Dentsply Sirona Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsply Sirona Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean and optimized layout for sharing or printing, enabling quick analysis and communication of market positions.

Delivered as Shown

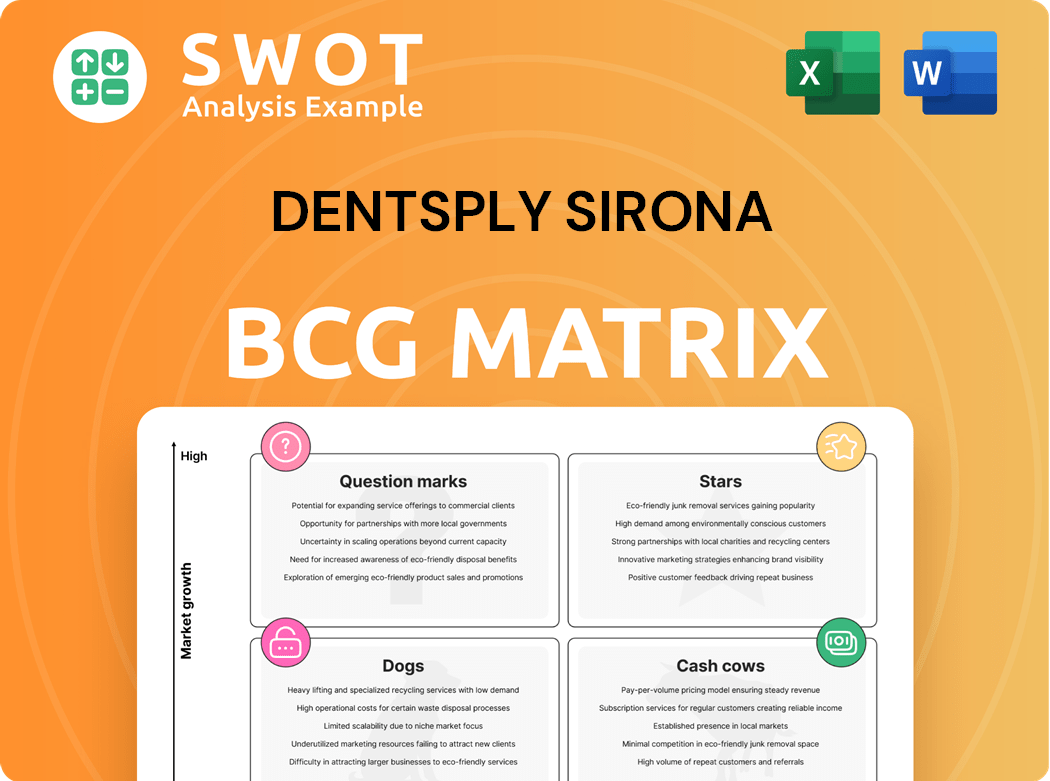

Dentsply Sirona BCG Matrix

The Dentsply Sirona BCG Matrix preview shows the complete document you’ll receive. This is the final, ready-to-use report—no hidden sections or revisions required post-purchase.

BCG Matrix Template

Uncover Dentsply Sirona's strategic product landscape through the BCG Matrix. See how each product line—from Stars to Dogs—contributes to their portfolio. Understand market share vs. growth rate dynamics for informed decisions. Explore the opportunities and challenges presented by each quadrant. This snapshot is just a taste of the complete picture. Get the full BCG Matrix and discover a clear strategic tool.

Stars

Dentsply Sirona's Primescan 2 is a Star, as the first cloud-native intraoral scanner. It offers direct-to-cloud scanning, boosting efficiency and patient care. This tech is a leader in modern dental practices, enhancing digital workflows. Primescan family generated $110.2 million in revenue in Q3 2023, up 2.5% organically.

The CEREC system continues to be a key offering, especially as digital dentistry expands. Its user-friendliness and efficiency, including dual spindle tech, enable same-day restorations. In 2024, Dentsply Sirona's CAD/CAM sales grew, showing CEREC's sustained importance. Same-day crowns remain a significant advantage for dental practices.

Celebrating 40 years, Astra Tech Implant System remains a top implant product. It's a key part of Dentsply Sirona's high-growth solutions. Its reliability and success drive significant market share. In 2024, Dentsply Sirona's implants and other products generated about $800 million in revenue.

DS Core Platform

The DS Core platform, a key component of Dentsply Sirona's portfolio, facilitates seamless connectivity within the dental ecosystem. It integrates various aspects of dental practice, from imaging to treatment planning, on a cloud-based system, streamlining workflows. This platform is designed to enhance operational efficiency and improve patient care by centralizing data and facilitating collaboration. In 2024, Dentsply Sirona's focus on digital solutions like DS Core is part of its strategic shift toward a more connected dental experience.

- Centralized Data: DS Core centralizes patient data, enhancing accessibility and management within a dental practice.

- Workflow Integration: Integrates imaging, diagnostics, and treatment planning for smoother operations.

- Cloud-Based: Operates on a cloud platform, promoting accessibility and collaboration among dental professionals.

- Efficiency Focus: Aims to increase productivity and patient communication in dental practices.

MAGNETOM Free.Max Dental Edition

The MAGNETOM Free.Max Dental Edition, a ddMRI device from Dentsply Sirona, is a Star in the BCG matrix, indicating high market growth and share. This innovative device, developed with Siemens Healthineers, improves dentomaxillofacial diagnostics by offering enhanced soft-tissue contrast. Early studies highlight its potential in radiation-free imaging for various dental conditions. This positions Dentsply Sirona to capture a significant share of the growing dental imaging market, with a projected global market size of $5.2 billion in 2024.

- ddMRI technology enhances diagnostic capabilities, attracting both dental practices and patients.

- Early research supports its effectiveness in diverse dental applications, like third molars and orthodontics.

- Dentsply Sirona's collaboration with Siemens Healthineers boosts credibility and market reach.

- The dental imaging market is growing, creating significant revenue opportunities.

Dentsply Sirona's Stars, like Primescan 2 and MAGNETOM Free.Max, show high growth potential. These innovations lead in digital dentistry, enhancing efficiency. Supported by cloud tech and ddMRI, they boost market share.

| Product | Description | Revenue Driver (2024) |

|---|---|---|

| Primescan Family | Cloud-native intraoral scanner | $110.2M (Q3 2023) |

| CEREC | CAD/CAM system | Sustained Growth in 2024 |

| Astra Tech Implant System | Implant product | $800M (implants, 2024 est.) |

Cash Cows

The Essential Dental Solutions segment is a Cash Cow for Dentsply Sirona. Despite a slight sales dip in Q4 2024, it remains a revenue cornerstone. These supplies are vital for dental practices, ensuring consistent income. For example, in Q3 2024, the segment generated around $350 million in sales. Focusing on operational efficiency boosts cash flow.

SDR flow+ Bulk Fill Flowable, a restorative material from Dentsply Sirona, is a Cash Cow in their BCG Matrix. It has seen over 135 million applications globally. In 2024, Dentsply Sirona marked 15 years of this resin technology's impact.

Dentsply Sirona's prosthetic solutions, such as dentures and bridges, are a solid revenue source due to the aging global population. These products benefit from consistent demand and have a stable market. In 2024, the dental prosthetics market was valued at approximately $22 billion, with steady growth. This segment provides reliable income, fitting the "Cash Cows" profile.

Endodontic Solutions

Endodontic Solutions, including products like X-Smart Pro+ and WaveOne Gold, are cash cows for Dentsply Sirona, generating consistent revenue from root canal procedures. These established solutions benefit from the ongoing demand for endodontic treatments. Their ease of use and efficiency are key to their sustained market position. In 2024, the global endodontics market is valued at approximately $2.5 billion, with steady growth expected.

- Steady revenue from root canal treatments.

- Well-established market presence.

- Focus on user-friendliness and efficiency.

- Benefiting from continuous need for endodontic procedures.

Basic Implant Systems

Basic implant systems remain a dependable revenue source for Dentsply Sirona, even with challenges in premium implants. These systems target a wider market, particularly in emerging markets where affordability is crucial. This focus ensures a steady cash flow for the company. In 2024, the dental implant market is projected to reach $4.8 billion.

- Market Size: The global dental implants market was valued at USD 4.8 billion in 2024.

- Emerging Markets: Demand is high in emerging economies due to affordability.

- Revenue Stability: Basic systems provide a consistent income stream.

- Cost-Effectiveness: Key factor for market penetration.

Dentsply Sirona's "Cash Cows" are stable revenue generators. These include Essential Dental Solutions, like supplies vital for dental practices. Prosthetic solutions also contribute, benefiting from an aging population. The focus is on steady demand and consistent income.

| Product Segment | Market Size (2024 est.) | Revenue Source |

|---|---|---|

| Essential Dental Solutions | $350M (Q3 2024 sales) | Supplies for dental practices |

| Dental Prosthetics | $22B | Dentures, bridges |

| Endodontic Solutions | $2.5B | X-Smart Pro+, WaveOne Gold |

Dogs

Byte Aligner Systems, a former direct-to-consumer dental aligner under Dentsply Sirona, targeted low-income individuals. The company decided to discontinue the at-home aligner systems due to regulatory hurdles and patient safety concerns. Dentsply Sirona will not reinstate Byte but will continue to support existing patients. In 2023, Dentsply Sirona's revenue was approximately $4 billion.

The U.S. equipment and instruments market, a "Dog" in Dentsply Sirona's portfolio, faced headwinds. Sales declined due to factors like high interest rates and lower patient volume for costly procedures. For instance, in 2024, the company reported a decrease in equipment sales. Innovation and adaptation are key to addressing these challenges.

In Dentsply Sirona's BCG Matrix, CAD/CAM equipment represents a "Dog" due to declining sales. High interest rates impacted sales of larger capital equipment, including CAD/CAM systems. Dentsply Sirona's 2024 performance, according to Moody's, was below expectations, with weak sales in this area. Specifically, the company's revenue declined by 4.8% in Q3 2023, with CAD/CAM being a key factor.

Implants (U.S. Market)

In the U.S. market for dental implants, Dentsply Sirona faces challenges. The demand for premium implants has been affected by a drop in full-arch prosthesis procedures. Globally, premium and value implants saw similar growth rates. The US implants business experienced a slight decline, but showed improvement compared to previous quarters. The company anticipates growth in 2024.

- Patient demand for full-arch prostheses decreased.

- Premium and value implants showed similar growth globally.

- U.S. implants business saw a slight decline.

- Dentsply Sirona expects growth in 2024.

Orthodontic and Implant Solutions Segment

The Orthodontic and Implant Solutions segment within Dentsply Sirona's BCG matrix saw a substantial downturn in 2024. Net sales plummeted, with a 28.6% decrease in Q4 and a 6.5% fall for the entire year. This segment also contributed to non-cash charges, including a $370 million impairment of goodwill in Q4 2024. These challenges reflect broader market pressures and strategic adjustments.

- Q4 2024 net sales decrease: 28.6%

- Full year 2024 net sales decrease: 6.5%

- Non-cash charges in Q4 2024: $370 million

Dentsply Sirona's "Dogs" include CAD/CAM equipment and U.S. equipment & instruments. These segments face declining sales due to high interest rates and lower patient volume. The Orthodontic and Implant Solutions segment also saw significant downturns, with a 28.6% drop in Q4 2024 net sales.

| Segment | Q4 2024 Net Sales Change | Key Challenges |

|---|---|---|

| CAD/CAM | Decline | High interest rates, lower patient volume |

| Equipment & Instruments (US) | Decline | High interest rates, lower patient volume |

| Orthodontic & Implant Solutions | -28.6% | Market pressures, strategic adjustments |

Question Marks

Dentsply Sirona is highlighting the MIS LYNX implant, a premium all-in-one solution. This implant system is designed for versatility and reliability. Visit booth #401 to see the MIS LYNX. Dentsply Sirona's revenue in 2023 was approximately $4 billion.

Dentsply Sirona's cloud solutions, such as DS Core, are positioned as question marks. Their success hinges on adoption within dental practices. The market share and growth remain uncertain, despite the potential. Investing in user-friendly features and integration is crucial for adoption; in 2024 the cloud based solutions market was valued at $6.89 billion.

Dentsply Sirona invests in AI diagnostics for better treatment. Uncertainty surrounds market adoption and approvals. Proving clinical benefits and reliability is key to success. In 2024, the dental imaging market was valued at $3.5 billion. These tools could significantly impact this sector.

Dental-Dedicated MRI (ddMRI)

Dental-dedicated MRI (ddMRI) is a question mark for Dentsply Sirona. Its high cost and limited availability currently restrict market penetration. While offering radiation-free imaging, its low market share reflects adoption challenges. Further development and cost reduction are crucial for ddMRI's success.

- Current ddMRI market share is less than 1% of the dental imaging market.

- Initial investment for a ddMRI system can exceed $500,000.

- Operating costs, including maintenance, are about $50,000 annually.

- The global dental imaging market was valued at $3.8 billion in 2024.

New Endodontic Solutions

Dentsply Sirona's new endodontic solutions, like Reciproc Blue, aim to simplify root canal procedures. These innovations, often paired with tools like X-Smart Pro+, are designed for efficiency. The Reciproc Blue uses a single file for root canal preparation. This positions it as a "Question Mark" in the BCG matrix.

- Reciproc Blue simplifies root canal procedures.

- X-Smart Pro+ pairs well with these solutions.

- The new solutions aim for greater flexibility.

- The "Question Mark" status reflects the potential for growth.

Dentsply Sirona's cloud solutions are classified as question marks in their BCG Matrix due to uncertain market adoption. This classification is also attributed to their AI diagnostics that are in the development stages. The dental-dedicated MRI (ddMRI) and new endodontic solutions also are considered question marks, influenced by factors like high costs and evolving market acceptance.

| Product Category | BCG Status | Key Challenge |

|---|---|---|

| Cloud Solutions (DS Core) | Question Mark | Market Adoption |

| AI Diagnostics | Question Mark | Regulatory Approvals |

| ddMRI | Question Mark | Low Market Share |

| New Endodontic Solutions | Question Mark | Market Growth |

BCG Matrix Data Sources

This BCG Matrix uses financial statements, market reports, and industry analyses to determine product positioning.