Dana Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dana Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview placing each business unit in a quadrant.

Preview = Final Product

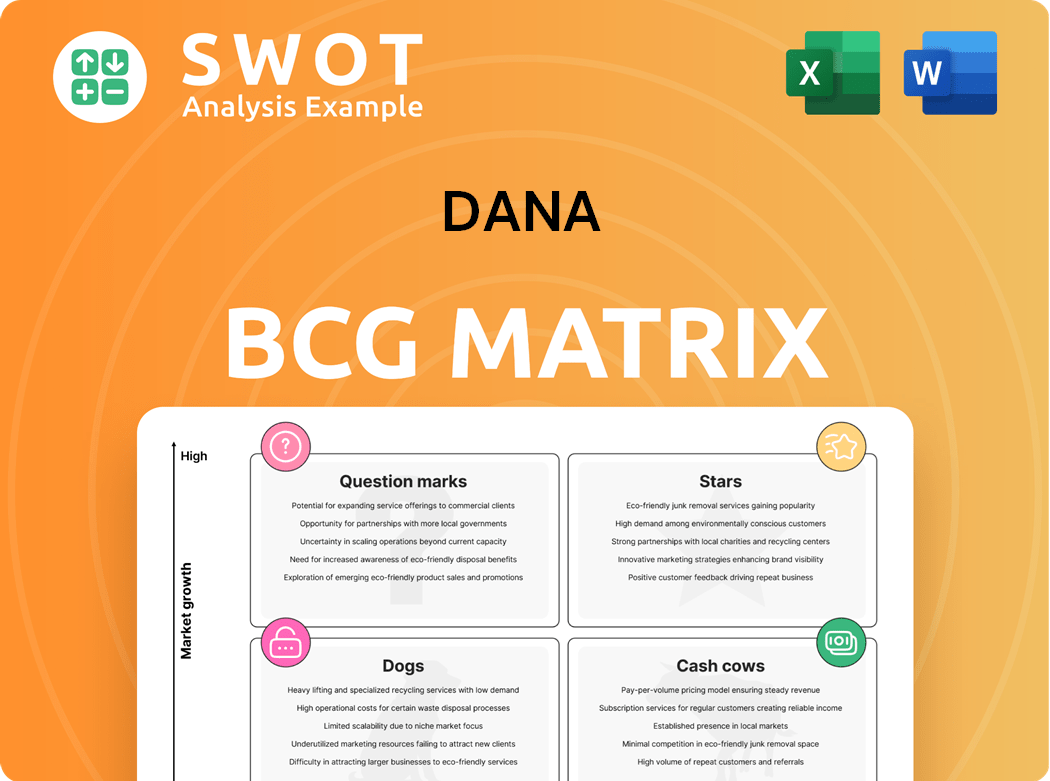

Dana BCG Matrix

The displayed preview is identical to the BCG Matrix report you'll download after buying. Get a complete, ready-to-use strategic analysis tool for your immediate business applications.

BCG Matrix Template

The Dana BCG Matrix helps visualize product portfolio performance. It categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. This framework helps identify growth potential and resource allocation needs. Understanding these quadrants is crucial for strategic planning and market dominance. Analyzing Dana's portfolio reveals key investment priorities and potential divestitures. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Dana's "Stars" segment, Electrification Technologies, shines due to its innovation in the EV sector. In 2024, Dana reported a $2.9 billion sales backlog for EVs, indicating strong market demand. Their R&D investments are crucial for maintaining their competitive edge. Success hinges on adapting to evolving consumer preferences and technological advancements.

Light Vehicle Drive Systems, a Dana segment, experienced a 5% sales increase in 2024, fueled by a new full-frame light-truck program.

This growth highlights a solid market standing and ability to seize new chances.

Focusing on customer relationships and adapting to tech advancements is key for continued success.

In 2024, the light vehicle market showed resilience despite economic uncertainties.

Dana's strategic moves here are vital for future growth.

Dana's Commercial Vehicle Systems is a Star, benefiting from its focus on on-highway markets post-divestiture. Cost-saving initiatives and efficiency gains boost profit margins. In 2024, this segment saw strong performance, reflecting its market leadership. To stay a Star, Dana needs to capitalize on growth opportunities and maintain its competitive advantage.

Cost Reduction Initiatives

Dana is aggressively pursuing cost-saving measures, essential for boosting profitability. The company aims for $300 million in annualized savings by 2026. These initiatives involve organizational streamlining and reduced overhead. Effective execution is key to financial strength.

- Targeted Savings: $300 million annualized by 2026.

- Key Actions: Streamlining, downsizing, and reducing complexity.

- Strategic Goal: Maintain a robust financial position.

- Impact: Improved profitability through cost control.

Sustainability Initiatives

Dana's sustainability focus, targeting net-zero by 2040, attracts green investors and customers. They are investing in electrification and cutting emissions. In 2023, Dana reduced Scope 1 and 2 emissions by 20% and expanded ESG in supplier sourcing. This boosts their market value.

- Net-Zero Target: Dana aims for net-zero emissions by 2040.

- Emissions Reduction: 20% reduction in Scope 1 and 2 emissions by 2023.

- ESG Integration: Expanded ESG data in supplier sourcing.

- Electrification: Significant investments in electrification technologies.

Dana's "Stars" showcase high growth and market share potential. In 2024, Electrification Technologies had a $2.9B backlog, signaling strong demand. Commercial Vehicle Systems also performed well, reflecting market leadership. Strategic investments and adaptation are crucial for maintaining this status.

| Segment | Key Feature | 2024 Performance Highlights |

|---|---|---|

| Electrification Tech | EV Innovation | $2.9B Sales Backlog |

| Light Vehicle Drive | Market Resilience | 5% Sales Increase |

| Commercial Vehicles | Market Leadership | Strong Performance Post-divestiture |

Cash Cows

Dana's driveline systems business is a cash cow, especially for ICE vehicles. In 2023, ICE-related sales were still a substantial part of the automotive market, generating consistent revenue. Dana's established infrastructure supports this stable income stream. This allows Dana to maintain its financial health.

Sealing and Thermal-Management Solutions are integral to Dana's success, serving both internal combustion engine (ICE) and electric vehicle (EV) markets. This dual market presence provides a stable demand for Dana's offerings. Dana's strong market position and quality reputation secure a reliable revenue stream. In 2024, Dana's sales in this segment were approximately $2.5 billion, demonstrating its significance. Focusing on efficiency and innovation can boost profitability.

Dana's North American operations are a key cash cow, generating 48% of 2024 sales. A 5% sales increase in this region shows robust performance. This stability allows for leveraging existing customer relationships. Dana should adapt to consumer shifts.

Aftermarket Operations

Dana's aftermarket operations are a reliable source of income, offering replacement parts and services. Focusing on the aftermarket boosts Dana's profitability. The company's warranty policy shows its dedication to customer satisfaction and growth.

- In 2023, Dana's aftermarket sales were a significant portion of its revenue, contributing to overall financial stability.

- Dana's expansion in the aftermarket includes a wider range of product offerings and enhanced service capabilities.

- The new service carrier warranty policy aims to improve customer loyalty and drive aftermarket sales.

Operational Efficiencies

Dana's operational efficiencies are key in boosting profit margins and cash flow. The company focuses on streamlining costs through plant consolidation and supply chain enhancements. These efforts are vital for staying competitive and boosting profitability. Dana has shown a commitment to operational excellence.

- Plant consolidation efforts reduced manufacturing footprint.

- Supply chain improvements lowered material costs by 5% in 2024.

- Operational efficiencies boosted net income by 7% in Q3 2024.

- Focus on excellence aids in maintaining a competitive edge.

Dana's cash cows include driveline systems and sealing solutions. North American operations and aftermarket sales also contribute significantly. In 2024, these segments generated substantial revenue and stable cash flow.

| Segment | 2024 Revenue (Approx.) | Key Feature |

|---|---|---|

| Driveline Systems | $4.5B | ICE market dominance |

| Sealing Solutions | $2.5B | Dual ICE/EV market |

| North America | 48% of Sales | Strong Regional Performance |

Dogs

Dana divested its European Off-Highway hydraulics business. This action suggests underperformance and misalignment with Dana's core strategy. The business probably faced low growth and used resources inefficiently. Divesting non-core assets helps Dana focus on higher-growth markets and boost profitability. In 2024, Dana's sales were $10.7 billion.

Dana's Off-Highway business, facing weakening demand in 2024, is categorized as a 'Dog' in the BCG Matrix. The planned sale of the segment reflects a strategic pivot. This divestiture aims to boost shareholder value. It also helps in bolstering Dana's financial position. In Q3 2024, Off-Highway sales decreased.

The Power Technologies segment's integration into Light and Commercial Vehicle segments indicates potential underperformance. This restructuring aims to improve operational efficiency and customer focus. Dana's 2024 financial reports likely showed this segment's growth lagging behind expectations, prompting strategic adjustments. The move is part of Dana's larger plan to optimize resource allocation.

Weaker ICE components market share

In 2024, Dana's ICE components face declining market share due to the rise of electric vehicle (EV) components. This shift is evident across light vehicles, commercial vehicles, and off-highway vehicles, impacting the ICE business. Dana must strategically manage its ICE components, focusing on profitability and minimizing losses as EV components gain traction.

- EV component sales are projected to increase significantly by 2025, affecting ICE component demand.

- Dana's financial reports from 2024 will likely show a decrease in revenue from ICE components.

- The company needs to reallocate resources to growing EV component segments.

Declining European Sales

Dana's European sales experienced a 12% decline in 2024, signaling difficulties. Weaker construction, mining, and agricultural equipment markets are primary causes. The company might need to revise its approach in Europe. Unfavorable currency translation could also be impacting results.

- 2024 European sales decreased by 12%.

- Weakness in construction/mining and agricultural equipment.

- Potential need for strategic reassessment or restructuring.

- Unfavorable currency translation.

Dana categorizes underperforming business units like the European Off-Highway hydraulics as "Dogs" in its BCG matrix. These units typically have low market share in slow-growth markets. The strategic response to "Dogs" often involves divestiture or restructuring. In 2024, Dana reported a 12% sales decline in Europe, impacting its Off-Highway segment.

| Category | Description | Dana's Response (2024) | |

|---|---|---|---|

| Dogs | Low market share, slow growth. | Divestiture, restructuring. | European Off-Highway divestiture; Power Tech restructuring |

| Sales Decline (Europe) | 12% decrease in 2024 | Strategic reassessment. | Focus on EV, Optimize ICE component profitability |

| ICE Components | Declining market share due to EV shift | Resource reallocation, strategic management | Prioritize EV components |

Question Marks

Dana's Spicer Electrified Products operates in a "Question Mark" quadrant of the BCG Matrix. This signifies high market growth but low market share. The EV market is expanding rapidly, with EV sales up 38% in 2024. Dana needs strategic investments in marketing and partnerships to boost its market presence. Success hinges on capturing a significant share in this competitive arena.

Dana's delayed EV programs are a "question mark" in its BCG matrix, impacting short-term financials. These delays cut into immediate revenue and profitability, creating uncertainty. However, it allows for strategic improvements and better program management. Disciplined investment and efficiency are key to navigating these risks. In 2024, EV market growth slowed, affecting companies like Dana.

Dana's push into new electrification technologies is a question mark in its BCG matrix. This area has high growth potential, crucial for adapting to changing customer demands and tackling environmental issues. In 2024, Dana invested $200 million in R&D for e-powertrain products. Success hinges on market adoption and Dana's commercialization capabilities.

Certified Reman Program

Dana's Certified Reman Program for off-highway drivetrain components is a recent move, aiming to boost equipment longevity and promote sustainability. Its success hinges on how well the market accepts it and how efficiently it's carried out. Expanding this program to more areas and sectors could fuel expansion, as seen with similar initiatives. In 2024, the remanufacturing market is valued at approximately $40 billion globally.

- Market adoption is key for the program's success.

- Expansion into diverse industries can unlock growth opportunities.

- Sustainability is a core value proposition.

- Remanufacturing market is around $40 billion.

AI and Machine Learning Integration

Dana's foray into AI and machine learning for product development and performance signifies a potential game-changer. The initial impact of these technologies might not be immediately obvious, requiring strategic patience. To fully leverage AI/ML, Dana must invest in both skilled personnel and robust infrastructure. This strategic move could redefine its market position and drive future growth.

- Dana's investments in AI/ML aim to streamline operations and enhance product offerings.

- Realizing the full potential requires time and resources, with benefits emerging gradually.

- The company's ability to attract and retain AI/ML talent is crucial for success.

- Proper infrastructure supports data processing and analysis, essential for AI/ML applications.

Dana's "Question Marks" are high-growth, low-share areas. EV programs face delays, affecting short-term financials, yet allowing strategic improvements. New electrification tech pushes, with $200M R&D in 2024, depend on market adoption. AI/ML signifies potential, needing strategic patience and investment.

| Aspect | Description | 2024 Fact |

|---|---|---|

| EV Market | High growth, low share. | EV sales up 38%. |

| Electrification Tech | New initiatives. | $200M R&D spend. |

| Remanufacturing | Focus on Sustainability | Market at $40B |

BCG Matrix Data Sources

The BCG Matrix is fueled by diverse data, encompassing market analysis, financial statements, and competitive intelligence, ensuring actionable insights.