China National Building Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China National Building Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Customize pressure levels based on new data or evolving market trends.

Preview the Actual Deliverable

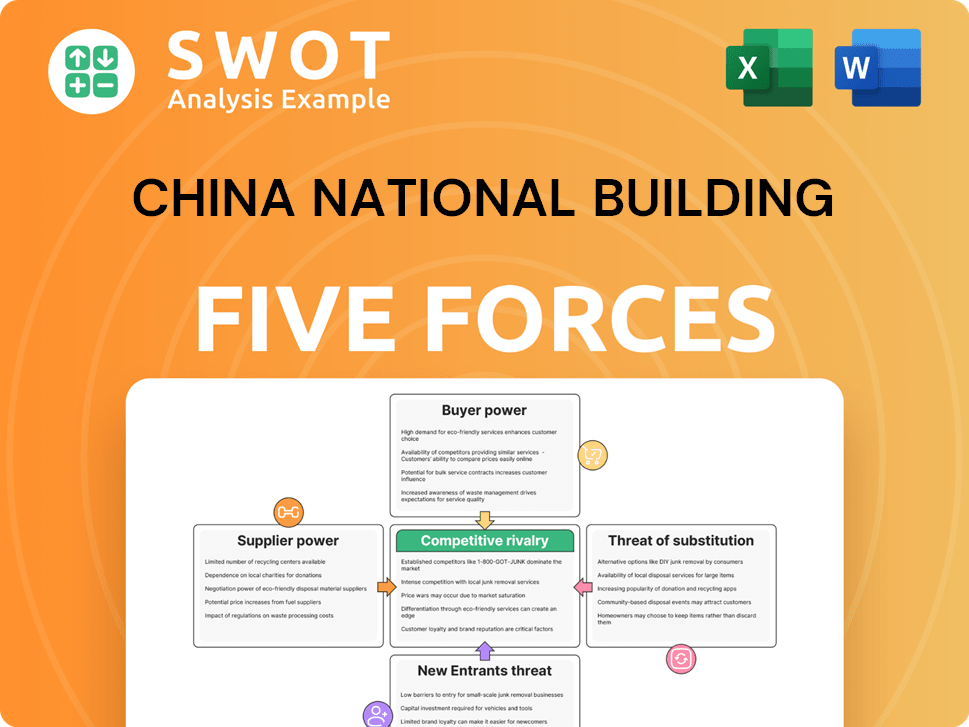

China National Building Porter's Five Forces Analysis

The preview showcases the China National Building Porter's Five Forces analysis in its entirety. This document provides a comprehensive evaluation of the company's competitive landscape. It examines key factors like rivalry, threat of new entrants, and supplier/buyer power. You'll receive this exact, fully-formatted analysis immediately after purchase.

Porter's Five Forces Analysis Template

China National Building operates within a construction market shaped by complex forces. The threat of new entrants is moderate, influenced by capital requirements and regulations. Bargaining power of suppliers varies, depending on material availability and supplier concentration. Buyer power is a key factor, driven by project scale and customer options. The intensity of rivalry is high, with numerous competitors vying for projects. The threat of substitutes is relatively low, but innovation could shift this.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore China National Building’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CSCEC's size and prestige give it strong supplier bargaining power. Suppliers compete for CSCEC contracts, accepting lower prices. In 2024, CSCEC reported ¥2.2 trillion in revenue, showing its market dominance. This dependence limits supplier negotiation abilities.

China's construction materials market is fragmented, with many suppliers of cement, steel, and aggregates. This fragmentation reduces suppliers' power, allowing CSCEC to switch easily. The competitive landscape ensures CSCEC can negotiate good deals. In 2024, the steel price volatility impacted supplier margins. For example, cement prices in some regions decreased, giving CSCEC leverage.

China National Building (CSCEC) benefits from the commodity nature of construction inputs. Cement and steel, key materials, are largely undifferentiated. This allows CSCEC to switch suppliers easily, reducing supplier power.

The ability to switch suppliers keeps prices competitive. In 2024, steel prices fluctuated but remained manageable for large buyers like CSCEC. Cement prices also showed similar trends.

CSCEC's scale further strengthens its position. Its vast purchasing volume gives it significant leverage in negotiations, minimizing supplier influence.

This bargaining advantage helps maintain project profitability. CSCEC's 2024 financial reports reflect this, with stable material costs.

Ultimately, the commodity nature of inputs limits supplier power, benefiting CSCEC's operations and financial performance.

Backward Integration Potential

CSCEC, while not primarily focused on it, could integrate backward, potentially producing its own materials. This move would reduce supplier bargaining power, as suppliers face a potential competitor. The construction industry in China saw a 2.9% increase in output value in 2024, indicating a competitive environment. Backward integration could also boost CSCEC's control over costs and supply chains.

- CSCEC could manufacture key materials.

- Suppliers face a potential competitor.

- China's construction output rose in 2024.

- Integration might control costs and supply.

Long-Term Contracts and Strategic Partnerships

China State Construction Engineering Corporation (CSCEC) leverages long-term contracts and strategic partnerships with suppliers to manage costs effectively. These agreements guarantee price stability and a reliable supply of materials, which is crucial in the construction industry. CSCEC's significant market share allows it to negotiate favorable terms, giving it an advantage over suppliers. This approach ensures CSCEC's operational efficiency and competitive edge.

- In 2024, CSCEC's revenue reached approximately $300 billion, indicating its substantial market power.

- Strategic partnerships help CSCEC secure materials, such as cement and steel, at competitive rates.

- These contracts often include volume discounts and early payment incentives.

- CSCEC's strong relationships with suppliers mitigate supply chain risks.

CSCEC's size and market dominance limit supplier bargaining power, as suppliers compete for contracts.

The fragmented construction materials market, with many suppliers, allows CSCEC to switch easily and negotiate favorable deals; Steel price volatility impacted supplier margins in 2024.

CSCEC's commodity-based inputs and ability to switch suppliers keep prices competitive and control costs.

Long-term contracts and strategic partnerships ensure stable material supplies, boosting operational efficiency. In 2024, CSCEC's revenue hit ~$300 billion.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Position | Strong bargaining power | Revenue: ~$300B |

| Supplier Landscape | Fragmented market | Steel price volatility |

| Strategic Alliances | Cost Control | Long-term contracts |

Customers Bargaining Power

CSCEC's diverse client base, including government bodies and private firms, dilutes the impact of any single client. This diversification strategy, as of late 2024, has helped maintain stable revenue streams, with no single client accounting for over 10% of total revenue. This reduces the bargaining power of individual customers.

China State Construction Engineering Corporation (CSCEC) frequently secures projects through competitive bidding, thereby increasing the bargaining power of customers. Customers can select from numerous qualified contractors, which gives them leverage. CSCEC must offer competitive pricing and comprehensive service packages to be awarded projects. For example, CSCEC's 2024 revenue was approximately $300 billion, with profit margins under pressure due to competitive bidding. This downward pressure is a key factor.

As a state-owned enterprise, China State Construction Engineering Corporation (CSCEC) faces substantial customer bargaining power from the government. The government's influence includes dictating project terms, timelines, and pricing, impacting CSCEC's profitability. In 2024, government infrastructure spending continues to be a key revenue driver for CSCEC. This relationship highlights the government's significant leverage over CSCEC's operations.

Project Complexity and Customization

CSCEC's projects often involve intricate designs and substantial customization, which limits customer bargaining power. This complexity means fewer competitors can bid, giving CSCEC an edge in securing high-value contracts. Their specialized skills are a key competitive advantage. In 2024, CSCEC's revenue reached approximately $300 billion, showcasing their market dominance in complex projects.

- High project complexity reduces customer options.

- Customization demands specialized expertise.

- CSCEC's capabilities offer a competitive advantage.

- 2024 revenue highlights market strength.

Demand Fluctuations in Real Estate

Fluctuations in China's real estate market directly affect demand for China State Construction Engineering Corporation's (CSCEC) services. Residential and commercial projects are particularly sensitive to market shifts. Economic downturns or instability empower customers by enabling them to delay or cancel projects, increasing their bargaining power. CSCEC's diversification into infrastructure projects helps cushion against real estate market volatility.

- In 2024, China's property investment decreased, impacting construction demand.

- CSCEC's infrastructure projects grew, partially offsetting the real estate slowdown.

- Customer bargaining power rises during market corrections, impacting project pricing.

CSCEC faces varied customer bargaining power.

Government influence and competitive bidding heighten it.

Project complexity and market diversification limit it.

| Factor | Impact | 2024 Data |

|---|---|---|

| Government Influence | High | Infrastructure spending continued to be a key revenue driver. |

| Competitive Bidding | High | Revenue $300 billion; profit margins under pressure. |

| Project Complexity | Low | Specialized skills give CSCEC an edge. |

| Market Volatility | Varied | Property investment decreased, infrastructure grew. |

Rivalry Among Competitors

The Chinese construction market is extremely competitive, with a multitude of domestic firms. China Railway Group, China Railway Construction, and China Communications Construction Company are key rivals. This competition leads to pricing pressure, impacting profit margins. In 2024, the construction industry's revenue in China reached approximately $4 trillion, reflecting the scale of competition.

CSCEC confronts escalating rivalry from global construction giants, especially abroad. These competitors introduce cutting-edge tech and project management skills, testing CSCEC's leadership. For example, in 2024, international construction revenue reached $1.5 trillion, highlighting fierce competition. To stay ahead, CSCEC must embrace global standards.

China State Construction Engineering Corporation (CSCEC) uses mergers and acquisitions to strengthen its market standing and lessen competition. Through these acquisitions, CSCEC broadens its services and accesses new markets. In 2024, CSCEC's M&A activity was significant, with deals valued at over $2 billion, showing its aggressive growth strategy.

Diversification and Expansion

China State Construction Engineering Corporation (CSCEC) actively counters competitive pressures through diversification and expansion strategies. CSCEC spreads its operations across infrastructure, housing, and international projects. This diversification reduces risk and broadens revenue streams. Geographic expansion into new markets also fuels growth.

- CSCEC's revenue in 2024 reached approximately $300 billion.

- International revenue accounted for about 15% of the total in 2024.

- CSCEC has projects in over 100 countries, expanding its global footprint.

- Diversification helps CSCEC maintain a strong competitive position in the market.

Technological Innovation and Sustainability

Technological innovation and sustainability significantly influence competitive rivalry for China State Construction Engineering Corporation (CSCEC). This drives CSCEC to invest heavily in advancements like Building Information Modeling (BIM) and artificial intelligence (AI) for project efficiency. Furthermore, the adoption of green building materials supports sustainability efforts, differentiating CSCEC in the market. These strategies help CSCEC attract clients focused on environmental responsibility.

- CSCEC's revenue in 2023 was approximately $300 billion.

- CSCEC has increased its investment in green technologies by 15% in 2024.

- BIM adoption has improved project efficiency by about 20% for CSCEC.

- The market for green building materials is projected to grow by 10% annually.

Competitive rivalry is intense in China’s construction market, driven by numerous domestic and global players. Pricing pressure significantly impacts profit margins, particularly with key rivals like China Railway Group. CSCEC's diversification and technological investments are crucial for maintaining a competitive edge.

| Metric | 2023 Value | 2024 Value (Est.) |

|---|---|---|

| CSCEC Revenue (USD Billions) | $300 | $305 |

| International Revenue (%) | 15% | 16% |

| Green Tech Investment Increase | N/A | 15% |

SSubstitutes Threaten

Direct substitutes for CSCEC's construction services are limited, given the need for physical structures. Modular construction and prefabrication offer alternatives to traditional on-site methods. The global modular construction market was valued at $115.14 billion in 2023. CSCEC must innovate to stay competitive.

Technological advancements are a long-term threat. 3D printing and robotics can reduce labor and material needs. China Construction needs to adopt these to stay competitive. The global construction robotics market was valued at $1.6 billion in 2023 and is projected to reach $3.8 billion by 2028.

Renovation projects present a viable alternative to new construction, especially in developed urban settings. Clients might opt to renovate existing structures, reducing the need for CSCEC's new construction services. In 2024, China's building renovation market reached $500 billion, illustrating the scale of this substitution threat. CSCEC can capitalize on its dual expertise in new builds and renovations to mitigate this risk.

Alternative Materials

The rise of sustainable building materials presents a significant threat to China State Construction Engineering Corporation (CSCEC). Alternatives like timber and recycled materials are gaining traction. CSCEC must adapt to this shift to stay competitive and meet green building demands. The market for sustainable materials is expanding, with a projected global value of $447.6 billion by 2028.

- The global green building materials market was valued at $308.3 billion in 2023.

- China's construction industry accounts for a large portion of global CO2 emissions.

- Recycled concrete use can reduce environmental impact by up to 60%.

- The adoption of timber construction is increasing globally.

Impact of Economic Downturns

Economic downturns significantly amplify the threat of substitutes for China State Construction Engineering Corporation (CSCEC). Clients facing budget constraints might switch to cheaper construction methods or postpone projects. This shift can directly impact CSCEC's revenue, especially in high-end projects. CSCEC must focus on cost-effective strategies to maintain market share during economic instability.

- In 2024, China's construction output growth slowed, reflecting economic pressures.

- Cost-conscious clients may prefer local contractors offering lower prices.

- Delays in projects due to funding issues become more common.

- CSCEC's diversification into different project types is crucial.

The threat of substitutes for China State Construction Engineering Corporation (CSCEC) arises from various sources. Clients might choose modular construction, valued at $115.14 billion in 2023, or renovation projects. Sustainable materials and economic downturns also intensify this risk.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Modular Construction | Offers faster, cheaper alternatives | Market: $125B (est.) |

| Renovations | Reduces demand for new builds | China's market: $500B |

| Sustainable Materials | Shifts demand to eco-friendly options | Global market: $400B+ (est.) |

Entrants Threaten

High capital requirements are a major hurdle. The construction sector needs substantial investment in machinery and skilled labor, raising the bar for newcomers. CSCEC's financial might, backed by state support, gives it an edge. In 2024, construction spending in China reached approximately $1.2 trillion, highlighting the capital-intensive nature of the industry.

China's construction industry faces extensive regulatory hurdles, including strict licensing. CSCEC benefits from its established expertise in compliance, a significant barrier for new entrants. New firms struggle to quickly navigate these complex rules. In 2024, new construction companies in China spent an average of $50,000 on initial regulatory compliance.

China State Construction Engineering Corporation (CSCEC) benefits from its well-established brand reputation, making it challenging for new entrants. CSCEC's history of successfully delivering major projects fosters client trust. In 2024, CSCEC's brand value was estimated at over $40 billion, reflecting its strong market position. This established credibility provides a significant competitive advantage.

Economies of Scale

China State Construction Engineering Corporation (CSCEC) enjoys substantial economies of scale, a major barrier for new entrants. Its massive size and widespread operations enable competitive pricing and efficient project delivery. This operational efficiency, a key strength, poses a significant cost challenge for smaller companies. CSCEC's revenue in 2024 is projected to exceed $300 billion, underscoring its scale.

- Competitive Pricing: CSCEC's scale enables lower prices.

- Efficient Delivery: Large projects are completed efficiently.

- Operational Strength: Efficiency is a key advantage.

- Revenue: Expected to exceed $300 billion in 2024.

Access to Government Projects

As a state-owned enterprise, China State Construction Engineering Corporation (CSCEC) benefits significantly from preferential access to government projects. This advantage offers a consistent flow of business, making it tough for new entrants, especially private companies, to compete. Government support is a key element in CSCEC's dominant market position, ensuring a steady pipeline of projects. This support is critical for maintaining its competitive edge.

- CSCEC's revenue in 2024 is projected to increase, reflecting its strong position in the market.

- New entrants face challenges due to CSCEC's access to large-scale infrastructure projects.

- Government backing provides CSCEC with significant financial and strategic advantages.

- The company's market dominance is bolstered by its privileged status.

New entrants face high capital costs and regulatory hurdles in China's construction sector. CSCEC benefits from its brand recognition and economies of scale. The company's access to government projects presents a significant barrier.

| Factor | Impact | Data (2024 est.) |

|---|---|---|

| Capital Needs | High Barrier | $1.2T construction spend |

| Regulations | Compliance Cost | $50,000 initial cost |

| Brand Value | Competitive Edge | $40B+ CSCEC value |

Porter's Five Forces Analysis Data Sources

The analysis utilizes industry reports, company filings, construction statistics, and economic data. It draws on government sources and market research for comprehensive coverage.