Dabur India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dabur India Bundle

What is included in the product

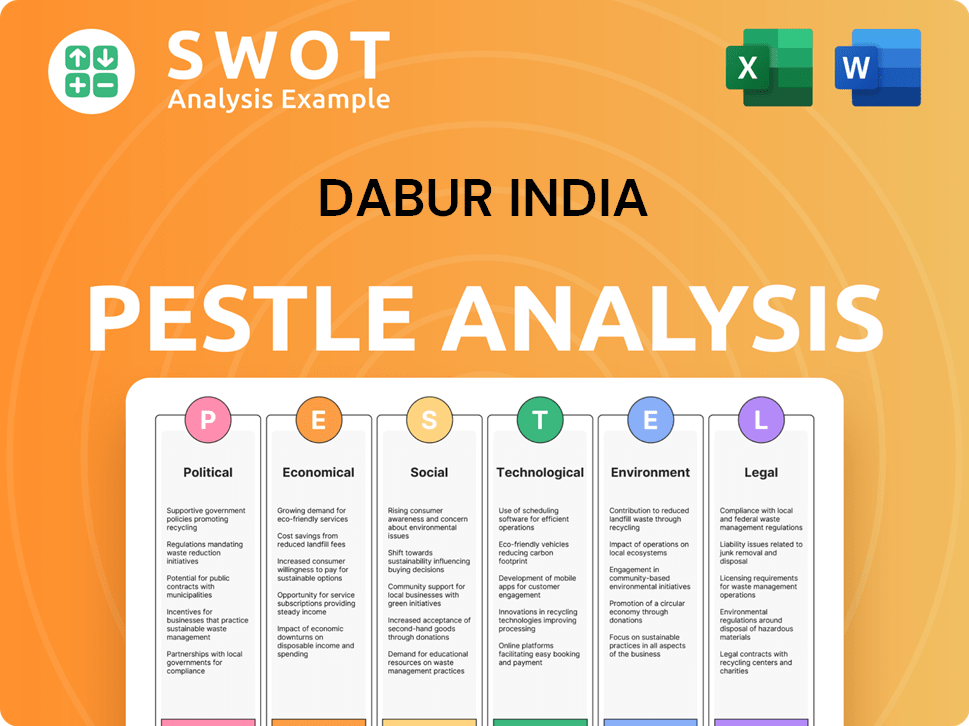

A PESTLE analysis unveils external influences shaping Dabur India across politics, economics, society, tech, environment, and law.

A concise summary format, ideal for quick alignment across teams and departments.

Preview Before You Purchase

Dabur India PESTLE Analysis

The Dabur India PESTLE analysis preview reflects the complete document. You'll download this fully formed analysis upon purchase.

PESTLE Analysis Template

Dive into Dabur India's external landscape with our detailed PESTLE Analysis. Uncover crucial insights on political, economic, social, technological, legal, and environmental factors. Understand how these elements shape Dabur's strategy and future success. Ready-made for investors and business planners alike. Download now and unlock actionable intelligence for smarter decisions!

Political factors

Government policies focused on rural development are crucial for Dabur. Initiatives boosting rural incomes and infrastructure can increase consumer spending in these key markets. Support for agriculture, like ensuring a normal monsoon, also influences rural demand. Tax reliefs and rural development focus in the Union Budget can stimulate consumer sentiment. For instance, in FY24, rural consumption grew by 7.6%, showing the impact of these policies.

Political stability in India supports Dabur's business and consumer trust. Global conflicts can disrupt Dabur's international growth and supply chains. Recent data shows India's GDP growth at 8.4% in Q3 FY24, reflecting stability. Geopolitical events in 2024/2025 may affect Dabur's exports, which were up 12% in FY23.

Dabur India faces political risks from regulatory shifts in the FMCG sector. Changes in food safety standards, packaging, and advertising guidelines directly impact Dabur's operations. Compliance with evolving legal frameworks is crucial for market access. In 2024, the Indian FMCG market, valued at $74 billion, saw increased regulatory scrutiny. Dabur must adapt to maintain its market position.

Trade Policies and International Relations

Trade policies and international relations are crucial for Dabur's global operations, impacting both import and export capabilities. For example, a change in tariffs can directly affect the cost of importing essential raw materials. Dabur's expansion plans are heavily influenced by the political and economic stability of the target markets.

- In FY2023-24, Dabur's international business accounted for approximately 28% of its total revenue.

- Any trade restrictions or political instability in key markets, such as those in the Middle East or Africa, could significantly affect these figures.

- Dabur's strategic focus on emerging markets necessitates careful monitoring of political risks.

Specific Political Issues

Political issues, like instability in Bangladesh, can directly affect Dabur's regional operations. Such instability might disrupt supply chains or consumer confidence. However, Dabur's diverse market presence can help offset these localized risks. The company strategically navigates political challenges by adapting its strategies. This includes adjusting distribution networks or modifying marketing campaigns.

- Dabur's international business contributed 19% to total revenue in FY24.

- Political risks can lead to supply chain disruptions.

- Dabur's strategy includes market diversification to mitigate risks.

Dabur thrives on India's rural development policies and political stability, fostering consumer confidence. Global conflicts pose risks to international growth; any trade issues may impact export and import. Regulatory shifts in FMCG, such as those in food safety, are critical for market access, and they directly affect Dabur. Trade policies, including tariffs, critically impact its international business.

| Political Factor | Impact on Dabur | Relevant Data (2024-2025) |

|---|---|---|

| Rural Development | Increased consumer spending, market access. | FY24 rural consumption growth: 7.6%, Government focus on rural budgets. |

| Political Stability | Supports business, reduces risk, market expansion. | India GDP Q3 FY24: 8.4% growth, International business: 19% of revenue (FY24). |

| Regulatory Shifts | Adaptation of market standards, operational compliance. | FMCG market value (2024): $74 billion, Regulatory scrutiny: increased. |

| Trade Policies | Affects imports/exports, cost, and strategic expansion. | Exports in FY23 increased 12%, Tariffs changes impact costs. |

Economic factors

High food inflation and rising input costs, like the 7.6% increase in edible oil prices in 2024, can erode consumer spending, especially in cities. This could squeeze Dabur's profits. Although inflation eased to 4.83% in March 2024, unstable commodity prices, such as the 10% jump in sugar costs, still pose risks.

Consumer spending and disposable income are crucial for FMCG demand. In 2024, India's GDP growth is projected at 6.5-7%, impacting income levels. Stagnant wages could limit spending, particularly for the middle class, a key Dabur consumer segment. This affects sales of health and personal care products.

Dabur India's performance is shaped by rural and urban market dynamics. Rural demand has been robust, sometimes exceeding urban growth. However, urban consumption slowed down due to inflation. In Q3 FY24, Dabur saw rural growth outpacing urban. Urban markets remain crucial for premium product sales.

Economic Growth and GDP

India's economic growth is a critical factor for Dabur India. The overall economic climate, both domestically and globally, influences consumer behavior and market opportunities. While global economic expansion is anticipated to be modest, India is positioned as a significant growth engine. The Reserve Bank of India (RBI) projects India's real GDP growth at 7% for fiscal year 2024-25.

- India's GDP growth is expected to be robust, offering expansion opportunities.

- Global economic conditions could impact Dabur's export markets.

- Consumer spending is likely to remain strong, supporting domestic sales.

Currency Fluctuations

Currency fluctuations significantly impact Dabur India. These fluctuations directly affect the cost of importing raw materials, potentially squeezing profit margins. Revenue from international operations, which constituted about 15% of total revenue in FY2023-2024, is also vulnerable. The Indian Rupee's volatility against major currencies like the USD and Euro requires active hedging strategies.

- FY2023-2024: International revenue ~15% of total revenue.

- Hedging strategies are crucial to mitigate risk.

- Import costs are sensitive to exchange rates.

Inflation, though easing to 4.83% in March 2024, still pressures costs. India's GDP growth, projected at 7% for FY2024-25 by RBI, boosts income. Consumer spending is pivotal for Dabur; rural markets show growth, yet urban areas drive premium sales. Currency fluctuations influence costs.

| Economic Factor | Impact on Dabur | Data Point (2024/2025) |

|---|---|---|

| GDP Growth | Drives consumer spending | Projected 7% for FY2024-25 |

| Inflation | Affects input costs, spending | March 2024: 4.83% |

| Currency Fluctuations | Impacts import costs, margins | Rupee volatility vs. USD |

Sociological factors

Consumer preferences are shifting towards natural and sustainable products, which suits Dabur's portfolio. In 2024, the demand for Ayurvedic products grew, with Dabur's revenue up 10%. Dabur can capitalize on this by innovating and expanding its health-focused lines. This includes boosting its e-commerce sales, which rose by 25% in the same year.

Urbanization and rural market penetration are vital. The FMCG sector, like Dabur, thrives on this shift. Dabur increases its rural distribution, aiming for growth. In 2024, rural FMCG sales grew by 10%. Dabur's rural revenue rose by 12%.

The expansion of India's middle class and increasing disposable incomes, especially in rural areas, boost the consumer market for products like Dabur's. Data indicates a consistent rise in per capita income, with projections showing further growth through 2025. However, income stagnation among some segments could affect spending patterns. The Indian middle class is expected to reach 100 million households by 2025.

Health and Wellness Consciousness

Consumers increasingly prioritize health and wellness, boosting demand for health-focused products. This trend is especially beneficial for Dabur's health supplements and ayurvedic offerings. In 2024, the global wellness market was valued at over $7 trillion, showcasing significant growth. Dabur's emphasis on natural and Ayurvedic products aligns well with this consumer shift. This positions Dabur to capitalize on the rising demand for health-conscious choices.

- Global wellness market valued over $7 trillion in 2024.

- Growing consumer focus on health and wellness.

- Dabur's product portfolio aligns with the trend.

Cultural Shifts and Brand Recognition

Cultural shifts significantly impact consumer behavior, influencing how brands are perceived and products are adopted. Dabur's established brand recognition is a key advantage, built over decades of consistent presence. Strong brand equity helps navigate changing consumer preferences and maintain market share. Dabur's ability to adapt its marketing to evolving cultural norms is crucial for continued success.

- Dabur India's revenue for FY24 was approximately ₹11,838 crore.

- The company's brand portfolio includes brands like Dabur Chyawanprash, which has a strong brand recall.

- Dabur's marketing strategy adapts to cultural nuances, ensuring relevance.

Dabur benefits from rising health awareness, reflected in Ayurvedic product growth and a $7 trillion global wellness market in 2024. Urbanization and middle-class expansion drive market opportunities, supported by increasing disposable incomes through 2025, targeting around 100 million households. Adapting to cultural shifts is crucial. In FY24, Dabur generated about ₹11,838 crore in revenue.

| Factor | Impact on Dabur | Data Point (2024) |

|---|---|---|

| Health & Wellness Trends | Boosts demand for health-focused products. | Global wellness market value: Over $7 trillion |

| Urbanization & Income | Drives FMCG sector growth. | Rural FMCG sales growth: 10% |

| Cultural Shifts | Influences consumer behavior and brand perception. | Dabur India revenue (FY24): ~₹11,838 crore |

Technological factors

Digital marketing and e-commerce are reshaping retail. Dabur must use digital platforms to expand its reach. In 2024, e-commerce in India grew by 25%. Dabur's online sales rose by 40% in the last fiscal year. Quick commerce is also gaining traction, with a 30% growth in 2024.

Technological advancements are pivotal for Dabur's supply chain efficiency. Dabur is using tech for better planning, route optimization, and automation. These tech investments improve manufacturing and distribution. According to recent reports, supply chain automation is projected to grow by 15% annually through 2025.

Dabur India leverages technology in R&D for product innovation, especially in natural and ayurvedic segments. The company invests significantly in research to create new products and improve existing ones. In FY2023-24, Dabur's R&D expenditure was around ₹150 crore, reflecting its commitment to innovation. This focus helps Dabur adapt to changing consumer demands and maintain its market position.

Automation in Manufacturing

Automation is transforming manufacturing, boosting efficiency and cutting costs for companies like Dabur. Dabur India is investing in automation to improve product quality and streamline operations. This includes advanced robotics and digital systems across its production lines. Recent reports show that automated processes can increase production output by up to 30%.

- Dabur's capital expenditure in FY23-24 was approximately INR 300 crore, partly for automation.

- Automated systems can reduce labor costs by 20-25%.

- Quality control improves with automated inspection systems.

Data Analytics and Consumer Insights

Dabur India can leverage data analytics for deeper consumer understanding and to refine marketing. This includes analyzing sales data and online behavior. For example, in FY24, Dabur's e-commerce sales grew, showing digital's importance. Data helps tailor campaigns, improving ROI. This approach supports more informed business decisions.

- FY24 e-commerce sales growth for Dabur.

- Use of data for targeted marketing campaigns.

- Analysis of sales data and online consumer behavior.

Dabur's digital presence is key, with e-commerce growing strongly. In 2024, India's e-commerce increased by 25%. Dabur's R&D investment in FY2023-24 was about ₹150 crore, fostering product innovation.

| Aspect | Details | Data (2024/2025) |

|---|---|---|

| E-commerce Growth | Reshaping retail | 25% growth in India, 40% for Dabur online |

| R&D Spend | Focus on Innovation | ₹150 crore (FY2023-24) |

| Automation Impact | Manufacturing Efficiency | Production output increase up to 30% |

Legal factors

Dabur must adhere to the Food Safety and Standards Regulations set by the Food Safety and Standards Authority of India (FSSAI). This is essential for their food and beverage products. Non-compliance can result in prohibition orders and legal issues. The FSSAI conducted over 100,000 inspections in 2024 to ensure food safety standards were met. In 2024, there was a 15% increase in food product recalls due to safety violations.

Dabur India, like other FMCG companies, heavily relies on protecting its intellectual property. This includes trademarks and copyrights to safeguard its brand identity and product designs. Legal battles over trademark infringement are common in the FMCG sector. In 2024, the company faced several cases to protect its brand. Dabur's focus on legal measures is crucial for maintaining market position and consumer trust.

Packaging and labeling regulations, crucial for Dabur, vary across markets. These rules dictate what must be on packaging and what's restricted. For instance, India's Food Safety and Standards Authority (FSSAI) sets labeling standards. Non-compliance can lead to product recalls, impacting sales and brand reputation. In 2024, Dabur invested in sustainable packaging, reflecting these regulations.

Advertising Standards and Regulations

Dabur India's advertising strategies must adhere to strict legal guidelines to prevent deceptive practices. These regulations ensure that all claims and communications are truthful and not misleading to consumers. Non-compliance can lead to significant penalties, including fines and legal challenges, affecting brand reputation. In 2024, the Advertising Standards Council of India (ASCI) handled over 5,000 complaints, showing the importance of regulatory compliance.

- ASCI's data indicates a rising trend in scrutinized advertisements.

- Dabur must ensure all marketing materials meet ASCI's standards.

- Failure to comply can result in legal and financial repercussions.

- Focus on transparent and accurate product representation is crucial.

Product Liability Laws

Dabur India faces product liability risks, and legal cases related to product safety can arise. The company maintains product liability insurance to mitigate financial impacts. Recently, there have been no major product liability litigations against Dabur. However, it's crucial to note the ongoing regulatory scrutiny of food and beverage products. This includes potential implications for Dabur's diverse product range.

- Insurance coverage helps manage financial risks.

- Regulatory changes can impact product compliance.

- Legal proceedings can affect brand reputation.

Dabur's adherence to FSSAI regulations and labeling standards is paramount. Protecting intellectual property and advertising standards is legally essential for its brand. Product liability insurance aids in managing financial risks related to product safety.

| Legal Area | Compliance Focus | Impact |

|---|---|---|

| Food Safety | FSSAI Regulations | Product recalls & legal issues |

| Intellectual Property | Trademark/Copyrights | Brand identity protection |

| Advertising | Truthful Representation | Penalties & brand damage |

Environmental factors

Dabur India's reliance on natural ingredients makes sustainable sourcing vital. The company faces increasing pressure to use organically grown materials. This could increase input costs, impacting profitability. In 2024, Dabur invested ₹150 crore in sustainable sourcing initiatives.

Dabur India faces growing pressure from environmental regulations. Restrictions on single-use plastics and rising consumer awareness impact packaging choices. In FY24, the company invested ₹150 crore in sustainable packaging. This shift necessitates investment in eco-friendly alternatives and potentially increases production costs.

Water is crucial for Dabur, especially in juice production. The company aims for water positivity and uses various conservation methods. In FY2023-24, Dabur reduced water consumption by 15% in its plants. This aligns with a broader trend of companies prioritizing water sustainability.

Climate Change Impact

Climate change poses significant risks to Dabur India, potentially disrupting supply chains due to extreme weather events and altering consumer preferences. Changes in seasonal patterns could affect the availability of key raw materials, like herbs and agricultural products. Dabur is actively responding to these environmental challenges. The company has set a goal to reduce Scope 1 and 2 emissions by 50% by 2030, aiming for carbon neutrality.

- Dabur India aims to reduce Scope 1 and 2 emissions by 50% by 2030.

- The company is working towards carbon neutrality.

- Extreme weather may disrupt raw material supplies.

Waste Management and Environmental Norms

Dabur India faces environmental pressures due to its FMCG operations. Changes in environmental norms, especially concerning waste treatment and manufacturing discharge, directly affect the company. Compliance is crucial to avoid disruptions and maintain production. Dabur's waste management strategies are vital for sustainable operations.

- In 2024, the Indian waste management market was valued at approximately $13.6 billion.

- The Indian government has increased investments in waste management infrastructure by 15% in 2024.

- Dabur has invested 5% of its capital expenditure in eco-friendly initiatives in 2024.

Dabur India addresses environmental issues through sustainable practices. The firm focuses on sustainable sourcing, investing ₹150 crore in 2024. Climate change poses supply chain risks, yet Dabur aims for carbon neutrality.

| Initiative | Investment (FY24) | Target |

|---|---|---|

| Sustainable Sourcing | ₹150 crore | Ongoing |

| Sustainable Packaging | ₹150 crore | Ongoing |

| Emissions Reduction | N/A | 50% by 2030 (Scope 1 & 2) |

PESTLE Analysis Data Sources

Our analysis draws from industry reports, financial databases, government data, and economic forecasts, ensuring data accuracy and relevancy.