Delta Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Electronics Bundle

What is included in the product

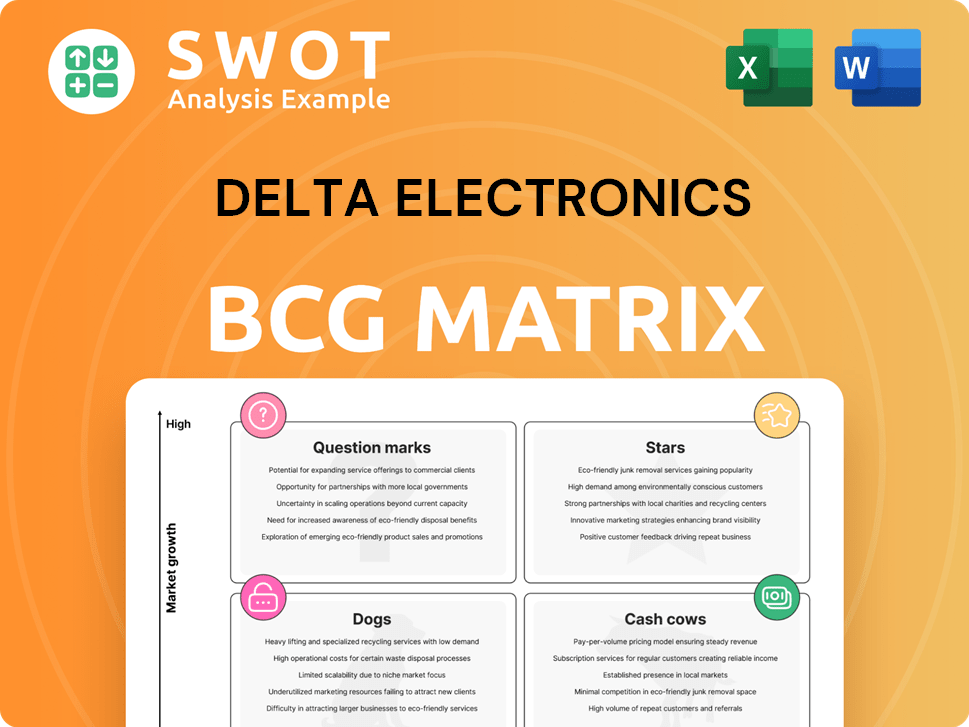

Delta Electronics' BCG Matrix analysis reveals investment opportunities, holding strategies, and divestment needs across its product portfolio.

Export-ready design for quick drag-and-drop into PowerPoint, saving time and effort for impactful presentations.

Delivered as Shown

Delta Electronics BCG Matrix

The BCG Matrix preview displays the full, final report you receive after purchase. This complete analysis, meticulously formatted, is ready for immediate strategic application across Delta Electronics' business units.

BCG Matrix Template

Delta Electronics thrives in diverse sectors, from power supplies to automation. Their BCG Matrix reveals the performance of key product lines. Identify high-growth Stars and stable Cash Cows that fuel innovation. Understand the risks of Question Marks and the challenges of Dogs. Discover how to allocate resources for maximum impact.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Delta Electronics' AI-driven power solutions are a star in its BCG matrix, fueled by the surge in AI-driven applications. These power management solutions for data centers and DC power systems are seeing strong growth. In 2024, Delta's revenue is projected to increase, supported by these innovative solutions. This strategic focus allows Delta to capitalize on current trends and maintain a strong position in the power electronics market.

Delta's high-voltage EV power supplies are stars, fueled by EV demand. They support up to 800 volts, using silicon carbide. This tech boosts efficiency and thermal management. The EV market is expected to see a 30% YoY growth, particularly in India.

Delta's industrial automation solutions, including the D-Bot series Cobots, are positioned as stars. These solutions boost manufacturing efficiency, tackle labor issues, and promote sustainability. The Indian market launch at ELECRAMA 2025 underscores their growth prospects. In 2024, the industrial automation market grew, with collaborative robots showing strong adoption.

Data Center Cooling Systems

Delta Electronics' data center cooling systems, launched in 2024, are a rising star. They're vital for managing heat in high-performance computing. US tariffs pose challenges for these China-made products. Delta must also tackle thermal issues in high-power charging solutions.

- Data center cooling market projected to reach $30 billion by 2028.

- Delta's 2024 revenue from data center solutions is expected to grow by 25%.

- US tariffs on Chinese goods could increase costs by 10-25%.

- High-power charging solutions market expected to grow by 30% annually.

Smart Green Solutions

Delta Electronics' Smart Green Solutions, a star in its BCG Matrix, encompass IoT-based building automation and energy storage. These solutions capitalize on global sustainability trends, addressing the need for eco-friendly tech. The company's commitment is highlighted by double 'A' scores from CDP. In 2024, Delta's green revenue grew by 20%.

- Delta's Smart Green Solutions focus on sustainability.

- They include building automation and energy storage.

- Delta scored double 'A' in CDP's reports.

- Green revenue grew 20% in 2024.

Delta's Stars include AI-driven power solutions, experiencing robust growth. They feature high-voltage EV power supplies, boosted by EV demand and efficient tech. Industrial automation, including D-Bot Cobots, also shines, particularly in the Indian market.

| Category | Star Products | 2024 Performance |

|---|---|---|

| Power Solutions | AI-driven power | Revenue growth: +25% |

| EV Solutions | High-voltage EV supplies | Market growth: +30% YoY |

| Industrial Automation | D-Bot Cobots | Market adoption: Strong |

Cash Cows

Delta Electronics' power electronics, a key revenue driver, is a cash cow due to its expertise and market dominance. This segment is well-established, offering consistent returns. The power supply market is forecast to expand significantly, with a value of USD 39.18 billion in 2024. By 2035, it's projected to reach USD 90.52 billion.

Delta Electronics' switching power supplies, especially for data centers, are cash cows due to their strong market position and the rising need for dependable power solutions. This segment benefits from the growth in data center infrastructure. Forecasts project the switching power supply market to grow at a CAGR of 3.6%.

Delta Electronics' telecom power solutions likely function as a cash cow, fueled by the continuous 5G network expansion and demand for dependable power infrastructure. Delta's strong brand and skills in this sector ensures stable income. The strict needs of telecom, server, and data center applications highlight Delta's competitive advantage. In 2024, the global telecom power systems market was valued at $11.2 billion.

Components

Delta Electronics' components business is a cash cow. It consistently meets demand across diverse industries, with established manufacturing capabilities. Key power management products include switching power supplies, EV chargers, DC-DC converters, and solar inverters. This segment's stability generates reliable cash flow. In 2024, Delta's power and energy business revenue grew, demonstrating its continued strength.

- Components provide essential parts for various products.

- Power management products are a significant revenue source.

- Delta's manufacturing expertise supports this segment.

- The cash cow status indicates strong, consistent financial returns.

Industrial Power Supplies

Delta Electronics' industrial power supplies are a cash cow, capitalizing on industrial electrification and the need for reliable power. The industrial power supply market has been expanding; projections indicate continued growth. The industrial sector is set to claim roughly 29.48% of the market share, fueling further expansion. This segment provides steady revenue and strong cash flow for Delta.

- Market size in 2024: $10.5 billion.

- Expected growth rate: 6.8% annually.

- Delta's market share: approximately 20%.

- Key applications: manufacturing, automation, and energy.

Delta Electronics' cash cows, including power electronics and industrial supplies, generate stable revenue. These segments, such as components and telecom power solutions, benefit from established market positions. The company's strong manufacturing capabilities and market dominance ensure consistent financial returns.

| Cash Cow Segment | Market Size (2024) | Growth Rate |

|---|---|---|

| Power Electronics | $39.18 billion | Expanding significantly to $90.52B by 2035 |

| Switching Power Supplies | N/A | CAGR of 3.6% |

| Telecom Power Systems | $11.2 billion | N/A |

| Industrial Power Supplies | $10.5 billion | 6.8% annually |

Dogs

Delta's traditional display solutions, like older flat-panel displays, could be "dogs" in its BCG matrix due to tough competition and evolving tech. The flat panel display market is projected to reach USD 320.69 billion by 2034. However, Delta's market share in this area might be limited, indicating low growth and market share.

Some of Delta Electronics' networking products, facing tough competition, could be classified as dogs. These products might need costly recovery efforts that may not succeed. In 2024, Delta saw approximately $1.3 billion in networking revenue. The 2025 infrastructure revenue is projected at 16%, but networking sales are expected to be weaker.

Legacy automation systems at Delta Electronics could be "dogs" in its BCG Matrix. These older systems might be less innovative and face phase-out due to newer tech. Turnaround plans may offer limited returns. Delta's focus is "Industrial + Commercial," including EV powertrain products and chargers. In 2024, Delta's revenue grew, showing a shift towards these areas.

Low-Efficiency Power Supplies

Delta's low-efficiency power supplies, considered "dogs" in its BCG Matrix, face challenges as the market shifts towards energy efficiency. These older products may struggle against newer, more efficient models. The demand for eco-friendly solutions is rising, impacting the competitiveness of these supplies. Delta's focus on sustainability, evidenced by its "Water Security" A List inclusion for five years and leadership-level "Climate Change" recognition nine times, contrasts with these less efficient products.

- Market trends favor high-efficiency power supplies.

- Older models face competition from eco-friendly alternatives.

- Delta's sustainability efforts highlight the inefficiency of older products.

- Energy efficiency is a key factor in today's market.

Products facing strong competition from China

In China, Delta Electronics might face challenges with some products, potentially landing them in the "Dogs" quadrant of the BCG matrix. This is primarily due to intense competition from local Chinese firms. Delta's power supply business, a key revenue driver at over 30% of sales, could be affected. Mainframe computer and server products have high switching costs.

- Competition from Chinese companies puts pressure on Delta's product margins.

- Power supplies contribute significantly to Delta's overall revenue.

- Switching costs are high for mainframe and server products.

- Delta's ability to innovate is vital for staying competitive.

Some of Delta's offerings may be "dogs" due to high competition. This includes certain networking and automation systems. They may require costly efforts with limited returns.

| Product Category | Status | Reason |

|---|---|---|

| Networking Products | Dog | Intense Competition |

| Legacy Automation | Dog | Outdated Tech |

| Low-Efficiency Power | Dog | Eco-Friendly Shift |

Question Marks

Delta's EV components business is a question mark in its BCG matrix. The EV market's rapid growth presents both opportunity and intense competition. Delta aims for earnings growth in 2025, spurred by EV power order increases. In 2024, EV sales rose, but market share battles remain.

Delta's ESS are question marks; the market is growing, but adoption needs investment. ESS could become stars if Delta gains market share. At ITAP 2024, ESS showcased energy efficiency. The global ESS market was valued at $18.4 billion in 2023, expected to reach $38.5 billion by 2028.

Delta's building automation is a question mark in its BCG matrix, indicating high growth potential but low market share. In 2024, the global building automation market was valued at approximately $70 billion, with an expected annual growth rate of 8-10%. Delta's position requires strategic investment to capture market share and compete effectively. High switching costs, due to integrated systems, create a barrier to entry for competitors.

New Collaborative Robots (Cobots)

The D-Bot series of Collaborative Robots (Cobots) from Delta Electronics are currently classified as question marks within the BCG matrix. These cobots are in a high-growth market, driven by increasing demand for automation across various industries. Despite the market's expansion, Delta's cobots have yet to secure a significant market share. To advance, they need substantial investment to increase their market presence and prove their ROI before they risk becoming dogs.

- The global cobot market was valued at $1.3 billion in 2023 and is projected to reach $12.3 billion by 2030.

- Delta Electronics reported a 12% increase in revenue in 2024 from its automation business segment.

- Cobots are increasingly used in electronics, automotive, and logistics.

Hydrogen Fuel Cell Solutions

Delta Electronics views its hydrogen fuel cell solutions as a question mark within its BCG matrix. This classification reflects the technology's potential, juxtaposed with the current market uncertainties. Delta's investment in hydrogen fuel cell development, including a GBP43 million deal with Ceres Power, indicates a strategic bet on future growth. However, the nascent state of the hydrogen market presents a challenge.

- Delta invested GBP43 million in hydrogen fuel cell technology.

- The hydrogen market is currently in its early stages of development.

- This area is considered a question mark due to market uncertainty.

- Delta is positioning itself for potential future growth in hydrogen solutions.

Delta's question mark status for hydrogen fuel cells highlights market uncertainties. Strategic investments, like the GBP43 million deal, show a commitment to future growth. The nascent hydrogen market presents challenges, but also opportunities for Delta.

| Area | Details | Data |

|---|---|---|

| Investment | Delta's Commitment | GBP43 million |

| Market Stage | Hydrogen Market | Early Development |

| Strategic Goal | Positioning | Future Growth |

BCG Matrix Data Sources

Our Delta Electronics BCG Matrix uses financial statements, market research, and industry publications to create a robust analysis.