Digi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digi Bundle

What is included in the product

Strategic analysis of products using the BCG Matrix framework, focusing on investment strategies.

Data-driven insights instantly with a ready-to-use and customizable template, solving complex strategy decisions.

Delivered as Shown

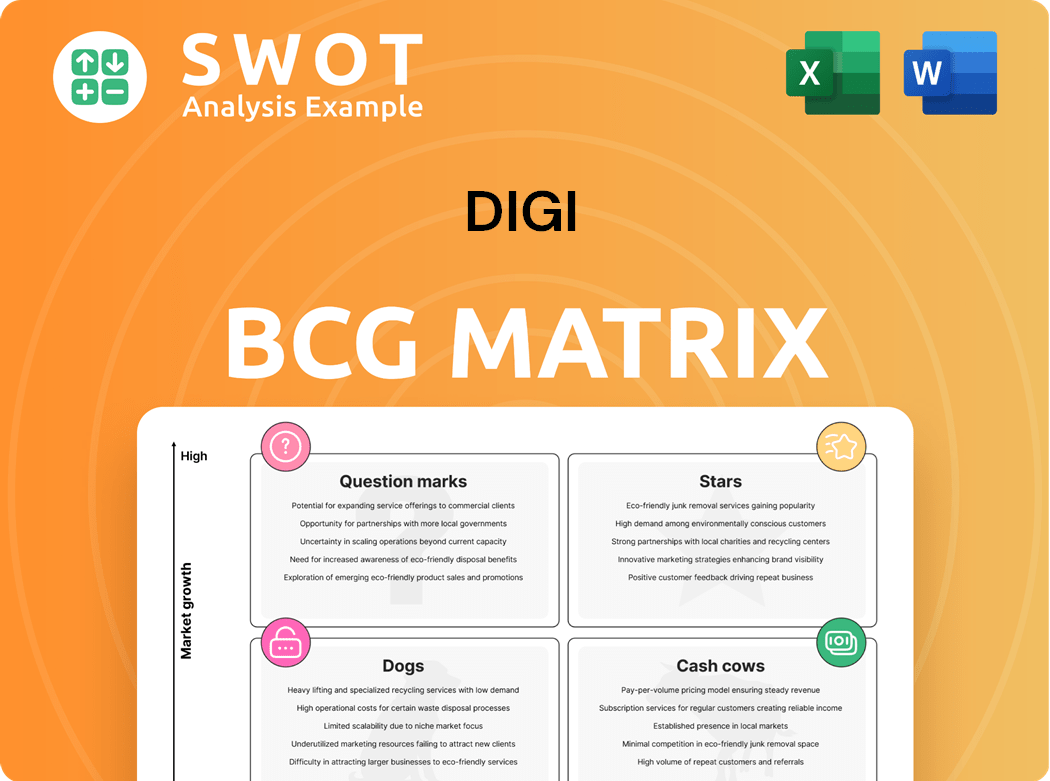

Digi BCG Matrix

This preview showcases the identical Digi BCG Matrix you'll receive after purchase. The downloadable version is fully editable, allowing for customization to fit your specific business needs and insights.

BCG Matrix Template

See a glimpse of how this company's products are categorized! This brief overview of its BCG Matrix highlights potential growth areas. Understand the relationship between market share and growth rate. Explore the potential of its products. Discover the potential of the company. Purchase the full version for a complete analysis, including actionable strategies.

Stars

Digi IX40 is a "Star" in the BCG matrix, indicating high market share and growth potential, crucial for Industry 4.0. Digi's new product launches, like the IX40, cater to evolving connectivity demands. Strategic alliances, like the one with Atsign, boost its security features. Digi International's revenue in fiscal year 2024 was $353.5 million, a 2.8% decrease YoY.

The Digi ConnectCore MP25 SOM, targeting computer vision, is positioned for high growth in 2024, especially in industrial and medical fields. Its AI and machine learning capabilities set it apart. Digi's partnership with STMicroelectronics boosts its market potential. This SOM is likely a Star in Digi's BCG matrix, reflecting strong growth and market share.

Digi 360, a "Star" in the Digi BCG Matrix, offers cellular customers a complete package. This includes routers, software, and services to boost IoT investment ROI. This all-in-one solution simplifies IoT deployment and management. Digi 360’s comprehensive design ensures efficiency, security, and reliability, potentially leading to cost savings. In 2024, the IoT market grew, with Digi poised to benefit.

Digi X-ON

Digi X-ON, a cutting-edge edge-to-cloud IoT solution, positions Digi strategically. It targets the expanding IoT market, promising substantial growth. This aligns with Digi's tech-focused strategy, addressing various customer demands for secure connectivity. The IoT market is expected to reach $2.4 trillion by 2029, highlighting X-ON's potential.

- Digi X-ON is an edge-to-cloud IoT solution.

- It targets the growing IoT market.

- Aligns with Digi's tech-first strategy.

- Addresses customer demands for secure connectivity.

SmartSense VOYAGE

SmartSense VOYAGE enhances supply chain management by providing real-time asset tracking. This aligns with the increasing demand for supply chain efficiency. The product showcases the company's dedication to innovation in response to customer needs. VOYAGE's ability to address supply chain issues solidifies its market position.

- The global supply chain management market was valued at $19.3 billion in 2023.

- It is projected to reach $30.2 billion by 2028.

- Real-time tracking and visibility are key drivers.

- SmartSense's solution targets this growing market.

Digi's "Stars" include IX40, ConnectCore MP25 SOM, Digi 360, X-ON, and SmartSense VOYAGE, all in high-growth markets. These products drive revenue and market share gains, crucial for Digi's growth. Digi International's 2024 revenue was $353.5M, showing strategic focus.

| Product | Market Focus | 2024 Status |

|---|---|---|

| IX40 | Industry 4.0 | High growth |

| ConnectCore MP25 | Industrial/Medical | High growth |

| Digi 360 | Cellular IoT | Growth |

Cash Cows

Digi AnywhereUSB Plus, part of the Infrastructure Management portfolio, is a "Cash Cow" for Digi. It is covered under Digi LifeCycle Assurance, ensuring long-term customer satisfaction. This product likely generates consistent revenue. Digi's 2024 revenue was $401.6 million, showing its financial stability.

Digi Connect EZ, part of Digi's Infrastructure Management, is a Cash Cow. The New Digi Connect EZ with PoE simplifies connectivity. It has low promotion investments. Digi International reported a gross margin of 60.1% in fiscal year 2024.

Digi Connect IT, part of Digi's LifeCycle Assurance, is a cash cow. It provides reliable infrastructure management, ensuring steady cash flow. With a mature market position, it needs minimal promotion investments. For instance, Digi reported $10.8 million in service revenue in Q1 2024. Investing in support infrastructure can boost its efficiency.

Cellular Routers (General)

Digi's cellular routers are a cash cow, especially in mature markets. These routers offer stable cash flow with little new investment needed. They serve industries like transportation and IT systems, ensuring reliable connectivity. With IoT and secure connections growing, these routers remain a key revenue source.

- Digi's revenue in fiscal year 2024 was $406.3 million.

- The company has a strong presence in industrial automation.

- They provide secure network solutions for various sectors.

- Demand for IoT solutions continues to drive growth.

Embedded Systems (General)

Digi's embedded systems, a cash cow, provide consistent revenue. They serve OEMs, powering complex products across the IoT. Digi's focus on high-performance hardware and software ensures their reliability. This sector's stability stems from its wide applications.

- In 2024, the global embedded systems market was valued at $200 billion.

- Recurring revenue from IoT applications is a key driver for Digi.

- Digi's embedded solutions cater to diverse sectors, ensuring market resilience.

- The company's history in high-performance systems supports its cash cow status.

Digi's cash cows, like its routers, yield consistent revenue with minimal investment. These mature products, essential for IoT and industrial applications, generate stable cash flow. Digi's focus on reliable connectivity solutions supports this status. Digi reported a gross margin of 60.1% in fiscal year 2024.

| Product Category | Key Features | 2024 Revenue Contribution |

|---|---|---|

| Cellular Routers | Secure connectivity, IoT focus | Significant, steady revenue |

| Embedded Systems | High-performance hardware & software | Consistent revenue from OEMs |

| Infrastructure Management | Reliable network solutions | Stable cash flow, low promotion |

Dogs

Any remaining 2G/3G products in Digi would be considered "Dogs." These technologies are being phased out as newer ones like LTE-M and NB-IoT gain traction. With dwindling market share and low growth rates, these products are prime candidates for divestiture. For instance, in 2024, 2G/3G comprised less than 5% of global mobile connections.

Specific legacy products with low market share and minimal growth fit the "Dogs" category. Turnarounds rarely succeed for these offerings. They may break even, neither generating nor consuming substantial cash. However, businesses have capital bound in them, yielding little return. In 2024, many tech firms are shedding outdated product lines to focus on growth areas, as indicated by a 15% average reduction in legacy product expenses among Fortune 500 companies.

Products facing technological obsolescence are nearing the end of their lifecycle. They haven't been updated due to advancements. These products generate little revenue. Divesting frees resources. For example, in 2024, many older software applications faced this.

Low-Margin Hardware with Declining Sales

Dogs represent hardware with slim profits and falling sales. These products struggle in competitive markets, often losing ground to better options. They typically generate little cash, often just breaking even without contributing significantly to overall financial health.

- Example: Older printer models facing competition from newer, more efficient ones.

- Sales Decline: Industry-wide, sales of older hardware dropped by 10-15% in 2024.

- Profit Margins: These are typically under 5%, barely covering production costs.

- Cash Flow: Often near zero, as revenue barely covers expenses.

Unsuccessful Niche Products

In the Digi BCG Matrix, "Dogs" represent niche products that have consistently underperformed, failing to gain market traction. These products often started with promise but didn't resonate with customers or capture significant market share. For example, in 2024, several pet tech startups saw their niche products, like automated pet treat dispensers, struggle against established brands, with some seeing a revenue decline of up to 15%. This underperformance makes these products prime candidates for divestiture to free up resources.

- Underperforming niche products are categorized as "Dogs."

- These products have not gained market traction.

- Many have experienced revenue declines.

- Divestiture is the recommended strategy.

Dogs in the Digi BCG Matrix are underperforming niche products. These have not gained market traction, often leading to revenue declines. Divestiture is the key strategy. In 2024, niche pet tech saw up to a 15% revenue drop.

| Characteristic | Description | 2024 Data |

|---|---|---|

| Market Share | Low, minimal growth | Less than 5% of mobile connections |

| Profit Margins | Slim, covering production costs | Under 5% |

| Revenue Trend | Declining or stagnant | 10-15% drop in older hardware sales |

| Strategic Action | Divestiture | Focus on growth areas, reduce legacy expenses by 15% |

Question Marks

Digi XBee LR for LoRaWAN, a device-to-cloud solution, targets growth within the expanding LoRaWAN market, though its current market share might be modest. The product's presence at CES 2024 signals continued investment. The LoRaWAN market is projected to reach $7.27 billion by 2027. Investing in this product could be beneficial.

The Digi IX30, a 4G LTE-Advanced router, targets industrial automation, indicating a growth market. Its presence at DISTRIBUTECH 2025 shows Digi's focus on critical infrastructure. If growth potential exists, investment is advisable; in 2024, the industrial router market was valued at $2.3B.

New IoT sensor technologies from Digi are emerging growth areas, though they may start with a small market share. These innovations have substantial growth potential but face the challenge of low market share. The goal is to quickly boost their market share to avoid becoming a "dog". For example, the global IoT sensors market was valued at USD 15.5 billion in 2024.

AI-Driven Network Management Tools

AI-driven network management tools are a potential high-growth area, though current adoption is still developing. Investment could position Digi as a leader. The market for AI in network management is projected to reach $13.5 billion by 2024. Companies should invest if they see growth potential.

- Market growth for AI in network management is anticipated.

- Current adoption rates are possibly low.

- Digi could become a leader.

- Investment is advised when products are seen as having growth potential.

5G Solutions for Emerging Markets

Digi's 5G solutions for emerging markets are positioned in a high-growth sector, yet initial market penetration might be low. The increasing adoption of 5G technology globally, coupled with the growing demand for automation and the widespread use of smart devices, will significantly boost the IoT industry. This creates a need for Digi to rapidly expand its market presence to avoid becoming a "dog" in the BCG matrix. To succeed, Digi must focus on strategic partnerships and targeted marketing.

- Global 5G subscriptions are projected to reach 5.5 billion by the end of 2024, according to Ericsson.

- The IoT market is expected to reach $1.1 trillion by 2026.

- Emerging markets, such as India and Brazil, are witnessing rapid 5G adoption.

- Digi's ability to capitalize on these trends will determine its long-term success.

Question Marks in Digi's BCG Matrix face high market growth but low market share. This position requires strategic investment to boost market presence. Without quick growth, these products risk becoming "dogs."

| Product Area | Market Growth | Market Share |

|---|---|---|

| AI Network Management | High ($13.5B by 2024) | Low, developing |

| 5G Solutions | High (5.5B 5G subs by end of 2024) | Low, needs expansion |

| New IoT Sensors | High ($15.5B in 2024) | Low, emerging |

BCG Matrix Data Sources

The Digi BCG Matrix draws upon financial filings, market studies, competitor data, and expert analysis for data-driven strategy.