Deloitte & Touche LLP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deloitte & Touche LLP Bundle

What is included in the product

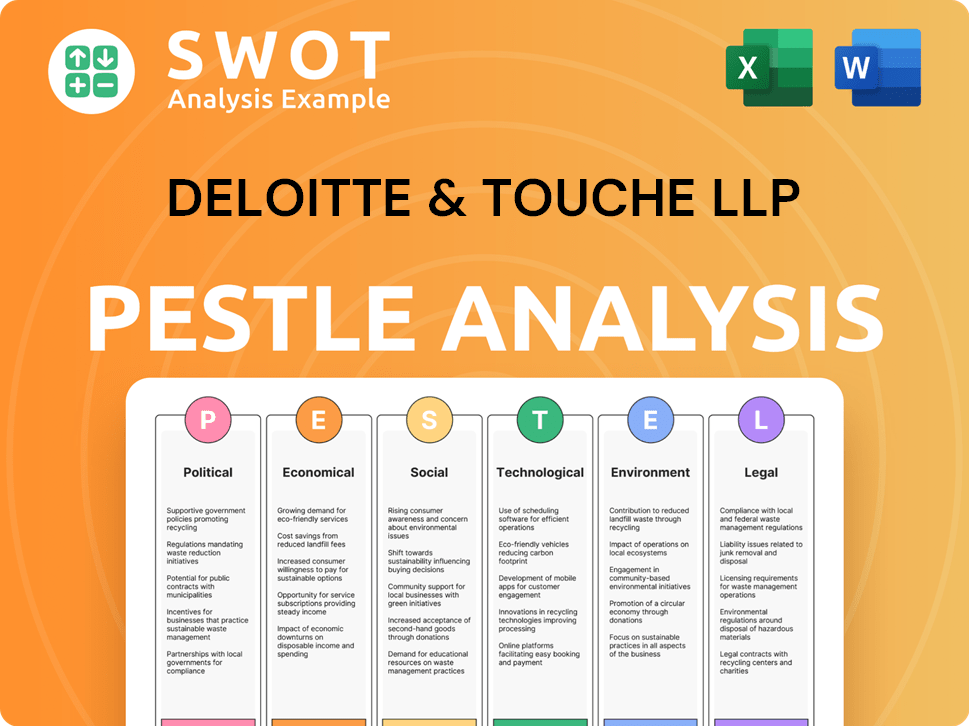

Provides a thorough analysis of external factors influencing Deloitte & Touche LLP.

A concise summary that is easily shared, perfect for quickly aligning stakeholders.

What You See Is What You Get

Deloitte & Touche LLP PESTLE Analysis

The file you’re seeing now is the final version of the Deloitte & Touche LLP PESTLE Analysis. This preview showcases the comprehensive assessment covering political, economic, social, technological, legal, and environmental factors. The structure and content in this preview are exactly what you will download. Ready to download right after purchase!

PESTLE Analysis Template

Uncover the external forces influencing Deloitte & Touche LLP. This PESTLE analysis breaks down political, economic, social, technological, legal, and environmental factors. Understand the risks and opportunities shaping their strategy. Download the full report for detailed insights. Enhance your own market strategy now!

Political factors

Geopolitical tensions, like the ongoing war in Ukraine and conflicts in the Middle East, significantly affect global markets and supply chains. These events introduce volatility and influence commodity prices, impacting business confidence. Deloitte's M&A Index for Q1 2025 highlights how these global dynamics shape market behavior. For example, the index may show a decrease in investment in certain regions due to political instability.

Government policies, like new tariffs or monetary shifts, heavily influence international trade and economic growth.

Changes impact borrowing costs, currency values, trade flows, and production costs.

For instance, in 2024, shifts in interest rates by the Federal Reserve affected borrowing across sectors.

Deloitte's reports analyze these shifts, providing insight into their business environment effects.

Their 2024 outlook highlighted the potential impact of evolving trade regulations on various industries.

Upcoming elections globally bring policy shifts, influencing inflation, borrowing costs, and trade. Political stability greatly impacts investor confidence and business activities. Deloitte's outlook underscores election-driven uncertainty. For example, in 2024, over 40 countries held elections, affecting global markets.

Trade Agreements and Disputes

Changes in trade agreements and disputes introduce uncertainty, disrupting international trade and supply chains. Businesses face complexities impacting market access and costs. Deloitte's reports cover new tariff policy impacts, potentially shocking international trade. For example, in 2024, global trade growth slowed to 0.8%, per WTO data, due to geopolitical tensions and trade barriers. These factors significantly influence business strategies and financial planning.

- Global trade growth slowed to 0.8% in 2024.

- Geopolitical tensions and trade barriers are key factors.

Government Spending and Fiscal Policy

Government spending and fiscal policy significantly influence economic conditions. Tax cuts or infrastructure investments can boost growth. These policies shape the business landscape. Deloitte's analysis highlights government spending's role in offsetting reduced business investment. In Australia, government spending rose, focusing on areas like infrastructure.

- Australian government's 2024-25 budget projects a deficit of $28.3 billion.

- Infrastructure investment in Australia is expected to reach $25.9 billion in 2024-25.

- Tax cuts are planned in various countries, potentially impacting business profitability.

Political factors such as geopolitical conflicts and governmental policies profoundly affect global markets and trade dynamics, creating uncertainty and volatility.

Government spending and trade regulations significantly shape economic conditions, with shifts in fiscal policy, such as infrastructure investments, directly influencing business profitability.

In 2024, global trade slowed, and elections worldwide further intensified market uncertainty, underscoring the need for businesses to closely monitor and adapt to evolving political landscapes.

| Aspect | Details | Data (2024) |

|---|---|---|

| Global Trade Growth | Slowdown in international trade. | 0.8% |

| Australian Budget Deficit | Projected deficit for 2024-25. | $28.3 billion |

| Infrastructure Investment (Australia) | Planned infrastructure spending. | $25.9 billion |

Economic factors

Inflation and interest rates are key economic drivers. High inflation, as seen in 2022, prompted central banks to raise rates. This impacts business costs and consumer spending. Deloitte's analysis in 2024/2025 will provide forecasts, with inflation expected to moderate.

Economic growth and recession risks significantly impact business. Deloitte's 2024 reports forecast GDP growth, with varying regional outlooks. For instance, the Eurozone's 2024 GDP growth is projected at around 0.8%. Slow growth can curb spending and increase business failures. Strong growth supports expansion and investment opportunities.

Consumer spending and confidence levels are crucial for gauging market demand. Reduced spending can hinder growth, while increased confidence can boost demand. Deloitte's analysis highlights that hesitant consumer spending is a key factor in the Eurozone's economic slowdown. In 2024, consumer spending growth in the Eurozone is projected to be around 0.8%. Consumer confidence in the Eurozone has been fluctuating, with a score of -15.7 in April 2024.

Investment Levels and M&A Activity

Investment levels and M&A activity are key indicators of economic health, mirroring business confidence and growth forecasts. Financing conditions significantly impact investment decisions and M&A trends. Deloitte's M&A Index offers valuable insights into transaction volumes and values, influenced by overall economic conditions. In 2024, global M&A activity saw fluctuations, with specific sectors experiencing notable shifts. For instance, technology and healthcare often lead in deal volumes.

- Deloitte's M&A Index tracks deal volumes and values.

- Financing conditions directly affect investment and M&A.

- Tech and healthcare are often M&A leaders.

- Economic conditions heavily influence M&A trends.

Labor Market Conditions

The labor market's condition significantly influences business operations and consumer behavior. High unemployment can diminish consumer spending, while a tight labor market may increase wage costs. Deloitte's reports often analyze these trends and their economic effects, providing valuable insights. Understanding these dynamics is crucial for strategic planning. For instance, in early 2024, the US unemployment rate hovered around 3.9%.

- Wage growth in 2024 remained a key focus.

- Labor shortages in specific sectors continue to be monitored.

- Consumer spending is tied to employment figures.

- Deloitte provides labor market analysis.

Economic factors shape business landscapes and investment decisions. Inflation and interest rates, influenced by central bank policies, affect business costs and consumer spending; for instance, the Federal Reserve held rates steady in May 2024. Growth forecasts and recession risks significantly influence expansion opportunities, with the Eurozone projecting 0.8% GDP growth in 2024. Consumer spending and confidence are key demand indicators.

| Economic Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| Inflation | Affects business costs | US inflation 3.3% (April 2024) |

| GDP Growth | Influences investment | Eurozone: 0.8% (2024 projection) |

| Consumer Confidence | Impacts market demand | Eurozone: -15.7 (April 2024) |

Sociological factors

Changes in population size, age distribution, and migration patterns significantly impact the labor pool and consumer demographics. These shifts directly affect demand for services and workforce planning. Deloitte's reports often include demographic pathways in their economic forecasts. For instance, the U.S. population is aging, with the 65+ age group growing. This influences healthcare and retirement services.

Consumer behavior shifts significantly, impacting market dynamics. Preference for sustainable products is growing; a 2024 study shows a 20% rise in eco-conscious purchases. Deloitte's surveys highlight these changes, particularly among Gen Z and Millennials. Media consumption habits are also evolving, influencing marketing strategies. Businesses must adapt to stay relevant.

Employee expectations are changing, with a focus on flexibility and mental health. Companies must adapt to attract and retain talent, especially considering the rise of Gen Z and Millennial workers. Deloitte's research highlights these shifts; for example, a 2024 Deloitte study found that 77% of employees prioritize work-life balance. This impacts productivity and workforce dynamics.

Social Inequality and Inclusion

Social inequality and the push for diversity, equity, and inclusion (DE&I) are vital for businesses. Companies must address these issues to foster inclusive workplaces and attract diverse customers. Deloitte emphasizes DE&I in its reports, recognizing its impact on business success. For example, in 2024, companies with strong DE&I policies saw a 15% increase in employee satisfaction.

- In 2024, 70% of consumers prefer to support businesses with strong DE&I initiatives.

- Businesses with diverse leadership teams show up to 25% higher profitability.

- Deloitte's 2024 reports highlight the importance of DE&I in attracting and retaining talent.

Public Perception and Trust

Public perception significantly influences business outcomes. Concerns about ethics, corporate responsibility, and data privacy shape brand reputation and customer loyalty, as highlighted in recent Deloitte reports. Trust is crucial for sustained success; for example, a 2024 study found that 75% of consumers prefer brands with strong ethical standards. Maintaining this trust is essential.

- 75% of consumers favor ethical brands (2024).

- Data privacy concerns are growing (Deloitte, 2024).

- Trust impacts tech adoption (Deloitte, 2024).

Sociological factors like demographics and consumer behavior significantly affect business. Shifts in age distribution and migration change the labor pool and demand. Consumer preferences for sustainable products and brand ethics also play key roles.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Demographics | Labor pool, consumer demand | Aging population, increasing healthcare needs. |

| Consumer Behavior | Market dynamics, marketing strategies | 20% rise in eco-conscious purchases. 75% favor ethical brands. |

| Employee Expectations | Attraction, retention of talent | 77% prioritize work-life balance. |

Technological factors

Rapid advancements in AI, particularly generative AI, are reshaping industries. This drives automation, boosting productivity, and creating new service offerings. However, it also stirs job displacement anxieties and the need for reskilling. Deloitte's TMT predictions and reports explore AI's impact, with the global AI market projected to reach $1.81 trillion by 2030, according to Statista.

Digital transformation and automation are reshaping business operations. This involves significant tech investments. Deloitte's reports highlight the growing need for tech solutions. Automation can boost efficiency. The global automation market is projected to reach $195 billion by 2025.

Cybersecurity threats are rising, creating major risks like data breaches and financial losses. Protecting data is crucial for businesses in the digital world. Deloitte's tech outlook names cybersecurity as a top priority. In 2024, global cybersecurity spending reached $200 billion. The average cost of a data breach is $4.45 million.

Cloud Computing Adoption

Cloud computing adoption is transforming how businesses manage data, providing scalability and flexibility. This shift, however, introduces data security and vendor dependency considerations. Deloitte's reports highlight this trend. Global spending on cloud services is projected to reach nearly $800 billion in 2024, a substantial increase from previous years.

- Cloud spending forecast: ~$800B in 2024.

- Focus areas: Data security and vendor dependency.

Evolution of Technology Infrastructure

Technological infrastructure is rapidly evolving, particularly with the rise of AI, which significantly increases energy consumption in data centers. This trend is reshaping the capabilities of tech-dependent services. Deloitte's TMT predictions highlight these energy consumption concerns. Mobile and computing device advancements also play a crucial role. These changes are key for technology planning.

- Data centers' energy use could reach 20% of global electricity by 2025.

- AI is projected to boost data center power demand.

- Mobile device innovation continues to drive service delivery.

AI and automation reshape industries, driving efficiency but also creating workforce shifts. The automation market is estimated to reach $195B by the end of 2025. Cybersecurity remains crucial, with spending reaching $200B in 2024 and the average breach costing millions.

| Technology Trend | Impact | Data/Statistics (2024/2025) |

|---|---|---|

| AI and Automation | Increased efficiency; Job displacement | Automation Market: ~$195B (by 2025) |

| Cybersecurity | Data breaches; Financial losses | Spending: ~$200B (2024), Breach cost: ~$4.45M |

| Cloud Computing | Data management and scalability | Cloud spending forecast: ~$800B (2024) |

Legal factors

Changes in tax regulations at national and international levels directly affect corporate tax liabilities and financial reporting. Staying compliant with evolving tax regimes is crucial, especially for multinational firms. Deloitte's tax@hand offers updates on tax treaty developments and new tax laws. In 2024, global tax reforms, including the OECD's Pillar Two, significantly altered tax planning. For example, the U.S. corporate tax rate is currently at 21%.

Data protection laws like GDPR are becoming stricter, dictating how businesses handle personal data. Non-compliance can lead to hefty fines and damage customer relationships. Deloitte offers legal services to help businesses navigate data protection regulations.

Industry-specific regulations significantly influence businesses. Sectors face rules impacting product standards and operations, demanding constant compliance. Deloitte Legal aids in navigating these regulations, offering specialized knowledge. For instance, the healthcare sector saw a 10% increase in regulatory scrutiny in 2024. Compliance costs rose by an average of 15% across regulated industries.

Labor and Employment Laws

Changes in labor and employment laws, covering working hours and employee benefits, directly affect workforce management and operational expenses. Businesses must comply with current legal requirements to avoid penalties. Deloitte Legal offers support for labor law matters, ensuring compliance. The U.S. Department of Labor reported over 80,000 workplace violations in 2024.

- Compliance with employment laws is crucial.

- Deloitte Legal assists with labor law matters.

- Workplace violations can lead to penalties.

- Staying updated is key.

Legal and Regulatory Compliance

Legal and regulatory compliance is crucial for Deloitte & Touche LLP. They must adhere to corporate governance and competition laws. Deloitte Legal offers comprehensive compliance services. The global legal services market was valued at $850 billion in 2023, expected to reach $1 trillion by 2025.

- Compliance with GDPR and other data privacy regulations is critical.

- Adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

- Maintaining ethical standards and avoiding legal disputes.

- Staying updated with evolving international legal frameworks.

Legal factors shape Deloitte's operations. Compliance with tax, data protection, and industry-specific regulations is vital. Labor and employment laws also impact workforce and operational costs.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Data Privacy | GDPR/Compliance | Fines: Up to 4% annual global turnover |

| Tax Regulations | Global tax planning | OECD Pillar Two: Influenced corporate tax liabilities |

| Labor Laws | Workforce management | U.S. Department of Labor: >80K violations in 2024 |

Environmental factors

The rise of extreme weather, intensified by climate change, threatens supply chains and infrastructure. This leads to both physical and financial risks for businesses. A Deloitte report notes climate risks; and younger generations are highly concerned. For example, in 2024, the World Economic Forum identified climate action failure as the top global risk.

Evolving environmental regulations and policies drive businesses to adapt. Emissions, waste, and resource usage are key areas. Sustainability and biodiversity initiatives are also relevant. Deloitte's governance is influenced by these policies. In 2024, global spending on environmental protection reached $800 billion.

Consumers, investors, and regulators are increasingly demanding sustainable business practices. This drives strategic shifts and supply chain changes. Companies set science-based targets and invest in clean energy. Deloitte emphasizes sustainability's role in business transformations. In 2024, sustainable investing hit $19 trillion.

Resource Scarcity and Management

Resource scarcity presents a growing challenge for businesses, particularly in sectors reliant on raw materials. Concerns about water scarcity and the availability of critical minerals like lithium and cobalt are increasing. Companies must enhance resource efficiency to mitigate risks and maintain operational stability. Deloitte's research highlights potential shortages of rare earth elements, essential for tech manufacturing.

- Water stress affects over 2.3 billion people globally (UN, 2024).

- Lithium prices increased by over 400% between 2021 and 2023 (S&P Global).

- The global market for rare earth elements is projected to reach $21.4 billion by 2025 (Grand View Research).

Stakeholder Expectations on Environmental Performance

Stakeholder expectations on environmental performance are rising, impacting corporate behavior. This includes employees and customers demanding environmental action and transparency. A 2024 study by Deloitte showed 70% of consumers prefer eco-friendly brands. Younger generations, like Gen Z and Millennials, prioritize environmental impact in career and consumer choices. These groups also influence investment decisions, with ESG funds attracting significant capital.

Environmental factors pose significant risks through climate change and resource scarcity. Companies must adapt to regulations and changing stakeholder demands for sustainability. Key challenges include water stress affecting billions and fluctuations in critical mineral prices.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Climate Change | Supply chain disruption & increased costs | Global climate-related disasters caused $290B in damages in 2024. |

| Environmental Regulations | Need to adapt to new standards | Global spending on environmental protection reached $800B in 2024. |

| Resource Scarcity | Operational and strategic risks | Water stress affected over 2.3B people. Lithium price fluctuations are expected. |

PESTLE Analysis Data Sources

The PESTLE analysis relies on reputable data from economic institutions, government reports, and industry publications, ensuring data integrity.