts, with favorable terms, can lessen their influence. Examining these contracts reveals Comcast's negotiation strength. In 2024, Comcast spent approximately $25 billion on programming and content.

Content creators, particularly those with exclusive or hit shows, have substantial bargaining power. Comcast relies on these providers for its cable and streaming services, giving them a negotiating edge. Consider that in 2024, Disney's content accounted for a significant portion of streaming viewership. Examining the concentration of content ownership is essential; for instance, the top 5 media companies control a majority of the most-watched content.

Equipment manufacturers hold some sway over Comcast due to their specialized offerings. Set-top box and network infrastructure suppliers can exert pressure. Comcast can lessen this power by diversifying suppliers and investing in its own tech development. In 2024, Comcast spent billions on network upgrades, highlighting its dependence on these suppliers.

Labor unions impact costs

Labor unions, representing technicians and actors, impact Comcast's labor costs. These unions can push for higher wages and benefits, thus increasing operational expenses. The labor relations landscape is important to consider. In 2024, Comcast faced negotiations with various unions, potentially affecting its financial outlook. Understanding these dynamics is crucial for assessing the company's cost structure.

- Unionized workers at Comcast include those in technical, creative, and customer service roles.

- Wage and benefit negotiations can significantly affect the company's operational costs.

- Labor disputes or strikes could disrupt service delivery and impact revenue.

- Comcast's labor costs are a key factor in its overall profitability.

Technology providers are key

Comcast depends on tech suppliers for streaming, cybersecurity, and data analytics. This reliance gives these suppliers some leverage. For example, in 2024, cybersecurity spending is projected to reach $215 billion globally, showing the providers' importance. Evaluating the competitive landscape of these technology providers is essential for Comcast.

- Streaming technology providers are crucial for content delivery.

- Cybersecurity suppliers protect Comcast's infrastructure.

- Data analytics services help Comcast understand customer behavior.

- The bargaining power of these suppliers affects Comcast's costs.

Comcast faces supplier bargaining power from content creators, equipment manufacturers, tech providers, and labor unions. Content providers, especially those with exclusive content, hold considerable leverage. Suppliers' influence affects costs and operations.

| Supplier Type | Bargaining Power | Impact on Comcast |

|---|---|---|

| Content Creators | High (Exclusive content) | Increased programming costs, dependence |

| Equipment Manufacturers | Moderate (Specialized offerings) | Network upgrade costs, technology lock-in |

| Labor Unions | Moderate (Negotiated wages) | Higher labor costs, potential service disruptions |

| Tech Suppliers | Moderate (Streaming, cybersecurity) | Technology costs, cybersecurity expenses |

Customers Bargaining Power

Customers now have numerous options for entertainment and communication. Streaming services, satellite, and fiber-optic internet offer alternatives to Comcast. This increased choice empowers customers to switch providers easily. Comcast's churn rate, a key metric, reflects customer switching behavior. In 2024, Comcast's churn rate was around 1.9%, indicating some customer turnover.

Customers' price sensitivity is high, readily comparing prices. Comcast faces pressure to offer competitive pricing and value. This impacts profitability as customers switch providers for better deals. Monitoring pricing trends and customer value perceptions is critical. In 2024, the average monthly cable bill was around $75, highlighting this sensitivity.

Customers in the cable and internet industry now demand top-notch service, including dependable internet and quick customer support. Dissatisfaction and customer turnover can result from subpar service. For instance, in 2024, Comcast's customer satisfaction score was 68 out of 100. Analyzing customer satisfaction scores and service performance metrics, such as average call wait times, is crucial. The ability of customers to switch providers also strengthens their negotiating power.

Bundling increases retention

Comcast's ability to bundle services like cable, internet, and phone enhances customer retention. Bundled packages provide customers with convenience and potential cost savings, increasing their loyalty. Analyzing the effectiveness of bundling strategies is crucial for maintaining a competitive edge. In 2024, Comcast's bundled packages were a significant factor in retaining approximately 60% of its customer base.

- Bundling increases retention

- Offers convenience and cost savings

- Effectiveness of bundling strategies is important

- Comcast's bundling retained ~60% of customers in 2024

Data privacy concerns matter

Data privacy is a major concern for customers, impacting their choices. Comcast, like other providers, must prioritize data security to maintain customer trust. In 2024, data breaches cost companies an average of $4.45 million, emphasizing the stakes. Assessing Comcast's data handling practices is vital for informed decisions.

- Data breaches cost companies an average of $4.45 million in 2024.

- Customer trust is crucial for maintaining market share.

- Privacy policies directly affect customer satisfaction.

- Data security incidents can lead to significant financial penalties.

Customers wield significant power due to multiple service options. Competitive pricing is vital, affecting Comcast's profitability. Service quality, like internet reliability, is essential for customer retention.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Churn Rate | Customer Switching | ~1.9% |

| Avg. Monthly Bill | Price Sensitivity | ~$75 |

| Customer Satisfaction | Service Quality | 68/100 |

Rivalry Among Competitors

The broadband market is fiercely competitive, with giants like Verizon, AT&T, and T-Mobile battling for subscribers. Comcast experiences significant pressure to retain its customer base. In Q3 2024, Comcast reported 20,000 net broadband customer additions, reflecting ongoing competition. Keeping tabs on rival strategies and shifts in market share is crucial for survival.

The surge of streaming services significantly intensified competitive rivalry in the media landscape. Netflix, Disney+, and Amazon Prime Video aggressively vie for consumers, challenging traditional cable like Comcast. This rivalry necessitates Comcast to adapt to attract viewers and maintain revenue streams. In 2024, streaming services accounted for over 38% of TV viewing in the U.S., underscoring their dominance and impact.

Comcast's NBCUniversal faces intense competition in content creation. This includes giants like Disney and Netflix. To stay ahead, Comcast invests heavily in original content. In 2024, NBCUniversal's content spending was around $24 billion. This is crucial to attract and keep viewers.

Technology innovation is key

Technology innovation is a crucial factor in the competitive landscape. Comcast faces constant pressure to innovate due to rapid technological advancements in telecommunications and media. Staying ahead requires significant investment in new technologies, such as 5G and streaming platforms.

- Comcast invested $10.1 billion in capital expenditures in 2023, including technology upgrades.

- The company's Xfinity mobile service competes with other mobile providers.

- Comcast's streaming service, Peacock, competes with Netflix and Disney+.

- Tracking adoption of technologies like Wi-Fi 6E and advanced video compression is essential.

Marketing and promotion battles

Marketing and promotion are significant battlegrounds for companies like Comcast, which invest heavily to capture and keep customers. Comcast needs to be exceptionally effective in its marketing strategies to differentiate itself. A careful examination of Comcast’s past and current marketing campaigns and their performance is essential. This evaluation helps assess their competitiveness.

- Comcast spent $6.9 billion on sales and marketing in 2023.

- This figure indicates the intense competition in the industry.

- Analyzing campaign effectiveness is vital for strategic decisions.

- Comcast's marketing ROI is a key performance indicator.

Competitive rivalry significantly impacts Comcast's operations. Intense competition exists in broadband, streaming, and content creation. Comcast invested billions in technology and marketing to stay ahead.

| Area | Competitors | Comcast Response (2024) |

|---|---|---|

| Broadband | Verizon, AT&T, T-Mobile | $10.1B in tech upgrades (2023) |

| Streaming | Netflix, Disney+, Amazon | Peacock service, original content |

| Content | Disney, Netflix | $24B content spend |

SSubstitutes Threaten

Streaming services directly compete with Comcast's cable TV, providing on-demand content. Their growing popularity threatens Comcast's core business. In 2024, streaming subscriptions continued to rise, with Netflix reaching over 260 million subscribers globally. Understanding the impact of these services is essential for Comcast's future.

The rise of streaming services poses a significant threat to Comcast. Cord-cutting is intensifying, with more people ditching traditional cable. This shift is directly impacting Comcast's cable subscriptions. Data from 2024 shows a continued decline in pay-TV subscribers. Investors should watch how Comcast navigates this changing landscape.

Fiber optic internet, offering superior speed and reliability, challenges Comcast's cable internet dominance. Competitors like Verizon and Google Fiber aggressively expand fiber optic networks, increasing the threat. In 2024, fiber optic subscriptions grew, impacting Comcast's market share. Monitoring fiber optic deployment is crucial for assessing competitive pressures.

Satellite TV remains an option

Satellite TV, offered by providers like Dish Network and DirecTV, poses a threat as a substitute for Comcast's cable services, especially in regions where cable infrastructure is less developed. Although satellite TV may have certain drawbacks, it remains a viable option for some customers. Examining the competitive standing of satellite providers is crucial. Data from 2024 indicates that satellite TV subscriptions account for a significant portion of the pay-TV market.

- In 2024, satellite TV providers held approximately 20% of the pay-TV market share.

- Rural areas often rely more on satellite due to limited cable availability.

- Satellite TV packages often compete on price and content bundles.

- Comcast must continuously assess satellite's market impact.

Over-the-air broadcasting persists

Over-the-air (OTA) broadcasting presents a substitute threat to Comcast, offering free access to local channels. This option appeals to budget-conscious viewers, even if its channel selection is limited compared to cable. The significance of OTA broadcasting as a substitute varies based on consumer preferences and market demographics. In 2024, approximately 14% of U.S. households rely on OTA signals as their primary TV source.

- OTA provides free access to local channels, a substitute for some.

- Its low-cost nature makes it a viable alternative for certain viewers.

- The relevance of OTA as a substitute varies based on market factors.

- Around 14% of U.S. homes used OTA in 2024.

Comcast faces substantial threats from various substitutes. Streaming services, like Netflix, with over 260 million subscribers in 2024, challenge cable TV. Fiber optic internet from competitors also increases pressure. Satellite TV and OTA broadcasting further diversify the market.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Streaming | On-demand content competes directly | Netflix: 260M+ subscribers |

| Fiber Optic | Offers superior speed | Subscription growth impacting Comcast |

| Satellite TV | Viable alternative, esp. rural | Approx. 20% pay-TV market share |

| OTA Broadcasting | Free access to local channels | 14% U.S. households rely on OTA |

Entrants Threaten

High capital costs significantly hinder new entrants in the telecommunications and media sectors. Building infrastructure, acquiring content, and developing technology demand substantial financial resources. For instance, in 2024, the average cost to deploy fiber optic networks can exceed $50,000 per mile. This financial hurdle effectively limits the number of potential new competitors. Assessing these capital demands is vital for strategic industry evaluation.

The telecommunications and media sectors face strict regulations, creating barriers for new entrants. New companies must overcome complex licensing and compliance, potentially delaying market entry. Regulatory hurdles can significantly impact a new firm's ability to compete. For instance, in 2024, the FCC imposed substantial fines on several companies for non-compliance, highlighting the importance of understanding the regulatory landscape.

Established companies such as Comcast benefit from strong brand recognition and customer loyalty, making it challenging for new entrants. New entrants face significant marketing and branding costs to build awareness. In 2024, Comcast's brand value was estimated at over $70 billion. Assessing brand recognition is essential in evaluating the threat of new competitors.

Economies of scale matter

Comcast, a major player in the telecom industry, enjoys significant economies of scale. This advantage enables Comcast to offer competitive pricing and invest heavily in cutting-edge technologies. New entrants often face an uphill battle trying to match Comcast's cost structure, making it difficult to compete effectively. Assessing the impact of these economies of scale is crucial when evaluating the threat of new competitors.

- Comcast's capital expenditures in 2024 were approximately $10.9 billion.

- The company's revenue for 2024 was around $122.9 billion.

- Comcast's subscriber base in 2024 included roughly 30.8 million customer relationships.

Access to content is critical

Securing access to quality content is crucial for media companies like Comcast. New entrants often struggle to obtain content rights, which can be expensive and difficult to secure. This is a significant barrier to entry. Assessing content availability and acquisition costs is therefore essential. Consider the high costs that Comcast pays for content rights.

- Comcast's content costs significantly impact its financial performance.

- New entrants face content acquisition challenges.

- Comcast's content strategy is crucial.

- Content rights are a major cost factor.

New entrants face substantial obstacles. High capital needs and stringent regulations create major hurdles for potential competitors, limiting their ability to enter the market. Comcast's strong brand and economies of scale further intensify these challenges. Content acquisition costs and access also pose significant issues for those looking to compete.

| Factor | Impact on New Entrants | Data (2024) |

|---|---|---|

| Capital Costs | High barriers to entry | Fiber optic deployment: ~$50,000/mile |

| Regulations | Compliance challenges | FCC fines for non-compliance |

| Brand & Scale | Competitive disadvantage | Comcast's brand value: $70B+, Capex: $10.9B |

Porter's Five Forces Analysis Data Sources

The analysis uses SEC filings, annual reports, and industry-specific publications to assess competition. We also incorporate market research and financial analysis reports.