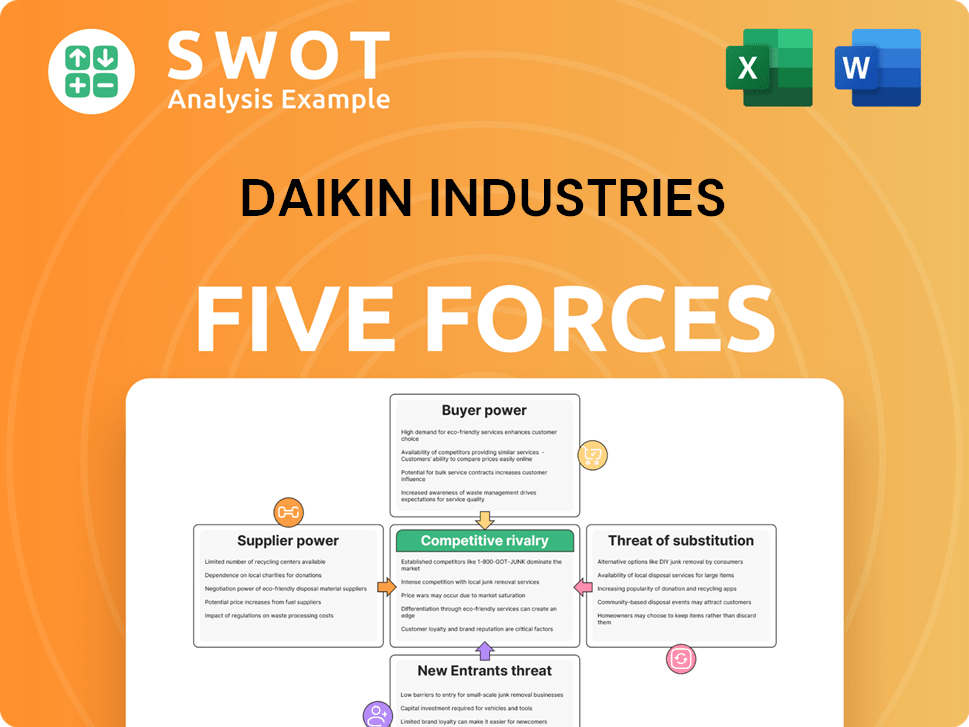

Daikin Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daikin Industries Bundle

What is included in the product

Tailored exclusively for Daikin Industries, analyzing its position within its competitive landscape.

Daikin's Porter's analysis provides a clear, one-sheet summary, enabling quick strategic decisions.

Preview Before You Purchase

Daikin Industries Porter's Five Forces Analysis

This preview shows the complete Daikin Industries Porter's Five Forces Analysis. You'll receive this fully-formatted document instantly after purchase.

Porter's Five Forces Analysis Template

Daikin Industries faces moderate competitive rivalry in the HVAC market due to established players and product differentiation. Buyer power is significant, influenced by price sensitivity. Suppliers have moderate influence due to the availability of components. The threat of new entrants is limited by high capital costs. Substitute products pose a moderate threat, like other heating and cooling technologies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Daikin Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Daikin's suppliers, ranging from raw material providers to component manufacturers, significantly influence its operations. The bargaining power of these suppliers is determined by their concentration and the availability of substitute components. Strong supplier power can elevate Daikin's input costs, impacting profitability. In 2024, Daikin's cost of revenue was ¥3.6 trillion, reflecting the impact of supplier costs.

Daikin's supplier power hinges on switching costs. Specialized parts increase supplier leverage due to retooling needs. Consider that Daikin's 2023 revenue was ~$30B; reliance on key suppliers impacts profitability. High switching costs can raise Daikin's input expenses.

Supplier power in Daikin's industry is influenced by alternative availability. A wide supplier base reduces supplier power, while a limited one increases it. For example, in 2024, the HVAC market experienced supply chain disruptions, impacting supplier bargaining power. Monitoring the supply market structure is crucial for Daikin's strategic planning to mitigate risks and secure favorable terms.

Supplier Power 4

Daikin Industries faces supplier power, especially if suppliers integrate vertically. This move could make them direct competitors, increasing their leverage. Monitoring suppliers' strategies is crucial for Daikin's operations.

Consider the potential impact of suppliers entering Daikin's markets. This shift could significantly alter Daikin's cost structure.

- Supplier concentration: Few suppliers dominate the market.

- Switching costs: High costs to change suppliers.

- Threat of integration: Suppliers' potential to enter Daikin's market.

- Importance of volume: Daikin's reliance on supplier products.

Supplier Power 5

Daikin Industries' bargaining power of suppliers is moderate, rated as 5. Daikin's substantial purchasing volume generally provides leverage over suppliers. However, the dependency can fluctuate based on specific component needs. Evaluating purchase volumes is important for understanding Daikin's position.

- Daikin's annual revenue in 2024 reached approximately ¥4.3 trillion.

- The company's global presence and diversified product portfolio increase its supplier options.

- Specific component dependencies can diminish Daikin's bargaining power.

- Large-scale procurement often results in cost advantages.

Daikin's supplier power is moderate. Its purchasing volume and diversified options provide leverage. However, specific component dependencies impact its power. In 2024, Daikin's cost of revenue was ¥3.6 trillion.

| Factor | Impact on Daikin | 2024 Data Point |

|---|---|---|

| Supplier Concentration | Concentration increases supplier power | HVAC market supply chain disruptions |

| Switching Costs | High costs increase supplier power | Specialized parts impact leverage |

| Integration Threat | Suppliers enter Daikin's market | Potential shift in cost structure |

Customers Bargaining Power

Daikin faces buyer power from large distributors and HVAC contractors, key customer segments. These buyers can negotiate prices, affecting Daikin's profits. Understanding buyer concentration is crucial; a concentrated buyer base can exert more pressure. In 2024, Daikin's revenue was approximately ¥4.7 trillion, with a significant portion flowing through these channels.

Daikin faces buyer power from residential, commercial, and industrial clients, influencing pricing and sales. Price sensitivity and brand loyalty are key factors. In 2024, Daikin's revenue reached ¥4.7 trillion, demonstrating customer impact. Understanding end-user preferences is crucial for Daikin's market positioning and strategy.

Customers wield substantial power due to the availability of numerous HVAC-R solutions. Their bargaining power increases with broader choices, while fewer options diminish it. For instance, in 2024, the global HVAC market was valued at approximately $140 billion, featuring diverse brands. Staying informed about competitors is essential; Daikin's 2024 revenue was around $35 billion.

Buyer Power 4

Customers' ability to access pricing and product details strengthens their negotiation position. Market transparency allows buyers to find better prices. Assessing market transparency is key to understanding buyer power. For example, online platforms and consumer reviews increase customer power. Daikin faces moderate buyer power due to brand loyalty, but price comparisons remain a factor.

- Increased price transparency: Online platforms facilitate price comparisons.

- Product information availability: Detailed specifications are readily accessible.

- Impact on Daikin: Moderate buyer power influences pricing strategies.

- Market dynamics: Competitive landscape impacts customer leverage.

Buyer Power 5

Daikin's customer bargaining power is moderate. Switching costs for HVAC systems can be a factor, but vary. Low switching costs, like for residential units, boost customer power. High costs, such as commercial installations, can limit this. Analyzing these costs is crucial.

- Residential HVAC: Lower switching costs, greater buyer power.

- Commercial HVAC: Higher switching costs, less buyer power.

- Service contracts: Impact buyer leverage.

- Market competition: Influences customer options.

Daikin faces moderate customer bargaining power. Transparency and options affect negotiation power. The global HVAC market, valued at $140B in 2024, sees varied switching costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Transparency | Enhances Customer Power | Price Comparison Platforms |

| Switching Costs | Influences Bargaining | Residential vs. Commercial |

| Daikin's Revenue | Reflects Market Position | Approx. $35B |

Rivalry Among Competitors

The HVAC-R market sees fierce competition. Major players like Carrier and Trane Technologies battle for market share. This rivalry affects pricing and drives innovation. For instance, in 2024, Carrier's revenue was around $23 billion. Keeping an eye on competitors is crucial for Daikin.

Daikin faces intense rivalry, especially in slow-growth markets. The HVAC market's growth rate impacts competition significantly. In 2024, the global HVAC market was valued at $130 billion, with an estimated 4-6% annual growth. Slow growth increases the fight for market share. Assessing this trajectory is vital for Daikin's strategic planning.

Daikin's product differentiation impacts competition. Companies with unique offerings often see reduced rivalry. In 2024, Daikin's focus on energy-efficient HVAC systems, valued at $30 billion, sets it apart. This strategy influences competitive dynamics, offering an advantage. Evaluating Daikin's differentiation is crucial for understanding its market position.

Competitive Rivalry 4

Competitive rivalry in the HVAC industry, including Daikin Industries, is significantly influenced by market concentration. A concentrated market, with fewer major players, might see less aggressive competition. Conversely, a fragmented market can lead to intense price wars and innovation battles. Understanding the concentration ratio is key to assessing competitive intensity.

- Daikin's global market share in the HVAC sector was approximately 15% in 2024, indicating a significant but not dominant presence.

- The top 5 HVAC companies control over 50% of the global market share, suggesting moderate concentration.

- Competition is fierce, with companies investing heavily in R&D and marketing.

- Price competition, especially in residential markets, is a constant factor.

Competitive Rivalry 5

Competitive rivalry in Daikin Industries' market is influenced by exit barriers. These barriers, including specialized assets, can intensify competition. High exit barriers keep companies in the industry, leading to aggressive competition. For instance, in 2024, Daikin faced intense competition from companies like Gree and Midea. Assessing these barriers is crucial for understanding market dynamics.

- Exit barriers can involve significant investments in specialized manufacturing plants.

- Contractual obligations with suppliers and distributors also play a role.

- These factors can lead to price wars and innovation battles.

- Daikin's ability to navigate these rivalries is key to its success.

Competitive rivalry in Daikin's market is high. Intense competition from Carrier, Trane, and others impacts pricing and innovation. Daikin's market share was approximately 15% in 2024, facing aggressive competition.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Growth | HVAC market growth | 4-6% annually |

| Daikin's Share | Global Market Share | ~15% |

| Key Competitors | Major Players | Carrier, Trane, Gree |

SSubstitutes Threaten

Alternative heating and cooling methods, like geothermal and solar, present a substitution threat to Daikin. The appeal of these alternatives depends on their cost and how well they perform. For example, the global geothermal heat pump market was valued at $2.8 billion in 2023. Keeping an eye on technological progress is vital in this area.

Energy-efficient designs and insulation pose a threat to Daikin's HVAC-R systems, acting as substitutes. Adoption rates significantly influence this threat level. Analyzing trends in sustainable building practices is crucial. In 2024, the global green building materials market was valued at $364.4 billion, showing growth. This growth suggests a rising threat.

The threat of substitutes for Daikin includes shifts in consumer preferences. Some consumers are turning to natural ventilation or passive cooling. Monitoring these trends is critical for Daikin. In 2024, the global passive cooling market was valued at approximately $15 billion.

Threat of Substitution 4

The threat of substitutes for Daikin Industries hinges on the performance-price ratio. If alternatives like cheaper HVAC systems or new cooling technologies provide similar benefits at a lower cost, the threat to Daikin grows. Evaluating the value proposition is crucial. Daikin faces competition from various sources.

- Energy-efficient HVAC systems are gaining popularity.

- Emerging cooling technologies pose a potential threat.

- The price sensitivity of consumers is a key factor.

- Daikin's brand reputation helps mitigate this.

Threat of Substitution 5

The threat of substitutes for Daikin Industries is influenced by external factors, particularly government regulations. These regulations often push for energy efficiency and the adoption of alternative technologies, which can directly impact demand for Daikin's products. Monitoring changes in government policies is crucial for assessing this threat effectively. Staying informed about policy developments, such as those related to HVAC standards or renewable energy incentives, is also important.

- In 2024, global investment in energy efficiency reached $300 billion, signaling the growing importance of this sector.

- Many countries are implementing stricter building codes.

- Government incentives for heat pumps and other efficient systems are rising.

- Daikin must adapt to these shifts.

The threat of substitutes to Daikin is significant, fueled by innovation and consumer preferences. Alternatives like geothermal and solar, alongside energy-efficient designs, challenge Daikin. For example, the global heat pump market was worth $75.1 billion in 2024. Price sensitivity and government regulations also play critical roles.

| Substitute Type | Market Value (2024) | Growth Drivers |

|---|---|---|

| Green Building Materials | $364.4 billion | Sustainability, efficiency |

| Passive Cooling | $15 billion | Consumer trends, eco-friendliness |

| Energy Efficiency Investment | $300 billion | Regulations, incentives |

Entrants Threaten

New entrants face significant hurdles in the HVAC-R market. High capital needs for manufacturing, like specialized facilities, create barriers. The industry's capital intensity, reflecting substantial investment, makes entry tough. In 2024, Daikin's capital expenditure was approximately ¥200 billion, showing the financial commitment needed. This deters new players.

Daikin faces moderate threat from new entrants. Established brands like Daikin benefit from strong brand loyalty, a major barrier. Newcomers need huge investments in marketing and distribution to compete. Daikin's global presence and reputation provide a significant advantage. In 2024, Daikin's revenue hit $30 billion, highlighting its market dominance.

The threat of new entrants for Daikin Industries is moderate. Access to distribution channels is crucial for success. Existing companies like Daikin often have strong relationships with distributors, creating a barrier. Assessing the ease of access to these networks is essential. Daikin's strong brand and global presence further limit new competitors.

Threat of New Entrants 4

The threat of new entrants for Daikin Industries is moderate, influenced by barriers like proprietary technology and patents. Daikin's strong intellectual property (IP) portfolio, including numerous patents, acts as a significant barrier. Evaluating the technological landscape is crucial, as advancements can disrupt the market. For instance, Daikin invests heavily in R&D, with spending reaching ¥120 billion in fiscal year 2024.

- Patents: Daikin holds over 10,000 patents globally.

- R&D Spending: ¥120 billion in fiscal year 2024.

- Market Growth: The global HVAC market is projected to reach $250 billion by 2027.

Threat of New Entrants 5

The threat of new entrants in the HVAC industry is moderate due to significant barriers. Government regulations and industry standards, such as those set by the EPA and DOE, create hurdles for new companies. Compliance with these requirements, including energy efficiency standards, increases both costs and operational complexity. Monitoring regulatory changes is crucial for all industry players.

- The EPA sets standards for refrigerants and energy efficiency.

- DOE enforces energy efficiency standards.

- Compliance costs can be substantial for new entrants.

The threat from new entrants to Daikin is moderate, affected by market dynamics.

High capital needs and strong brand loyalty pose barriers. Daikin's robust R&D investments and global presence further limit new competitors.

The market is also influenced by regulations and industry standards, like those from the EPA and DOE.

| Aspect | Details | 2024 Data |

|---|---|---|

| R&D Spending | Investment in innovation. | ¥120 billion |

| Revenue | Daikin's global revenue. | $30 billion |

| Global HVAC Market | Projected market size by 2027. | $250 billion |

Porter's Five Forces Analysis Data Sources

We base our analysis on Daikin's financial reports, competitor profiles, industry research, and market analysis reports for accurate force assessments.