Continental Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Continental Materials Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs that empowers strategic discussions.

What You’re Viewing Is Included

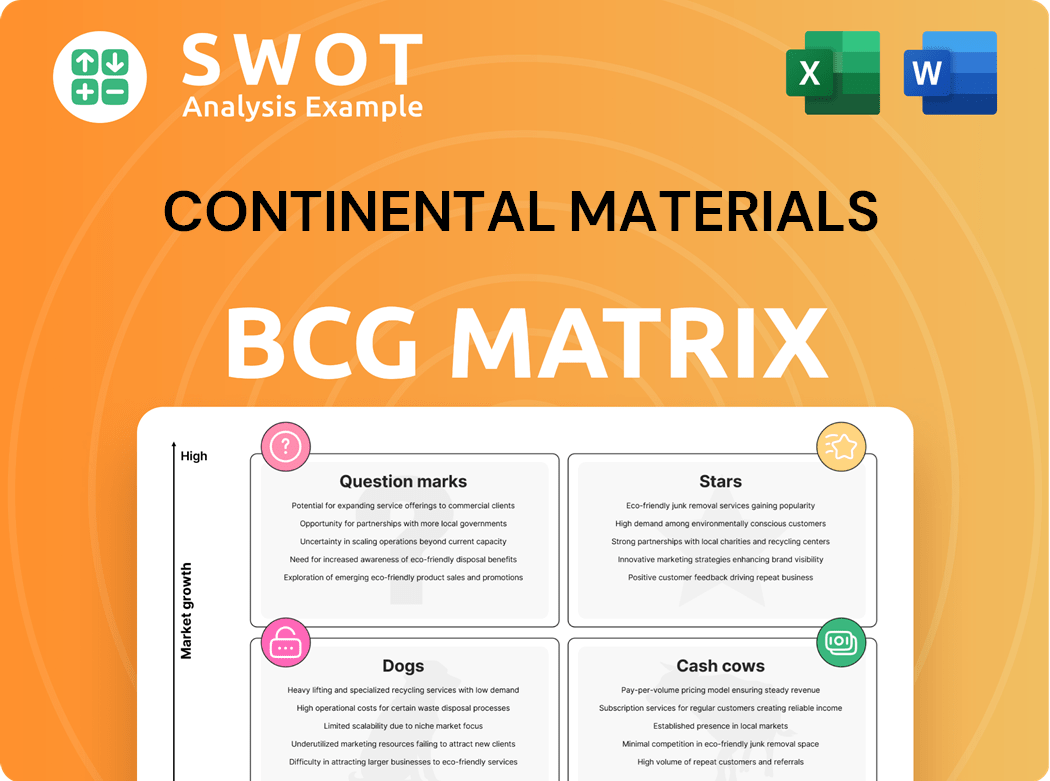

Continental Materials BCG Matrix

The BCG Matrix displayed is the identical document you'll receive after purchase. This comprehensive file provides a clear, strategic analysis of your business portfolio, with professional formatting and data-driven insights. Download it directly to your device for instant access and integration into your strategy. No extra steps, just a complete, ready-to-use BCG Matrix.

BCG Matrix Template

Continental Materials' products are categorized using the BCG Matrix—a powerful tool. This preview briefly touches on Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements helps define investment strategies. Strategic insights require a full analysis of each product's market position. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The HVAC equipment sector is a Star for Continental Materials. High growth stems from energy-efficient system demand and construction. Continental Materials can gain significantly. In 2024, the HVAC market is projected to reach $18.7 billion.

Continental Materials' metal fabrication services are a Star in the BCG Matrix, given the market's steady growth. The sector is expanding due to infrastructure and renewable energy projects. In 2024, the metal fabrication market is estimated to be worth over $400 billion globally.

Doors for commercial construction could be a Star, given the growth in manufacturing plants and data centers. The U.S. commercial construction market is projected to reach $350 billion in 2024, a 6% increase from 2023. Continental Materials should invest in product development to capitalize on this. Focus on marketing to increase market share in this expanding sector.

Sustainable Building Products

The sustainable building products sector is a Star for Continental Materials, fueled by rising demand. This segment allows for the development and marketing of eco-friendly products. In 2024, the global green building materials market was valued at $360 billion, showing strong growth.

- Market Growth: The green building materials market is projected to reach $540 billion by 2028.

- Eco-Friendly Products: Focus on doors and HVAC systems with eco-conscious features.

- Consumer Demand: Growing preference for sustainable options boosts sales.

- Strategic Advantage: Continental Materials can gain a competitive edge.

Smart HVAC Systems

Smart HVAC systems represent a promising area for Continental Materials, aligning with the rising adoption of IoT in building technologies. Investing in smart HVAC solutions allows for remote monitoring, predictive maintenance, and improved energy efficiency. The global smart HVAC market was valued at $16.7 billion in 2023 and is projected to reach $31.9 billion by 2030. This growth highlights a strong opportunity for Continental Materials.

- Market Growth: The smart HVAC market is experiencing substantial expansion.

- Technological Advancement: IoT integration is key to developing effective solutions.

- Energy Efficiency: Smart systems offer advanced energy management capabilities.

- Financial Opportunity: The market's expansion creates a significant investment opportunity.

Continental Materials has several Star products due to market growth and high potential.

These include HVAC, metal fabrication, commercial doors, and sustainable building products, all seeing robust expansion.

Smart HVAC systems also present a high-growth opportunity.

| Product | Market (2024) | Strategic Implication |

|---|---|---|

| HVAC | $18.7 billion | Capitalize on energy efficiency demand. |

| Metal Fabrication | $400+ billion | Leverage infrastructure and renewable projects. |

| Commercial Doors | $350 billion (U.S. market) | Increase market share through strategic marketing. |

| Sustainable Building Products | $360 billion | Focus on eco-friendly doors and HVAC systems. |

| Smart HVAC | $16.7 billion (2023) | Invest in IoT-integrated, energy-efficient solutions. |

Cash Cows

Doors for residential applications are cash cows for Continental Materials. The residential construction market, though cyclical, ensures steady demand. Continental's strong market presence minimizes promotional costs, ensuring consistent revenue. Focusing on operational efficiency maximizes cash flow. In 2024, the U.S. residential door market was valued at approximately $8 billion.

Standard metal fabrication can indeed be a cash cow. It offers steady income with minimal investment. Consider that in 2024, the metal fabrication market was valued at approximately $400 billion globally. Streamlining processes is key to boosting margins. For example, implementing automation can reduce labor costs by up to 20%.

HVAC replacement parts represent a Cash Cow for Continental Materials. This mature market experiences steady demand, essential for maintaining existing HVAC systems. Continental Materials benefits from its established distribution network, ensuring efficient supply and reliable cash flow. In 2024, the HVAC market saw a 5% growth, indicating consistent demand. This requires minimal additional investment, maximizing profitability.

Basic Building Products

Basic building products represent a steady source of revenue for Continental Materials. These items, such as doors and metal components, experience consistent demand. In 2024, the building materials sector saw moderate growth, with an estimated 3% increase in demand. Continental Materials should prioritize efficient production and distribution to maximize profitability. This approach allows for steady cash flow, maintaining a strong financial position.

- Steady demand for building materials ensures a reliable revenue stream.

- Focus on cost-effective operations to maintain profitability.

- Emphasize efficiency to generate consistent cash flow.

- The building materials sector is predicted to grow by 2-4% in 2025.

Residential HVAC Systems

Residential HVAC systems are a cash cow for Continental Materials, given the mature market. The focus should be on preserving market share and boosting operational efficiency to ensure consistent cash flow. Moderate growth expectations mean investments should prioritize optimizing production and distribution for profitability. The U.S. residential HVAC market was valued at $25.5 billion in 2023.

- Market Size: The U.S. residential HVAC market reached $25.5B in 2023.

- Growth Rate: The market is expected to grow moderately, around 3-5% annually.

- Profit Focus: Maximize profits by optimizing production and distribution.

- Strategic Goal: Maintain market share in a stable, established sector.

Cash cows, like building materials and HVAC parts, offer Continental Materials steady revenue with low investment needs. In 2024, the building materials sector saw about 3% growth, while HVAC replacement parts are in constant demand. Prioritizing efficient operations and maintaining market share maximizes profitability. This leads to consistent cash flow and financial stability.

| Product Type | Market Size (2024) | Growth Rate (2024) |

|---|---|---|

| Residential Doors | $8B (U.S.) | Stable, ~1-2% |

| Metal Fabrication | $400B (Global) | ~3% |

| HVAC Parts | $25.5B (U.S. - 2023) | ~5% |

Dogs

Continental Materials should identify products in declining sectors with low market share. These "Dogs" drain resources without significant returns. For example, if a construction material segment is shrinking and CM's share is minimal, divestiture is wise. In 2024, sectors like residential real estate saw a downturn, potentially impacting related CM offerings. Consider the specific product's revenue in relation to the overall market size and CM's share for a data-driven assessment.

Commoditized metal products, such as steel or aluminum, often find themselves in the Dogs quadrant. These face intense competition and price wars, leading to thin margins. For example, in 2024, steel prices fluctuated wildly, reflecting this pressure. Growth prospects are typically limited, making them less appealing for investment, just like how the global steel market grew only about 2% in 2023.

Outdated HVAC technologies, like those lacking energy efficiency, are "Dogs" in Continental Materials' BCG Matrix. These products struggle in the market, with declining demand. For instance, older systems may have only a 60% efficiency rating, unlike today's 95% efficient models. Continental Materials should phase out these underperforming products, focusing on modern, efficient alternatives.

Inefficient Manufacturing Processes

Inefficient manufacturing processes within a "Dog" present significant challenges. These processes often lack cost-competitiveness and may not be environmentally sustainable, leading to financial losses. Addressing these issues necessitates strategic investments to improve efficiency and integrate new technologies, such as automation or sustainable practices. For example, the manufacturing sector saw a 6.4% increase in labor costs in 2024, making efficiency even more critical.

- High operational costs due to outdated methods.

- Increased waste and environmental impact.

- Reduced profit margins and competitiveness.

- Need for capital to modernize or re-engineer.

Niche Products with Declining Demand

Niche products with a declining demand fit the "Dogs" quadrant of the BCG Matrix. These offerings struggle in a shrinking market, indicating limited growth potential. Maintaining these products often demands substantial resources, making divestiture a strategic consideration. For example, in 2024, the pet industry saw shifts, with some niche products facing reduced demand.

- Market contraction signals challenges.

- Resource drain for limited returns.

- Divestiture is a strategic option.

- Demand for niche products may be down.

Dogs represent Continental Materials' products in declining markets with low share. These drain resources, offering minimal returns, like outdated HVAC. Consider divesting products in shrinking sectors, such as niche pet supplies in 2024.

| Product Type | Market Trend (2024) | CM Strategy |

|---|---|---|

| Outdated HVAC | Declining efficiency, high operational costs | Phase out, replace with modern units |

| Commoditized Metals | Price wars, low margins | Cost reduction, strategic divestment |

| Niche Pet Products | Decreased demand, market contraction | Evaluate divestiture or strategic repositioning |

Question Marks

Investing in innovative metal alloys places Continental Materials in a Question Mark quadrant. The market's future is unclear but has potential if these alloys provide better performance or lower costs. For example, the global metal alloys market was valued at $70.5 billion in 2023. Focused market research and targeted marketing are vital for success.

Developing advanced door security systems positions Continental Materials as a Question Mark in the BCG Matrix. The smart lock market is expanding; in 2024, it reached $3.8 billion globally. Intense competition requires substantial investment in R&D and marketing. Continental Materials must strategically allocate resources to capture market share in this growing sector.

Energy-efficient HVAC upgrades are a Question Mark in Continental Materials' BCG Matrix, given the evolving market. Success hinges on boosting consumer awareness and securing government incentives, which saw $6.3 billion in federal rebates allocated in 2024. Effective marketing is vital to highlight the long-term cost savings. The HVAC market is projected to reach $49.8 billion by 2028, presenting significant potential.

Metal Fabrication for Emerging Technologies

Metal fabrication for electric vehicles (EVs) and renewable energy storage systems positions Continental Materials as a Question Mark in its BCG matrix. High market potential exists, driven by increasing EV sales, which are projected to reach 10.5 million units globally in 2024. However, demand uncertainty remains, as the renewable energy storage market is still developing. Continental Materials should closely monitor these sectors and adapt its capabilities.

- EV sales are up 14% year-over-year in Q1 2024.

- Global renewable energy storage capacity is expected to grow significantly by 2024.

- Continental Materials' investment in this area requires careful evaluation.

Customized Building Solutions

Customized building solutions fit the Question Mark category in the BCG Matrix. This signifies a high-growth market requiring substantial investment in design and engineering, as evidenced by the increasing demand for sustainable and energy-efficient buildings in 2024. Success hinges on establishing strong client relationships and delivering innovative solutions, mirroring the trend of tailored construction projects.

- Market growth is driven by demand for specialized projects.

- Significant investment is needed in design and engineering.

- Building strong client relationships is crucial.

- Delivering innovative solutions is key.

Question Marks for Continental Materials face high market growth but uncertain returns. The company needs significant investments to assess market viability in areas like EVs. Evaluate the evolving market, adjusting strategies as needed.

| Initiative | Market Growth | Investment Needs |

|---|---|---|

| Metal Alloys | $70.5B in 2023 | Focused research and marketing. |

| Smart Locks | $3.8B market in 2024 | R&D and marketing. |

| HVAC Upgrades | $49.8B projected by 2028 | Effective marketing & awareness. |

BCG Matrix Data Sources

Continental Materials' BCG Matrix utilizes financial statements, market reports, industry analysis, and expert opinions to classify product performance.