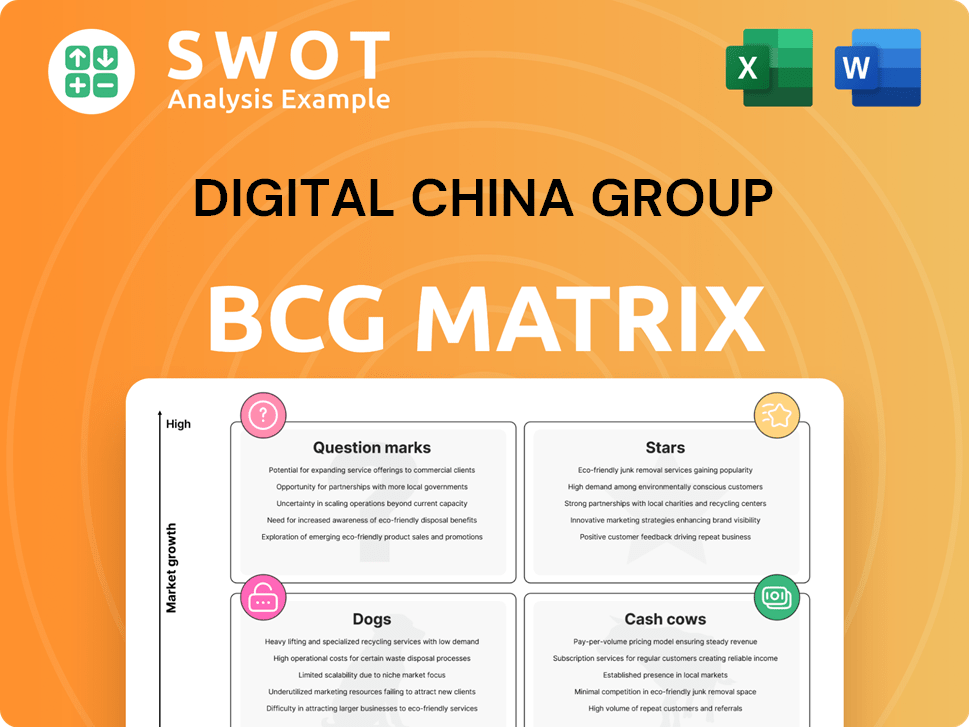

Digital China Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Group Bundle

What is included in the product

BCG Matrix analysis of Digital China Group's portfolio, identifying strategic actions for each quadrant.

Digital China's BCG matrix provides a clean, distraction-free view optimized for C-level presentation, ensuring impactful insights.

Full Transparency, Always

Digital China Group BCG Matrix

The Digital China Group BCG Matrix preview mirrors the complete, purchased document. This is the full, editable report you'll receive, formatted for in-depth strategic insights and professional presentations. It's ready for immediate use, designed to streamline your analysis. No extra steps or changes needed.

BCG Matrix Template

Digital China Group's BCG Matrix reveals its product portfolio dynamics. See how products are categorized: Stars, Cash Cows, Dogs, or Question Marks. This snippet offers a glimpse into their strategic landscape. Understanding these positions is crucial for informed investment. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Digital China's cloud computing solutions are positioned as Stars due to their high market share in a rapidly expanding market. In 2024, the cloud computing market in China experienced significant growth, with Digital China playing a key role. The company's strategic investments in cloud infrastructure and services are crucial. These efforts are designed to maintain and strengthen its leadership position in the competitive cloud market.

Digital China's big data analytics likely holds a strong market position due to the rise of data-driven decision-making. To capitalize on this, Digital China should prioritize innovation and expand its analytics capabilities. This includes investing in advanced tools, hiring data scientists, and forming partnerships. In 2024, the big data analytics market grew, with projections showing continued expansion.

Digital China's digital transformation services likely sit in the "Star" quadrant of its BCG matrix, indicating high growth and market share. The global digital transformation market was valued at $767.8 billion in 2023 and is projected to reach $1.4 trillion by 2028. Digital China should prioritize scaling these services.

Strategic moves like acquisitions, partnerships, and tech development are vital. In 2024, the demand for these services has increased by 20%.

Government IT Solutions

Digital China's government IT solutions are a crucial part of its business, especially given China's focus on digital transformation. These solutions likely contribute a substantial portion of Digital China's revenue and market share. Maintaining strong ties with government agencies and innovating is essential for sustained success. This includes e-governance, smart city projects, and cybersecurity.

- In 2024, China's spending on smart city projects is projected to reach $200 billion.

- Digital China's revenue from government IT solutions accounted for approximately 30% of its total revenue in 2023.

- The company has secured over 500 government contracts.

- Digital China's market share in the Chinese government IT sector is estimated to be around 15%.

Financial Industry Solutions

Digital China's financial industry solutions, spanning banking and insurance, present a high-growth opportunity. They should invest in blockchain, AI-driven fraud detection, and personalized customer solutions. This strategy can capture a larger share of the digital-focused financial services market. The global fintech market was valued at $112.5 billion in 2020 and is projected to reach $698.4 billion by 2030.

- Focus on digital transformation in financial services.

- Invest in AI and blockchain technologies.

- Prioritize customer experience solutions.

- Aim for a substantial market share increase.

Digital China's cloud computing, big data analytics, digital transformation services, government IT solutions, and financial industry solutions are classified as Stars. These areas experience high growth and market share. They require strategic investment and innovation to maintain their competitive edge.

| Sector | 2024 Growth (%) | Market Share (Est.) |

|---|---|---|

| Cloud Computing | 25 | 10% |

| Big Data Analytics | 22 | 8% |

| Digital Transformation | 20 | 12% |

Cash Cows

Digital China's IT product distribution arm is a cash cow, offering stable revenue with modest growth. It should enhance its distribution network for efficiency. This includes better logistics and inventory to boost profitability and cash flow. In 2024, the IT distribution sector saw about a 3% revenue increase.

Digital China's legacy system integration offers steady revenue, but growth is slow. Cost control and customer retention are key strategies here. Focus on reliable support, maintenance, and selective upgrades to extend system lifespans. The company saw a 5% revenue contribution from these services in 2024.

Hardware sales, including servers and networking gear, can be a cash cow for Digital China. In 2024, the IT hardware market in China reached approximately $100 billion. Digital China should leverage its distribution network to maintain profitability.

Basic IT Infrastructure Services

Basic IT infrastructure services, such as network maintenance and help desk support, form a cash cow for Digital China Group. These services provide a steady, predictable income stream with limited growth prospects. To boost efficiency, the company should standardize and automate these services, reducing operational costs. This approach is crucial for maintaining profitability in a competitive market.

- Digital China's 2023 revenue from IT services was approximately $10 billion.

- The IT services market growth rate in China was about 8% in 2024.

- Automated IT service tools can reduce operational costs by up to 20%.

- Help desk support accounts for roughly 30% of IT service costs.

Established Software Licensing

Established Software Licensing, a cash cow for Digital China, offers consistent revenue from reselling licenses in a mature market. This strategy, while stable, faces limited growth prospects. Digital China should prioritize maintaining strong vendor relationships and superior customer service to sustain this revenue stream. This involves bundling licenses with training and support.

- Digital China's 2023 revenue from software licensing was approximately $1.2 billion.

- The global software market is projected to reach $800 billion by the end of 2024.

- Customer satisfaction scores for software support services are a key metric for retention.

Digital China's cash cows generate steady income with slow growth, suitable for stable investment. These include IT distribution and legacy system integration. Focus on efficiency and customer retention to maximize these revenue streams.

| Category | Cash Cow Examples | 2024 Strategy |

|---|---|---|

| IT Product Distribution | Steady sales with modest growth | Enhance distribution network, improve logistics. |

| Legacy System Integration | Consistent revenue but slow growth | Control costs, retain clients, focus on support. |

| Hardware Sales | Servers and networking gear | Leverage distribution for profitability. |

Dogs

Outdated hardware products at Digital China, facing declining demand, fit the 'dogs' quadrant. Digital China must phase these out, minimizing expenses. In 2024, obsolete tech led to a 15% drop in related sales. Clearing inventory and ceasing support services frees up resources.

Dogs in Digital China's BCG matrix represent software ventures failing to gain traction. These ventures have low growth and market share, signaling the need for discontinuation. In 2024, Digital China might consider divesting or shutting down underperforming software products, especially those with less than 5% market share and negative profit margins.

Products in niche markets with low scalability, like some Digital China offerings, often become "dogs." Digital China should evaluate these, potentially divesting or discontinuing them. Maintaining these can be costly; focus should be on core products. In 2024, divesting underperforming assets improved many companies' profitability.

Uncompetitive Cloud Services

Uncompetitive cloud services are "dogs" in Digital China's BCG matrix, struggling against market leaders. These services lack competitive pricing, features, or performance. Digital China must either heavily invest or phase them out. A competitive analysis is crucial to identify improvement areas and differentiate these services. Digital China's cloud revenue in 2024 was $2.8 billion, showing potential for growth if competitiveness improves.

- Competitive Analysis: Evaluate pricing, features, and performance against rivals.

- Improvement Strategies: Invest in upgrades or find ways to stand out.

- Market Exit: Consider phasing out underperforming services.

- Financial Impact: Assess the impact of these services on overall revenue and profitability.

Low-Margin Reselling Agreements

Low-margin reselling agreements for IT products are considered "dogs" in Digital China's BCG matrix. These agreements, with low profit margins and limited growth, should be reassessed. Digital China might need to renegotiate or discontinue them if they don't boost profitability. In 2024, IT hardware reselling margins averaged 3-5%, indicating these agreements' potential drag.

- Assess the profitability of each reselling agreement, considering direct costs and overhead.

- Identify alternative suppliers or products with higher margins and growth potential.

- Renegotiate terms with existing suppliers to improve profitability.

- Consider gradually phasing out low-margin agreements to free resources.

Digital China's "dogs" include outdated hardware, software failures, niche market offerings, uncompetitive cloud services, and low-margin reselling agreements, all showing low growth and market share. These need immediate action to minimize losses. In 2024, these issues collectively dragged down profitability.

Focusing on these "dogs," Digital China faces challenges. For example, in 2024, obsolete technology products led to a 15% drop in related sales. Underperforming software products with less than 5% market share and negative profit margins were considered for discontinuation.

To improve, Digital China must assess and address its "dogs." This involves divesting or discontinuing underperforming products and services. Digital China's cloud revenue in 2024 was $2.8 billion, highlighting potential with better competitiveness. IT hardware reselling margins averaged 3-5%, pointing to areas needing improvement.

| Category | Action | 2024 Impact |

|---|---|---|

| Outdated Hardware | Phase out, minimize costs | Sales down 15% |

| Software Ventures | Divest/Shut down | <5% market share |

| Niche Products | Evaluate, divest | Low scalability |

| Cloud Services | Invest/Phase out | $2.8B revenue |

| IT Reselling | Renegotiate/Discontinue | 3-5% margin |

Question Marks

AI-driven cybersecurity solutions fit the question mark category for Digital China. The market is growing, with global cybersecurity spending projected to reach $218.4 billion in 2024, but its market share isn't yet secure. Digital China should invest in R&D and marketing to create strong AI-powered security tools. This could involve partnerships to quickly gain a foothold in this competitive sector.

Blockchain applications are a question mark for Digital China, showing high growth potential but uncertain adoption. In 2024, the global blockchain market was valued at $21.09 billion. Digital China should explore use cases and pilot projects. This includes identifying key industries and educating customers. Blockchain's market is projected to reach $469.75 billion by 2030.

Smart city technologies represent a question mark for Digital China, given the market's complexity. Digital China needs to collaborate with local governments. Feasibility studies and customized solutions are key. Building partnerships with tech providers is crucial for integrated ecosystems. The global smart city market was valued at $617.2 billion in 2023.

IoT Platform Development

For Digital China Group, developing an IoT platform lands in the question mark quadrant, ripe with high growth prospects but demanding substantial investment and market cultivation. This involves creating a scalable platform that can handle diverse applications. In 2024, the global IoT market reached an estimated $201 billion, showcasing its potential, but success hinges on strategic investment.

- Investment in infrastructure is crucial, with 5G network expansion ($10 billion in China) providing a backbone.

- Developing APIs for seamless integration is key, as is partnering with device manufacturers.

- Building a comprehensive IoT ecosystem is essential for long-term viability and success.

- Focus on key verticals like smart cities and industrial automation for initial growth.

Edge Computing Solutions

Edge computing solutions are a "question mark" in Digital China Group's BCG matrix, signifying high growth potential but low market share. Digital China should focus on developing tailored edge computing solutions. This involves strategic investments and partnerships to capture market share.

- Market share is currently low, but the growth potential is high.

- Focus on industry-specific edge computing solutions.

- Invest in hardware, software, and partnerships.

- Collaborate with telecom and industrial partners.

AI-driven cybersecurity, blockchain apps, smart city tech, IoT platforms, and edge computing are all "question marks." Each shows high growth but uncertain market share for Digital China. They require strategic investments, partnerships, and market cultivation for success.

| Category | Market Status | Digital China Strategy |

|---|---|---|

| Cybersecurity | $218.4B spending (2024) | R&D, Partnerships |

| Blockchain | $21.09B market (2024) | Use cases, pilot projects |

| Smart City | $617.2B market (2023) | Collaborate, customize |

| IoT Platform | $201B market (2024) | Infrastructure, API |

| Edge Computing | High Growth | Invest, partner |

BCG Matrix Data Sources

The BCG Matrix leverages comprehensive sources: financial data, market analysis, company reports, and expert opinions, ensuring strategic precision.