Crossroads Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crossroads Systems Bundle

What is included in the product

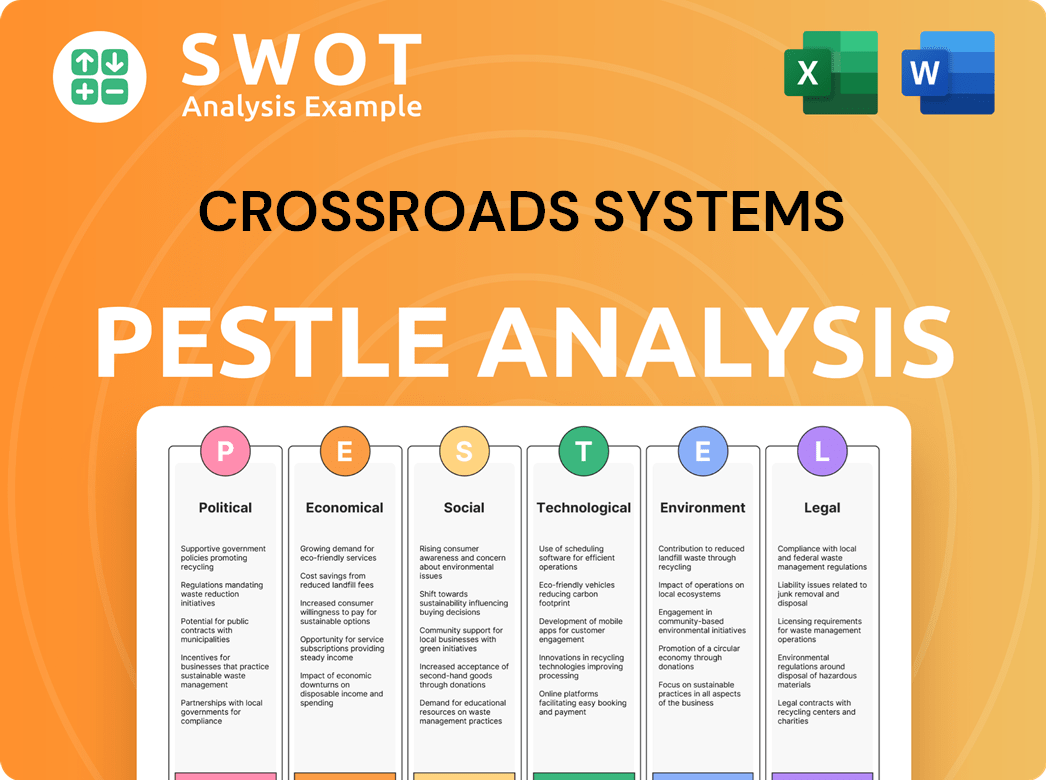

Explores macro-environmental factors affecting Crossroads Systems: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Crossroads Systems PESTLE Analysis

What you see here is the exact Crossroads Systems PESTLE analysis document.

This detailed analysis will be available to download instantly upon purchase.

The format, structure, and content in this preview are identical to the final product.

Rest assured, the finished document is professionally crafted.

Get access to this insightful PESTLE analysis right after buying!

PESTLE Analysis Template

Navigate Crossroads Systems' future with our PESTLE Analysis. Uncover the political and economic pressures impacting the company.

Explore the social and technological factors shaping their market presence. This ready-made analysis offers crucial strategic insights. Gain a competitive edge. Download the full version today!

Political factors

Government backing heavily influences industrial tech. Funding for R&D, tech adoption subsidies, and tax breaks shape sector attractiveness. In 2024, the U.S. allocated $1.9B to AI R&D, impacting tech acquisitions. Tax incentives for manufacturing boosted growth by 7% in some sectors.

Trade policies, including tariffs, significantly impact Crossroads Systems. For instance, the US-China trade tensions have led to fluctuating tariffs, affecting tech companies. In 2024, tariffs on specific tech components could increase costs. Export controls, like those on semiconductors, might limit access to key markets. Crossroads Systems must analyze these factors to gauge acquisition target profitability and adjust its strategies.

Political stability is vital for Crossroads Systems' industrial tech targets. Geopolitical risks and policy shifts can disrupt operations. For example, in 2024, political instability in Eastern Europe impacted supply chains. Businesses must assess these risks to protect value. A stable political environment is key for long-term investment success.

Regulatory Environment for Technology

Government regulations significantly shape the technology sector. For Crossroads Systems, understanding these rules is crucial. This includes laws on data privacy, cybersecurity, and AI, which impact operations and acquisitions. Compliance is key to avoid penalties and maintain market access.

- EU's GDPR has led to fines exceeding €1 billion.

- US government spending on cybersecurity reached $70 billion in 2024.

- AI regulation proposals are increasing globally.

Government Procurement and Spending

Government procurement and spending significantly influence industrial technology, impacting companies like Crossroads Systems. Increased government investment in infrastructure, defense, and public projects boosts demand for related products. Analyzing government spending trends reveals growth opportunities and informs acquisition strategies.

- In 2024, the U.S. government's infrastructure spending reached $1.2 trillion.

- Defense spending in 2024 was approximately $886 billion.

- These figures highlight potential market segments.

Political factors are vital for industrial tech like Crossroads Systems, significantly influenced by government backing through R&D funding and tax incentives. Trade policies, such as tariffs and export controls, directly impact costs and market access; the US-China trade tensions highlight these risks. Political stability, coupled with regulatory environments including data privacy and cybersecurity laws, dictates operational viability.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| R&D Funding | Boosts innovation, affects acquisition targets | U.S. AI R&D: $1.9B; EU Digital Strategy: €140B |

| Trade Policy | Influences costs, market access | Tariffs on tech components rise; Export controls on semiconductors |

| Regulation | Defines operational landscape, drives compliance | U.S. Cybersecurity spending: $70B; GDPR fines >€1B |

Economic factors

Economic growth and industrial output significantly affect demand for industrial tech. A strong economy typically boosts investment in technology. In 2024, U.S. industrial production rose, but growth may slow in 2025. Downturns can cut tech spending, impacting company revenues.

Interest rate shifts significantly influence Crossroads Systems' borrowing costs and client spending. Higher rates can curb acquisitions and customer investments. The Federal Reserve held rates steady in May 2024, but future moves impact capital access. Affordable capital is crucial for acquisitions and operational enhancements, as demonstrated by the 6% average interest rate on corporate bonds in early 2024.

Rising inflation presents significant challenges for Crossroads Systems, potentially increasing the costs of essential resources. It is crucial to evaluate how prospective acquisitions handle cost pressures. In 2024, the U.S. inflation rate hovered around 3.1%, impacting operational expenses. The ability to pass costs to clients without losing market share is vital.

Investment Climate and Valuations

The investment climate significantly affects Crossroads Systems. A robust market can lower acquisition costs and ease investment exits. Favorable conditions also facilitate capital raising for strategic moves. The industrial tech sector saw a 15% increase in M&A activity in 2024.

- M&A deals in tech reached $3.5 trillion in 2024.

- Industrial tech valuations are up 10% year-over-year as of early 2025.

- Interest rate changes impact financing costs for acquisitions.

Currency Exchange Rates

Currency exchange rate volatility is a critical factor for Crossroads Systems, especially given its potential international dealings. For instance, in 2024, the Eurozone experienced fluctuations against the U.S. dollar, impacting the profitability of U.S. companies with European operations. Crossroads must assess how currency movements could affect its revenue streams and operational costs. Currency risk management strategies are crucial.

- 2024: EUR/USD exchange rate fluctuated significantly.

- Impact: Affects revenue and cost in international markets.

- Strategy: Currency risk management is essential.

Economic conditions directly affect Crossroads Systems. Industrial output and growth influence tech demand, with industrial tech valuations up 10% year-over-year as of early 2025. Interest rate changes also significantly impact the company's financials. These shifts affect borrowing costs and client spending, affecting M&A and operations.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Economic Growth | Affects tech demand and investment | Industrial production up in 2024, possible slowdown in 2025 |

| Interest Rates | Influences borrowing and client spending | Average corporate bond rate ~6% in early 2024 |

| Inflation | Raises operational costs | U.S. inflation ~3.1% in 2024 |

Sociological factors

The availability of skilled labor, including engineers and software developers, significantly impacts industrial tech firms. Demographic shifts and educational outputs influence talent pools. According to the U.S. Bureau of Labor Statistics, the tech sector added 135,000 jobs in 2024. This impacts operational capacity and innovation potential for Crossroads Systems.

Societal acceptance and industry readiness to embrace automation, robotics, and AI significantly shape market demand for industrial tech. Recent data shows a surge in AI adoption, with a 20% increase in manufacturing firms integrating AI in 2024. This trend highlights the growing openness to new technologies.

Analyzing adoption rates across sectors is crucial for evaluating growth potential. The automotive industry, for instance, is rapidly adopting robotics, with investments expected to reach $50 billion by 2025, indicating strong growth prospects. Understanding these patterns is key.

Societal pressure on companies like Crossroads Systems to engage in Corporate Social Responsibility (CSR) is growing. This includes demands for ethical labor, community involvement, and sustainable practices. Companies face scrutiny; in 2024, 77% of consumers favor brands with strong CSR. Crossroads must assess CSR in targets and integrate responsible practices.

Public Perception of Automation and AI

Public opinion on automation and AI significantly shapes regulatory actions and market responses. Concerns about job losses and ethical issues can hinder the adoption of these technologies. A 2024 study showed that 60% of people worry about AI's impact on jobs, potentially slowing market growth. Negative views might increase resistance to automation.

- 60% of people worry about AI's impact on jobs.

- Negative perceptions can increase resistance to automation.

Changing Work Culture and Remote Work

The shift towards remote work and flexible schedules significantly influences industrial tech firms like Crossroads Systems. Companies must adapt operational models and talent strategies to accommodate these changes. In 2024, approximately 30% of U.S. workers were fully remote, and 40% had hybrid arrangements, reflecting this trend. This necessitates a focus on digital infrastructure and adaptable management styles for acquisitions.

- Remote work adoption increased by 15% in the tech sector in 2024.

- Companies with flexible work policies report a 20% higher employee retention rate.

- Demand for tech roles with remote options grew by 25% in early 2025.

Public concerns about AI’s impact on jobs and ethical considerations influence market and regulatory responses. Around 60% of the public in 2024 worried about AI-related job losses, affecting the tech sector's growth. Consumer demand also shifts, with 77% preferring brands committed to strong CSR. Companies like Crossroads Systems must prioritize responsible practices.

| Sociological Factor | Impact | Data (2024/2025) |

|---|---|---|

| Public Perception of AI | Influences tech adoption and regulatory actions | 60% worry about AI-related job impacts; Demand for remote tech roles grew 25% in 2025 |

| CSR Demand | Affects brand preference and corporate strategies | 77% of consumers favor CSR-focused brands. |

| Workplace Trends | Impacts operational models and talent acquisition | 30% of U.S. workers fully remote in 2024; Hybrid work 40%. |

Technological factors

The industrial tech sector is experiencing rapid innovation, particularly in AI, IoT, robotics, and 3D printing. For instance, the global industrial robotics market is projected to reach $78.8 billion by 2025, growing at a CAGR of 10.5% from 2019. Crossroads Systems needs to assess technological capabilities and R&D of acquisition targets. Consider the rise of predictive maintenance; the market is expected to reach $14.2 billion by 2025.

As systems become more connected, cybersecurity threats escalate. Crossroads Systems must evaluate its cybersecurity robustness. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion. Strong protection of intellectual property and operational tech is vital.

The availability and advancement of infrastructure, such as 5G and cloud computing, are essential. Crossroads Systems should assess how infrastructure supports acquisitions. The global cloud computing market is projected to reach $1.6 trillion by 2025. This growth impacts tech deployment strategies.

Intellectual Property Protection

Intellectual Property (IP) protection is crucial for tech companies, especially in acquisitions. Crossroads Systems must assess the IP of targets and the strength of IP laws. In 2024, global spending on IP protection reached $25 billion, with a projected 8% annual growth. Weak IP protection can significantly devalue a target.

- Patent litigation costs averaged $3 million per case in 2024.

- China's IP enforcement has improved, but risks persist.

- Strong IP boosts company valuations by up to 20%.

Integration of IT and OT (Information Technology and Operational Technology)

The convergence of IT and OT is transforming industrial operations. It allows for enhanced efficiency and data utilization across systems. Crossroads Systems needs to evaluate how acquisitions integrate these technologies. This includes assessing the security implications of interconnected systems.

- Market growth for IT/OT integration is projected to reach $98.2 billion by 2025.

- Cybersecurity spending in industrial control systems is expected to increase by 10% annually.

Technological advancements like AI, IoT, and robotics are rapidly changing industrial tech. The global industrial robotics market is predicted to hit $78.8 billion by 2025. Cybersecurity, with costs nearing $9.5 trillion in 2024, and IT/OT convergence ($98.2B by 2025), significantly influence Crossroads Systems.

| Factor | Details | Financial Impact (2024/2025) |

|---|---|---|

| Robotics Market | Industrial automation, smart manufacturing | $78.8B (by 2025, CAGR 10.5%) |

| Cybersecurity Costs | Threats to interconnected systems, IP | $9.5T (2024) |

| IT/OT Integration | Enhanced efficiency, data utilization | $98.2B (market by 2025) |

Legal factors

Legal frameworks heavily influence Crossroads Systems' M&A activities. Antitrust laws and regulatory approvals are crucial for each deal. In 2024, the FTC and DOJ scrutinized numerous tech acquisitions, impacting deal timelines. Regulatory compliance can significantly delay or even block transactions, as seen with some recent tech mergers. Understanding these legal hurdles is vital for strategic planning.

Industrial tech firms face strict safety, product standards, and environmental rules. Crossroads Systems needs acquisitions to comply with these regulations. Compliance can be costly, impacting financial planning. For example, in 2024, environmental compliance spending rose 10% for similar firms.

Data privacy laws like GDPR and CCPA are crucial for tech firms managing data from connected devices. Crossroads Systems must assess data practices and compliance of acquisition targets. The global data privacy market is projected to reach $13.3 billion by 2025. Ensuring compliance is vital to avoid hefty fines, which can reach up to 4% of a company's annual revenue under GDPR.

Labor Laws and Employment Regulations

Labor laws and employment regulations are critical legal factors. These laws, which dictate hiring, firing, working conditions, and unionization, significantly influence operational costs. Crossroads Systems must carefully evaluate these laws during potential acquisitions. Compliance ensures smooth operations and avoids costly legal battles.

- In 2024, the US Department of Labor reported over $2 billion in back wages owed to workers due to labor law violations.

- European Union labor law reforms, effective in 2024, increased employer obligations regarding worker rights and data privacy.

Intellectual Property Law

Intellectual Property (IP) laws are crucial for tech firms like Crossroads Systems. These laws cover patents, trademarks, copyrights, and trade secrets, safeguarding innovation. Crossroads Systems needs to assess a target's IP protection to avoid infringement risks. The global IP market was valued at $7.8 trillion in 2023, projected to reach $9.2 trillion by 2025.

- Patent filings in the US increased by 2.5% in 2024.

- Trademark applications grew by 4% in the EU in 2024.

- Copyright infringement cases rose by 7% globally in 2024.

- Trade secret litigation costs average $5 million per case.

Legal factors significantly influence Crossroads Systems’ strategies, especially in M&A activities and compliance. Regulatory hurdles, including antitrust laws, impact deal timelines and may block acquisitions. Data privacy laws like GDPR are crucial, with the global market projected to reach $13.3 billion by 2025.

| Legal Aspect | Impact on Crossroads Systems | 2024/2025 Data Points |

|---|---|---|

| Antitrust/Regulatory | Delays, blocks M&A | FTC/DOJ scrutiny: Affects deal timelines; EU: Increased antitrust enforcement |

| Data Privacy | Compliance costs; fines | Global market to $13.3B by 2025; GDPR fines up to 4% annual revenue |

| IP Protection | Risk management; infringement | IP market valued $7.8T in 2023, projected to $9.2T by 2025 |

Environmental factors

Manufacturing firms, including those in industrial tech like Crossroads Systems, face stringent environmental regulations. These rules cover emissions, waste, and resource use. In 2024, the EPA reported a 7% increase in enforcement actions. Crossroads must evaluate compliance costs for targets. Failing to comply can lead to significant fines, potentially reducing profit by as much as 15%.

Sustainability is reshaping the industrial tech market. The need for eco-friendly solutions is rising. In 2024, the global green tech market was valued at $366.8 billion. Crossroads could gain from energy-efficient tech acquisitions.

Climate change presents significant risks to Crossroads Systems. Extreme weather events, like floods and storms, can disrupt manufacturing and supply chains. Consider the resilience of target companies to climate risks. In 2024, the World Economic Forum identified climate action failure as a top global risk.

Resource Efficiency and Circular Economy

The increasing focus on resource efficiency and the circular economy is reshaping industrial technology. Crossroads Systems could find opportunities by investing in companies that develop circular economy technologies. The global circular economy market is projected to reach $622.6 billion by 2028.

- 2024: The circular economy is gaining traction across various sectors, including manufacturing and waste management.

- 2025: Expect to see increased investment in technologies that promote material reuse, recycling, and waste reduction.

ESG Reporting Requirements

Crossroads Systems faces growing demands for environmental, social, and governance (ESG) reporting, which affects industrial tech firms. Companies must assess the ESG performance and reporting capabilities of acquisitions. This affects investor relations, with ESG assets globally expected to reach $50 trillion by 2025. Consider the impact on your investment decisions.

- ESG assets are projected to hit $50 trillion globally by 2025.

- Companies must evaluate ESG performance of potential acquisitions.

- Investor relations are increasingly focused on ESG data.

Environmental factors heavily impact Crossroads Systems, including strict EPA regulations leading to potential profit reductions.

The green tech market is booming, presenting growth opportunities through eco-friendly tech and acquisitions, with a 2024 valuation of $366.8 billion.

Climate change and resource efficiency demand resilience and investments in circular economy tech, targeting a $622.6 billion market by 2028; while ESG reporting affects investor relations.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Compliance Costs, Fines | EPA enforcement actions increased by 7% in 2024 |

| Sustainability | Market for Eco-Solutions | Global green tech market: $366.8B (2024) |

| Climate Change | Supply Chain Disruptions | Extreme weather top global risk in 2024 |

PESTLE Analysis Data Sources

The analysis relies on industry reports, financial databases, legal resources, and economic indicators for Crossroads Systems' PESTLE framework.