Danaher Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danaher Bundle

What is included in the product

Tailored analysis for Danaher's product portfolio across the matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, so you can analyze anywhere.

What You See Is What You Get

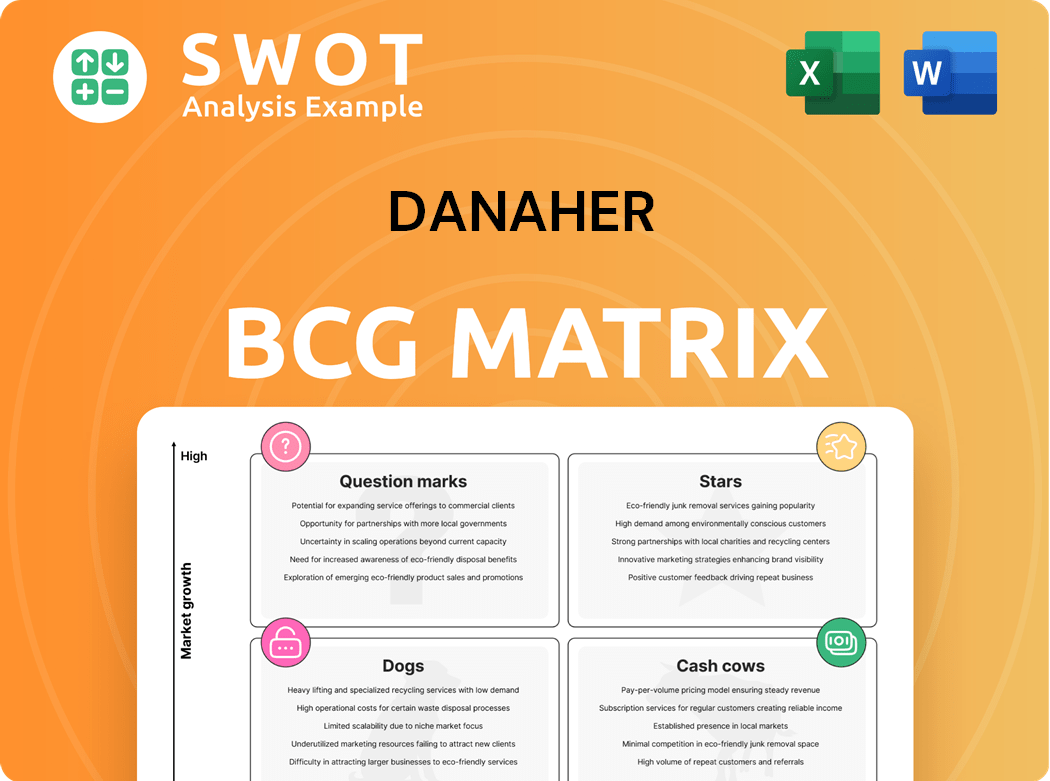

Danaher BCG Matrix

What you're viewing is the complete Danaher BCG Matrix report you'll receive post-purchase. This downloadable file delivers a fully functional, analysis-ready tool without any watermarks or hidden content.

BCG Matrix Template

Danaher's diverse portfolio presents a fascinating strategic puzzle. Our preliminary analysis unveils key product placements within the BCG Matrix. See how its offerings stack up in terms of market share and growth. Understanding these quadrants is crucial for informed decision-making. Discover potential stars, cash cows, dogs, and question marks within their business. Purchase the full BCG Matrix for detailed insights, actionable strategies, and a complete competitive edge.

Stars

Danaher's Diagnostics segment is a "Star" in its BCG Matrix, showing robust growth. Leica Biosystems and Beckman Coulter Diagnostics are key drivers. Core revenues rose 3% year-over-year in 2024. A flat to low-single-digit core revenue increase is expected in 2025, reflecting strategic investments.

Danaher's Life Sciences segment, amplified by Abcam's acquisition, demonstrates significant growth prospects. Abcam's antibody portfolio boosts Danaher's healthcare domain, focusing on consumables and genomic medicines. The segment's revenue increased by 2.6% in 2024, indicating a strong trajectory. This segment is well-positioned for ongoing expansion within the healthcare industry.

Danaher's Environmental & Applied Solutions segment is a "Star" in the BCG matrix. It offers solutions for water quality and product identification, benefiting from stricter regulations and sustainability demands. In 2024, this segment saw robust growth, with revenues up by a solid percentage, driven by strong demand and market expansion. This segment's recurring revenue model and leadership position fuel its high growth potential, making it a key driver of Danaher's overall performance.

Cytiva

Cytiva, acquired from General Electric, is a Star in Danaher's BCG Matrix. It is a key player in biopharma, developing and manufacturing vaccines, diagnostics, and therapeutics. This segment thrives due to increasing biopharmaceutical R&D investments and demand for bioprocessing tools. Cytiva's innovative technologies and market presence are strong.

- Cytiva's revenue grew significantly, contributing substantially to Danaher's overall growth in 2024.

- The bioprocessing market, where Cytiva operates, is projected to continue expanding, driven by new therapies.

- Danaher's strategic focus on Cytiva includes expanding manufacturing capacity.

- Cytiva's product portfolio includes cell culture media, chromatography systems, and single-use technologies.

Danaher Business System (DBS)

Danaher's DBS is a key operational strategy. It drives continuous improvement and efficiency, supporting successful acquisitions. DBS boosts margins and growth, creating long-term shareholder value. It's a key Star in Danaher's business model.

- DBS contributed to Danaher's revenue growth of 8.5% in 2023.

- Operating margins improved by 150 basis points in 2023, thanks to DBS.

- Danaher completed several acquisitions, integrating them using DBS.

- DBS is a core factor for Danaher's consistent outperformance.

Danaher's Stars, like Diagnostics, Life Sciences, Environmental & Applied Solutions, Cytiva, and DBS, drive substantial growth. These segments benefit from strategic investments and market demands. Danaher's focus on innovation and operational excellence bolsters their positions. In 2024, DBS helped to increase revenue by 8.5%.

| Segment | Key Driver | 2024 Revenue Growth |

|---|---|---|

| Diagnostics | Leica, Beckman Coulter | 3% |

| Life Sciences | Abcam Acquisition | 2.6% |

| Env. & Applied Solutions | Water Quality, Product ID | Significant % |

| Cytiva | Biopharma Tools | Significant |

| DBS | Operational Efficiency | 8.5% (2023) |

Cash Cows

Danaher's clinical diagnostics, including Leica Biosystems and Beckman Coulter, consistently performs well. The business benefits from new products and molecular diagnostics. These factors drive steady growth and market share, making it a reliable cash cow. In 2024, this segment saw revenue growth, reflecting its strong market position.

Cepheid, within Danaher's Diagnostics, shows strong growth. Its respiratory and non-respiratory disease tests drive revenue. Cepheid's market presence ensures steady income, making it a Cash Cow. In 2024, the Diagnostics segment grew, reflecting Cepheid's contribution.

Danaher's molecular diagnostics segment, fueled by respiratory and other disease tests, generates consistent revenue. This area benefits from a strong market foothold and continuous demand for diagnostic services. In 2024, this segment saw substantial growth, contributing significantly to Danaher's overall financial performance. Its stability and market position solidify its status as a Cash Cow.

Product Identification

Danaher's product identification solutions, housed within the Environmental & Applied Solutions segment, thrive due to regulatory demands and traceability needs. This business model generates consistent revenue and leverages strong customer connections. Its market dominance and stable financial performance define it as a Cash Cow. For example, in 2024, this segment represented a significant portion of Danaher's overall revenue, showing its financial stability.

- Regulatory Compliance: Products must meet standards.

- Recurring Revenue: Consistent sales and services.

- Customer Relationships: Strong ties lead to repeat business.

- Market Position: Dominance ensures steady performance.

Water Quality

Danaher's water quality solutions, a key part of its Environmental & Applied Solutions segment, are a classic Cash Cow. They meet vital water treatment and monitoring needs, boosted by stricter regulations and the push for sustainable water management. This segment enjoys consistent demand and a strong market position, ensuring steady revenue. In 2024, Danaher's Environmental & Applied Solutions segment saw strong growth, reflecting the ongoing importance of water quality.

- Danaher's water quality segment addresses essential water treatment and monitoring needs.

- Benefiting from rising regulatory standards and sustainable water management trends.

- Its stable demand and market leadership solidify its Cash Cow status.

- In 2024, the Environmental & Applied Solutions segment showed robust growth.

Danaher's Cash Cows consistently generate revenue and hold strong market positions. These segments include clinical diagnostics, Cepheid, and product identification solutions. They benefit from continuous demand, regulatory needs, and robust customer relationships. In 2024, these segments saw substantial growth, solidifying their financial stability.

| Segment | Key Features | 2024 Performance |

|---|---|---|

| Clinical Diagnostics | New products, market share | Revenue growth |

| Cepheid | Disease tests | Strong growth |

| Product ID | Regulatory, traceability | Significant revenue |

Dogs

Danaher's Dental segment, once a key part of the company, was spun off. This strategic move, completed in 2019, suggests the segment's performance lagged behind other areas. The divestiture categorized it as a "Dog" in Danaher's portfolio.

Danaher's Dogs include sluggish discovery and medical businesses in its Biotechnology segment. Core revenues declined 4.5% year-over-year in 2024, indicating weak demand. Underperforming areas may require restructuring or divestiture. This segment's challenges are a key focus for strategic adjustments.

Danaher's mass spectrometry business faced headwinds, with sales declining due to reduced demand in key markets. This downturn positions mass spectrometry as a potential Dog in the BCG Matrix. The Life Sciences segment may need strategic revamps. In 2024, Danaher's Life Sciences segment saw revenue growth of 4.5%, but specific mass spectrometry figures are needed for precise BCG classification.

Flow Cytometry & Lab Automation Solutions

Danaher's flow cytometry and lab automation solutions face challenges. Sales have declined due to weak equipment demand in key markets. This situation indicates the business may be a Dog within Life Sciences. Strategic adjustments are likely needed to boost its market standing.

- Sales declines reflect broader market pressures in 2024.

- The segment's profitability is under scrutiny.

- Focus on operational efficiencies and innovation.

- Danaher's strategy might involve portfolio adjustments.

Microscopy Businesses

Danaher's microscopy businesses, facing demand softness, show sales declines. This downturn indicates potential "Dog" status within Life Sciences. Strategic shifts are needed to enhance market position. In Q3 2024, Danaher's Life Sciences segment saw a revenue decrease. This is a key indicator for the BCG Matrix.

- Sales decline in microscopy businesses.

- Potential "Dog" status in Life Sciences.

- Need for strategic market adjustments.

- Q3 2024 revenue dip in Life Sciences.

Danaher's "Dogs" within its portfolio include underperforming segments with declining sales and market challenges. These areas, such as certain microscopy and mass spectrometry businesses, face weak demand. The company may consider restructuring or divestitures in these segments.

| Segment | Performance | Strategic Implications |

|---|---|---|

| Microscopy | Sales Decline | Restructure or Divest |

| Mass Spectrometry | Sales Decline | Revamp or Divest |

| Biotechnology (Discovery/Medical) | Core Revenue Decline (4.5% in 2024) | Restructuring |

Question Marks

Danaher's foray into emerging diagnostic technologies signifies high-growth potential, yet market share remains uncertain. Substantial investment is crucial for these technologies to gain acceptance. Successful ventures could elevate them to Stars, while setbacks might result in them becoming Dogs. In 2024, Danaher allocated $1.5 billion for R&D, partly fueling these innovations.

Danaher is integrating AI and digital solutions into its products. These initiatives have high growth prospects but low market share currently. Strategic investments are crucial to capitalize on their potential. In 2024, Danaher invested $3 billion in R&D, including digital health solutions. This is aligned with the company's focus on innovation.

Danaher's genomic medicines focus is in the "Question Marks" quadrant of the BCG Matrix. These areas, like advanced therapies, show high growth potential but currently have a low market share. Danaher is investing heavily in these innovative areas. In 2024, Danaher's life sciences segment, which includes genomic medicines, saw revenue growth, signaling progress. Success requires significant investment to become "Stars."

Precision Diagnostics

Danaher's precision diagnostics, part of its partnership focus, shows high growth potential but currently has a low market share. These areas require significant investment and successful development to become Stars within the BCG matrix. Innovative precision diagnostics represent long-term growth opportunities for Danaher. In 2024, Danaher's diagnostics segment saw revenue of approximately $9 billion, reflecting the company's commitment to this area.

- High Growth Potential

- Low Current Market Share

- Requires Significant Investment

- Long-term Growth Opportunity

Next-Generation Biomanufacturing

Danaher's focus on next-generation biomanufacturing aligns with high-growth potential, but currently holds a smaller market share. This positioning places it within the Question Marks quadrant of the BCG Matrix. Substantial investment and successful innovation are vital to elevate these areas to Stars. These initiatives represent long-term growth opportunities for Danaher. This area has a lot of potential for the future.

- Next-generation biomanufacturing requires significant capital for research and development.

- Danaher's strategic partnerships are key to expanding market share in this area.

- Success in this field could significantly boost Danaher's revenue and market valuation.

- The biomanufacturing market is projected to reach billions in the coming years.

Question Marks represent Danaher's high-growth, low-share areas. These ventures, like genomic medicines and next-gen biomanufacturing, need significant investment to gain market traction. Danaher's R&D spending in 2024, totaling $4.5 billion, reflects its commitment. Success transforms them into Stars, driving future revenue.

| Category | Characteristics | Examples at Danaher |

|---|---|---|

| Growth Rate | High | Genomic Medicines |

| Market Share | Low | Precision Diagnostics |

| Investment Need | Significant | Next-gen Biomanufacturing |

| Goal | Become Stars | AI & Digital Solutions |

BCG Matrix Data Sources

Our Danaher BCG Matrix uses financial reports, industry research, and competitive analysis to give precise insights. This approach combines market data with expert interpretations.