Public Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Public Power Bundle

What is included in the product

Strategic analysis of Public Power's business units within BCG Matrix quadrants.

Quickly assess your portfolio with a one-page overview placing each business unit in a quadrant.

What You See Is What You Get

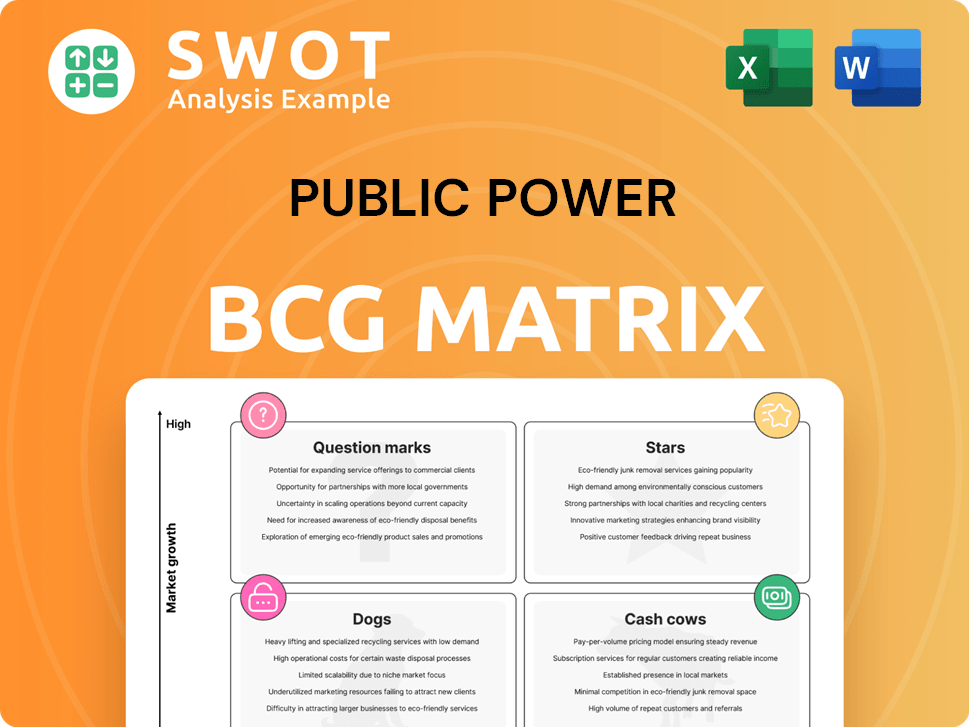

Public Power BCG Matrix

The BCG Matrix preview is identical to the purchased document. You’ll receive a complete, ready-to-use analysis tool after your purchase, without any changes or watermarks. This streamlined version offers immediate value.

BCG Matrix Template

Public Power's BCG Matrix offers a snapshot of its product portfolio's market position. Stars represent high-growth, high-share offerings, while Cash Cows generate steady revenue. Dogs struggle in low-growth markets, and Question Marks need careful consideration. This preview hints at crucial insights into Public Power's strategy.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

PPC's renewable energy projects, including solar and wind, are experiencing high growth. Its installed RES capacity reached 6.2 GW by late 2024, fueled by government green energy initiatives. This expansion positions PPC as a leader in Greece and Southeast Europe. PPC's aggressive strategy is paying off.

PPC's aggressive moves into new markets, such as Romania, showcase its high-growth ambitions. The 2024 acquisition of Enel's assets in Romania boosted its presence. These strategic expansions contributed to a revenue increase of 27.7% in Q1 2024, and a 17.8% increase in EBITDA.

PPC's data center plan at Agios Dimitrios is a star, promising high growth. Demand for data storage is soaring, with the global data center market valued at $200 billion in 2024. This project can boost PPC's revenue significantly. Repurposing lignite sites for tech aligns with green energy goals.

Fiber Optic Network (FiberGrid)

FiberGrid, PPC's FTTH initiative, shows considerable promise. By September 2024, they connected 477,000 households/businesses. The goal is to reach 1.7 million by the end of 2025. This expansion is crucial for revenue growth and market positioning.

- High growth potential in FTTH market.

- 477,000 households/businesses connected by Sept. 2024.

- Target: 1.7 million connections by end of 2025.

- Enhances PPC's telecommunications presence.

E-mobility Infrastructure

PPC's e-mobility infrastructure, a "Star" in its Public Power BCG matrix, highlights its leadership in the Greek market. In 2024, PPC held a 37% share of public Charging Points (CPs), showcasing a strong position. Expansion into Greece and Romania supports the rising electric vehicle adoption. Further investment could bring substantial returns.

- 37% share of public CPs in Greece (2024).

- Expansion into Greece and Romania.

- Focus on growing e-mobility market.

Stars like e-mobility and FiberGrid drive PPC's high growth. PPC held 37% of public charging points in Greece in 2024, expanding to Greece and Romania. FiberGrid connected 477,000 by Sept. 2024, targeting 1.7M by 2025. These initiatives enhance PPC's market position.

| Initiative | Market Position (2024) | Growth Drivers |

|---|---|---|

| e-Mobility | 37% CP share (Greece) | Expansion in Greece & Romania; rising EV adoption. |

| FiberGrid | 477K connections (Sept. 2024) | Target: 1.7M connections by 2025; FTTH market growth. |

| Renewable Energy | 6.2 GW RES Capacity (2024) | Government initiatives, leader in Greece/SE Europe. |

Cash Cows

PPC is a cash cow in Greece's low-voltage electricity distribution. It had a 71.69% market share in 2024. PPC managed 5.52 million power meters. This sector generates consistent revenue for PPC.

PPC dominates medium-voltage electricity distribution. In December 2024, PPC held a 40.7% market share. This segment fuels significant revenue and profits. Network efficiency is key to this cash cow's success.

PPC's electricity supply to Greek households is a cash cow, leveraging its established customer base and brand recognition. This segment generates steady income due to consistent electricity demand. In 2024, PPC reported €5.8 billion in revenue from its supply segment. Maintaining customer satisfaction is key to sustaining this cash flow.

Balancing Market Participation

Public Power Corporation's (PPC) involvement in the balancing market is a substantial revenue source. In 2023, this market contributed about 21% to the total revenues of electricity producers. This market includes the Balancing Capacity Market, Balancing Energy Market, and imbalance settlements, all providing income opportunities for PPC. Efficient management of its generation portfolio is crucial for PPC to maximize its earnings from these markets.

- Balancing Market Contribution: Approximately 21% of total revenues in 2023.

- Revenue Streams: Balancing Capacity Market, Balancing Energy Market, and imbalance settlements.

- Operational Efficiency: Key for maximizing revenue in these markets.

Kotsovolos Retail Operations

Kotsovolos, a retail operation within Public Power Corporation (PPC), acts as a reliable cash cow, bolstering the company's financial stability. In 2024, Kotsovolos's diverse offerings, including electronics and services, have been key to customer retention. This retail arm strengthens PPC's 'holistic partner strategy'. The integration aims to boost the cash cow's performance.

- Kotsovolos contributed significantly to PPC's revenue in 2024.

- Customer retention rates improved due to the range of products and services.

- The holistic partner strategy aims to enhance Kotsovolos's market position.

- Kotsovolos’s integration supports PPC's financial goals.

Public Power Corporation (PPC) has several cash cows, ensuring financial stability. These include electricity distribution and supply, generating consistent revenue. PPC's balancing market participation and Kotsovolos retail arm also act as cash cows. They contribute significantly to PPC's overall profitability.

| Cash Cow | Key Metrics (2024) | Revenue Contribution |

|---|---|---|

| Low-Voltage Distribution | 71.69% market share | Consistent |

| Electricity Supply | €5.8 billion revenue | Steady |

| Balancing Market | 21% of total revenue (2023) | Substantial |

Dogs

Lignite-based power generation is now a 'dog' for Public Power Corporation (PPC). The company is phasing out lignite-fired plants by 2028, aligning with environmental rules. In 2024, lignite output dropped by about 28% compared to 2023. Lignite made up only 15% of PPC's total output in 2024.

PPC's high-voltage electricity market share plummeted to 20.5% by December 2024. This is a sharp decrease from 48% in December 2023. The drop stems from the end of old fixed contracts. PPC must strategize to regain its market position and avoid more losses.

Inefficient legacy systems, considered "dogs," include outdated infrastructure like older power plants and distribution networks. These systems lead to higher operational expenses, diminishing profitability. For example, in 2024, some utilities faced up to 15% higher maintenance costs due to aging equipment. Modernization is key; upgrading can cut costs by up to 20%.

Non-Interconnected Islands (NII) Infrastructure

Serving Non-Interconnected Islands (NII) with infrastructure is challenging due to outdated systems. These islands use older, less efficient power generation, increasing costs and environmental impact. Integrating them into the main grid or using sustainable solutions is essential. In 2024, upgrades could reduce operational expenses by up to 20%.

- Outdated infrastructure leads to higher operational costs.

- Environmental concerns due to reliance on older methods.

- Integration into the main grid offers an opportunity.

- Sustainable solutions are crucial for long-term viability.

Unprofitable Legacy Contracts

PPC has been actively terminating unprofitable, high-voltage contracts, signaling that these agreements were financially underperforming. This strategic move aims to cut losses and redirect resources toward more profitable areas. Identifying and addressing such contracts is key to boosting PPC's financial health. Renegotiation or termination can free up capital. In 2024, PPC's net profit was approximately €200 million.

- Contract termination reduces financial strain.

- Focus shifts to more profitable ventures.

- Improved financial performance expected.

- Resource reallocation is a key benefit.

Dogs in the BCG Matrix represent underperforming segments for PPC. These include lignite-based power, which saw a 28% output decrease in 2024. Outdated infrastructure and high-voltage contracts also contribute to this category. PPC aims to address these inefficiencies to improve its financial health.

| Category | Details | 2024 Data |

|---|---|---|

| Lignite Output | Decline in production | -28% vs. 2023 |

| Market Share (HV) | Decline in market presence | 20.5% by Dec 2024 |

| Legacy Systems | Higher operational costs | Up to 15% maintenance cost increase |

Question Marks

PPC's venture into offshore wind aligns with high-growth ambitions, though market share remains uncertain. Greece's potential is vast, yet projects demand significant investment and face hurdles. In 2024, offshore wind capacity in Greece is expected to grow, fueled by EU funding. Success could establish PPC as a sector leader, capitalizing on the expanding renewable energy market.

Investments in Battery Energy Storage Systems (BESS) represent a question mark for Public Power Corporation (PPC). BESS projects are vital for grid stabilization and renewable energy integration; however, profitability is market-dependent. PPC's planned 300 MW BESS system in Amyndaio and Ptolemaida needs careful strategic planning. In 2024, the global BESS market is projected to reach $15.7 billion.

PPC's plan to convert Ptolemaida 5 to a hydrogen-ready plant is a high-risk venture. Hydrogen technology's economic viability is uncertain, with costs fluctuating. In 2024, hydrogen production costs varied widely. PPC's move needs close scrutiny due to evolving tech and economics.

Expansion into Italy

Public Power Corporation's (PPC) expansion into Italy with new photovoltaic (PV) plants is a strategic move, given the Italian renewable energy market's growth. The Italian solar market saw significant growth in 2023, with approximately 5.2 GW of new capacity added. PPC's success hinges on securing contracts and efficient operations in this competitive landscape. This expansion is a growth opportunity, but careful management is crucial.

- Market Competition: Italy's solar market is highly competitive, with numerous players.

- Growth Potential: The Italian renewable energy sector is expanding, driven by EU targets.

- Risk Factors: PPC faces challenges in securing favorable contracts and managing costs.

- Financial Data: In 2023, the Italian solar market was valued at over €2.5 billion.

Value-Added Services (VAS)

Public Power Company's (PPC) foray into value-added services (VAS) like heat pumps, PV installations, and energy coaching is a strategic pivot. This move aims to boost customer retention and diversify revenue streams, a crucial strategy in the evolving energy market. However, successful implementation hinges on customer adoption and market competitiveness. PPC must effectively market and deliver these services to ensure profitability and market share growth.

- PPC is expanding into VAS to retain customers and increase revenue.

- Success depends on customer uptake and market competition.

- Effective marketing and delivery are vital for profitability.

- These services include heat pumps, PV installations, and energy coaching.

PPC's offshore wind ventures and BESS investments are question marks due to market uncertainties and high investment needs. Hydrogen-ready plants also pose risks. PPC's Italian expansion in PV is an opportunity, but requires careful contract management. The VAS expansion requires strategic marketing.

| Venture | Risk/Reward | 2024 Data Snapshot |

|---|---|---|

| Offshore Wind | High growth, high investment | Greece's offshore wind capacity expected growth driven by EU funds. |

| BESS | Market-dependent profitability | Global BESS market projected to reach $15.7 billion. |

| Hydrogen-ready plant | Uncertain economic viability | Hydrogen production costs showed wide variation. |

| Italian PV expansion | Growth potential, market competition | Italian solar market valued over €2.5 billion in 2023. |

| Value-Added Services | Customer uptake and marketing dependent | Focus on heat pumps, PV installations, and energy coaching. |

BCG Matrix Data Sources

The Public Power BCG Matrix utilizes data from financial statements, industry analysis, market reports, and regulatory filings to drive accurate positioning.