Costain Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costain Group Bundle

What is included in the product

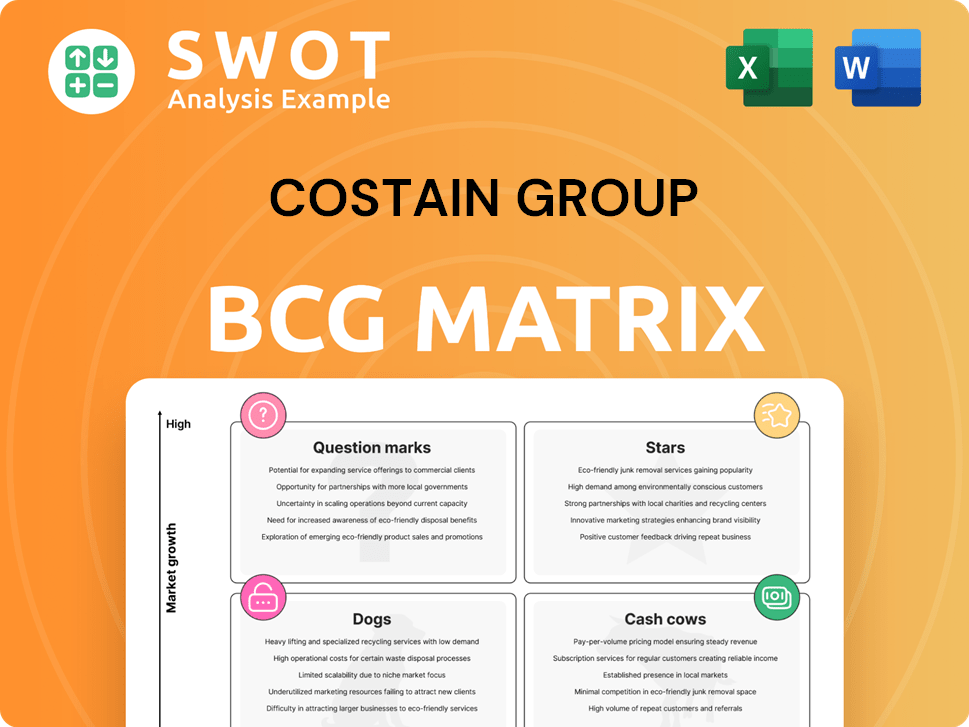

Costain's BCG matrix: Strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

Printable summary optimized for A4 and mobile PDFs, providing a succinct overview for any format.

What You’re Viewing Is Included

Costain Group BCG Matrix

The preview demonstrates the identical Costain Group BCG Matrix you'll receive post-purchase. It offers a clear strategic overview, enabling data-driven decisions for portfolio management. This ready-to-use report is immediately downloadable, perfect for presentations or strategic planning. No hidden elements, this is the complete document.

BCG Matrix Template

Costain Group's BCG Matrix offers a glimpse into its diverse portfolio. Stars indicate strong growth potential, while Cash Cows generate steady revenue. Dogs may require restructuring, and Question Marks need strategic investment decisions. Understanding these placements is key to informed strategy. The full BCG Matrix report delivers deep analysis, quadrant breakdowns, and action-oriented recommendations for optimal resource allocation.

Stars

The HS2 rail systems contracts, worth at least £400 million, are a substantial win for Costain, placing them firmly in a high-growth infrastructure project. This encompasses design, supply, and commissioning, demonstrating Costain's extensive capabilities. Starting in Q1 2025, the seven-year contract, with possible extensions, solidifies Costain's leadership in rail infrastructure development. This promises significant revenue and growth, as HS2 continues to develop.

The AMP8 projects, running from 2025 to 2030, are a significant growth area for Costain in the water sector. These projects emphasize enhancing asset and operational resilience, showing a long-term focus on water infrastructure. Costain's expertise in water treatment and network solutions makes it a key player, potentially boosting revenue. In 2024, the UK water sector saw investments exceeding £6 billion.

Defense and nuclear energy investments represent a "Star" for Costain, fueled by rising public and private sector spending. Costain's expertise in complex engineering positions it well to win lucrative contracts. In 2024, UK defense spending is projected to reach £50 billion, supporting growth. These projects offer high-value, long-term revenue streams.

Integrated Transport Solutions

Costain's Integrated Transport Solutions, such as Heathrow H7 and TfL contracts, show a solid market presence. Their expertise in complex projects and consultancy boosts their standing, opening doors for future ventures. This segment's potential for high returns warrants continued investment, reinforcing Costain's leadership. In 2024, Costain secured a £120 million contract for transport infrastructure projects.

- Market Position: Strong due to large-scale projects and consultancy.

- Project Examples: Heathrow H7, TfL contracts.

- Financial Data: £120 million contract secured in 2024.

- Future Outlook: Continued investment is expected to yield significant returns.

Technology and Innovation

Costain Group's emphasis on technology and innovation, especially AI and robotics for projects like tunnel M&E installation, is a key strength. This approach enhances efficiency and lowers costs. This focus draws in new projects and clients, pushing growth. In 2024, Costain invested £15 million in digital transformation and innovation, improving project outcomes.

- Costain's investment in digital transformation was £15 million in 2024.

- AI and robotics are used to improve efficiency.

- This enhances project outcomes.

- The focus attracts new clients.

Costain's Defense and nuclear energy, fueled by public and private spending, form a "Star" in its BCG matrix. High-value, long-term revenue streams come from these projects, with UK defense spending reaching £50 billion in 2024. The company's expertise secures lucrative contracts.

| Area | Details | Financials (2024) |

|---|---|---|

| Key Projects | Defense, Nuclear Energy | UK Defense Spending: £50B |

| Market Position | Strong, growing | Rising investment |

| Future Outlook | High-value, long-term | Lucrative contracts |

Cash Cows

Costain's framework agreements in transportation and natural resources generate stable revenue. These agreements ensure consistent cash flow through maintenance and project delivery. In 2024, these sectors contributed significantly to Costain's £1.5 billion revenue. They enable efficient resource management, boosting profitability, and solidifying their cash cow status.

Costain Group's consultancy services, especially in green energy, are a cash cow, yielding high-margin revenue. These services offer expert advice, supporting complex infrastructure projects. Costain's consultancy expertise ensures efficient execution and robust cash flow. In 2024, consultancy revenues increased by 15%, boosting overall profitability.

Costain Group's long-term contracts, including projects like the Urenco infrastructure upgrade, are pivotal. Securing these contracts, such as the AMP8 framework with Southern Water, guarantees stable revenue. This predictability aids in resource planning and financial stability. These partnerships boost Costain's market position and ensure consistent cash flow. Costain's order book stood at £4.1 billion in 2023.

Asset Optimization and Support Services

Costain Group's asset optimization and support services act as a cash cow, delivering consistent revenue through existing infrastructure projects. These services focus on improving asset performance and extending lifespans, fostering client satisfaction and long-term collaborations. Costain's proficiency in this domain enables efficient service delivery and robust cash flow generation. For example, in 2024, the support services segment contributed significantly to overall revenue, demonstrating its reliability.

- Recurring Revenue: Stable income from ongoing support contracts.

- High Margins: Efficient service delivery leads to strong profitability.

- Client Retention: Focus on asset longevity builds strong relationships.

- Cash Flow: Predictable cash flow supports investments and growth.

Managed Service Provider (MSP) Contracts

Costain's MSP contracts, particularly with United Utilities, exemplify a cash cow. This arrangement, extended to May 2026, provides reliable revenue via maintenance and asset management. The MSP model encompasses core, high-volume, short-term tasks alongside non-core capital projects. This strategic positioning ensures steady cash flow within the AMP8 cycle, solidifying Costain's role in water infrastructure.

- The extension to May 2026 ensures continued revenue streams.

- MSP contracts include both core and non-core activities.

- Costain is a key player in water infrastructure management.

Costain's cash cows include framework agreements and consultancy, ensuring consistent revenue. Long-term contracts and asset optimization services also provide stable income. In 2024, these segments boosted profitability, with consultancy revenues up 15%.

| Key Area | Contribution | Financial Impact (2024) |

|---|---|---|

| Framework Agreements | Transportation, Natural Resources | £1.5B Revenue Contribution |

| Consultancy | Green Energy Projects | 15% Revenue Growth |

| Long-term Contracts | Urenco, AMP8 with Southern Water | £4.1B Order Book (2023) |

Dogs

The decrease in road volumes, reflecting project completions and delays, signals a potential decline in market share for Costain within certain road construction segments. These projects may not be driving substantial revenue growth, classifying them as potential dogs. Costain's 2024 financial reports indicated a 7% drop in revenue from legacy road projects.

The completion of projects like Gatwick Station signifies a shift; they no longer drive revenue growth. Costain's reliance on such completed projects presents a challenge, classifying them as "dogs" in the BCG matrix. In 2024, Costain needs new rail contracts to offset the loss of revenue from completed projects. Without these, the company's market share could diminish.

Low-margin, high-risk contracts can significantly hurt profitability. These projects demand intense management due to their complexity. Costain needs to assess these contracts, possibly divesting or renegotiating terms. In 2024, construction firms faced margin pressures, with some projects contributing to losses.

Underperforming Joint Ventures

Joint ventures that consistently underperform, like those in the Costain Group's portfolio, are often categorized as dogs. These ventures may be draining resources without delivering sufficient returns. For example, a 2024 analysis might reveal several joint ventures contributing negatively to Costain's overall profitability. Costain's strategic focus should be to reassess the financial viability of these underperforming partnerships, potentially restructuring or exiting to mitigate financial losses.

- Financial targets not met.

- Require significant investment.

- Restructure or exit.

- Minimize losses.

Projects with Limited Growth Potential

In Costain Group's BCG Matrix, "Dogs" represent projects in slow-growth markets with low market share. These projects typically have limited potential for expansion and consume resources that could be allocated more effectively. Costain might consider divesting or gradually phasing out these projects to enhance overall portfolio performance. For example, in 2024, projects in mature infrastructure markets with low contract values could be classified as Dogs.

- Limited expansion opportunities.

- Resource drain with low returns.

- Divestment or phase-out focus.

- Examples: Low-value infrastructure contracts.

In the Costain Group's BCG matrix, "Dogs" are projects in slow-growth markets with low market share, often requiring significant investment. These ventures can drain resources without sufficient returns, like the joint ventures revealed in 2024 analyses, negatively impacting profitability. Costain should reassess the financial viability of such partnerships in 2024, potentially restructuring or exiting to minimize losses.

| Characteristic | Impact | Action |

|---|---|---|

| Slow growth/Low share | Limited expansion | Divest/Phase-out |

| Resource intensive | Low returns | Restructure/Exit |

| Example: Low-value infra | Financial drain | Reassess viability |

Question Marks

Costain's green energy push, like FEED contracts for Net Zero Teesside, is a question mark in its BCG Matrix. The market share is relatively low initially despite the high-growth potential in 2024. Significant investment and strategic focus are crucial for success. In 2024, the global green energy market was valued at $881.1 billion.

New nuclear energy contracts represent a "question mark" in Costain Group's BCG matrix, indicating high growth potential but a low market share. These contracts demand considerable initial investment and specialized skills, impacting profitability. In 2024, the nuclear energy market is projected to grow, presenting Costain with an opportunity to increase its market share. Strategic investment and expert development are crucial for Costain to capitalize on this expansion.

AI robotics in tunnel M&E installation is a question mark for Costain Group. It has high growth potential but faces uncertain market acceptance. The company needs investments to prove its value, like the £1.5M spent on innovation in 2023. This could lead to a competitive edge. Costain's 2023 revenue was £1.2 billion, highlighting the scale of potential impact.

Defense Sector Project Management Commissions

Defense sector project management commissions are a growth area for Costain, although its current market share is low. These commissions, which offer potential, require specialized expertise and security clearances. Costain must strategically invest in its capabilities to capitalize on this opportunity. Securing long-term contracts is crucial for sustained growth in this sector.

- Market share: Costain's current defense market share is relatively low, indicating room for expansion.

- Expertise: Projects require specific skills and security clearances.

- Investment: Strategic investment in capabilities is essential for growth.

- Contracts: Securing long-term contracts will be key for success.

International Expansion Initiatives

International expansion initiatives for Costain Group fit into the "Question Marks" category within the BCG matrix. These ventures involve high investment coupled with uncertainty, particularly when entering new markets. Costain must thoroughly assess these opportunities, considering factors like market size, competition, and regulatory environments. A well-defined strategic plan is critical to navigate challenges and maximize the potential for success.

- Costain's international projects face inherent risks.

- Success hinges on strategic planning and market understanding.

- Significant capital is needed for these ventures.

- Careful evaluation is essential before investing.

Costain's projects in the defense sector, like project management commissions, are "question marks" due to low initial market share despite high potential. These require specialized expertise and strategic investments, impacting profitability. Securing long-term contracts is vital for sustainable growth. The global defense market was valued at $2.5 trillion in 2024.

| Aspect | Details | Financial Impact |

|---|---|---|

| Market Share | Low initially, requiring expansion. | Limited immediate revenue. |

| Expertise | Demands specific skills and clearances. | Increased operational costs. |

| Investment | Strategic investment is essential. | Capital expenditure for growth. |

BCG Matrix Data Sources

The Costain Group BCG Matrix uses data from company filings, industry reports, and market analysis to inform strategic positions.