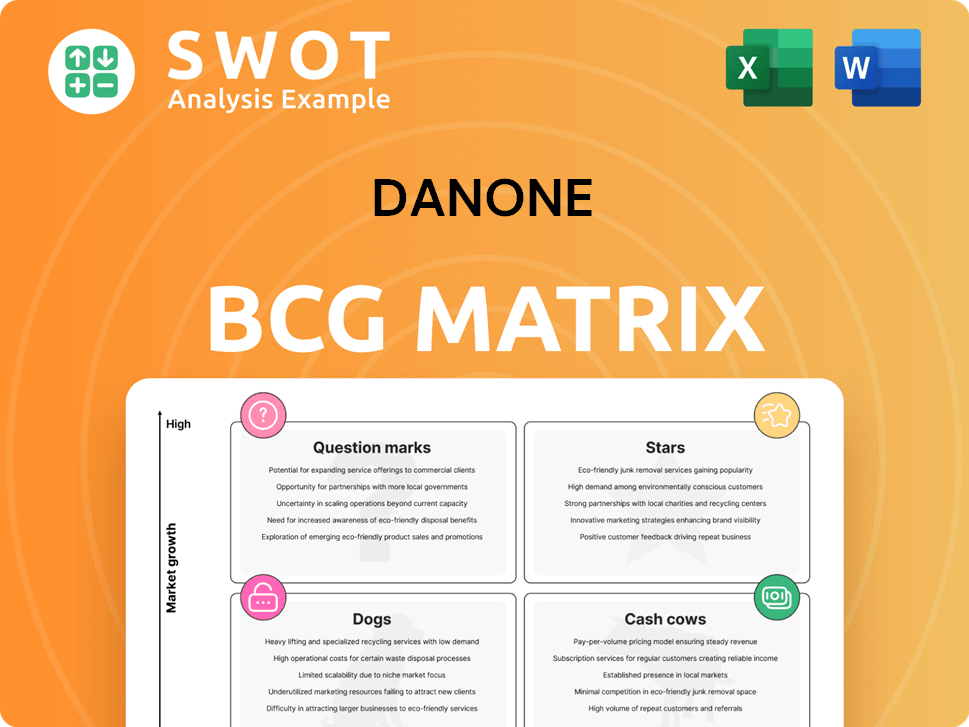

Danone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

What is included in the product

Analysis of Danone's business units using BCG Matrix, highlighting strategic moves based on each quadrant.

Simplified Danone BCG Matrix with clear labels, reducing the need for lengthy explanations.

Full Transparency, Always

Danone BCG Matrix

The Danone BCG Matrix preview mirrors the final document you’ll download. Prepared for strategic insights, it's ready for your business evaluation. Access the complete, watermark-free report upon purchase. This document is designed for professional implementation.

BCG Matrix Template

Danone's product portfolio spans diverse markets. This preliminary view hints at its strategic priorities. Are its brands Stars, Cash Cows, or somewhere in between? Understanding this reveals potential for growth. The full BCG Matrix unveils the quadrant placements. Gain insights for informed investment choices. Purchase the full report for a clear strategic edge!

Stars

Danone's high-protein products, like Oikos Greek yogurt, shine brightly in the market. Oikos holds a significant market share in North America, driven by health trends. In 2024, the Greek yogurt market grew by 5%, reflecting robust consumer demand. Ongoing innovation and marketing are key to sustaining this star status.

Danone's Infant Milk Formula in China, particularly its premium Essensis product, is experiencing strong growth. This segment benefits from the expanding Chinese market and the brand's established reputation. In 2024, the infant formula market in China was valued at approximately $26 billion, with premium brands like Essensis capturing a significant portion. Danone should keep investing to capitalize on the demand for premium infant nutrition.

Danone's Medical Nutrition is a star, showing robust demand in China, North America, and Europe. This segment benefits from an aging global population and health awareness. In 2024, Medical Nutrition saw a 7% sales growth. Further expansion of products and distribution will strengthen its market position.

Evian and Volvic Waters

Evian and Volvic, Danone's star brands, are thriving. They've gained ground in Europe and North America. This success is linked to the rising interest in healthy drinks and the brands' premium image. To keep this momentum, Danone should focus on brand strength and distribution.

- 2023: Evian's global sales grew significantly, reflecting its strong brand appeal.

- Volvic saw increased demand, especially in markets emphasizing natural products.

- Both brands benefit from Danone's sustainability initiatives, appealing to eco-conscious consumers.

- Expansion into new distribution channels supports growth.

Coffee Creations

Danone's coffee creations, like International Delight and STōK, shine brightly. These brands boast robust growth, especially in North America, thanks to shifting consumer tastes. In 2024, the coffee creamer market in the US is valued at around $4.5 billion. This segment's expansion is driven by innovation.

- Market growth is around 5% annually.

- North America is a key market for Danone's coffee products.

- STōK's cold brew is a standout performer.

- Danone should keep innovating in this area.

Danone's stars include high-protein products, infant formula, medical nutrition, Evian, Volvic, and coffee creations. These products see robust growth and significant market share. Investing in innovation and distribution boosts these stars.

| Product | Market | Growth (2024) |

|---|---|---|

| Oikos | North America | 5% |

| Essensis | China | Strong |

| Medical Nutrition | Global | 7% |

| Evian/Volvic | Europe/NA | Increased Demand |

| Coffee | NA | 5% annually |

Cash Cows

Activia, a Danone product, is a cash cow, especially in Europe, due to its strong brand and loyal customers. Despite a mature yogurt market, Activia generates consistent cash flow. In 2024, Danone's global yogurt sales were approximately €5 billion. Maintaining market position through marketing and innovation is key.

Danone's Essential Dairy Products (EDP) in Europe demonstrate stable demand. The segment has consistently shown positive volume/mix growth. This generates substantial cash flow, though growth rates are moderate. Focus on efficiency and marketing to maintain profitability; In 2024, EDP sales accounted for a significant portion of Danone's revenue.

Mizone, Danone's vitamin drink, is a cash cow in China, enjoying strong sales. Its established presence and brand recognition in the Chinese market are key. In 2024, the beverage market in China was valued at approximately $250 billion. Danone should focus on maintaining brand equity and distribution to meet demand.

Alpro Brand

Alpro, a leading plant-based brand under Danone, operates as a cash cow due to its strong market position, particularly in Europe. It benefits from a loyal customer base, generating consistent cash flow. Focusing on efficient marketing and product innovation is key to sustaining this status. In 2024, the global plant-based food market is valued at over $30 billion.

- Alpro's market share remains substantial within the growing plant-based sector.

- Consistent cash flow is supported by its established brand and customer loyalty.

- Efficient marketing and product innovation are essential for maintaining its cash cow status.

- The plant-based market continues to expand, offering opportunities for growth.

Zywiec Zdroj Brand

Zywiec Zdrój, a key water brand for Danone, holds a strong position, especially in Europe. Its high market share and established consumer base provide consistent cash flow. Although growth may be moderate, its stable demand supports profitability. Strategic marketing and operational efficiency are crucial for maintaining its competitive edge.

- Market share in Poland's bottled water market: approximately 20-25% in 2024.

- Revenue contribution to Danone's overall revenue: significant, though specific figures are not publicly segmented by brand.

- Focus: maintaining profitability through efficient operations and targeted marketing.

Danone's cash cows, like Activia, Alpro, and Mizone, generate steady cash flow. These brands hold strong market positions, supported by loyal customers and established brands. Their success hinges on effective marketing and operational efficiency. In 2024, these brands contributed significantly to Danone's revenue, with specific figures varying by product and region.

| Product | Market | Key Feature |

|---|---|---|

| Activia | Europe | Strong Brand, Loyal Customers |

| Alpro | Europe | Plant-Based Market Leader |

| Mizone | China | Established Presence |

Dogs

Danone's coffee creamer sales in the US experienced a tough start in 2024. This reflects a weak market share and sluggish growth, with a reported decline in volume during the first quarter. Given the competitive landscape, Danone needs to assess the long-term viability of this product. Strategic options like divestiture or repositioning should be considered to boost performance.

Horizon Organic, once part of Danone's portfolio, was divested in 2024, signaling its classification as a "Dog" within the BCG Matrix. This category signifies both low market share and low growth potential. The decision to sell suggests the brand was underperforming, likely impacting Danone's overall financial strategy. In 2023, Danone's North America sales were $6.5 billion, showing potential for strategic shifts.

Danone divested Wallaby Organic, mirroring the fate of Horizon Organic. This strategic decision likely stemmed from underperformance, prompting resource reallocation. The divestiture underscores Danone's efforts to optimize its brand portfolio. In 2024, Danone's focus shifted towards core, high-growth areas.

Licensed Milk Business in Brazil

Licensing Danone's milk business in Brazil signals a strategic retreat from a sector deemed low-growth, possibly due to intense competition or changing consumer preferences. This move aligns with the BCG Matrix, which categorizes this as a "dog" – low market share in a slow-growing market. In 2024, Danone's focus shifts toward higher-growth segments, prioritizing investments in areas with stronger potential within Latin America. This strategic recalibration aims to optimize resource allocation and enhance overall profitability.

- 2024: Danone's revenue in Latin America is approximately $3 billion.

- Brazil's dairy market growth is projected to be around 1-2% annually.

- Danone aims to increase its focus on plant-based products.

- Strategic shifts often involve divestitures to streamline operations.

Select Underperforming Product Lines

Danone actively manages its portfolio by addressing underperforming product lines, a key aspect of its Dogs category. While specific examples are often kept private, this reflects a strategic focus on efficiency. The aim is to free up capital for faster-growing segments. This strategic shift is evident in their financial results for 2024, with a focus on profitable growth.

- 2024 saw Danone focusing on streamlining its product portfolio.

- They aim to reduce investment in areas with limited growth prospects.

- Reallocating resources to higher-potential businesses.

- This strategy is reflected in their financial performance reports.

Dogs in Danone's BCG Matrix are products with low market share and growth. This often leads to divestitures, like Horizon Organic in 2024. The focus is on reallocating resources to high-growth areas. In 2024, Danone streamlined its portfolio, aiming for profitable growth.

| Category | Description | Examples |

|---|---|---|

| Characteristics | Low growth, low market share | Underperforming brands |

| Strategy | Divest, reposition, or restructure | Horizon Organic (divested) |

| Goal | Free up resources for better opportunities | Focus on high-growth segments |

Question Marks

YoPro, a functional product under Danone, currently sits as a Question Mark in the BCG Matrix. This signifies a high-growth market with a low market share. In 2024, Danone should consider significant investments to boost YoPro's market presence. The strategic options include aggressive marketing or potential divestiture, depending on growth potential and market dynamics. According to Danone's 2023 financial report, the company has allocated $1.2 billion for innovation and brand investments.

Harmless Harvest, a question mark in Danone's portfolio, saw double-digit growth in Waters. To capitalize on this, substantial investments are needed to boost market share before it declines. In 2024, the coconut water market grew, indicating potential. The optimal strategy is to invest or consider a sale.

High Protein products are a Star in North America, but elsewhere, they're a Question Mark for Danone. To boost market share, Danone should analyze these markets closely. This includes figuring out consumer preferences and competition in 2024. For example, in 2023, the global protein supplements market was worth $9.4 billion, showing potential for growth.

Plant-Based Dairy Alternatives

Danone's plant-based dairy alternatives face a dynamic market. The sector's growth is significant, with the global plant-based milk market valued at $23.6 billion in 2024. New products and competitors emerge, requiring Danone to stay agile. Investments in innovation and marketing are crucial to solidify market share and position brands as Stars.

- Market growth: The plant-based milk market is projected to reach $43.8 billion by 2029.

- Competitive landscape: Numerous brands challenge Danone's position, requiring strategic responses.

- Investment needs: Innovation and marketing are critical for sustainable growth.

- Strategic goal: Transform plant-based brands into Stars within Danone's portfolio.

Gut Health Innovation

Danone's emphasis on gut health, particularly with next-generation probiotics, positions it in a high-growth sector. This area demands substantial investment in research, development, and marketing. Successful ventures could yield "star" products, significantly impacting market share.

- Danone's 2024 financial reports will likely highlight R&D spending in this domain.

- Market analysis indicates increasing consumer interest in gut health products.

- The BCG Matrix categorizes these initiatives as "question marks" due to high growth potential and associated risks.

YoPro, Harmless Harvest, and High Protein products exemplify Danone's "Question Marks." These brands operate in high-growth markets, demanding strategic investment. Danone must assess each brand's potential and market dynamics in 2024 to decide whether to invest or divest, aiming for "Star" status.

| Brand | Market | Strategy |

|---|---|---|

| YoPro | Functional Products | Invest/Divest |

| Harmless Harvest | Coconut Water | Invest/Divest |

| High Protein | Global Supplements | Invest/Divest |

BCG Matrix Data Sources

The Danone BCG Matrix relies on public financial reports, market analysis, and expert assessments for dependable, strategic insights.