DexCom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DexCom Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean and optimized layout for sharing or printing of the DexCom BCG matrix to easily present data.

Delivered as Shown

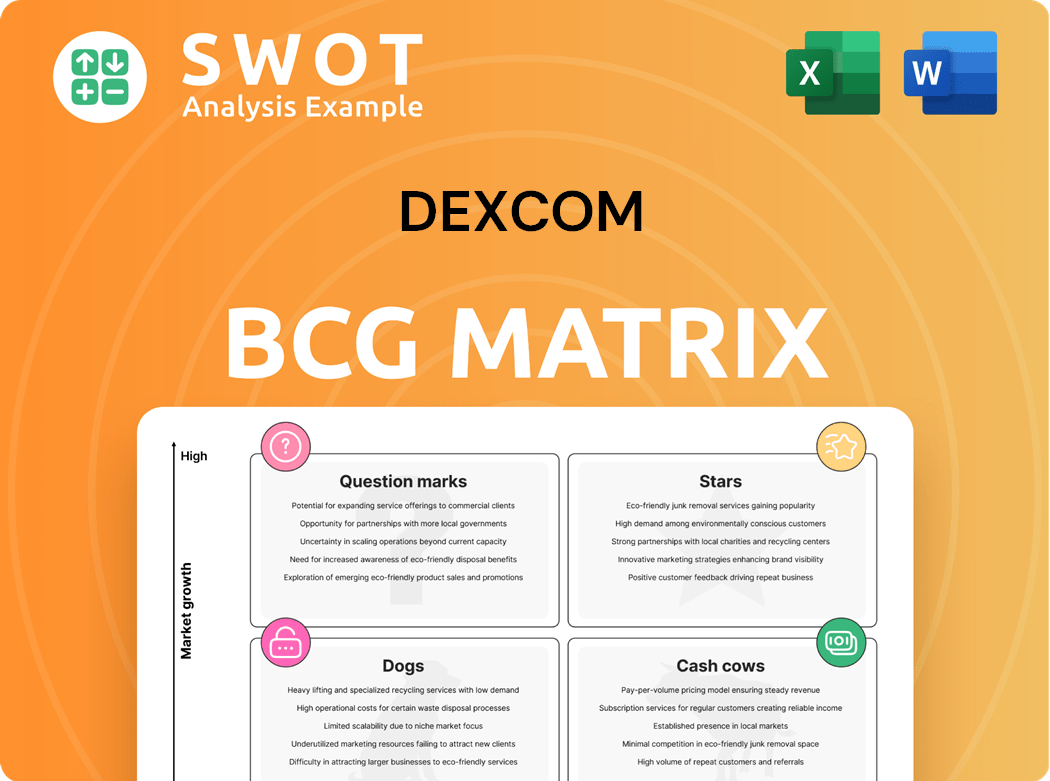

DexCom BCG Matrix

The BCG Matrix you see is the identical file you'll receive. This comprehensive report offers a clear strategic overview, complete after your purchase.

BCG Matrix Template

Explore DexCom's product portfolio with a quick peek at its BCG Matrix! We see promising Stars like continuous glucose monitors. The Cash Cows provide steady revenue streams. Question Marks show potential for growth. Dogs could be underperforming assets. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Dexcom G7 CGM system is a star within Dexcom's portfolio, excelling in a booming market. It holds a significant market share, reflecting strong demand. Continued investment is vital for growth. In Q1 2024, Dexcom's revenue grew to $921 million, a 24% increase year-over-year, highlighting its star status.

Dexcom's international expansion, especially in Europe and Asia, marks it as a star. These areas show strong growth potential for diabetes solutions. This move demands considerable investment in marketing and distribution. In 2024, international sales made up a significant portion of Dexcom's revenue, with growth rates outpacing domestic figures. Success here boosts Dexcom's global lead and drives revenue.

DexCom's partnerships with insulin delivery system manufacturers are crucial. Collaborations with companies such as Tandem Diabetes Care and Insulet allow for direct CGM data integration. These partnerships enhance user experience and improve glycemic control. In 2024, the AID market is experiencing rapid growth. Integrated systems are becoming the standard, driving adoption and market share.

Digital Health Ecosystem

Dexcom's digital health ecosystem, featuring apps and data analytics, fuels growth. These tools boost patient engagement and offer insights to healthcare providers. Investment in data security and user experience is crucial. Expanding beyond hardware strengthens its value proposition and fosters loyalty. In 2024, Dexcom's revenue grew to $3.6 billion, a 24% increase, driven by its ecosystem.

- 2024 revenue reached $3.6 billion.

- Revenue increased by 24%.

- Focus on data security is a priority.

- Enhances customer loyalty.

Next-Generation CGM Technology

Ongoing research and development are vital for DexCom's next-generation CGM technologies. These advancements, like non-invasive glucose monitoring, could transform diabetes care. The company's R&D spending reached $741 million in 2023, reflecting its commitment. Successful innovation fuels growth and market dominance.

- R&D investment is key to staying competitive.

- Non-invasive tech could be a game-changer.

- Successful launches drive market leadership.

- DexCom spent $741M on R&D in 2023.

Dexcom's CGM systems are stars, showing strong market demand and significant growth. International expansion boosts its global lead, driving revenue. Partnerships with insulin delivery system makers are crucial for market share.

| Key Metric | Data | Year |

|---|---|---|

| 2024 Revenue | $3.6B | 2024 |

| YOY Revenue Growth | 24% | 2024 |

| R&D Spending | $741M | 2023 |

Cash Cows

The Dexcom G6 CGM System is a prime example of a cash cow. Despite the G7's emergence, G6 still generates substantial revenue. It holds a solid market share, with established users and insurance coverage. In 2024, Dexcom's revenue reached $3.6 billion. Investment should focus on efficiency.

Dexcom's recurring revenue from sensor subscriptions forms a solid cash cow, ensuring predictable cash flow. This model, driven by the continuous need for sensor replacements, boosts customer loyalty. In 2024, recurring revenue accounted for a significant portion of Dexcom's total revenue. Optimizing the subscription service and customer retention is crucial for maintaining this status.

DexCom's strong brand reputation is a key asset in the CGM market. This reputation, built on accuracy and reliability, fosters customer loyalty. In 2024, Dexcom's revenue reached $3.6 billion, reflecting its market position. Consistent quality and service are crucial to maintaining this brand value. This supports a steady cash flow.

Established Distribution Network

Dexcom's strong distribution network is a cornerstone of its success. The company utilizes pharmacies, medical equipment suppliers, and direct-to-consumer channels to reach customers. Efficiently managing and expanding this network is crucial for boosting cash flow. In 2024, Dexcom's revenue increased, showing the effectiveness of its distribution strategies.

- Expanded network: partnerships with pharmacies and suppliers.

- Optimized logistics to reduce costs.

- Direct-to-consumer sales: revenue growth in 2024.

- Increased market penetration.

Favorable Reimbursement Landscape

Dexcom thrives due to favorable reimbursement policies for its continuous glucose monitoring (CGM) systems, a key aspect of its 'Cash Cow' status. These policies from public and private payers significantly boost access and demand for Dexcom's products. Securing and expanding coverage is crucial, necessitating ongoing advocacy and demonstrating CGM's clinical and economic advantages. This approach ensures sustained access and profitability for Dexcom.

- In 2024, Dexcom's revenue grew, partly due to expanded insurance coverage.

- Medicare and Medicaid coverage significantly impacts CGM adoption rates.

- Dexcom actively engages in lobbying efforts to maintain favorable reimbursement.

- The company's market share is directly linked to reimbursement success.

DexCom's cash cow status stems from its established products like the G6, generating $3.6B in revenue in 2024. Recurring revenue from subscriptions boosts customer loyalty and ensures a predictable cash flow. The company's brand reputation and strong distribution network further support this. Reimbursement policies boost access and demand.

| Aspect | Details |

|---|---|

| Revenue (2024) | $3.6 Billion |

| Customer Loyalty | High due to recurring revenue |

| Distribution | Pharmacies, direct-to-consumer |

Dogs

If Dexcom still offers legacy blood glucose meters, they're likely "dogs" in their BCG matrix. These meters face tough competition and slow growth. Phasing them out would free up capital. The focus should shift to continuous glucose monitoring (CGM) tech.

Outdated data systems at Dexcom, if any, fit the "Dogs" quadrant. These legacy systems, with low usage and high maintenance, hinder efficiency. Replacing them with cloud-based solutions is crucial. In 2024, this could affect data analysis speed, potentially impacting market responsiveness.

Certain niche markets, showing low CGM adoption despite marketing, could be "dogs". These segments might have unique needs or adoption barriers. Re-evaluating investments in these areas is smart. For instance, adoption rates in specific pediatric or geriatric sub-segments might lag. In 2024, DexCom's revenue was $3.6 billion, so resource reallocation is key.

Unsuccessful Pilot Programs

Unsuccessful pilot programs at DexCom, akin to "Dogs" in the BCG Matrix, show poor market traction. These initiatives have inherent flaws or face challenges. Terminating or repurposing them prevents further resource drain. Focus on learning from these experiences for future initiatives. In 2024, DexCom's R&D spending was $750 million; re-evaluating underperforming programs is crucial.

- Identified programs with low ROI.

- Programs are facing market challenges.

- Redirect resources to more promising areas.

- Utilize data from failures.

Regions with Limited Market Access

Certain areas where Dexcom struggles to enter, perhaps due to strict rules or limited payment options, fit the "dogs" category. These regions might soak up resources without offering much in return. It's wise to rethink our strategy there and focus on friendlier markets. Consider reallocating funds to places with a higher chance of thriving.

- Regulatory hurdles in countries like China and India have slowed market entry.

- Limited reimbursement in some European countries impacts sales volume.

- Dexcom's international revenue growth was 25% in 2024, slower than in the U.S.

- Prioritizing markets with faster growth and easier access is key.

Dexcom's BCG Matrix identifies "dogs" needing careful management. These are programs with low growth and market challenges. The goal is to redirect resources to higher-potential areas. In 2024, this involved reallocating R&D spending of $750 million.

| Category | Details | Action |

|---|---|---|

| Legacy Products | Outdated blood glucose meters | Phase out |

| Inefficient systems | Data systems | Replace |

| Underperforming segments | Niche markets | Re-evaluate |

Question Marks

Aggressive direct-to-consumer advertising for DexCom's new CGM features is a question mark. These campaigns aim to boost awareness and encourage adoption. Success hinges on how effectively they reach and convert the target audience. In 2024, DexCom's marketing spend was about $800 million. Monitoring and analysis are key to scaling or adjusting these campaigns.

Entering emerging markets with little CGM infrastructure is a question mark. These markets, like parts of Southeast Asia, offer big growth potential but need upfront investment. DexCom's 2024 revenue was $3.6 billion, showing potential for expansion. Successful ventures depend on research, partnerships, and local adaptation, turning them into stars or dogs.

Exploring Dexcom CGM data integration with wearables is a question mark. This could boost user convenience and expand CGM tech reach. User acceptance, tech feasibility, and data privacy matter. In 2024, the global wearable medical device market was valued at $20.6 billion. Iterative development and careful evaluation are key for success.

AI-Powered Data Analytics

DexCom's investment in AI-powered data analytics for its continuous glucose monitoring (CGM) systems is a strategic question mark. This involves using machine learning to analyze CGM data, offering personalized insights to improve diabetes management. Success hinges on algorithm accuracy, user-friendly insights, and regulatory approvals, with thorough validation and user testing being critical. The global diabetes care devices market was valued at $19.7 billion in 2023.

- Market growth is projected to reach $32.8 billion by 2030.

- DexCom's revenue in 2023 was $3.6 billion.

- AI could improve glycemic control significantly.

- Regulatory hurdles and user acceptance pose risks.

Subscription-Based Diabetes Management Services

Subscription-based diabetes management services represent a question mark for DexCom. These services, which include remote monitoring, coaching, and education, aim to improve patient outcomes and engagement. The model's success hinges on cost-effectiveness, service quality, and patient demand. Careful planning and execution are crucial for this segment.

- DexCom's G7 CGM system received FDA clearance.

- Institutional holdings in DexCom are a key indicator.

- The company is presenting at investor conferences.

- Market analysis provides insights into potential growth.

Aggressive marketing, like DexCom’s $800 million spend in 2024, for new CGM features is a question mark. Entering emerging markets, a strategic gamble given DexCom’s $3.6B 2024 revenue, is a question mark due to infrastructure needs. Exploring wearable integration, with a $20.6B market in 2024, is a question mark.

| Strategic Area | Description | Financial Implication |

|---|---|---|

| Direct-to-Consumer Marketing | Advertising campaigns for new CGM features. | Requires effective reach & conversion. |

| Emerging Markets | Expansion into markets with low CGM infrastructure. | Needs upfront investments. |

| Wearable Integration | Merging CGM data with wearable tech. | Focus on user convenience & reach. |

BCG Matrix Data Sources

The DexCom BCG Matrix is constructed using financial reports, market analyses, and industry forecasts for data-driven insights.