CSW Industrials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSW Industrials Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, providing a concise view of each business unit's position.

Full Transparency, Always

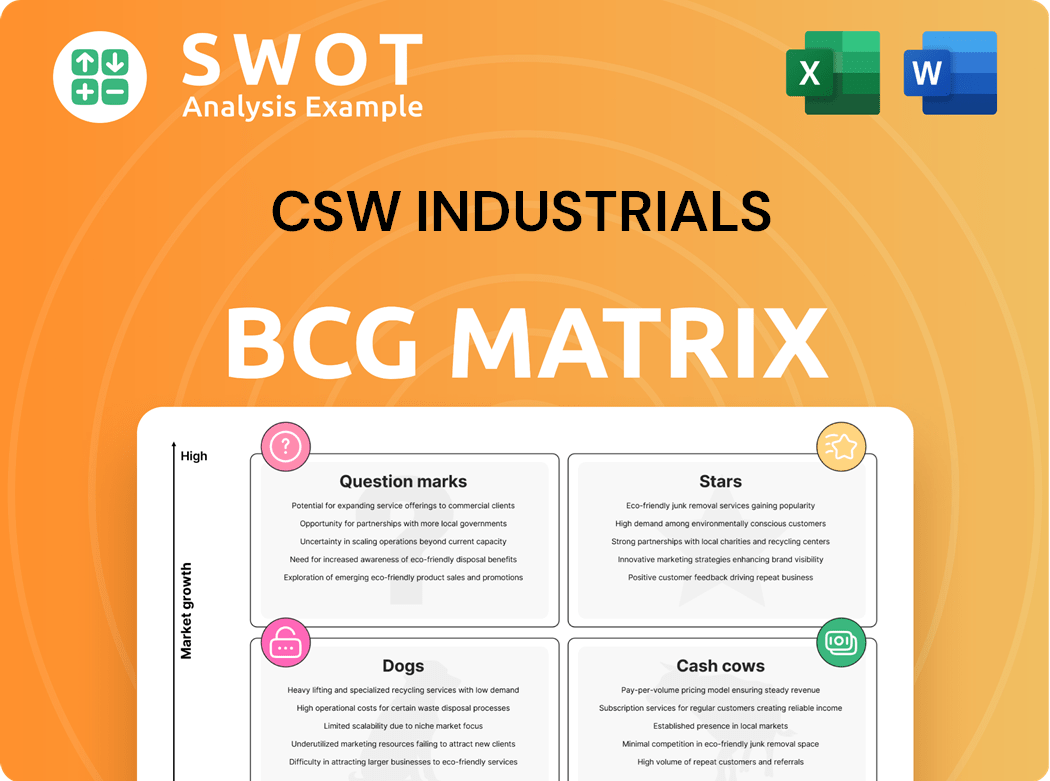

CSW Industrials BCG Matrix

The BCG Matrix preview you're exploring is identical to the final document you'll receive. It's a fully functional, strategic tool for analyzing CSW Industrials' business units, ready for immediate download and application. Prepare to gain a clear understanding of your portfolio with this detailed report. This is the exact version—no hidden content.

BCG Matrix Template

CSW Industrials' product portfolio is a dynamic mix! Some products may shine as "Stars," generating high growth. Others could be "Cash Cows," providing steady revenue. "Dogs" may need reevaluation, while "Question Marks" offer growth potential. This preview only scratches the surface. Purchase the full BCG Matrix report to uncover detailed quadrant placements, and strategic insights you can act on.

Stars

Contractor Solutions, especially in booming construction markets, align with the Stars quadrant. They likely have a solid market share and need sustained investment. For instance, the global construction market was valued at $15.2 trillion in 2023. Continuous innovation and market expansion are vital.

Engineered Building Solutions, particularly those emphasizing energy efficiency, could be Stars due to high adoption. These solutions likely dominate their niches, requiring continued promotion and strategic placement. Focusing on long-term value and environmental advantages is key to market dominance. For example, in 2024, the green building materials market is projected to reach $368.4 billion.

Specialty chemicals, especially those in growing sectors, are often stars. They likely command significant market share, necessitating investment in R&D and marketing. Companies like CSW Industrials, with a focus on niche markets, must explore new applications. In 2024, the specialty chemicals market was valued at approximately $700 billion, reflecting its importance.

First-to-Market Products

If CSW Industrials has pioneering products that are first to market, they're stars. These innovations often have a temporary monopoly, needing constant investment to stay ahead. CSWI's focus on expanding distribution channels is key. Building a strong brand is also important for lasting success.

- CSWI's revenue in 2023 was $798 million.

- Gross profit in 2023 was $378 million.

- CSWI's net income in 2023 was $96 million.

- CSWI's market capitalization is approximately $7 billion.

Segments Benefiting from Regulatory Changes

Stars in CSW Industrials' BCG Matrix are segments that thrive on regulatory tailwinds. For instance, energy-efficient building materials, boosted by environmental regulations, fit this profile. These areas see fast growth, demanding strategic investment to capitalize on rising demand. Adapting products to meet changing regulations is crucial. In 2024, the global green building materials market was valued at $367.3 billion.

- Rapid growth driven by regulatory changes.

- Need for strategic investment to meet demand.

- Adaptation of product offerings is key.

- Example: Energy-efficient building materials.

Stars in CSW Industrials' portfolio have high growth and market share. They need continued investment to maintain their position. For example, CSWI's revenue in 2023 was $798 million.

| Characteristic | Description |

|---|---|

| Market Growth | High growth potential in a competitive market. |

| Investment | Requires significant investment in innovation. |

| Examples | Contractor Solutions, Engineered Building Solutions. |

Cash Cows

Within Contractor Solutions, established product lines like specific tools often act as cash cows. These products, holding significant market share in a mature market, need minimal investment. Consider that in 2024, CSWI's Contractor Solutions segment generated substantial revenue, reflecting the steady demand. The focus should be on efficiency and distribution to boost cash flow. In 2024, the segment's operating margin was strong, showing its profitability.

Certain legacy products in CSW Industrials' Engineered Building Solutions, holding established market positions, fit the cash cow profile. These generate consistent revenue with low marketing costs. For example, in 2024, the segment's revenue was $1.06 billion. Infrastructure investment and streamlined production can boost profitability.

Commodity chemicals in specialty chemicals, like those used in construction, often become cash cows. These products, with high market share in slow-growing sectors, are ideal for generating steady cash. For example, in 2024, the global construction chemicals market was valued at $63.8 billion. To maximize profit, prioritize cost-efficiency and strong customer relations.

High-Volume Standardized Products

High-volume, standardized products in mature markets are cash cows, demanding minimal marketing and R&D. These products thrive on efficient production and supply chains. CSWI reported a gross profit of $268.2 million in fiscal year 2024, highlighting effective management.

- Focus on streamlined operations.

- Prioritize supply chain efficiency.

- Maintain consistent cash flow generation.

- Minimize investment in innovation.

Replacement Parts and Services

Replacement parts and services for CSW Industrials' products form a solid cash cow. The existing equipment base fuels consistent revenue with minimal marketing needs. A focus on top-notch customer service and readily available parts inventory is key. In 2024, aftermarket sales contributed significantly to CSW's overall revenue. This segment's stability helps offset fluctuations in other areas.

- Aftermarket revenue is a steady revenue stream.

- Limited marketing expenses are needed.

- Customer service and inventory are crucial.

- Aftermarket sales consistently contribute to revenue.

Cash cows in CSW Industrials' portfolio are mature products with high market share. These generate steady cash with minimal investment needs. Prioritize operational efficiency and strong customer relationships to maximize profits. In 2024, CSWI's strong gross profit underlines effective management of these assets.

| Aspect | Details | Impact |

|---|---|---|

| Market Position | High share in mature markets | Consistent revenue |

| Investment Needs | Low marketing and R&D | High cash generation |

| Strategic Focus | Operational efficiency, customer service | Profit maximization |

Dogs

In CSW Industrials' BCG matrix, declining product lines within Contractor Solutions, facing obsolescence or changing preferences, are considered dogs. These lines have low market share in a low-growth market. For instance, in 2024, certain outdated sealant products saw a 5% sales decline. Consider divesting or phasing them out to minimize losses.

Outdated Engineered Building Solutions, like those not meeting current standards, fit the "Dogs" quadrant of the BCG Matrix. These have low market share and limited growth. CSW Industrials reported a revenue of $696.8 million in fiscal year 2023. Consider repurposing or discontinuing these offerings. Focus on modern, compliant solutions for better financial returns.

Specialty chemicals facing stricter environmental rules or sustainable alternatives could be "Dogs." These have low market share, becoming a financial strain. For instance, in 2024, the global market for specialty chemicals was about $600 billion. Consider divesting or reformulating to stay compliant.

Products with Unsustainable Margins

Products at CSW Industrials with low or negative margins, due to high costs or competition, are "dogs." These offerings consume resources without generating substantial returns. For instance, a specific product line might show a consistent operating margin below the company average of 18.7% in 2024, indicating a problematic area. A cost-benefit analysis is crucial to decide if these should be kept or removed.

- Low Profitability: Products with margins consistently below the company average.

- Resource Drain: These products may consume resources, potentially impacting overall profitability.

- Strategic Review: A cost-benefit analysis is essential to determine the product's future.

- Decision Making: Evaluate whether to continue, improve, or discontinue the product line.

Niche Products with Declining Demand

Dogs in CSW Industrials' BCG matrix are niche products with dwindling demand, facing low market share and minimal growth. These items struggle due to changing markets or new alternatives. For example, in 2024, sales of certain specialized sealants dropped by 7% due to new competitors. Reallocating resources from these underperforming products is key.

- Declining Demand: Products facing reduced customer interest.

- Low Market Share: Limited presence in their respective markets.

- Limited Growth: Restricted potential for future expansion.

- Resource Reallocation: Shifting funds to better opportunities.

Dogs in CSW Industrials' BCG matrix are low-performing products with low market share in slow-growth markets. These products drain resources, affecting profitability. For instance, a specific sealant line saw a 5% sales decline in 2024. Strategic reviews and potential divestments are crucial.

| Category | Characteristic | Financial Impact |

|---|---|---|

| Market Share | Low | Reduced revenue |

| Growth Rate | Low | Limited expansion |

| Profitability | Negative or low | Resource drain |

Question Marks

New sustainable building materials in CSW Industrials' Engineered Building Solutions are question marks. They face high growth due to environmental concerns but may have low initial market share. In 2024, the green building materials market was valued at over $360 billion. Marketing and education are key to boosting adoption.

Innovative chemical formulations, a question mark in CSW Industrials' BCG matrix, represent high-growth potential but low market share. These specialty chemicals, addressing emerging needs, require strategic investment. Market research and targeted campaigns are crucial. In 2024, CSWI's revenue was $783 million, reflecting growth opportunities.

In CSW Industrials' BCG matrix, emerging technologies in Contractor Solutions, like smart tools, are question marks. These innovations target a high-growth market but face potentially low adoption rates initially. Offering training and support is key to boosting uptake. For example, the smart HVAC market is projected to reach $1.8 billion by 2024.

Expansion into New Geographic Markets

Expansion into new geographic markets with existing product lines aligns with a question mark in the BCG Matrix. These markets offer high growth potential but involve significant investment to establish a presence and capture market share. CSW Industrials must conduct thorough market research to understand local needs and competition. A tailored market entry strategy is crucial for success in these new regions.

- Market entry strategies include exporting, licensing, joint ventures, and direct investment.

- CSWI's revenue in 2024 was approximately $740 million, reflecting growth opportunities.

- Consider the PESTLE analysis to assess political, economic, social, technological, legal, and environmental factors.

- Evaluate the competitive landscape and potential market share gains.

Solutions Targeting Emerging Industries

CSW Industrials might view developing solutions for emerging sectors like renewable energy or EV infrastructure as a "Question Mark" in its BCG Matrix. These industries promise high growth, but demand substantial initial investments and come with elevated risks. Consider that CSWI's revenue for fiscal year 2023 was $897.8 million, indicating the scale at which potential new ventures could be evaluated. Thorough due diligence and flexible business plans are crucial for navigating these uncertainties. This approach helps manage the potential for high returns while mitigating risks.

- 2023 Revenue: $897.8 million, showing the financial scope of potential investments.

- Focus on high-growth, high-risk markets such as renewable energy.

- Requires significant upfront capital investment.

- Emphasizes the necessity of thorough due diligence and flexible strategic planning.

Question marks in CSWI’s BCG matrix often involve high-growth potential with uncertain market share. These ventures need strategic investment and careful market analysis to succeed. The key is to identify high-potential areas while mitigating risks. CSWI's 2024 revenue of $783 million illustrates the scale of possible investments.

| Category | Description | Strategic Actions |

|---|---|---|

| New Markets | Expansion into new geographic areas with established products. | Market research, targeted marketing, and tailored entry strategy. |

| Emerging Sectors | Ventures in renewable energy or EV infrastructure. | Thorough due diligence, flexible business plans, and upfront capital. |

| Innovative Products | Specialty chemicals and smart tools. | Strategic investment, market research, and training support. |

BCG Matrix Data Sources

CSWI's BCG Matrix is built using SEC filings, market reports, and industry analysis, plus competitor data for robust, actionable strategies.