Danske Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danske Bank Bundle

What is included in the product

Tailored analysis for Danske Bank's product portfolio.

Export-ready design for quick drag-and-drop into PowerPoint

Delivered as Shown

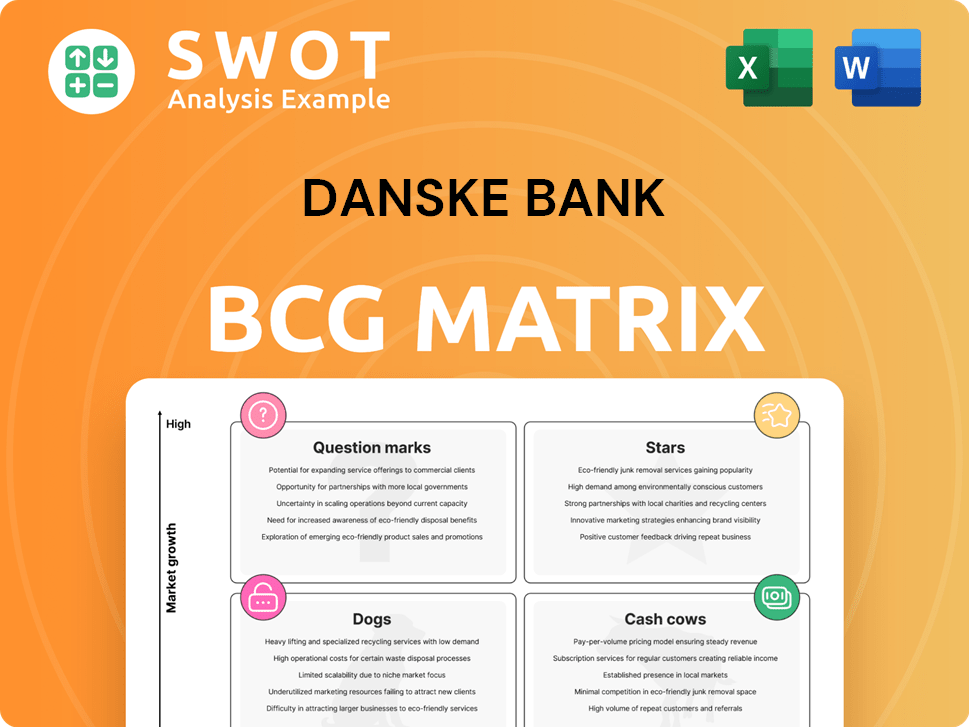

Danske Bank BCG Matrix

The Danske Bank BCG Matrix preview is the identical document you'll receive after purchase. This full report is ready to guide your strategic decisions, with no hidden content or watermarks to obscure the analysis. The downloadable version offers immediate access for use in presentations or reports.

BCG Matrix Template

Danske Bank's BCG Matrix offers a snapshot of its diverse portfolio. It reveals how different business units are positioned in the market. This includes Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is key to strategic planning. The full report provides deeper analysis and strategic recommendations. It also provides a roadmap to smart investment and product decisions. Get the full BCG Matrix now for actionable insights.

Stars

Danske Bank's 2024 results showcase robust financial health. The bank reported a record net profit of DKK 23.6 billion. Return on equity reached an impressive 13.4%, reflecting strong profitability. This financial success enables strategic investments.

Danske Bank excels in customer satisfaction. It's the top choice for Nordic corporate and institutional clients. This leadership is evident in the highest customer satisfaction scores across the Nordics. The bank's focus on strong partnerships and service improvements drives this success. In 2024, customer satisfaction scores reached record highs.

Danske Bank is advancing its tech transformation. They are using digitalization, data, AI, and tech to boost customer engagement and efficiency. The bank launched DanskeGPT and developed a new District online banking platform version. In 2024, Danske Bank's digital customer interactions rose by 15%, showcasing progress.

Sustainability Transition Support

Danske Bank aids clients in the sustainability shift. It offers advice, products, and services focused on sustainability. Their Climate Action Plan shows dedication. The bank engages with high-impact industries. In 2024, they allocated over $10 billion to green projects.

- Financial advice for sustainable choices.

- Products and services supporting sustainability.

- Climate Action Plan implementation.

- Engagement with key industries.

Capital Distribution Commitment

Danske Bank focuses on shareholder value via consistent capital distribution. The bank aims for a 40-60% dividend payout ratio of net profit. In 2024, the Board launched a DKK 5 billion share buy-back program. This action reflects its strong financial position and confidence.

- Dividend Payout: Targeted at 40-60% of net profit.

- Share Buy-Back: A new DKK 5 billion program initiated.

- Financial Performance: Buy-back shows confidence in the bank's financial strength.

- Capital Management: Focused on returning capital to shareholders effectively.

Danske Bank, positioned as a "Star," shows high market growth and share. It leads in customer satisfaction, crucial for market leadership. The bank's tech and sustainability focus boosts its star status, driving future value.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Growth | High, due to tech and sustainability investments. | Digital customer interactions rose by 15%. |

| Market Share | Leading customer satisfaction scores. | Top choice for Nordic corporate clients. |

| Strategic Focus | Tech transformation and green finance. | Over $10B allocated to green projects. |

Cash Cows

Danske Bank's core banking activities remain a key revenue driver. Customer activity and robust credit quality support this. The bank's investment in digital, cloud, and data capabilities reinforces its position. In 2024, net interest income reached DKK 12.7 billion. This is a testament to its cash cow status.

Danske Bank's strategic focus has boosted personal and private banking relationships. Tailored services and enhanced experiences generate consistent cash flow. In 2024, this segment saw a 5% increase in customer satisfaction. Deposits grew by 7% in the same period, reflecting strong performance.

Danske Bank targets leading positions with business and institutional clients. It leverages expertise and customer solutions, driving significant cash flow. In 2024, corporate & institutional banking contributed substantially to Danske Bank's revenue, with figures close to €2.5 billion. This segment's profitability highlights its cash cow status within the BCG matrix.

Asset Management Fees

Danske Bank generates substantial income from asset management fees, reinforcing its cash cow position. These fees are a significant part of its revenue stream. The bank's success in managing assets directly impacts its financial health. Strong asset management helps maintain its profitability.

- In 2023, Danske Bank's total income was approximately DKK 22.3 billion, including asset management fees.

- Assets under management (AUM) are a key driver for fee income.

- Danske Bank's focus on asset retention and growth is critical.

Northern Ireland Operations

Danske Bank's Northern Ireland operations are a financial stronghold, classified as a "Cash Cow" in the BCG matrix. In 2024, the Northern Ireland arm generated a profit before tax of £218.2 million, underscoring its profitability. This substantial financial contribution bolsters the bank's overall cash flow and stability. The consistent performance of these operations supports strategic investments elsewhere.

- Profit before tax for 2024: £218.2 million

- Contribution to overall bank stability: Significant

- Strategic implication: Supports investment in other areas

Danske Bank's Cash Cows are consistently profitable. They generate reliable income, such as net interest income and asset management fees. Strategic business areas, like Northern Ireland, consistently perform well. This ensures a stable financial foundation for the bank.

| Aspect | Details | 2024 Data |

|---|---|---|

| Net Interest Income | Core banking revenue | DKK 12.7 billion |

| Northern Ireland Profit | Profit before tax | £218.2 million |

| Asset Management Fees | Contribution to revenue | Significant |

Dogs

Danske Bank's health and accident insurance arm struggles. In 2024, this segment saw a profitability dip due to increased claims. Restructuring is likely needed to boost returns. A possible divestment could also be on the table. Consider the 2024 operational challenges.

Danske Bank faces ongoing profitability challenges due to legacy remediation costs. Although expenses for financial crime prevention and legacy issues decreased, they still impact the bank's finances. In 2024, these costs remain a key focus for improving efficiency. The bank aims to reduce financial burdens by tackling these issues, as evidenced by the 2023 annual report.

Danske Bank faces a high cost/income ratio, hindering profitability and competitiveness. In 2024, the bank's cost/income ratio was around 50%, above industry averages. Reducing this ratio is crucial for Danske Bank's financial health. This strategic focus is key to boosting shareholder value.

Underperforming Markets

If Danske Bank has markets that consistently underperform, they would be considered "Dogs" in its BCG matrix. These markets typically consume resources without generating sufficient returns. For instance, if Danske Bank's operations in a specific region show lower profitability compared to the average for its competitors, it fits this category. This often leads to strategic decisions like divestiture or restructuring. In 2024, Danske Bank's return on equity was around 5.5%, which is below the average of its Nordic peers.

- Low Profitability: Markets with consistently low-profit margins compared to competitors.

- Resource Drain: These markets often require significant investment without commensurate returns.

- Strategic Options: Potential decisions include restructuring, downsizing, or exiting the market.

- Market Performance: The bank’s strategy emphasizes profitability and efficiency, aiming to improve returns in all markets.

Products with Declining Market Share

Products with declining market share for Danske Bank, categorized as "Dogs" in their BCG Matrix, need careful attention. These are financial offerings in low-growth markets, experiencing a consistent decrease in market share, signaling potential challenges. Divestment should be seriously considered for these underperforming assets to reallocate resources effectively.

- Specific products in areas like traditional banking services could be examples.

- Market share declines might be evident in specific loan products or outdated investment options.

- Financial data from 2024 would show the actual performance and market share shifts.

- Danske Bank's strategic reports from late 2024 will provide detailed insights.

Danske Bank's "Dogs" are underperforming segments. These markets show low profitability and drain resources. Strategies include restructuring or exiting these markets. 2024 data shows focus on profitability.

| Category | Description | Strategy |

|---|---|---|

| Low Profitability | Low-profit markets | Restructure or Exit |

| Resource Drain | Consume resources | Reallocate Funds |

| Market Share Decline | Falling sales | Divestment |

Question Marks

Danske Bank's District, launching in Denmark in 1H 2025, is a question mark in its BCG Matrix. As a new platform, its market share is uncertain, and it requires significant investment. Its success hinges on customer adoption and market penetration against competitors. In 2024, digital banking saw a 15% growth in small business adoption.

Danske Bank's GenAI initiatives, including DanskeGPT, are currently classified as a question mark in its BCG Matrix. These technologies aim to boost productivity. However, their lasting effect on the bank's profitability isn't yet clear. In 2024, banks are investing heavily in AI, with global spending expected to hit $27 billion.

Danske Bank's sustainable finance target of over DKK 100 billion is a question mark within its BCG matrix. This initiative's success hinges on strong demand for sustainable financing and the bank's effective capital deployment. In 2024, the demand for such financing has grown significantly, with ESG-linked loans increasing. The bank's ability to capitalize on this trend will determine its position.

Danica's New Commercial Strategy (Forward '28)

Danica's "Forward '28" strategy, aiming for preferred pension status in Denmark by 2028, fits the BCG Matrix's question mark category. This positioning reflects its potential for high growth but uncertain outcomes. Success hinges on customer acquisition and satisfaction improvements. For context, the Danish pension market is highly competitive, with significant players.

- Market share data for 2024 shows Danske Bank and Danica hold significant positions, but face competition.

- Customer satisfaction scores and retention rates will be key performance indicators (KPIs).

- Investment in digital platforms and customer service are vital for Forward '28.

- Regulatory changes and market dynamics pose challenges.

Partnerships and Integrations

Danske Bank's alliances with BlackRock and Broadridge represent question marks in its BCG matrix. These partnerships aim to boost customer experience, streamline operations, and improve efficiency. Their success hinges on effective integration and achieving the desired outcomes in a competitive market. The bank’s strategic investments in these areas are critical for future growth and profitability.

- BlackRock's Aladdin Wealth platform integration aims to enhance investment decision-making.

- Broadridge's Tbricks solution seeks to optimize trading and operational processes.

- These initiatives align with Danske Bank's goal to modernize its services.

- The impact of these partnerships will be visible in the coming years.

Danske Bank's initiatives, like District and GenAI, are question marks due to uncertain market share and investment needs. Success depends on customer adoption and market penetration. Sustainable finance targets and Danica's strategy also fall into this category, with high growth potential but uncertain outcomes. Partnerships, such as with BlackRock, are also classified as a question mark.

| Initiative | Category | Key Factor |

|---|---|---|

| District | Question Mark | Customer Adoption |

| GenAI | Question Mark | Profitability Impact |

| Sustainable Finance | Question Mark | Capital Deployment |

| "Forward '28" | Question Mark | Customer Satisfaction |

| BlackRock & Broadridge | Question Mark | Integration |

BCG Matrix Data Sources

The Danske Bank BCG Matrix leverages comprehensive data, using financial reports, market analysis, and expert opinions.