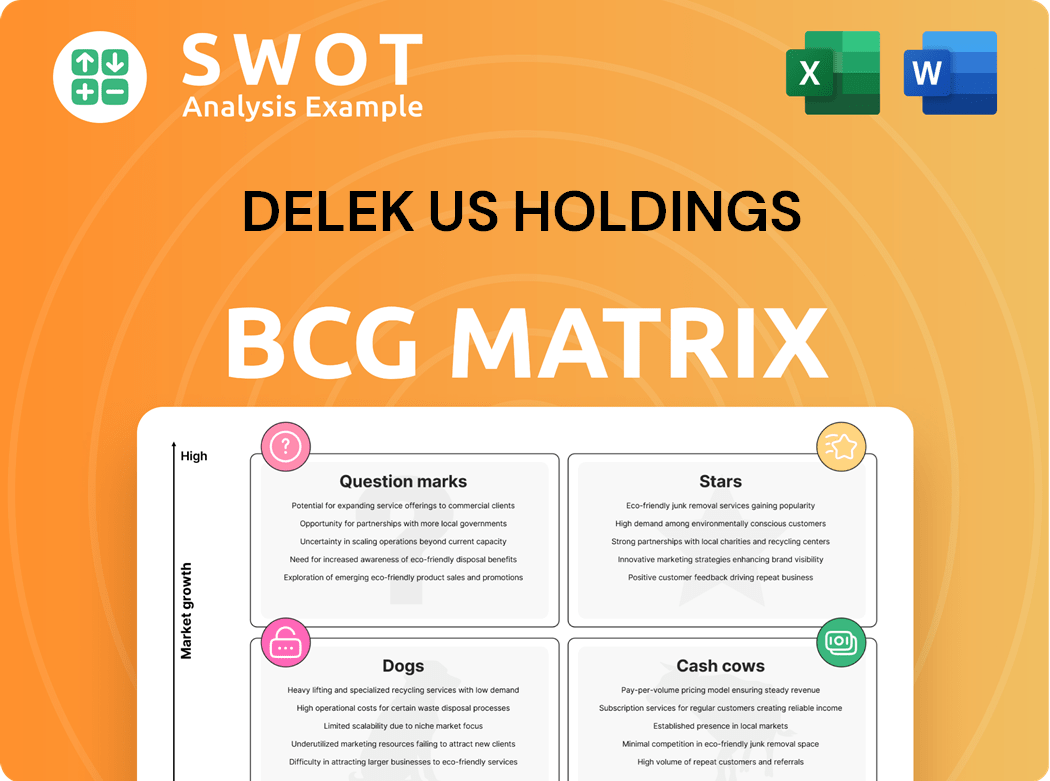

Delek US Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

What is included in the product

Tailored analysis for Delek's portfolio across the BCG Matrix. Highlights investment, hold, or divest decisions.

Clean, distraction-free view optimized for C-level presentation, providing clear strategic insights.

Full Transparency, Always

Delek US Holdings BCG Matrix

The BCG Matrix preview you see is the exact document you'll receive upon purchase. It offers a comprehensive analysis of Delek US Holdings' business units, ready for immediate application. The full, watermark-free version unlocks strategic insights for informed decision-making.

BCG Matrix Template

Delek US Holdings navigates a complex market. Its BCG Matrix spotlights key product segments. The matrix reveals growth potential and resource allocation needs. Are its assets Stars, Cash Cows, or Dogs? Knowing this is key to strategy. Gain a clear view of its quadrant placements. Purchase the full version for deep strategic insights.

Stars

Delek Logistics Partners (DKL) shines as a Star in Delek US Holdings' portfolio. It has shown robust growth, especially in the Permian Basin. Recent acquisitions and expansions, like the Libby plant, boost future prospects. DKL's distribution growth policy and full suite strategy solidify its midstream leadership. In Q3 2024, DKL's net income was $95.2 million.

Delek US Holdings' Permian Basin operations are a "Star" in its portfolio, demonstrating high growth. The region's strong demand for midstream services fuels expansion. Delek Logistics aims to be the top provider, capitalizing on opportunities. In Q3 2024, Delek Logistics reported $109.9 million in adjusted EBITDA, a 20% increase year-over-year, showing the region's financial strength.

Delek US Holdings' Big Spring refinery was selected for a carbon capture pilot project by the Department of Energy, showcasing its competitive edge. This initiative, capturing 145,000 metric tons of CO2 yearly, cements Delek's role in the energy transition. The project promises environmental and economic gains through pollution reduction. It reflects Delek's strategic focus on sustainable practices.

Enterprise Optimization Plan (EOP)

Delek US Holdings' Enterprise Optimization Plan (EOP) is a Star in its BCG Matrix, aiming for significant profitability gains. The EOP is designed to boost overall profitability by at least $100 million, with expectations at the high end, potentially reaching $120 million. This strategic initiative targets operational enhancements and strategic moves to improve future results. Progress suggests strong potential for increased cash flow and profitability.

- EOP targets operational enhancements.

- Expected profitability gains are up to $120 million.

- Focus on improving future performance.

- Progress indicates potential for enhanced cash flow.

Strategic Asset Base

Delek US Holdings leverages a robust strategic asset base, fostering a competitive edge. Their integrated model, including transportation and storage, boosts efficiency and reduces third-party dependencies. The 2024 refining capacity reached approximately 302,000 barrels per day. Strategic moves, like the Delek/Alon Merger, expanded market reach and refining capabilities.

- Integrated business model enhances operational efficiency.

- Control over transportation and storage reduces third-party reliance.

- 2024 refining capacity is around 302,000 barrels per day.

- Strategic acquisitions, like the Delek/Alon Merger, boosted refining capacity.

Delek US Holdings' "Stars" include initiatives like the Enterprise Optimization Plan (EOP) and strategic assets. EOP aims for up to $120 million in profitability gains, boosting future performance. Delek's integrated model and refining capacity of 302,000 barrels per day enhance its market position.

| Star | Key Feature | 2024 Data |

|---|---|---|

| Enterprise Optimization Plan | Profitability Enhancement | Up to $120M profit gains |

| Strategic Assets | Integrated Model | ~302,000 BPD refining capacity |

| Permian Basin | Midstream Growth | DKL Adj. EBITDA +20% YoY |

Cash Cows

Tyler and Big Spring refineries, located in Texas, are key cash cows for Delek US Holdings. These facilities are crucial for Delek's refining capacity, consistently generating revenue. In 2024, Delek's refining segment, including these, saw a solid performance. Maximizing operational efficiency and throughput ensures strong cash flow.

El Dorado and Krotz Springs refineries are key cash cows for Delek US. These refineries, in Arkansas and Louisiana, have a combined crude throughput capacity of 302,000 barrels daily. They consistently provide fuel to the Southern U.S. market, with 2024 refining margins remaining stable. Ongoing maintenance ensures their operational reliability.

Delek US Holdings views the Wink to Webster (W2W) pipeline as a cash cow, generating consistent revenue from crude oil transportation. This pipeline is crucial, moving oil from the Permian Basin to the Gulf Coast, boosting its value. In 2024, Delek aims to optimize operations and secure contracts to maintain profitability. The W2W pipeline is a key asset for Delek.

Asphalt Operations

Delek US Holdings' asphalt operations function as a reliable cash cow, especially given the constant need for road infrastructure. These operations generate steady revenue due to the essential nature of asphalt in construction and upkeep. The company's focus on efficient production and distribution helps maintain a strong cash flow from this sector. For example, in 2024, the infrastructure sector saw a 6% increase in spending, which directly benefits asphalt sales.

- Stable revenue stream from asphalt sales, especially in areas with ongoing infrastructure projects.

- Asphalt's role in road maintenance and construction ensures consistent demand.

- Efficient production and distribution are crucial for maximizing cash flow.

Renewable Fuels Initiatives

Delek US Holdings' renewable fuels initiatives, such as biodiesel facilities, are evolving into potential cash cows. Demand for sustainable energy is rising, boosted by government incentives and consumer interest. Strategic investments and operational improvements are key to boosting their profitability. These assets could become significant contributors. Delek's 2024 renewable diesel production was about 150 million gallons.

- Delek's 2024 renewable diesel production was approximately 150 million gallons.

- Government incentives significantly support renewable fuel projects.

- Growing consumer awareness drives demand for sustainable options.

- Strategic investments can enhance profitability and market share.

The retail segment of Delek US, including gas stations and convenience stores, acts as a stable cash cow. These locations benefit from consistent consumer traffic and high-margin product sales. Efficient store management and strategic location choices are critical for solid cash generation. In 2024, convenience store sales increased by 3.5%.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| Retail Segment | Gas stations, convenience stores. | Convenience store sales increased by 3.5% |

| Wink to Webster Pipeline | Crude oil transportation. | Optimized operations and contracts |

| Refineries (Tyler, Big Spring, El Dorado, Krotz Springs) | Oil refining facilities. | Stable refining margins |

Dogs

The retail fuel and convenience store segment, once part of Delek US Holdings, has been classified as a Dog in the BCG Matrix. This segment was divested to FEMSA for $385 million. The sale enables Delek to channel resources into its core refining and logistics operations. This strategic move provides a cash influx for reinvestment.

The Crossett, Arkansas biodiesel facility, part of Delek US Holdings, might be a Dog. Its performance could be hindered by varying feedstock expenses and market demand. Operational inefficiencies also play a role. In 2024, Delek's refining segment faced challenges, impacting the facility's profitability. Assessing improvement possibilities is key.

The Cleburne, Texas biodiesel facility, mirroring Crossett, may struggle with profitability and growth. Operational efficiency, market access, and feedstock supply are key. Strategic options include restructuring, upgrades, or divestiture. Delek US Holdings reported a net loss of $16.7 million in Q4 2023, impacting such facilities.

New Albany, Mississippi Biodiesel Facility

Delek US Holdings' biodiesel facility in New Albany, Mississippi, could be a Dog in its BCG Matrix if underperforming. Competition, such as from renewable diesel, and regulatory hurdles like the Renewable Fuel Standard (RFS) could be issues. Technological limitations or operational inefficiencies may also impact profitability. A detailed review is vital to decide its future.

- Delek US reported a net loss of $39.2 million in Q3 2023 due to lower refining margins.

- The RFS mandates a certain volume of renewable fuels, affecting biodiesel demand.

- Biodiesel production in the U.S. reached 1.8 billion gallons in 2023, indicating market saturation.

- Renewable diesel has gained market share, impacting biodiesel profitability.

Corporate, Other and Eliminations

In Q4 2024, Delek US Holdings' "Corporate, Other and Eliminations" segment reported an Adjusted EBITDA loss of $(60.3) million, a decline from the $(43.8) million loss in Q4 2023. This increase in losses is primarily attributed to the W2W dropdown and higher corporate expenses. This segment's performance signals potential underperformance or a need for cost optimization.

- W2W dropdown impact contributed to increased losses.

- Higher corporate expenses are a key driver of the negative EBITDA.

- Cost control and efficiency improvements are crucial for profitability.

- The segment requires strategic adjustments to improve financial performance.

The "Corporate, Other and Eliminations" segment of Delek US Holdings is likely categorized as a Dog in the BCG matrix. In Q4 2024, this segment's Adjusted EBITDA loss grew to $(60.3) million. This indicates poor financial performance. Strategic adjustments are needed to cut costs and boost efficiency.

| Segment | Q4 2023 Adjusted EBITDA Loss (USD millions) | Q4 2024 Adjusted EBITDA Loss (USD millions) |

|---|---|---|

| Corporate, Other and Eliminations | (43.8) | (60.3) |

| Impact Factor | W2W dropdown, higher corporate expenses | W2W dropdown, higher corporate expenses |

| Strategic Implication | Cost optimization, efficiency improvements | Cost optimization, efficiency improvements |

Question Marks

Delek US Holdings is considering a renewable diesel plant in Bakersfield, classifying it as a Question Mark in its BCG Matrix. This project demands substantial capital investment, with potential costs reaching hundreds of millions of dollars. Uncertainties surround market demand and regulatory support, impacting profitability. In 2024, renewable diesel production capacity in the U.S. is projected to increase, but competition is fierce.

Delek US Holdings' forays into carbon capture, utilization, and storage (CCUS) and low-carbon fuels are currently viewed as question marks within its BCG matrix. These initiatives are in the early stages, facing market uncertainties. Substantial capital is needed, alongside navigating technological and regulatory challenges. For example, in 2024, the CCUS market was valued at $2.8 billion, projected to reach $10.6 billion by 2029, indicating high potential but also risk. Strategic collaborations and pilot programs will be crucial for de-risking and attracting further funding.

Delaware Gathering Systems, a Question Mark in Delek US Holdings' BCG matrix, contributes significantly to the logistics segment. Its future profitability hinges on demand and operational efficiency. Strategic moves are vital for growth, like the $160 million expansion of the Big Spring gathering system announced in 2024.

International Expansion

If Delek US Holdings ventures into international markets, it becomes a Question Mark in the BCG matrix, given the inherent high risks and uncertainties. Expansion into new territories introduces complexities like political instability and varying regulatory environments. Successful international expansion requires in-depth market analysis and strategic partnerships to navigate these challenges effectively.

- Political risk is significant; in 2024, geopolitical tensions impacted energy markets globally.

- Regulatory differences can lead to compliance costs and operational hurdles.

- Cultural barriers can affect consumer behavior and business practices.

- Market analysis is crucial for identifying viable expansion opportunities.

Advanced Refining Technologies

Advanced refining technologies are a key area for Delek US Holdings, representing a strategic investment to boost efficiency and reduce environmental impact. These technologies, such as those aimed at processing alternative feedstocks or lowering emissions, demand considerable capital investment. Pilot projects and partnerships with tech providers are crucial for validating their effectiveness and managing risks.

- Capital expenditures in refining can be substantial, with projects potentially costing hundreds of millions of dollars.

- The success of these technologies is crucial for Delek to maintain its competitive edge.

- Partnerships can provide access to specialized expertise and shared risk.

- Emissions reduction is increasingly important due to environmental regulations.

Question Marks in Delek US Holdings' BCG matrix, like international ventures and advanced refining, face high uncertainty. These require substantial capital and carry significant risks. Successful ventures depend on in-depth market analysis, strategic partnerships, and risk management.

| Initiative | Description | Challenges |

|---|---|---|

| International Expansion | Venturing into new markets | Political instability, regulatory differences, cultural barriers |

| Advanced Refining Tech | Improving efficiency and reducing emissions | High capital expenditures, tech validation, regulatory compliance |

| CCUS & Low-Carbon Fuels | Early-stage initiatives | Market uncertainties, tech & regulatory hurdles; CCUS market projected to hit $10.6B by 2029 |

BCG Matrix Data Sources

This BCG Matrix is based on SEC filings, analyst reports, industry analysis, and market share data to ensure credible insights.