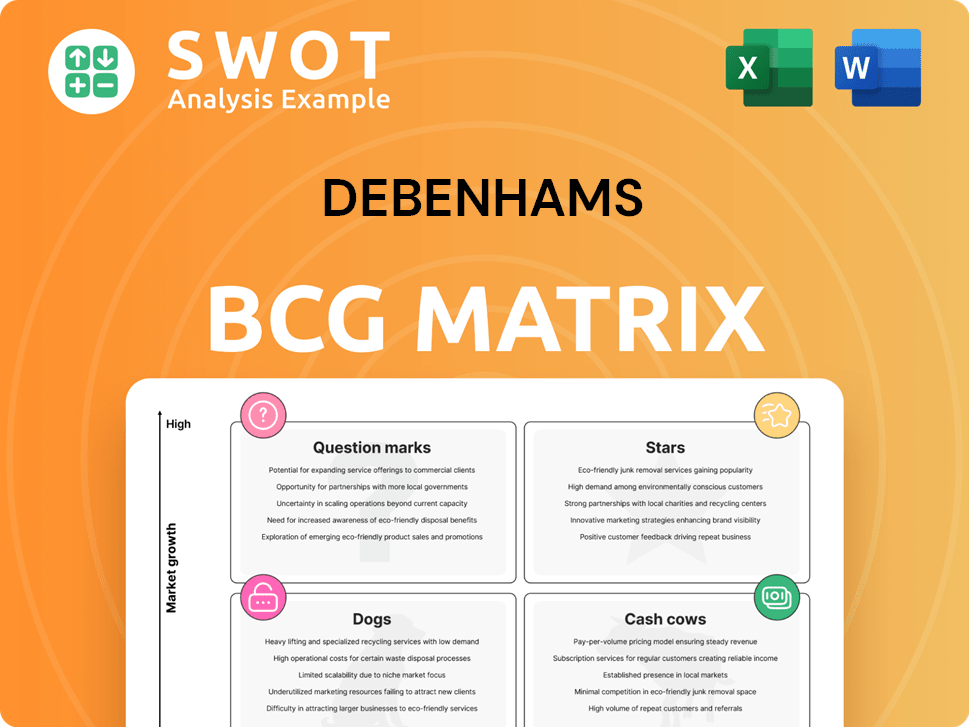

Debenhams Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debenhams Bundle

What is included in the product

Tailored analysis for Debenhams' product portfolio, exploring strategic choices within each quadrant.

Clean and optimized layout for sharing or printing of the Debenhams BCG Matrix, creating a better analysis.

What You’re Viewing Is Included

Debenhams BCG Matrix

The Debenhams BCG Matrix displayed here is the complete document you receive post-purchase. This means no hidden content or alterations—just a ready-to-use strategic analysis tool. Utilize it to understand the business strategy and make confident, data-driven decisions.

BCG Matrix Template

Debenhams' BCG Matrix reveals its product portfolio's competitive landscape. This analysis classifies products as Stars, Cash Cows, Dogs, or Question Marks. It helps understand resource allocation and growth potential. This strategic tool reveals opportunities & challenges. Purchase the full BCG Matrix to access detailed classifications, actionable insights, and drive informed decisions.

Stars

Prior to 2021, Debenhams' private label fashion, like Principles, was a "Star" due to its strong market share and customer loyalty. These lines, including brands like "Maine", contributed significantly to the company's revenue. In 2020, Debenhams reported that private label sales accounted for approximately 40% of its total fashion sales. Further investment in design and marketing could have boosted profits.

Debenhams' beauty lines, featuring collaborations and popular brands, were a revenue driver, existing in a high-growth market. The beauty sector's strong demand was capitalized by Debenhams' diverse selection. In 2020, the UK beauty market was valued at £27 billion, showing its potential. Personalized experiences and online expansion could have boosted Debenhams' market share, attracting consumers.

Before 2021, Debenhams' online presence had growth potential, aligning with e-commerce trends. The online platform offered broad customer access. Investing in web optimization and delivery could have boosted its Star status. Data analytics could personalize shopping, enhancing sales. In 2020, online sales rose, yet overall revenue declined.

Multi-Brand Shopping Experience (Pre-2021)

Debenhams' multi-brand strategy, pre-2021, aimed to draw in diverse shoppers. This approach provided a wide array of choices in one place, boosting foot traffic. To enhance this, they could have offered personalized services and events. Data from 2019 showed a decline in sales, highlighting the need for innovation.

- Foot traffic driven by diverse brands.

- Enhanced customer experience through services.

- In 2019, Debenhams' sales had dropped.

- Need for innovation to stay relevant.

Loyalty Program (Pre-2021)

Debenhams' loyalty program before 2021 aimed to boost customer retention through discounts and rewards. Such programs can increase customer lifetime value. However, to be effective, it needed tiers, personalized offers, and gamification. Integration with online platforms was also crucial for a better customer experience.

- Customer loyalty programs can increase customer retention rates by up to 25%.

- Personalized offers can boost sales by 10-15%.

- Gamification in loyalty programs increases engagement.

- Integrating online and offline experiences increases customer lifetime value.

Debenhams' "Stars" pre-2021 were key revenue drivers. Private label fashion and beauty lines thrived in high-growth markets. Online platforms and multi-brand strategies had significant potential. Loyalty programs aimed to boost customer retention.

| Star Category | Key Features | 2020 Performance/Stats |

|---|---|---|

| Private Label Fashion | Strong market share, customer loyalty. | ~40% of total fashion sales. |

| Beauty Lines | Diverse selection, collaborations. | UK beauty market: £27B. |

| Online Presence | E-commerce growth potential. | Online sales rose, overall revenue declined. |

Cash Cows

Debenhams' pre-2021 homeware, like bedding, were cash cows, providing consistent revenue. Demand was steady, boosted by brand recognition. The UK homeware market, valued at £13.7 billion in 2024, offered stable sales. Optimizing operations could boost profitability, and sustainable lines could attract eco-minded consumers.

Classic clothing ranges, like basic knitwear and formal wear, were cash cows. These items had consistent sales and low marketing costs. Debenhams could have maximized profits by focusing on quality and affordability. Consider that in 2020, the UK clothing market was valued at approximately £53 billion.

Before 2021, Debenhams thrived on a loyal, older customer base, a dependable revenue source. These customers valued Debenhams' traditional appeal and trusted its brand. In 2020, the company reported a loss of £532.5 million. Strengthening relationships through tailored services and promotions could've boosted sales. Focusing on customer satisfaction was crucial for sustained revenue.

Store Card (Pre-2021)

The Debenhams store card, pre-2021, functioned as a cash cow, generating revenue through interest and fees, providing a stable income stream. Store cards boosted customer loyalty and repeat purchases, crucial for maintaining sales. Debenhams could have enhanced its card's value with exclusive discounts and flexible payments. The program's profitability hinged on continuous innovation and customer value.

- Interest rates on store cards often ranged from 20% to 30% APR.

- Store cards typically contributed up to 10% of a retailer's total revenue.

- Customer loyalty programs increased spending by 15% to 20%.

- Average cardholder spending was often 2-3 times higher than non-cardholders.

Concessions (Pre-2021)

Before 2021, Debenhams' concessions, where external brands leased space, were cash cows. These generated revenue with low investment, attracting diverse customers and enhancing the shopping experience. Debenhams could have optimized this by carefully selecting brands and negotiating favorable lease terms. This would have ensured a steady income stream. In 2019, concessions contributed significantly to Debenhams' revenue, highlighting their importance before the company's struggles.

- Revenue from concessions provided a stable income source.

- Concessions attracted a variety of customers.

- Optimizing brand selection was a key strategy.

- Favorable lease terms were crucial.

Debenhams' cash cows before 2021 included items like homeware, classic clothing, and store cards, generating reliable revenue. These were popular with a loyal customer base. Effective strategies included enhancing customer services and optimizing brand selections within concessions, which were profitable before the company's financial struggles.

| Category | Description | Impact |

|---|---|---|

| Homeware | Bedding and related products | Steady sales with the UK market valued at £13.7B (2024). |

| Clothing | Basic knitwear and formal wear | Consistent sales, with the UK clothing market around £53B (2020). |

| Store Card | Revenue from interest and fees | Loyalty and repeat purchases boosted revenue; interest rates 20%-30% APR. |

Dogs

Debenhams' international forays, particularly pre-2021, struggled. These ventures, lacking local understanding, faced tough competition and marketing failures, leading to losses. For example, Debenhams closed its stores in Russia in 2019. Careful market analysis and planning were crucial. Divesting from these "Dogs" could have boosted profits.

Before 2021, some Debenhams locations struggled with outdated designs, negatively impacting foot traffic and sales. These stores didn't update to meet customer trends, hindering their ability to compete. Investments in renovations and new tech were needed to improve shopping experiences. Modernizing stores could've boosted sales, but it didn't happen.

Underperforming own-brand products at Debenhams, pre-2021, meant low sales and high inventory costs due to poor customer appeal. These items suffered from design flaws or quality issues. For instance, in 2019, Debenhams reported a 1.6% drop in like-for-like sales, partly due to weak own-brand performance. Better market research, design, and marketing were crucial. Improving the product offerings would have minimized losses.

Clearance Sections (Pre-2021)

Large clearance sections at Debenhams before 2021 signaled issues with inventory and profitability. These areas, designed to move slow-moving items, often tied up capital. The size of these sections highlighted problems in inventory management and product choices. Addressing these issues was crucial for Debenhams' financial health.

- Pre-2020, Debenhams reported significant losses, partly due to inventory issues.

- Clearance sales often involve markdowns of 50% or more, reducing profit margins.

- Inefficient inventory management leads to higher holding costs and potential obsolescence.

- Effective inventory strategies could have reduced the need for extensive clearance.

Products with Declining Demand (Pre-2021)

Products facing declining demand, like outdated fashion trends, were a challenge for Debenhams. These items lost appeal, impacting sales. Debenhams needed to adapt, following market trends and consumer preferences. This meant divesting from losing products.

- In 2020, Debenhams reported a loss of £554 million, reflecting the impact of declining sales and changing consumer habits.

- By 2020, clothing sales in the UK had decreased by 10% compared to 2019, highlighting the need for retailers to adapt.

- Debenhams closed stores in 2020, reducing its physical presence by 25% to cut costs.

- The company's online sales increased by 40% in 2020, showing the shift towards digital shopping.

Debenhams struggled with "Dogs" before 2021, including poorly performing international ventures and outdated store designs, which led to financial losses. In 2019, the company reported a loss of £491.5 million. These Dogs required divestment. Failure to adapt led to closures.

| Category | Description | Impact |

|---|---|---|

| International Ventures | Stores in Russia closed due to poor performance. | Reduced revenue. |

| Outdated Stores | Stores didn't meet customer trends. | Decreased foot traffic and sales. |

| Underperforming Products | Own-brand products with low sales. | Increased inventory costs. |

Question Marks

Debenhams' early steps in sustainable fashion, though forward-thinking, faced a challenge, with low market share and the need for investments to boost visibility. The sustainable fashion segment saw a rapid expansion, driven by consumers' increasing environmental awareness. To succeed, Debenhams should have focused on marketing to highlight its sustainable offerings and attract more customers. Collaborating with sustainable brands could have strengthened its position and market presence.

Debenhams' efforts to personalize shopping were in a high-growth phase pre-2021. Personalization was crucial, yet adoption lagged. Investing in AI and data could have boosted tailored recommendations. This could have increased sales, potentially turning it into a Star. In 2020, e-commerce sales grew by 43.1% in the UK, highlighting the shift towards online retail, which personalized experiences could have capitalized on.

Before 2021, Debenhams' online platform needed significant enhancements, including AI-driven recommendations. The online retail market was booming, making personalization a crucial advantage. Investing in features like virtual try-ons could have boosted sales. Gathering customer feedback would have improved personalization, potentially converting this into a Star.

Expansion of Beauty Services (Pre-2021)

Expanding beauty services, like in-store treatments, was a strategic move for Debenhams, aiming to capture a growing market. The beauty services sector was booming pre-2021, with an estimated global market size of $532 billion. However, this expansion needed significant investment in staff training and advanced equipment to compete effectively. Partnering with beauty brands and influencers could have boosted customer attraction and sales.

- Beauty services growth was projected at 4.7% annually before 2021.

- Investment in staff training was crucial for service quality.

- Partnerships with brands could have increased revenue.

- Debenhams could have turned this into a Star.

New Digital Marketing Strategies (Pre-2021)

Before 2021, Debenhams faced "Question Marks" with innovative digital marketing strategies. These strategies, such as influencer collaborations and interactive social media campaigns, offered high potential but uncertain returns. For instance, in 2020, Debenhams was already exploring digital avenues, but it wasn't enough to offset its financial struggles, with online sales accounting for only a fraction of overall revenue. The shift to digital was crucial as consumer behavior changed, spending more time online.

- Influencer marketing was gaining traction, with potential to boost brand awareness.

- Interactive social media campaigns could have engaged new customers.

- Targeted advertising was key to reaching specific customer segments.

- Analyzing and optimizing campaigns were essential for improving returns.

Debenhams' digital marketing initiatives were "Question Marks" pre-2021 due to high potential and uncertain outcomes. Influencer marketing and interactive campaigns aimed to boost awareness and engagement. However, digital sales were a small portion of total revenue. Effective strategies needed optimization and targeted advertising. In 2020, digital ad spending in the UK rose significantly.

| Strategy | Potential | Challenges |

|---|---|---|

| Influencer Marketing | Increased Brand Awareness | Measuring ROI, Costs |

| Interactive Campaigns | Customer Engagement | Content Creation, Tech |

| Targeted Advertising | Reach Specific Segments | Data Privacy, Competition |

BCG Matrix Data Sources

The Debenhams BCG Matrix utilizes financial statements, market research, and competitor analyses for robust and insightful positioning.